Juan has written a very good article about Toyota's strategy in the Electric Cars and Lithium space. We have shared with you already quite a few times why Toyota's position towards use of Lithium Batteries is so important for the lithium Industry. Today Juan makes excellent points in his analysis about the major trends in the Lithium Batteries technology.

Toyota Tsusho has a stake in Lithium Miner Orocobre Resources with its Olaroz project in Argentina.

World’s Largest Automaker’s Lead in Lithium Battery Tech Investments

"The idea about the Lithium as the strategic commodity for the Next Big Thing - Electric Cars will be making its rounds now in the investment news."

Will Tesla Model S Bring The Life Back To Lithium Miners?

"Now the only time is required for general public to realise that shale oil is the dead end and find out why China and Japan are securing the Lithium supply now. Way Of The Future came out with the great article putting Lithium Big Picture together."Seeking Alpha:

Are Ford And Tesla Pushing Toyota To Adopt Li-Ion Batteries?

The recent news that Toyota (TM) -- albeit not confirmed by the Japanese motor giant -- will increase its lithium-ion (Li-ion) battery production by sixfold prompted me to offer this analysis. It's not the first time I've written about this company. In fact, I have long argued that to remain competitive in today's global automotive industry, Toyota needs to significantly change its business strategy to begin using Li-ion (instead of nickel metal hydride, or NMH) batteries in its emblematic Prius. Of course, Toyota is much more than the hybrid car, which represents only a tiny part of its overall vehicle production. What is crucial about the Prius, however, is that it constitutes Toyota's "green face," or its main source of reputation.

As of now, the competitive position it enjoyed for many decades in producing and selling the Prius has begun to be threatened by other competitors, all of which happen to have already transitioned to lithium-based battery technologies. Hence, Toyota faces the challenge of maintaining its pioneering innovative character that -- contrary to its previous expectations -- will most likely lead it to finally switching to lithium. In what follows, I attempt to argue that time is indeed running out for Toyota.

To begin with, Toyota can no longer maintain that Li-ion batteries are not ready for prime-time. In effect, Panasonic -- its long-time partner in battery production -- in association with Tesla Motors (TSLA) has opened up a new set of possibilities for Toyota and the world. The Li-ion battery produced by Panasonic-Tesla currently powering Tesla's Model S is a concrete representation of a different way of doing things. It is clear that the Model S and the Prius are not strictly comparable. After all, the former is an all-electric car whereas the latter is a conventional hybrid. But if Li-ion batteries work well for all-battery cars, they sure do so forhybrids. So Toyota has no valid pretext not to like lithium nowadays. This argument must be taken a bit further, though.

In a Seeking Alpha article from almost two-and-a-half years ago, I described my perception about Toyota's business strategy, which can be summarized as follows: First, invest in Panasonic (the world's largest Li-ion battery manufacturer) and Tesla (the most innovative electric car producer on earth) to prepare for the transition to electric propulsion, and go beyond permanent magnet electric motors to avoid a future dependence on any rare earths, respectively. Second, delay as much as possible the upcoming electric vehicle revolution because this will simply kill the Prius, Toyota's most representative product. And third, go beyond lithium-ion batteries to develop different kinds of options, from magnesium-sulfur to lithium-air and metal-air batteries or even fuel cells.

In retrospect, Toyota's investment in Panasonic gave rise to Primearth, a joint battery venture of which the auto giant owns an 80% stake. It also invested in Tesla, which allowed Toyota to receive firsthand collaboration from the world's most innovative EV maker to develop its new all-electric RAV-4. Nevertheless, chances are this car is being produced in limited numbers only to comply with California's ZEV (Zero Emission Vehicle) mandate. Indeed, it has been known that up to 2,600 vehicles will be manufactured, with production halting at the end of next year. The huge price difference between the ICE and EV versions should also make us think that this is only a kind of "pilot balloon" for Toyota to find out, at best, what's in the EV market space. In addition, the auto giant seems to be interested in giving a boost to production of NHM batteries in China in an effort to introduce by 2015 its hybrid cars in the world's second-largest market.

Does that mean Toyota will continue delaying the arrival of the electric car rush? Yes, in a sense, but not completely or permanently. For one thing, Toyota's move is aimed at taking advantage of both human and natural resources available -- recent anti-Japanese sentiment notwithstanding -- in China to produce cheaper NHM batteries and prepare a massive introduction of hybrids into the Chinese market. For another, to preserve Prius's competitiveness in the rest of the world, it will have to adopt Li-ion batteries for its symbolic car. Why? Well, because new competitors are beginning to show up in the market, all of which using this kind of energy technology.

