The art of modern economics turns into the pure magic now: how to make it enough for everybody, when there is not enough left.

We are hitting Peak of Everything.

It is time for a reflection point today: we will post some charts, some quotes from our previous articles and you can draw your own conclusions as usual.

The basis for our weekend university will be our article from September 6th, 2010.

"Investing in Lithium: Looking for Catalyst. With traders coming back from holidays, it is time to look at the potential catalyst to reward us for our patiently acquired collection in Gold, Silver, Copper, Zinc and Lithium.

One of the major catalyst which can trigger redistribution of liquidity is on the chart above. We have a Sell signal in long term Treasuries. Maybe, our Treasuries Bubble is really ready to pop this time. Bear market, upcoming crash and Deflation are so much advertised now that it is time to take a contrarian approach again and take the side of the FED.

As you remember, you can never find any investment advise on this blog - you are always welcome to read our travel notes - but today we have to warn you particularly. Our investment thesis has a one, but mortal flaw - if we are wrong and Deflation will beat the FED with Mr. Bernanke and his shareholders - we do not know what to do. And the most dangerous part of it is that it will not be important any more even for us. US Corp does not have a luxury of "lost decades" like Japan - it will be teared apart by internal and external forces, when the coming war will be seen as a relief even by the population sacrificed in it. It is history; but we will not go there.

We will share one free, but very expensive advise here - before the end of the world, time will come to pay your bills and not once. Let's concentrate on our circle of competence: what we can change and try to position ourselves in case if somebody will manage to get all of us from headlines about Deflation and into the Inflation stage.

We will be looking at the signs - footprints - left in the charts, volume and direction will be the confirmation of our ideas and you can always make your own opinion."

It is not the dream any more, when people like Warren Buffett are backing the idea of Electric Cars with their money.

It is not the dream any more, when people like Warren Buffett are backing the idea of Electric Cars with their money.

We will start with a joke, which is so close to the truth...

We can talk about a lot of things, we can try to search for the trends and even find them, but the magic will come true only if the liquidity will be coming in the sectors and particular Plays we have chosen.

Our Call on Treasury Bubble is ongoing and now the Double Top in Long Term US Treasuries is confirmed. Even recent announcement about QE 2.0 did not change the picture here. Record outflow from equity funds and into the bond funds by retail investors are confirming that the next blood bath is already in the making. After the Dot.com bust and Real Estate Crash, investors who are looking for safety will be creamed again.

When this picture will be apparent and Inflation will make headlines - after first hitting your grocery bills and insurance premiums - bursting Treasury Bubble will provide the redistribution of liquidity in search for the yield and protection of the principal value eroded by Inflation.

This flood of freshly minted money by the FED out of thin air will raise the boats, we need to find the sectors, which will benefit the most. When the relative value of the amount, which investors are willing to pay for those assets, will make it not only for the lost purchasing power of that FIAT currency they will be priced in, but also will provide a premium and the return at the real rate adjusted for the inflation.

We will be searching for the bottle necks, where the most powerful economic forces of Supply and Demand will be driven by changing perceptions with creation of the new markets and shifting Demand with very limited and Non Elastic Supply in the best case.

"On the chart above we have another powerful formation in case of confirmation of our Sell Signal in long term treasuries. TLT could be signaling the formation of a double top with a very strong reverse pattern, which means higher yields and lower treasury prices. It means that FED is ready to QE 2.0 Among the anecdotes from the market place, explaining this technical footprint in the market, we will mention:

1. China is selling Treasuries and buying into the Japan and Korean bonds.

2. Serious talk on CNBC about 100 year bonds.

3. Record low yields in treasuries with record high corporate cash balances.

4. Corporations like IBM and Johnson&Johnson among others issuing record low yield bonds and slashing their interest payments.

5. M&A activity in growth sectors: BHP and Potash, Dell and HP bidding war for 3Par, deals in the Gold sector and Lithium.

6. Record outflows from equity funds into bond funds. Investors are primed for another blood bath - this time in "safe" bonds.

7. China holding record amount of treasuries and US Dollar denominated assets is the interesting combination with idea of national security, but we do not bank on Crash - gradual collapse in US Dollar will do the trick: 7% inflation in the real terms will slash the debt by almost 50% within next eleven years."

It looks like that the party for the green fellow was a very short lived and now all FIAT currencies are ready to come back to the game of whose currency is the worst one. Money performs the function of the store of value and means of exchange. US Dollar has lost its status as a store of value long time ago and charts of Gold and silver are screaming below about it.

