Below is an article with a good overview of recent developments in a mass market for Electric cars in Japan. It is very important to watch this progress particularly in Japan: country imports all of its oil, gas prices are one of the highest among OECD countries, population is aging and still under severe financial stress after years of recession, people are open to new technology and are an early adopters. Japanese technological and manufacturing base allows to bring electric cars to the mass market.

By Hiroyuki KoshojiUPI Correspondent

Published: August 27, 2009

Tokyo, Japan — Japan's major carmakers – already leaders in eco-car technology – are ready to begin mass production of electric cars that produce no emissions at all. Can these environmentally friendly vehicles edge out existing gasoline vehicles and hybrid cars in the mainstream market?

Electric vehicles have no engine, transmission or fuel tank. They are quiet, with very little vibration as they are run by electric motors instead of gasoline engines. Although EVs have been attracting attention in Japan as the ultimate eco-car because of their zero emissions, there are still challenges to be resolved before they can dream of dominating the global market.

Early this month Japan's third-largest carmaker, Nissan, introduced the world's first medium-sized and mass-produced all-electric car, the “Leaf." It will go on sale in late 2010 in Japan, the United States and Europe. Nissan expects an initial annual production of 50,000 cars, which will rise to 200,000 when the car

is sold globally in 2012.

Prior to Nissan's announcement, Mitsubishi’s "i-MiEV" had captured headlines when it went on sale in July to corporate customers. It

is the world's first mini-size mass-produced electric vehicle. It

is now accepting orders for private customers, to be delivered after April next year.

Both EVs run 100 miles on a single battery charge. Another mini-size electric vehicle, the "Subaru Plug-in Stella," introduced in June by Fuji Heavy Industries, runs only 56 miles on a single charge.

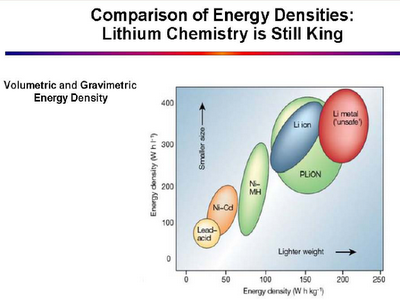

All three EVs are powered by laminated compact lithium-ion batteries, which can be charged up to 80 percent in 15 to 30 minutes with a quick charger. Charging at home on a regular electric outlet takes from eight to 14 hours.

"Short distances like 100 miles and high-cost batteries are weak points of the current electric vehicles. Unless the performance of lithium-ion batteries

is drastically improved, EVs will not replace existing gasoline vehicles," said Junji Akimoto, a group leader in manufacturing research at the National Institute of Advanced Industrial Science and Technology.

At an exhibition of Nissan’s new cars during the opening of its new global headquarters in Yokohama, Japan, company chief Carlos Ghosn said EVs could account for 10 percent of the new vehicle market by 2020. Akimoto agreed with Ghosn's view.

"There

is no doubt that lithium-ion batteries are one of the strongest candidates among next-generation rechargeable batteries for electric vehicles, but further technical innovations have to be made," Akimoto said.

The high cost of such batteries

is certainly a drawback. Both the i-MiEV and Plugin Stella are mini-vehicles, but in Japan they are priced at US$49,000 and $50,000 respectively, similar to luxury cars. Even with government tax incentives to promote the ownership of eco-cars and subsidies for drivers who replace older vehicles with eco-cars, they will cost about US$34,000. More than half

is the battery cost.

Nissan has not revealed the price tag on its new Leaf. In order to compete with similarly equipped gasoline vehicles, it plans to lease the batteries. According to its public relations department, if the car

is driven 620 miles in a month, the cost of leasing the batteries and the electricity to charge them will be one-fifth cheaper than what customers spend on gasoline for regular cars.

Although automakers emphasize the 100-mile running capacity, the actual travel distance seems to be around 60 miles if the navigation system and air conditioner are used. However, studies show that most drivers living in big cities and their satellites around the world drive less than 30 miles a day. If the prices fall to a reasonable level, these vehicles could find a place in the market.

Currently, only around 100 quick chargers have been installed at gas stations in Japan, but there

is a move to strengthen the charging infrastructure among giant supermarkets and convenience store chains.

On the other hand, sales of hybrid cars, equipped with both a gasoline engine and an electric motor, are increasing due to government tax incentives and subsidies. When the world's largest automaker and hybrid innovator Toyota introduced its hybrid car, the "Prius" – which can achieve 90 miles per gallon – it got more than 200,000 orders in a month. The Prius

is considered the most fuel-efficient vehicle on the market today.

Toyota plans to introduce a plug-in hybrid electric vehicle, which can be charged at home, within this year, an electric vehicle in 2012, and a hydrogen-powered fuel cell vehicle by 2015.

A pillar of the restructuring program by the struggling Big Three automakers in the United States

is to shift from producing existing cars to electric or plug-in hybrid electric vehicles. General Motors

is scheduled to introduce a plug-in hybrid electric vehicle, the "Chevrolet Volt," in 2010. Ford Motor Co. will introduce four kinds of EVs by 2012. Chrysler has said it aims to sell 500,000 EVs by 2013.

It

is still far from clear that EVs will ever dominate the mainstream market. Experts still show an interest in fuel cell vehicles, which attracted considerable attention a few years ago before disappearing due to safety

issues, costs and problems with peripheral technology.

FCVs, which emit only water, are also considered an "ultimate eco-car" by many. While some remain skeptical that these vehicles can surmount their problems, Japan's largest public research institute, the New Energy and Industrial Technology Development Organization, predicts that FCVs will begin selling in 2015, and that an explosion of demand will follow from 2020 to 2030.

"Nobody has ever seen electric vehicles that run 300 miles on a single charge, but this distance has already been accomplished by fuel cell vehicles," said Sayaka Shishido, who works in the fuel cell and hydrogen technology development department at NEDO. "The remaining problems are just costs and infrastructure."

Shishido predicted that existing gasoline vehicles will be replaced with fuel cell vehicles and that electric vehicles will secure a place as short-range vehicles in the future.

Akimoto has a negative perception of FCVs, however. "Fuel cell vehicles need to be developed dramatically. Hybrid cars will dominate the mainstream and electric vehicles will take some share in the coming decade," he said. He predicted that hybrid vehicles will account for half of total car sales in 20 years.

Masahiro Tatsumisago, a professor of applied chemistry at the Graduate School of Engineering of Osaka Prefecture University, said, "Hybrid vehicles will be more popular because the current models are very sophisticated." Tatsumisago predicts that gasoline cars will vanish and that FCVs and EVs will dominate the global market in the next three decades."