China M&A: Canada Zinc Metals - Akie Targets Upcoming Zinc Shortage CZX.v, LUN.to

"With announced today China Central Bank's Rate Cut - it is time to revisit what actually Chinese companies are buying now in the resource sector."China M&A: Canada Zinc Metals - Bob Moriarty: How to Unscramble an EGG CZX.v, LUN.to

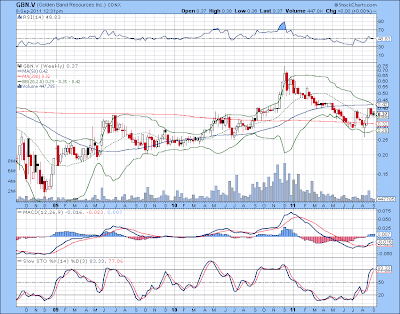

"Canada Zinc Metals has seen some activity last couple of days - Bob Moriarty thinks that it is cheap now. We can not argue here - all juniors have been beaten into the dust lately, but not all of them will rise again. You need solid projects and team, which is able to develop them. Tongling Nonferrous from China with 36% in Canada Zinc Metals and Lundin Mining are good company to navigate the recent market.

Interestingly enough, the company has renewed its "poison pill" plan couple of weeks ago."

China M&A: Canada Zinc Metals Files Revised NI 43-101 Mineral Resource Estimate Report for the Cardiac Creek Deposit CZX.v, LUN.to

In our big picture view, when Energy Transition will be the major driver for the next phase of the economic development, Copper and Zinc will play a very important role as well.

"Electric Cars produce the one life time opportunity for China now - do not get us wrong, not everything is driven by the ancient wisdom of "The Art Of War", but just look at what people are doing and not what they are talking about. It is the most apparent situation in the strategic commodities markets - Rare Earths are already controlled by China, Graphite is under the siege and Lithium is the next frontier. Despite all noise in the media, China is steadily implementing its 12th Five Year Plan - to build the new strategic industry based on Electric Cars."

"Electric Cars produce the one life time opportunity for China now - do not get us wrong, not everything is driven by the ancient wisdom of "The Art Of War", but just look at what people are doing and not what they are talking about. It is the most apparent situation in the strategic commodities markets - Rare Earths are already controlled by China, Graphite is under the siege and Lithium is the next frontier. Despite all noise in the media, China is steadily implementing its 12th Five Year Plan - to build the new strategic industry based on Electric Cars."

"Highlights of the updated mineral resource are as follows:

- Indicated resource of 12.7 million tonnes of 8.38 % Zn, 1.68% Pb & 13.7 g/t Ag at 5% Zn cut-off

- Inferred resource of 16.3 million tonnes of 7.38% Zn, 1.34% Pb & 11.6 g/t Ag at 5% Zn cut-off

- 23% increase in overall tonnage compared to the previous (2008) estimate

- Upgrade of 44% of the total resource into the indicated category"

China M&A: Canada Zinc Metals Corp - Akie Property Updated Resource Estimate

"Canada Zinc Metals has come out with another great exploration results, deposit has all chances to grow further. Stock was moving Up strongly from the recent lows couple of months ago fueled by this drill program expectations and constant rumours about Chinese consolidation. Chinese giant Tongling Nonferrous holds 36% in the company and the only question left is when they will move to increase their stake. Lundin Mining keeps all its options open with the strategic stake in the company - these two companies can easily make this Canadian region play into one of the largest Zinc and Lead mines in the world. We can talk about the magnitude of 100 million tons Zinc and Lead above 5% grade combined after consolidating the Korea Zinc and Teck Resources J/V property in the region.

In our small interconnected world Canada Zinc Metals holds strategic stake in TNR Gold with its Lithium, Rare Earths and, now - Iron Ore projects. The most intriguing part is Los Azules litigation TNR Gold vs Minera Andes with more than Half of this "Big Copper deposit in Argentina" at stake now. One day, after Canada Zinc Metals acquisition, Chinese Tongling can be knocking together with TNR Gold on the Minera Andes and US Gold door after their merger."