Next blow will come, when US dollar will be excluded from the means of exchange: Brazil, China and Russia among other countries more and more are making transactions in their national currencies excluding dollar altogether from the transaction. US Corp. has enjoyed the status of its currency as the Reserve one for too long and made too much reckless and arrogant decisions to destroy it. The most ironic in this situation is that it is main goal of the FED now to debase US Dollar in order to bring Inflation.

We have called it The End of Money before:

Next blow will come, when US dollar will be excluded from the means of exchange: Brazil, China and Russia among other countries more and more are making transactions in their national currencies excluding dollar altogether from the transaction. US Corp. has enjoyed the status of its currency as the Reserve one for too long and made too much reckless and arrogant decisions to destroy it. The most ironic in this situation is that it is main goal of the FED now to debase US Dollar in order to bring Inflation.

We have called it The End of Money before:

"We have the very strong complications with FED engaged in QE in a situation, when Federal Reserve is as federal as Federal Express. In absence of Gold - as the base for the monetary system - with it's external disciple, we have a traders paradise, when Enron is auditing itself. Arthur Anderson has not saved the shareholders of Enron and collapsed with it's client - today in our monetary system nobody even pretends to be sane any more.

Last few weeks we are hearing a lot of voices about the currency war, when all governments are trying to debase their currencies again each other. So far they are all successful in driving Gold up against all Fiat currencies.

US Dollar will have it's own destiny here: General Bernanke is winning his war against deflation. US corp. With it's total obligations above 100 Trillion dollars will have to debase it currency not only against Gold on par with other Fiat currencies, but also against other fiat currencies. We will remind you the basic math about inflation economics and the value of Debt.

"7. China holding record amount of treasuries and US Dollar denominated assets is the interesting combination with idea of national security, but we do not bank on Crash - gradual collapse in US Dollar will do the trick: 7% inflation in the real terms will slash the debt by almost 50% within next eleven years."

All our observations above - about QE, the source of liquidity and value of US Dollar - must be confirmed by the Real store of Value: Gold and Silver - they are two monetary metals performing the function of money and ultimate currency for thousands of years. Both charts are screaming about debasing of FIAT currencies now.

"Gold will be go much higher from here, it will not be the straight line, but every set back will provide an investment opportunity in Gold and Silver space.We will share with you our thoughts and companies we like and you will be cautioned to make your own DD as usual.

Next stage will be fight for the resources and M&A activity at all stages of investing in Gold mining cycle. With rising Gold price and inflated paper Majors will shop for juniors to buy time and gold in the ground. Jim Puplava will be a very good narrator to all our travel maps and reports about our journey. With rising gold, price price of physical gold will become even more prohibitive, we do agree with Jim that people will start to buy gold mining shares again with their easy to run discount brokerage accounts."

Silver, finally, acts like a true monetary metal and made a multi year break out to the upside. This confirmation was very important:

"Next couple of weeks will be very important for Silver and Gold market: all announcements by Obama about new economic initiatives should confirm Bernanke's "We will use everything what is necessary". It should translate into sell off in treasuries, lower Yen against the US Dollar and lower US Dollar against the other currencies. Silver should break out to the upside above USD 20/Oz confirming Gold upside move. There is always a risk of open market operations in Gold and Silver markets to show that the FED is in control of inflation situation. It will provide another buying opportunity. Triggered selling addressing "lower risk of economic recovery" will be met by buyers diversifying out of FIAT currencies in the new credit expansion cycle. Word inflation first will come to you with your grocery bills and insurance premiums and later in the headlines. If you can understand Australian language you can check their press and BOA Cash Rate of 4.5% and Inflation which is already there with official 3.1%.

"Gold bears always mention Silver non-confirmation of the recent Gold Bull Run - and they are right up to the certain point. Gold performs its function as a real wealth preservation in both Inflationary and Deflationary environments. Silver, with its industrial usage in electronics, needs more conviction that the FED will win its battle against Deflation Death Spiral and Inflation will be in the headlines for years to come. It is time for us to write up on our Silver squad from our Summer 2010 Top Picks."

Now Silver is catching up with Gold and you can have a few laughs with this cartoon explaining the Silver Short Squeeze, but it is very close to the truth and drama unfolding behind the curtain. Whether the Wikileaks will change rules and definition of The Game forever or not - one conclusion is very clear and safe to make: the world has changed and the markets and its participants can not be manipulated forever, we are at the tipping point.

