Showing posts with label Alaska. Show all posts

Showing posts with label Alaska. Show all posts

Monday, August 17, 2015

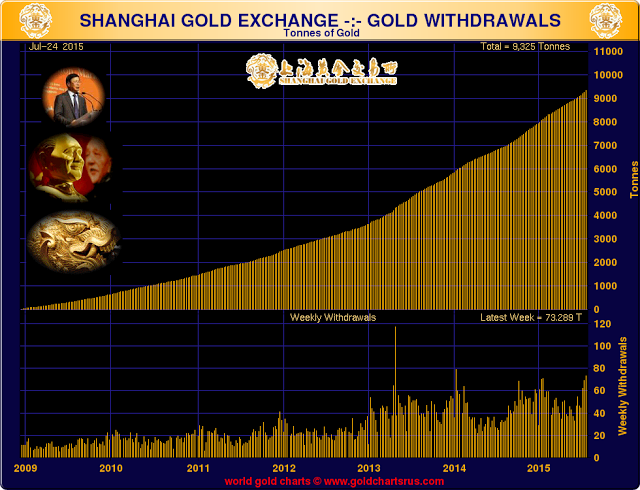

Boom: China SGE Gold Withdrawals An Enormous 1464 Tonnes So Far This Year.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

This Has Never Happen Before: Gold Hedge Funds Aggregate Net Position Has Been Short For The First Time In History.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Thursday, August 13, 2015

Number Of Owners Per Once Of Gold At The COMEX Is At Record High At 117 to 1.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Shanghai Gold Exchange Has 73.3 Tonnes of Bullion Withdrawn Its Third Largest Week.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Gold Catalyst: Don Coxe: Bull Market in Bonds Now Ending - Risks Ahead.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Monday, August 03, 2015

Is China Moving Toward a Gold Standard? Peter Schiff on the Chinese Market Crash.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Sunday, August 02, 2015

FED's Mission Impossible: "Gold Is Dead And Nobody Loves It Any More."

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Is China Moving Toward a Gold Standard? Peter Schiff on the Chinese Market Crash.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

The Asset They Love To Hate: Gold And The Grave Dancers.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Gold Catalyst: Don Coxe: Bull Market in Bonds Now Ending - Risks Ahead.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Tuesday, August 12, 2014

China Rolls Out Welcome Mat for Electric Cars: Ganfeng Lithium Partners with International Lithium in Argentina and Ireland. $ILC.v $TNR.v $TSLA $LIT

Kirill Klip.:

China Rolls Out Welcome Mat for Electric Cars: Ganfeng Lithium Partners with International Lithium in Argentina and Ireland.

Financial Post:

China Rolls Out Welcome Mat for Electric Cars: Ganfeng Lithium partners with International Lithium in Argentina and Ireland.

According to the World Bank, air pollution costs China as much as $300-billion a year in health problems and productivity losses.

In response, the Chinese central government just announced a slate of pro-electric car policies, including slashing charging station rates by 30%. Navigant Research predicts that global lithium ion battery sales will increase 400% by 2023.

A Canadian company is strategically positioned to benefit from this macro-trend.

On Aug. 5, International Lithium Corp (ILC-TSX.V) announced that it has secured 100% interest in the Mariana lithium brine property in Argentinawhile finalizing a joint venture with Ganfeng Lithium (002460-SHE) – a $1.3-billion Chinese goliath producing industrial grade lithium for new energy, new medicine, and other industries.

“Ganfeng has an army of lithium-focused geologists who looked at projects in every corner of the planet,” stated ILC president Kirill Klip in an exclusive interview, “but they chose ILC to do business with. This is a big de-risking factor for our current and future shareholders. The Chinese do their homework. They believe in the geology of our assets, our management and our development strategy.”

Ganfeng is in the process of buying a lithium battery company in China. That transaction is expected to be completed Q4 2014. They are currently one of the world’s top lithium producers.

Under the terms of the agreement, Ganfeng now holds an 80% interest in the Mariana project and they will loan ILC up to $2-million to cover ILC’s required contribution to the joint venture.

HandoutVertically integrated Ganfeng Lithium holds an 80% interest in ILC’S Mariana project in Argentina – de-risking it financially and geologically.

Klip is a MBA-trained economist who has extensive experience in banking, transportation, mining, telecommunications and internet industries.

