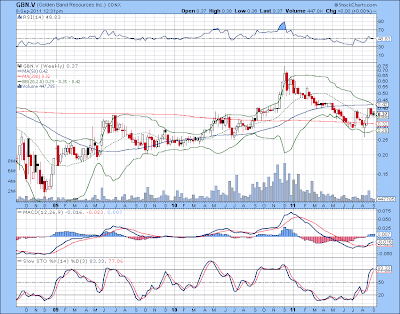

This Ron Netolitzky's Gold play in Canada slowly is waking up - we will see soon whether it can regain respect from the market due to its Chairman and his legacy.

"We are searching for the value among the bitten into the dust by the recent market panic juniors. Strong portfolios, solid management and special situations are the name of this game today as usual.

The Fear and Panic will pass and the recent turmoil provides another opportunity to accumulate your favorite plays among the Juniors in Gold, Silver, Lithium, REE and Copper. If you have people with money involved in the game your chances for reward will be even more higher. Chinese players with their appetite to secure resources can make not only REE and Lithium plays interesting, but even such a dull and out of love commodity as Zinc can be transformed into the promising value M&A plays."

The Fear and Panic will pass and the recent turmoil provides another opportunity to accumulate your favorite plays among the Juniors in Gold, Silver, Lithium, REE and Copper. If you have people with money involved in the game your chances for reward will be even more higher. Chinese players with their appetite to secure resources can make not only REE and Lithium plays interesting, but even such a dull and out of love commodity as Zinc can be transformed into the promising value M&A plays."

Saskatoon, Saskatchewan, September 7, 2011. Golden Band Resources Inc. (TSX-V: GBN) is pleased to announce the preliminary results for its summer exploration bulk till sampling program that was focused in a five km radius of the Company’s Komis and EP mine sites in the Upper Waddy Lake area of the La Ronge Gold Belt.

This summer’s exploration program has been especially successful with the identification of at least three new gold prospects and several more targets in an area that is already the focus of near-term mining development by the Company. Following are the preliminary highlights, with the locations of specific follow-up targets illustrated on the accompanying map (Figure 1).

Follow-up diamond drilling in several phases on the gold-in-till targets will start this month.

Fireweed Prospect

A total of 201 detailed till samples were collected, with three medium to strongly anomalous sites for gold identified over a strike length of 250 metres (Figure 1). The strongest, with 36 gold grains per kilogram (gg/kg) and 1,770 ppb gold in the fire assay of the fine fraction, was immediately followed-up by bulldozer and excavator trenching, exposing an east-west trending gold-mineralized shear zone that is currently exposed for 36 metres along strike and that remains open along strike in both directions (Figure 2 and in photos on the Company's website).

The initial two highly weathered rock samples from the eastern end of the showing returned 9.07 g/t gold from a vein quartz (sample FW-01-11) and 14.32 g/t Au from a shear zone (sample FW-02-11).

Channel samples were then cut over the exposed 36-metre length of the showing (Figure 2) with the best initial assay returning 3.06 g/t gold over 6 metres, including 8.17 g/t gold over one metre. The initial fire assay results are provided in Table 1.

These results are very encouraging and indicate that follow-up drilling is expected to start during September.

Big M Prospect

This gold-in-till anomaly located 1.5 km north of the Komis and EP mine sites (Figure 1), was originally identified by the Company in 2003. This summer, 93 detailed follow-up till samples were collected, with the best returning a very anomalous 68 gg/kg and 454 ppb gold in the fine fraction fire assay. The target is covered by up to 5 metres of lacustrine clays, but appears to be close to the bedrock source. Follow-up drill holes have been spotted for the initial testing of this target in September.

Bean Lake Prospect

This summer, the target was followed up by about 150 till samples at very close intervals. The best samples returned strong anomalous values in the range of 10 to 12 gg/kg. Assays of the fine fraction are not yet available. The source is likely only a few tens of metres up ice. A narrow sulphide mineralized quartz vein within a diorite dyke found nearby returned an assay of 3.2 g/t gold. Follow-up drilling is warranted.

This gold-in-till dispersion train, located four km south of the Komis mine (Figure 1), had the first anomalous till samples discovered in 2009. The prospect area is underlain by the small Bean Lake diorite stock. The pebbles of the anomalous till samples indicate hematization of the diorite and the presence of quartz.

Round Lake Area

The potentially most significant exploration discoveries of 2011 were made within the Round Lake and Dog Creek diorite stocks (Figure 1). Both of the Company’s Komis and EP gold deposits are east of the Round Lake stock and have been associated with late hydrothermal mineralizing activities within the Round Lake stock.