However, as another author has stated, increasing Li-ion battery production by sixfold doesn't mean that "every Toyota hybrid will use the new lithium batteries." I'll come back to this point later. Lastly, Toyota doesn't seem to have made much progress insofar as delivering better batteries, but we probably can't say the same about fuel cells. Regarding batteries, Toyota's most recent say has been around all-solid state and metal-air batteries, which are meant to be superior to conventional Li-ion batteries, but the Japanese company hasn't shown any real advances on the horizon. By contrast, in recent days, Toyota started to talk loudly about fuel cells. It would have even just said that the hydrogen-based sedan they plan to introduce into the market by 2015 could be cheaper than Tesla's Model S. Although almost everybody knows that the most difficult hurdle to this energy technology may still be a lack of hydrogen filling stations, whose build-up could take some time, it does seem that hydrogen is projecting itself as lithium's main rival, clearly conspiring against its dominance in the years to come.

Leaving hydrogen aside, the question remains then as to whether Toyota's dual strategy (i.e., nickel for China and lithium plus nickel for the rest of the world) will work. And my opinion is that it won't for two reasons. One, as I commented a few months ago, "China is becoming part of the exclusive group of mainstream economies that run the world nowadays. The days when Western companies used to go to China to invest mainly because of its cheap labor are gone. They now go to China to produce and sell. No wonder GM's total vehicles sold in China outpaced its U.S. sales for the first time in 2011." Toyota doesn't appear to understand that China's growing middle class, its most likely target population to demand hybrid cars, will simply not take second-best options even if they are cheaper. And two, Ford and Tesla may be or will start pushing Toyota to adopt Li-ion batteries as soon as possible, which, in turn, will push Panasonic to produce those advanced energy storage systems. Here is how and why.

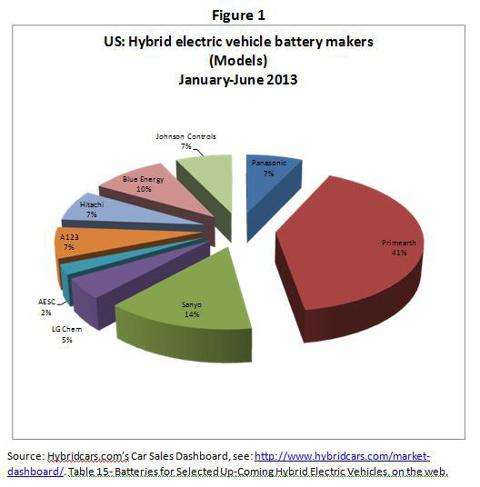

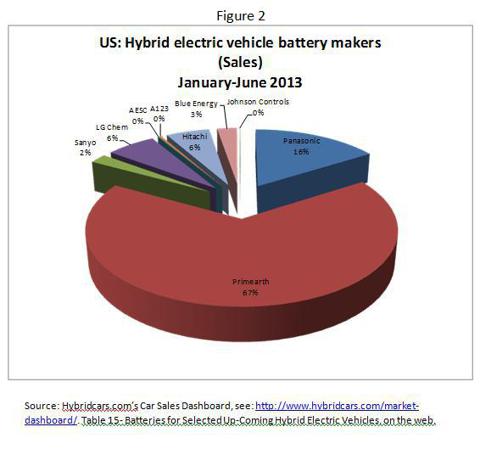

As shown in Figures 1 and 2 below, during the first six months of the year Primearth, the joint venture formed by Toyota and Panasonic, produced (on average) 41% of the batteries required by the different hybrid electric vehicle (HEV) models and accounted for 67% of the HEV market in terms of average car sales. These percentages rise to 62% and 85%, respectively, when data on batteries produced and sold separately by Panasonic and Sanyo are added up. This exercise makes sense in light of Panasonic's acquisition of Sanyo in 2011. So today, Toyota is indeed significantly related to the largest HEV battery producer/seller in the U.S. What is not clear, though, is how this pertains to lithium.

Click to enlarge images.