Update on Akie and Kechika Regional Projects – 2012 Exploration Program

Vancouver, British Columbia, Canada – Monday, July 23, 2012 – Canada Zinc Metals Corp. (TSX Venture Exchange: CZX) (“Canada Zinc Metals” or the “Company”) is pleased to provide an update on the Akie and Kechika Regional Projects. The Akie property is the Company’s flagship exploration project and is host to the Cardiac Creek SEDEX Zn-Pb-Ag deposit. The Kechika Regional Project, represented by a series of property blocks including Pie and Mt. Alcock, extends northwest from the Akie property for approximately 140 kilometres covering the prospective Gunsteel Formation shale. The southernmost project is located approximately 260 kilometers north-northwest of the town of Mackenzie, in northeastern British Columbia, Canada. The Company has been engaged in ongoing discussions with both the Tsay Keh Dene and Kwadacha First Nations communities that are located at the northern end of the Williston Lake Reservoir. At this time the two communities and the Company have entered into an interim agreement reflected in a Letter of Understanding. The objective over the coming months will be to conclude a formal agreement between the three parties. Canada Zinc Metals remains committed to maintaining a strong beneficial relationship with the two communities in the region. The Akie Zn-Pb-Ag Project The Company recently published a NI 43-101 report that provided an updated mineral resource calculation for the Cardiac Creek deposit. This report, authored by Robert Sim, P. Geo, is filed on SEDAR (www.sedar.com) and outlined an indicated resource of 12.7Mt of 8.38% Zn, 1.68% Pb, 13.7g/t Ag and an inferred resource of 16.3Mt 7.38% Zn, 1.34% Pb, 11.6g/t Ag. In response to the report, a delegation from Tongling Nonferrous Metals Group Holdings Co. Ltd., a major shareholder of Canada Zinc Metals, recently visited the Akie property to review ongoing exploration and infrastructure developments on the Cardiac Creek deposit. The Tongling delegation was very pleased with progress to-date and met with Company management to discuss further potential business developments. In preparation for underground exploration, a construction program to upgrade the portal access trail and finalize the preparation of the portal site and the waste rock dump was initiated in the fall of 2011. This was largely completed; with a 4 to 6 week program this season expected to complete the balance of the outstanding work. Environmental monitoring and baseline studies will continue throughout the summer months. The 2012 Exploration Program The 2012 exploration program is anticipated to primarily focus on the southern Kechika Regional properties following up on the recommended work proposed in the two recently published NI 43-101 reports on the Pie and Mt. Alcock properties. A prospecting, mapping, and geochemistry program is being planned on the Pie and Mt. Alcock properties to follow up on promising showings and extend soil geochemical anomalies defined in the 2011 field season. The work in 2012 is designed to improve drill target definition on both properties. In addition, prior to finalizing any subsequent drill targets on the Pie property, a review and possible resampling of the 2006 drill core may be conducted. To further enhance the understanding of the prospectivity of the Pie, Mt. Alcock and Akie properties, an airborne time-domain EM geophysical survey is being considered that was recommended in the recently published NI 43-101 reports for both the Pie and Mt. Alcock properties. A review of the historical geophysical data conducted over the Akie deposit and elsewhere in the Kechika Trough, indicates that this method should effectively delineate geology and structure. Furthermore, an earlier EM survey conducted over the Akie property appeared to obtain a geophysical response from the Cardiac Creek horizon, differentiating it from the carbonaceous to graphitic Gunsteel Formation shale host rocks. This initial survey was isolated to a few clustered lines and very limited in scope however it strongly suggests that SEDEX style mineralisation can be identified using this technique. Also, preliminary testing of drill core samples from the Cardiac Creek horizon demonstrated that the orebody is conductive. The proposed survey will cover the Pie, Mt. Alcock and Akie properties with a 200 metre