ILC was initially spun out of TNR Gold Corp., a mineral exploration company with a strong portfolio of assets such as the Shotgun gold project in Alaska and the back-in rights to McEwen Mining’s world renowned Los Azules copper property in Argentina. TNR Gold holds 25.5% in ILC. Ganfeng Lithium holds 17.5%. Klip is the largest individual shareholder in ILC. The company is tightly held by the insiders and management.

ILC retains the right to “buy back” a 10% interest in the Mariana property by repaying Ganfeng 10% of its total incurred exploration costs.

“In the context of junior mining, the partnership with Ganfeng is the best possible scenario,” stated Klip, “we have gained a strong international strategic partner and an exploration budget with minimal dilution to the share structure.”

The recent acquisition of the Taca Taca copper deposit by First Quantum Minerals has confirmed Klip’s view that mining investment in Argentina will increase. Both Taca Taca and Mariana are located in Salta, Argentina, a mining friendly province and heart of the South American Lithium Triangle. Infrastructure development work at nearby Taca Taca is expected to benefit the Mariana project.

“I spent many years developing an integrated Lithium strategy with Ganfeng’s chairman, Liangbin Li, and vice-chairman, Wang Xiaoshen,” stated Klip, “I think it is fair to say that we understand one another, and that Li is receptive to our geological expertise.”

HandoutKirill Klip, president of International Lithium, right, and Li Liangbin, president with Ganfeng Lithium

China is competing with other countries for lithium supply. Tesla Motors (TSLA-NASDAQ) planned “gigafactory” will more than double the current global lithium ion battery production.

“Ganfeng inspected projects in Australia, North America, Europe and other projects in Argentina,” confirms Klip, “But the Ganfeng team circled back to us and chose to make a sizeable financial investment in two of our projects, in Argentina and Ireland.”

Ganfeng have also finalized a joint venture agreement with ILC on the Blackstairs Lithium project in Ireland, exercising an option to acquire 51% of the Blackstairs project with the possibility to acquire an additional 24% in the project by spending $10-million within 10 years or producing a positive feasibility study. A budget for the first phase of 1.6-million euro has just been announced on Blackstairs.

Ganfeng Lithium is a vertically integrated lithium business. As well as mineral development, they produce lithium batteries so they are looking to ILC as a future source of raw materials for their production chain in China.

ILC and Ganfeng will now begin an accelerated program to develop a pilot plant in Argentina. This project is currently being budgeted. Ganfeng’s technological expertise and research facilities are expected to reduce costs and improve efficiencies in on-going development and feasibility studies. A recently signed trade agreement between China and Argentina provides state-level support for the joint venture.

“The Mariana project has a high potassium-lithium ratio” stated Xiaoshen. “This will make the cost of the lithium resource very competitive. We believe this project will have a bright future considering the fast growing lithium demand for electric vehicles and plug-in hybrid electric vehicles.”

ILC’s agenda is to become a primary source of lithium to meet the increasing demand of its strategic partner Ganfeng Lithium.

“For people who have been to China, and understand the way they do business, this partnership is a very significant milestone,” stated Kirill. “Our projects have passed through a rigorous testing procedure by a sophisticated team of international lithium geologists. This is the financial and strategic catalyst for our next phase of growth.”

Last month, the Chinese government announced a new mandate that by 2016 at least 30% of all automobiles purchased by the government must be electric.

ILC is currently trading at .03 with a market cap of $2.7-million.

This story was provided by Market One Media for commercial purposes. Postmedia had no involvement in the creation of this content."

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.

Labels:

Alaska,

Apple,

Argentina,

Batteries,

Canada,

china,

Electric Cars,

Ganfeng Lithium,

Green,

ILC,

International Lithium,

Ireland,

Kirill Klip,

Los Azules Copper,

McEwen Mining,

Tesla

Friday, June 27, 2014

Kirill Klip.: Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

Bubble Chronicles. Mystery Solved: Meet Satoshi Nakamoto - The Face Behind Bitcoin

Kirill Klip.:

Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

Even Golden Bubbles Are Made Of Bubbles. I was following Bitcoin for a while ... and other 50 crypto-currencies. Once the amount of crypto-ideas about Gold 2.0 exceeded 60 - I have lost my interest. But the last Fall moment was truly historical: when Bitcoin has briefly touched parity with Gold.