Be careful with any investment decisions here, based purely on this cartoon, or a price tag for Silver or medical terms used - the most important message is that story is getting out into the public space and we are indeed at the tipping point now. After latest Jobs number QE 2.0 is already a history, time is to be ready for the QE n+1.

"Story about market manipulations in gold and silver, about which gold bugs have been talking for years, makes its way into the mass media in Europe as well now. JP Morgan is an interesting party of this game - there are some reports that is holds one of the largest derivative books and some have even suggested that the bank was engaged in gold market manipulations to artificially suppress the gold price. We do not expect earth shattering revelations from this trial - the all FIAT monetary system is a ponzi scheme - but hot heads will be more careful in the future.

If these accusations will be confirmed, the mere fact of such manipulation can drive Gold and Silver prices much higher - buyers will demand the physical delivery of both metals. As Warren Buffett has put it - "When the tide will be gone - we can see who stays without the trunks". Silver market just can not provide delivery on all contracts including futures and ETF - it will be the Mother of Short Squeeze. Do not bet your farm on it, but we are moving into the right direction. We will address you to the Jim Puplava and his interviews with Erick Sprott and David Morgan.

Silver and Gold in the ground - Junior mining companies with solid projects will be the next game in town now. M&A activity will drive valuations in this sectors.

Today's call - from the World Bank "to debate the return of the Gold Standard" - we are finding just fascinating and it would be unbelievable just a few months ago. We can expect some tree shaking and corrections now in Gold and Silver markets, but they will only provide more buying opportunities to those who seeks ones."

The real party is here, reflected on the chart above, it is the Junior Mining sector. You can find stories about companies we follow on this blog, please do not take anything as an investment advise, but only as an introduction and our travel map. You have to make your own journey, we can provide the ideas and our travel notes, but you have your own destination, your own schedule and your own taste for sightseeing. We will mention here the companies we are following, some of them we will be accumulating further, some have risen enough to warrant some profit taking and move down the food chain where the money will be going next.

Sector is very volatile - it is the place where you have to know what you are doing. We have our own GPS on this journey - we are following "so called smart money".

"What is the common sense in the so different investment situations: when Erick Sprott buys into Avino Silver, Silver Wheaton buys into Revett Minerals, Lukas Lundin buys into NGeX Resources and invest more to keep its stake in Sunridge Gold, Panasonic buys into Tesla, Tongling buys into Canada Zinc Metals and Nova Gold sells 50% of 1 mil NON 43-101 historical resource of gold at Shotgun for shares of TNR Gold and significantly increase its position in that company? All these situations are common only in one, but very powerful in investment world thing: industry and/or company insiders are buying in. Can they be mistaken - yes, by all means - but we like to follow the "smart" money."

Our list here, which is for our and your own homework - if you like our ideas about the good time on the road - will be the following: TNR Gold, Goldstone Resources, Revett Minerals, Avino Silver, NGeX Resources, La Quinta Resources, Golden Band Resources, Fortuna Silver, Esperanza Silver, Mines Management, Bitteroot Resources, Max Resource, Copper Fox Metals, Cornerstone Resources, Kootenay Gold, Yamana Gold, Bravo Gold, Bravada Gold, Almaden Minerals, Sunridge Gold.

Most of these stocks have already enjoyed QE party and we had fun with the most of them after summer napping time, others are still in consolidation patterns and some are the clear underdogs - further investigation and DD in the management, properties and potential catalyst on the company level could show, who of them can have the next run.

All those QE exercises, which we have discussed above, will unleash a very powerful force of Inflation all around the world. The new most powerful trend in 21st century will be the Energy or lack of it to drive the world and its population forward. All recent progress is based on relatively cheap energy available to us for the last one hundred years. The chart above is from the latest groundbreaking revelations of International Energy Agency - it shows to us that we do not have that luxury any more. Cheap oil is gone - according to the IEA - and "Crude Oil: fields yet to be found - is the politically correct way of saying Oil Shortage. We have now Population Growth multiplied by Peak Oil and Inflation, which will push all prices higher.

"It is very interesting - now IEA is talking about Peak Oil and that we had the Peak Oil already in the production from conventional sources in 2006 (read: Cheap Oil is gone). The admissions are groundbreaking for Energy Security, Electric Cars mass market and strategic commodities - it is the same magnitude of change as an invitation from the World Bank to discuss Gold standard - the real messages are still muted among different facts, but they are there, in the report from IEA! Unbearable truth must be impossible to hide any more - when will we start to act with the same scale as the problem we are facing in the nearest future?"