spaced grid. Areas of interest will have detailed coverage with infill lines being flown at 100 metre spacing. The information obtained over the Cardiac Creek deposit will be used to calibrate a geophysical SEDEX model and will be applied to the remainder of the survey areas to identify targets for follow up ground work or possible drilling. This type of geophysical survey has been successfully utilized in helping Teck Resources define its world class Red Dog deposit in Alaska. Towards the end of the 2011 exploration season a baseline water geochemistry survey was completed on the Pie and Akie properties to test for the presence of increased amounts of sulphate in the water column down-stream of known mineralized occurrences. Samples collected downstream of the Cardiac Creek showing (the surficial representation of the Cardiac Creek deposit) and the GPS bedded barite showing returned elevated to highly anomalous amounts of sulphate. This survey will be expanded upon in 2012 to cover all major rivers, creeks and stream draining from the Akie property north to the Mt. Alcock property. To assist the Company’s exploration efforts on the Kechika Regional Project, the project area has been sub-divided into 10 major property blocks including Pie and Mt. Alcock. They are, from northwest to southeast, Thro, Saint, Driftpile South, Bear/Spa, Weiss, Kwad, Mt. Alcock, Yuen, Cirque East and Pie. Compilation of the historical exploration work is well underway on all properties. This compilation effort will endeavor to digitize all information regarding geology, geochemistry, geophysics, drilling and other pertinent data. This work is largely complete on the Pie, Mt Alcock and Akie properties and a preliminary review and compilation of the historical data from the properties northwest of Mt. Alcock has also been completed. One of the more significant prospects to the north of Mt. Alcock is the Bear prospect, located on the Bear/Spa property block, southeast of Teck’s SI property. Historical drilling on the Bear prospect includes 15 drill holes totaling a minimum of 1,578.80 metres (6 drill holes were not reported in assessment work). This work defined a stratiform lead-zinc-silver-barium enriched horizon hosted within the Gunsteel Formation shale, with an approximate strike length of 800 metres, which appears to be open ended. Encouraging results were obtained from historical drilling, with 6.7 metres (true width) of 3.95% Zn+Pb and 26 g/t Ag in drill hole B-80-02; and 4.4 metres (true width) of 3.45% Zn+Pb and 2.5 g/t Ag in drill hole B-80-01. Individual samples from the drilling demonstrate high grade tenor, with results reaching up to 8.06% Zn, 1.6% Pb and 47.5 g/t Ag in B-80-01; and 10.70% Zn, 5.73% Pb and 52.5 g/t Ag in B-80-02. Drilling conducted by Teck Exploration Ltd in the mid 1990’s continued to intersect encouraging results, including 6.84% Zn in B-95-14 and 2.27% Zn in B-95-15; some 400 metres to the northwest of the initial drilling. Continued examination of this data is required to determine the viability of the Bear prospect for further exploratory drilling. Continuation of the compilation work will enhance the Company’s decision making ability allowing it to focus on high priority targets present on the individual properties and identify areas that are underexplored for SEDEX and possible Nick (Ni, Zn, Mo) style mineralisation. As part of the Company’s obligation under its Road Use Agreement and Road Use Permit it will be funding repairs and maintenance in a joint project with Canfor (major logging company). Repairs will be made to a few bridges leading to and allowing access to the Akie property. This work is expected to be completed by the end of July. Ken MacDonald P.Geo., Vice President of Exploration, is the designated Qualified Person as defined by National Instrument 43-101 and is responsible for the technical information contained in this release. The TSX Venture Exchange has neither approved nor disapproved the contents of this press release. ON BEHALF OF THE BOARD OF DIRECTORS CANADA ZINC METALS CORP. “PEEYUSH VARSHNEY” PEEYUSH VARSHNEY, LL.B CEO & CHAIRMAN |

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advise on this blog and there is no solicitation to buy or sell any particular company here. Always consult with your qualified financial adviser before making any investment decisions.