Actual results reported today is even Worse then in my recent projection:

Free Cash Flow for the Q4 2006 is ... only 0.544 bln USD vs my projection of 0.61 bln USD and it is with Tax rate of 13% (?!) for Q4 and 23% (?!) for the whole year. Do I smell a cooking oil here? With such creative accounting earnings are meaningless, we really can try to understand the value here only by Free Cash Flow Ratio to recent capitalization. Total FCF for 2006 is 1.112+0.544=1.656 vs projected 1.722. The Google market cap of outstanding 313 mln shares at the closing price 501.5 is 157 bln USD.

MC/FCF ratio is 95!

Yahoo! has MC/FCF ratio of ... 28.9.

Growth story has ended here and we have Great Company with Completely Unsustainable Valuation. Perception of the crowd is so far away from reality that nobody is even checking numbers any more.

When you will normalize all the accounting tricks with taxes and SBC and R&D tax credit you can understand that real picture here is Slowing Rate of Growth.

Free Cash Flow as Ultimate Measure of Company ability to generate cash is indicating that Company is unable generate enough Cash in order to sustain valuation, it is under compression and MC/FCF is approaching Totaly Insane Level.

If we will apply "normal" ratio of 40 for fastest growing company, leader in the market and real innovator we will come to possible market cap of 66.24 bln USD which will bring us to Target Price of USD 212.

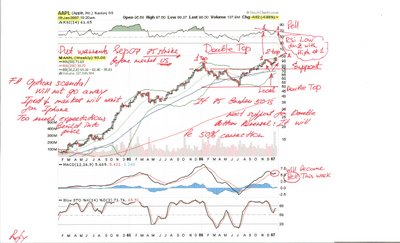

It looks like MR Market is starting to hesitate about share price of this enterprise.

Once The Double Top will be confirmed by Sell Off with significant volume the Reversal Pattern will dominate on this stock for the whole year.

I will keep you posted (those who will not be forced to Sell PC or unable to pay for electricity).