All those QE exercises, which we have discussed above, will unleash a very powerful force of Inflation all around the world. The new most powerful trend in 21st century will be the Energy or lack of it to drive the world and its population forward. All recent progress is based on relatively cheap energy available to us for the last one hundred years. The chart above is from the latest groundbreaking revelations of International Energy Agency - it shows to us that we do not have that luxury any more. Cheap oil is gone - according to the IEA - and "Crude Oil: fields yet to be found - is the politically correct way of saying Oil Shortage. We have now Population Growth multiplied by Peak Oil and Inflation, which will push all prices higher.

"It is very interesting - now IEA is talking about Peak Oil and that we had the Peak Oil already in the production from conventional sources in 2006 (read: Cheap Oil is gone). The admissions are groundbreaking for Energy Security, Electric Cars mass market and strategic commodities - it is the same magnitude of change as an invitation from the World Bank to discuss Gold standard - the real messages are still muted among different facts, but they are there, in the report from IEA! Unbearable truth must be impossible to hide any more - when will we start to act with the same scale as the problem we are facing in the nearest future?"

If you look at the chart above, you can hardly think that we are on the edge of Deflation and another economic collapse. Even with anemic growth in Developed countries Oil is making new highs after the crisis. It is not about US Corp all the time any more - Asia and emerging countries in general are making its call on the oil markets now.

"IEA World Energy Outlook 2010. It s hard to overstate the growing importance of China in global energy markets. Our preliminary data suggest that China overtook the United States in 2009 to become the world's largest energy user...Prospects for further growth remain strong, given that China;s per-capita consumption level remains low, at only one-third of the OECD average, and that it is the most populous nation on the planet, with more than 1.3 billion people."

"We will not join those who suggest to panic - that time has come in 2008 and is gone already - it is too late to panic. We need to put all resources together and move forward like China is doing now.

GE with its purchase of 25000 Electric Cars is the first, but very important step in electric cars mass market creation.

There is a technology available to us to preserve our way of life: Electric Cars - any shortcomings like price, range and others, written and posted on every corner by mass media under the light from the Kerosine lamps - will be nothing compare to Oil Shock and the matter of survival with Oil price above 100 USD/barrel again. Technology will deal with a lot of things: battery price, range, safety - Nissan Leaf and GM Volt are already on the streets today! U.S. grid, which needs modernisation by all means, even in its today's state can support recharging of 50 million EVs overnight. Start-Ups like DBM Energy from Germany can move our expectations from Lithium technology further even today - what would you say about 375 mile rage on one charge?"

All those fundamentals, we have discussed above, are moving Lithium ETF now confirming our macro view on this micro cap sector.

"Time is to come to the most important sector for us now - Lithium and Rare Earth Elements. We are using above SQM as a semi proxy for the sector. Stock shows very strong move to the upside this summer even considering deflation scare and dreadful August for the most markets. For us it is an indication that institutional money are positioning themselves in this sector.

"We have been proudly running Gold Bull for nearly ten years now: Gold first, than Majors and follow up on Junior side. We were always wondering about Future of Energy and have collected some great memories on Uranium Run, Solar and Water plays. Gold Bull has years to run, but we are searching constantly for new Macro trends - it is very interesting to find out what will be the next Bull which will come out of these rubbles in case we are right and Inflation will be the answer to the Deflation war scenario. It is time for Lithium to come into picture.

Lithium is the leveraged play on Peak Oil and rising Oil price with coming Inflation. Sector is very small and market is even more smaller - everything is ready for the parabolic move in case of supporting fundamentals.

Recent Oil Spill shows the real price for Oil and leaves no doubt for us that there will be no more cheap oil: offshore drilling is costly now, it will be even more costly later. Relatively cheap Oil is in the hands of state owned companies in not so friendly to U.S. places. Oil squeeze will come from diminishing production rates and rising Inflation. The move will be even more explosive than in the Gold market - in the end only minority of people is effected by the gold price even now, Oil is the underlining of all Western Energy Diet. It is not sustainable. Emerging markets are taking more and more share of world wide production, oil producing countries are spending more at home. If you account all cost to produce, deliver and protect Oil supply to U.S. corp the price is already above 150 USD/barrel."

"This year we have a staggering number of reports and warning on the looming Peak Oil situation. It takes time for reality to settle in, particularly, when nobody knows what to do with it. We have put REE in the headline and only few months ago we would have to explain, what is it all about - now suddenly everybody is talking about REE and stocks involved in Rare Earths are all making new highs. It takes a crisis for us to realise that fundamentals are driving the real trends. Sudden realisation that China controls more than 90% of REE market and their reserves maybe will last only for another twenty years, created the catalyst in the market place. What will it take to realise that we are running out of cheap oil? Another crisis?

