"Rick Mills was one of the first to cover the Lithium and REE story. He has wrote extensively about Lithium Canadian Junior market from early 2009 following TNR Gold, Rodinia Minerals, Western Lithium and other companies. In his Lithium ABC he described this investment opportunity of the century with necessary depth to understand basic risks, challengers and leverage provided by different Lithium market players. Now he is coming back to TNR Gold at the moment of International Lithium spin off and we think that it is an important step for the company to bring its story out. Results will speak later for themselves, with deals in Argentina and in Nevada with Asian Corporations asset portfolio of the company should get recognition in the coming months. Do not forget about all the risks connected with early stage play in exploration business, but project generation model described by Rick in his article can buffer some uncertainties while still providing upside to the successful projects. Company is very tightly held, management is concentrating on the business development and brings the story on the investment radar screens now - it is time to make a proper DD on this story.

We have a position in this company, please, do not consider anything as an investment advise, as usual, on this blog.

Ahead of the Herd

"As you already know, our top pick in Lithium space is TNR Gold with its coming spin out of International Lithium. You have Copper, Gold and Lithium in one portfolio of properties holding by this one company. Do your own DD particularly here - we have a position in the company - nothing should be taken as an investment advise here, we are biased, but you can still find a lot of information about the company on this blog.

The company is followed now by Jay Taylor and Richard Mills. The stock is building its upward momentum from the recent double bottom this summer, and after announced developments on its major lithium brine project in Argentina. Insiders are buying more shares and the company is raising capital for its pre IPO financing. Investors coming on board will give us another hint on the future development of this company. The most important value play will be in TNR Gold's ability to position the International Lithium portfolio of properties among strategic partners in order to rapidly advance Mariana into development stage and make a consolidation of projects in Nevada for US based Lithium development play."

Now Mariana becomes a very sizable project among other lithium brines in Argentina. Company talks about "New claim secures prospective land area for potential future processing plant facility" - management seems to be carefully considering its options before International Lithium spin out with major focus on Mariana lithium brine in Argentina. It will be very important to see investors coming on board in pre IPO financing. With recent M&A activity in the lithium space company has a very strong position to attract strategic partners from the A-list of lithium end users.

Press Release Source: TNR Gold Corp. On Tuesday August 31, 2010, 1:58 pm EDT

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Aug. 31, 2010) - TNR Gold Corp. ("TNR") (TSX VENTURE:TNR - News) and wholly-owned International Lithium Corp. ("ILC") (jointly the "Company") are pleased to announce the granting of an additional 4,000 hectare claim at the Mariana lithium brine project in Salta province, northwestern Argentina.

Key Highlights:

-- 40 sq km (4,000 hectares) claim granted adjacent to the east and south of Mariana claim group;

-- 33% increase in project area to 160 sq kms (16,000 hectares);

-- New claim secures prospective land area for potential future processing plant facility; and

-- $1 million drill program planned fourth Quarter 2010.

-- 33% increase in project area to 160 sq kms (16,000 hectares);

-- New claim secures prospective land area for potential future processing plant facility; and

-- $1 million drill program planned fourth Quarter 2010.

About the Mariana Project

The Mariana project, a lithium-boron-potassium salar, consists of several contiguous mineral claims covering a 160 km2 project area that strategically encompasses the entire salar and now includes a significant portion of the surrounding area to provide prospective land for a potential future processing plant facility. Salars, or salt lakes, host some of the largest known lithium, potassium, and boron resources in the world. Lithium brines with economical grades can produce cost effectively relative to other more cost intensive mine settings.

To date the Company has completed a number of phases of shallow subsurface brine sampling surveys across the salar on a 2 kilometre grid pattern. The majority of samples within the main 10 by 15 kilometre body of the salar returned values between 250-650 mg/L lithium. These lithium concentration levels are comparable to early stage results from producing salars in North and South America. In addition, the Company has conducted systematic sampling around the salar to characterize inflows and identify distinct geochemical as well as structural zones in the salar.

The Company is planning to initiate a $1 million drill program for fourth quarter 2010 on the Mariana lithium brine property in Argentina. The goals include a) geochemical characterization of the subsurface brine across different zones within the basin, b) identification of the stratigraphy for a geological model of the salar, c) identification and characterization of the aquifer potential of the basement of the salar, and d) establish a weather station and collect data on evaporation characteristics. The Company's intent is to utilize this drill program as a first step towards a resource classification of the brine.

The scale and timing of the proposed exploration programs are subject to and dependent upon the Company raising sufficient funds.

John Harrop, P.Geo, is the company's qualified person on the project as required under NI 43-101 and has reviewed the technical information contained in this press release.

ABOUT TNR GOLD CORP. / INTERNATIONAL LITHIUM CORP.

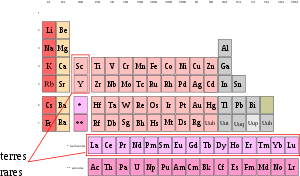

The Company is a diversified international metals exploration company focusing on the continued advancement of existing properties and identifying and acquiring new prospective projects. The Company has a portfolio of 18 active projects, of which 9 rare metals projects, including Mariana, will be held or optioned to the Company's wholly owned subsidiary International Lithium Corp upon completion of a proposed plan of arrangement.

The objective of the proposed plan of arrangement is to spin out the Company's rare metals property interests into a separate public company, International Lithium Corp. This proposed plan of arrangement has been approved by the Company's shareholders and the courts of British Columbia. The Company will now proceed with the spin out and will provide updates on the progress of the spinout in further news releases. For further details of the spinout, please refer to Stockwatch news dated May 26, 2010, or visit International Lithium's website.

The recent acquisition of lithium, other rare metals and rare-earth elements projects in Argentina, Canada, USA and Ireland confirms the combined companies' commitments to generating projects, diversifying its markets, and building shareholder value.

On behalf of the board,

Gary Schellenberg, President