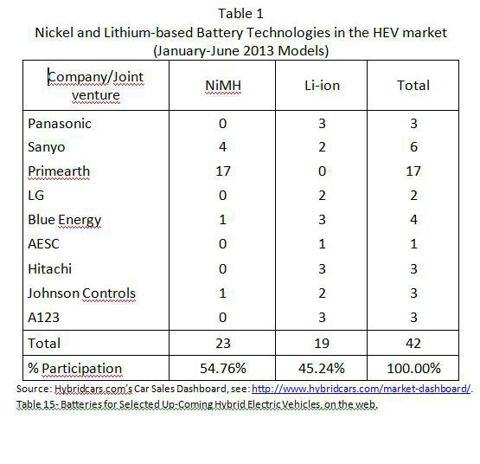

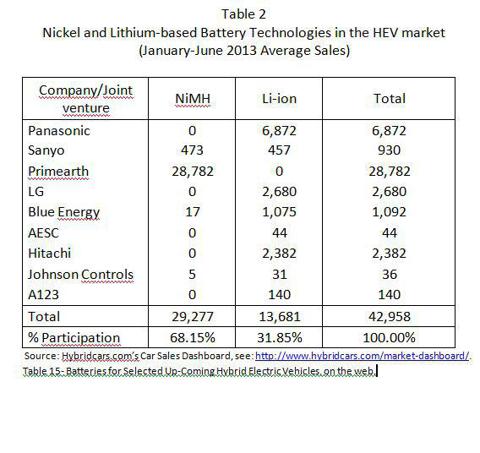

The following points showcase lithium's new state of affairs in advanced energy storage. First, as shown in Tables 1 and 2, lithium now appears to be the technology of choice for 45% of HEV batteries (in terms of models), and 32% of HEV batteries (in terms of sales). Behind are left those previous skeptical views that Li-ion batteries are not ready for commercialization.

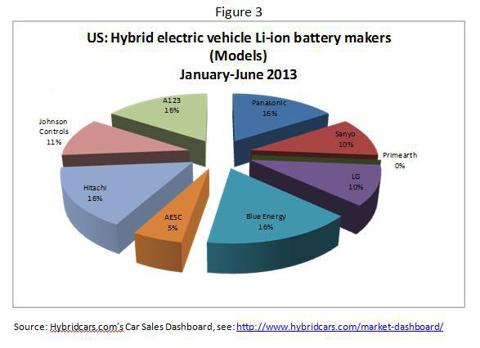

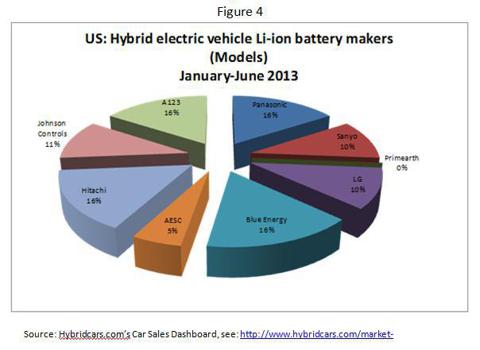

Second, as can be seen in Figures 3 and 4, during the period from January 2013 through June 2013, Panasonic's conglomerate produced 26% of the batteries for HEV models and 54% of the batteries for HEVs sold in the U.S. In both cases, Panasonic appears to be the main producer of Li-ion batteries in the U.S. HEV market.

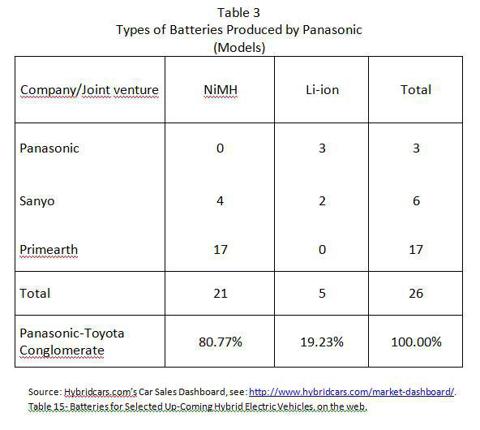

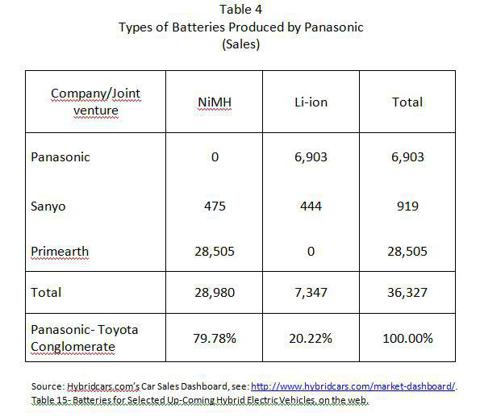

Third, lithium is becoming more and more relevant within the Japanese battery firm (see Tables 3 and 4, where it is observed that 19%-20% of all its HEV batteries, both in terms of car models and sales, are Li-ion batteries).

In this context, my first contention is that much sooner than anyone would expect, Panasonic is likely to be pulled by Toyota to become the leading Li-ion battery maker in the world for the automotive industry. As I have argued in my latest work, electric car producers can be considered lead firms in a global EV value chain that exert a leading and coordinating position within the chain and are able to set parameters in the entire chain. Hence, if Toyota requires more Li-ion batteries for its hybrids, Panasonic, its only battery supplier, will have to act accordingly.

Still, one has to wonder where all the new batteries that Toyota demands will go. Be aware that Toyota hasn't yet really been committed to plug-in electric cars. Yes, it is producing an all-electric vehicle (the EV RAV-4) and a plug-in hybrid EV, but their numbers are simply too small so as to think that they will absorb a sixfold increase in Li-ion battery production. In this connection, it doesn't seem difficult to assume that the bulk of the new batteries will have to be used for Toyota's hybrids.