We are talking here about the powerful mega trend Inflation multiplied by Peak Oil situation - we have to move and readjust our society. Our Energy diet is not sustainable any more. We are lucky in a sense that there is technology available to us to survive the Oil Shock if we will all move fast - Electric Cars. It is our Next Big Thing and at the heart of this disruptive technology lie strategic commodities: REE and Lithium."

The sector is very small - now is the time to find and pick up value among the hype, backed by strong shareholders and based on solid portfolio of Lithium and REE properties. Headlines from China, Jim Puplava and James Dines are moving REE into the mainstream in the investment space now and Lithium will get its recognition one day as well. Only few companies left without strategic investors in the sector, when even only this catalyst can bring the transformation to the junior from a holding company into actively pushing into production developer. It will bring multiples to the dormant valuation.

We will provide some links for the further homework here:

Our Top Picks from Lithium Bull: Rest Before The Charge have already enjoyed a very active M&A season, out of the two - Rodinia Lithium has already secured strategic investor and only International Lithium left for dating now. Among the strategic suitors are the same faces - people with money vs others with debt.

"We have another deal in Lithium space - Rodinia Lithium has attracted strategic investment from Chinese Shan Shan. Last week Canada Lithium has announced investment with Black Rock affiliated company - big money managers and Lithium end users are coming into the sector now.

Today first GM Volt is rolling off from the factory line and CNBC is on air from the GM to highlight this event all the day. Peak Oil revelations will bring more and more people to the realisation of the fact that Electric Cars are the way forward now. More than 6000 people test driven Chevy Volt during recent promotion sessions and many thousands more attended Nissan Leaf Test Drives all across the country.

It is the very beginning, but this new trend can be changing our lives very fast - Electric Cars are coming on our drive ways now.

In this light - of strategic importance of Lithium and REE for the new disruptive technology for the electrification of our transportation system - this transaction shows again that China and other asian countries are again way ahead of any North American corporations in realisation that secure supply of Lithium and REE will be the cornerstone of the post carbon economy.

We are happy for the company and its shareholders, but only few Lithium projects left out there and majority of them have secured major strategic interests from Chinese, Japanese and Korean companies. Sadly, situation with REE did not provide lessons to anybody. Where are GE, GM, Ford, Corning, Dow, 3M, Boeing and Du Ponts of this world? Will we all be at the mercy of Lithium Opec one day?

On our M&A radar screen here we have left only one company in Lithium space open for strategic partnerships - International Lithium Corp. to be spun out from TNR Gold. We hope that they are dating somebody interesting as well for their IPO."

With all that excitement about Electric Cars and our positioning for the mega trend among Lithium and REE plays, time is to ask the question - where will electricity come from? Answer is simple - "from the socket on the wall" and this joke will be very powerful driver for the Electric Cars - basic infrastructure is already there, we have a lot of walls with electric sockets.

Electricity will be the next drive in the Energy mega trend play. It is the most convenient form of energy, which can be easily transferred from the production side to the consumer, transformed into mechanical work or other forms of energy. Now we have means to store it - and here Lithium will come into play one more as a part of the Utility Storage System in the Smart Grid, making integration of different alternative sources of energy possible and providing opportunity for distributed local generation energy systems.

You can not step twice in the same river, but Mr Market sometimes provides us with a time machine, when you can buy almost the same value or even increased one at the depressed by the external events valuation in the market place.

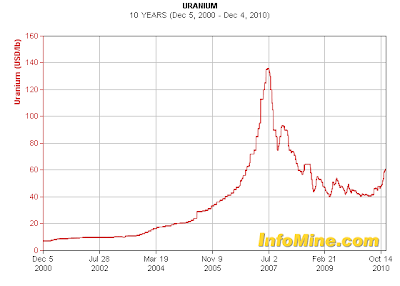

The only thing different will be you and your ability to act this time in a bold fashion. All the charts provided show you this opportunity in 2008, when the world was coming to the end, our loyal readers know about it from numerous observations on this blog. It was the same with Gold and Silver juniors, now it is with Lithium and Uranium plays. Chart above is signaling that Uranium sector is ready to move again and China with its plans to increase Nuclear generation capacity from 10 Gw to almost 120 Gw by 2020 will not let this market nap for a long time.