During the past summer, close to 500 till samples were collected over the stock with an excavator with a seven-metre boom that easily penetrated the clay cover. Several strong to very strong and extensive gold-in-till anomalies have been discovered.

One anomaly, named "301 Pit" is only 300 metres south west of the Komis mine. This area is covered by 1.5 m of till overlain by another 1.5 m of clay. The gold grain count returned 52 gg/kg and the assays of the fines are still pending.

Trenching to bedrock revealed numerous hematized diorite cobbles with ribboned quartz. Fifty hematized diorite and 10 quartz pebbles (between 5 and 9 mm in diameter, 180 g in weight) assayed 2.2 g/t gold at the Company’s Jolu assay lab. Because of high ground water, no observations could be made about the attitude of the quartz veins. Either additional trenching using a sump pump or diamond drilling is required for further follow up of this showing.

In addition to this "301 Pit", at least five more gold-in-till anomalies have been discovered in various parts of the Round Lake and Dog Creek diorite stocks (Figure 1). Only areas with multiple samples exceeding 10 gg/kg are shown. Many individual pits returned gold grain counts in the 20- to 40-gg/kg range and the first assay returns indicate a gold content of 200 to 300 ppb in the fines. Common to all anomalies is the presence of quartz and hematized diorite pebbles. Significant additional work, trenching, sampling and drilling are required to follow up on these new anomalies.

Other Areas

The balance of the till samples were taken from several other areas (Contact Lake, Earl-Kidney Lake, A-Zone and Old Komis Road) and some have returned encouraging results, and additional work is needed.

The Company is also undertaking mapping and prospecting within the North Lake Project and this will continue through September.

Bulk Till Sampling Program Details

Between June 21 and August 30, 2011, 1,340 bulk till samples were collected and processed in the in-field lab at the Company’s Waddy Lake exploration camp. Previous work has established that 3 to 5 gold grains per kilogram (gg/kg) are anomalous.

A major advantage of the in-field lab processing is that the gold-grain anomalies can be followed up within one day, whereas the commercial labs have long turnarounds such that those results often cannot be followed-up until a later field season.

Gold-in-till anomalies are especially encouraging within overburden-covered terrain, as they are direct indications of mineralized systems that contain gold, as compared to indirect methods such as geophysics that cannot detect gold directly.

In addition to the recovery of gold grains that is done in the Company’s in-field laboratory, the fine fractions of the till samples are also assayed for gold in a commercial laboratory.

Assays were completed at both the Company’s non-accredited Jolu Mill assay lab and at the Saskatchewan Research Council Geoanalytical Laboratories.

QA/QC

The Company's Jolu Lab assay lab is a non-accredited facility. Results are based on the Standard Fire Assay method and utilization of a 30-gram assay charge. The final results for this program include check assays of the significant intervals. Standard Fire Assay results greater than 3 g/t gold were re-assayed using the Screened Metallic Assay method for the significant intervals. The quality assurance/quality control of the assay results was monitored by a series of sample standards and sample blanks that Golden Band routinely inserts into the sample sequences.

The Standard Fire assays done by the Saskatchewan Research Council Geoanalytical Laboratories are in accordance with ISO/IEC 17025:2005 (CAN-P-4E) Standards. The quality assurance/quality control of the assay results was monitored by a series of sample standards and sample blanks that Golden Band routinely inserts into the sample sequences.

About Golden Band

Golden Band Resources, already Saskatchewan's leading gold explorer, is now also its newest gold producer. Golden Band is a Saskatchewan-based, publicly listed company (TSX-V: GBN) whose focus is the long-term, systematic exploration and development of its 100%-owned La Ronge Gold Belt properties. Since 1994, Golden Band has assembled through staking and strategic acquisition a land package of more than 875 km2, including 12 known gold deposits, four former producing mines, and a licensed gold mill. Golden Band's key value drivers are the methodical and systematic targeting of primary to advanced-stage exploration while progressing along a parallel path of being a sustainable gold producer. The Company is aggressively pursuing its near-term goal of commercial production of its Bingo, Komis, and EP deposits with processing at the 100%-owned Jolu mill. The Company’s objective is the annual production of at least 75,000 ounces of gold over a ten-year project life. Other longer-term objectives include the continuation of its highly successful exploration and acquisition strategies.

On behalf of the Board of Directors of Golden Band Resources Inc.,

"Ronald K. Netolitzky"

Ronald K. Netolitzky, Executive Chairman"

No comments:

Post a Comment