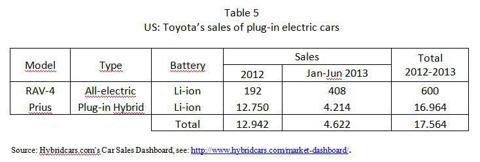

The reasoning here goes as follows: First, according toGreenCarCongress.com, at present Toyota through its joint-venture with Panasonic (Primearth) produces 36,000 Li-ion batteries per year at its Teiho factory in Japan. Second, following Insideevs.com, between March 2012 and March 2013, Toyota's worldwide sales of plug-in electric cars exceeded 31,100 units, whereas sales of Toyota's RAV-4 EV from September 2012 through June 2013 in the U.S. reached 600 units (see Table 5 below). Note that Toyota's PHEV was launched in March 2012, so the global estimation should be quite accurate and the RAV-4 EV might be only a "compliance car" produced in limited numbers (2,600 units) over a limited period of time (2012-14) and concentrated in only one market (U.S.).

Third, based on the previous numbers, it appears safe to say that the Teiho factory in Japan is attaining a 90% capacity. But given the previously described character of the RAV-4 EV, and a very slow growth of sales of PHEVs during the first quarter of 2013 (as compared to 2012) in the U.S. (see Table 5), it is hard to believe that PHEV sales will have such a significant rise so as to justify a sixfold increase in Li-ion batteries in the near future. Fourth, so we conclude that the new batteries will have to be directed to Toyota's hybrids, in general, and the Prius, in particular. And this takes us to my next contention.

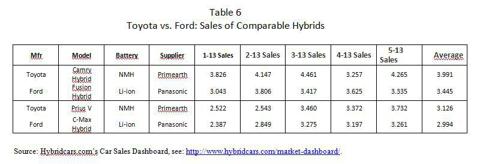

My second contention is that Ford will also soon begin to push Toyota to adopt Li-ion batteries for its hybrids, in general, and its Prius, in particular. Competition is emerging in the hybrid market following the launch of a series of hybrid cars by Ford. For the first time ever, Toyota has started to feel its effect in a market it created and long dominated. In Table 6, we see the evolution of sales of comparable HEV from Toyota and Ford during the first six months of the year.

It is quite clear that the race between these two companies is getting closer and closer. These results shouldn't be surprising considering critics' positive reviews of the Ford hybrid models. Of course, the Prius Liftback with average monthly sales in the first half of the year of 12,802 units still holds an overall supremacy on the hybrid market, but one can foresee new developments in this segment of the market as well. In fact, if Ford is about to beat Toyota with its Fusion and C-Max hybrids, it seems plausible to think that it could also do so with a new model designed to kill the Prius Liftback.

So Toyota does have a reason to worry here. This would, therefore, explain why it has decided to increase its Li-ion battery production. One shouldn't be so sanguine though about Toyota's transition to lithium since a sixfold increase in Li-ion battery production will probably not be enough to kill NMH batteries. In effect, if we concede that the new 164,000 (i.e., 200,000-36,000) Li-ion batteries will be directed to hybrids, in general and the Prius, in particular, then we need to multiply this quantity by three since the PHEV uses a 4.4 kWh Li-ion battery and the Prius is likely to use only a 1.4 kWh Li-ion battery. This gives us 492,000 Li-ion batteries, covering about 41% of hybrids produced globally by Toyota. This dual strategy will cost Toyota a great deal, especially if Ford (or some other automaker) does manage to introduce in a short period of time a comparable Prius Liftback model into the market.

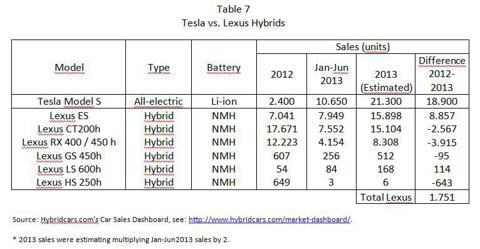

Lastly, we need to look into my third contention, namely that Tesla's Model S has become a real threat for Toyota's luxury hybrids (Lexus), hence forcing them to go lithium. As shown in Table 7, between 2012 and 2013 Tesla's Model S is likely to reflect a sales increase of 18.900 cars, whereas the sales increase of all Lexus hybrids combined will only be 1.751 cars. Consequently, Tesla's performance may be another reason why Toyota is being pushed to adopt Li-ion batteries, in this case, for its luxury hybrids.

To conclude, as shown in Figure 5, in the last three-month period a trend is beginning to emerge in the stock market as Tesla distances significantly from Ford and Toyota, and Ford appears to start outperforming Toyota. As weak as it might be, this evidence provides additional support to a previous argument of mine that innovation does indeed pay off in the stock market.

No comments:

Post a Comment