In the days ahead we will revisit these ideas further and today we will address you to the Jim Puplava and James Dines and our initial hit list for DD and search for the survivors among the rubbles of the correction in the uranium market: JNR Resources, NuPower Resources, UraniumSA, Stella Resources, Consolidated Abaddon Resources, Anglo-Canadian Uranium, Cornerstone Resources.

Copper chart above tells us that decoupling is already in action - by the Copper price action, there is no Deflation and no lack of credit - we will be talking about China again here. The real drive for commodities is the Negative Real Rates, we remember when FED started raising the rates in 2003, but the party in Gold, Silver, Copper and Zinc have only started, then Uranium and Potash made headlines as well. At some point move in Copper was more impressive than in Gold and Zinc just exploded upside in 2005. Now we have Goldman Sachs talking about Copper shortage, Credit Swiss put 10000 $/t target price and today Chinese companies are searching the Globe for M&A deals.

It will be all about growth, urbanisation and Energy: Electrification of transportation will demand a lot of power to be produced and new power distribution infrastructure to be developed. Copper will go into Electric Cars motors and those sockets on the walls need to be connected.

"First Uranium, then Potash - Now Copper and Lithium. Friedland pointed out that the while the world mined 585 million tonnes of copper metal from 1900 to 2008, it will need to mine 600 million tonnes of copper in the next 20 years alone, assuming 3 per cent global economic growth.

''Frankly, those of us in the business have no idea where this metal is actually going to come from,'' he told delegates.

But more importantly, Friedland reckons that the forecast need for 600 million tonnes of copper over the next 20 years not including the demand to come from the ''phenomenon'' of electric cars. He believes that hybrid cars are old news. The world will shift its car fleet over to lithium battery-powered electric over the next 20 to 30 years or so, waving goodbye to reliance on Middle East oil supplies at the same time.

Good news for those chasing lithium as the next big thing. But don't forget copper, Friedland added."

We are looking for M&A activity in this sector among familiar faces: TNR Gold, Lundin Mining, Copper Fox Metals, Sunridge Gold, NGeX Resources, Cornerstone Resources.

"We are wholeheartedly agree with CIBC: Be Long What China's Short. M&A will drive this sector activity and we have just a few quality juniors with large copper deposits to go after. In this report, we found particularly very interesting the different valuations in the takeover scenarios, presented overall picture of Supply and Demand and qualities, which Chinese buyers are seeking in the potential partners.

Los Azules emerges in this light as a very important Copper deposit with a lot of upside in its valuation among the leaders in this particular quality, relatively high CAPEX requirements, but in the solid middle or to the higher band in a lot of different investment metrics compare to the other juniors in the analysis provided by CIBC."

Zinc and Lead are still not on the radar screens of investors with Copper taking all attention now, these two metals are driven by the same dynamic as Copper and we can argue even, that Supply side here could be more constrain.

It is all about China and its growth again and it is about cars. China became the largest auto market in the world and you need a lot of steel and old fashioned Lead batteries to power this bull. For lithium market's explosive growth we need 20% of Electric Cars by 2010, the rest will be still with conventional batteries for a while.

Here our primary plays are again M&A candidates with different angles: Lundin Mining with its Cobalt play at Tenke Fungurume and Canada Zinc Metals with its Chinese investor on board Tongling.

The reason behind the-long-time-due correction in the overheated markets is China and its Inflation. Everybody is rushing to sell today - we will send you back to the 2002, when the previous cycle of Higher Nominal Rates has been started. Study the charts of Gold, Silver, Copper and Zinc for starters - the keys to the commodities super-cycle are real growth in Emerging Markets and Negative Real Rates. The US Dollar party will be very short lived, even green buck can not take seriously all those talks about QE "not debasing dollar value". Now with "crashing markets" and "non-existing" Inflation in official statistics General Bernanke can chop every tree in the DC area for his QE games, problem will come later when the price of Oil will be too expensive to run his choppers to drop the bucks.

As per Inflation - just jump across the pond - UK is the indicator of things to come after QE and universal bailouts. Inflation there is above 3% and will "stay now at elevated levels throughout 2011" And it is when they have already students on the streets after first austerity measures. Who will dare to try it at home?

Canada Zinc Metals in this sense, is a very interesting indicator with Chinese Tongling taking its stake above 36% in the company during this financing. We guess they have some clues about the real state of the Chinese economy and why do they need one of the world's top zinc deposits in Canada, into which they are buying with premium to the market price."

No comments:

Post a Comment