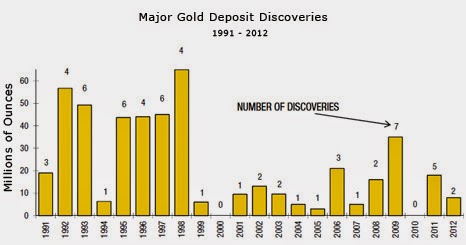

I will leave you to your own studies on this subject, but will mention only one particular angle. Bitcoin was supposed to be the competition to FIAT currencies. Why there is such a "tolerance" from authorities in U.S. - compare to the "FED's 100 years War on Gold"? Maybe I know the answer, maybe you will find another one. Gold is finite and the Only Money accepted for thousand of years as such. It cannot be printed or created in any way apart from the very hard work to discover and recover it from the ground. Gold companies are mining the dust now compared to the 90s and new discoveries are few and far between. Bitcoin, on another side, can be manufactured at Will and there is the different opinions about the Control of this Will in Bitcoin case, but NSA will always provide you with the better substitute of Bitcoin at some point: NSAcoin.

TNR Gold: Shotgun Gold Project - Why Do We Need New Gold Deposits?

Some wise, but very dangerous men once said: "We will take the best out of Them, we will intrigue them by Enigma and Secret, we will make Them think that they are running the world ... but it will be Us who is really in charge." Do you see the historical parallels?"Brothers" are still in denial and Bitcoin "revolutionaries" are fighting the FED ...

Chris Martenson: The Perfect Business Case - Exponential Money And Limited Resources Supply.

I will encourage you to read the brilliant "Gold Price Relative To Monetary Base At All-Time Low":

"The newest edition of the annual In Gold We Trust report is out. This eight edition goes again to the heart of gold’s value and analyzes the yellow metal as a monetary asset rather than an industrial commodity. The In Gold We Trust 2014 report takes a sober look at the big picture in the monetary system and offers a holistic analysis of the gold sector. It is written by Ronald Stoeferle who is the managing partner of a global fund at Incrementum AG in Liechtenstein, based on the principles of the Austrian school of Economics. GoldSilverWorlds."

If James Rickards is right with his "The Death Of Money", which I think is the case, than we are heading straight into the Currency Collapse at some point. The idea to test the substitutes to US Dollar and build up the opposition to the Only and True Money - Gold is very attractive. Problem is that the people with a lot of even FIAT money prefer Gold, only people with a lot of Debt are searching for Gold 2.0 - China buys Gold and encourages its citizens to do so. And as James Rickards has put it:

#Bitcoin fans are always promoting "Gold v Bitcoin" debates. I've never seen a#gold advocate do that.#RealMoneyEnvy

Tuesday, April 22, 2014

TNR Gold Shotgun Gold Presentation TNR.v GDX GLD MUX

TNR Gold has published its new Shotgun Gold presentation. After the news about Barrick Gold and Newmont Mining talks about the merger we are looking for the major bottom in the mining cycle. The best projects will find its way now to the investors' radar screens.

Gold M&A: Barrick Gold - Newmont Mining Merger Talks ABX MUX TNR.v NEM

"As you remember, we were looking for M&A activity in Gold and Commodities to pick up in order to confirm the major Bottom built up last year. Now we have the very important confirmation about that bottom from the industry insiders. Announced deals with Las Bambas - being bought by Chinese companies and these talks about the merger between Barrick Gold and Newmont Mining signify the very important point in the cycle. It is cheaper "to dig" for Gold and Copper on the Exchange than in the ground. Depressed market valuations of the resources represented by the discounted share prices of miners provide the best entry points in the decades for the commodity markets. It is not only our talk any more - it is the flash news from the top boardrooms in the mining business. It is the money talk by the Insiders. "Don't discount this merger talks in the future!"

Las Bambas Purchase Shows China Is Still in the Hunt for Copper MUX TNR.v LCC.v CU

We have narrowed it down from the Wall Street headline: the best Copper projects are going to those who can think about the economic development with the long term view. We have been discussing Las Bambas Sale for quite a while here and other our stories could be coming to fruition now as well. Security of supply is the major issue during the next stage of the Rising Power and Chinese companies are scooping the Globe for the best projects available.

After the bidding war for Las Bambas Copper in Peru there are not so many world class copper assets left. M&A activity in Copper sector is heating up with ongoing deals on Glencore's Las Bambas, Hudbay's acquisition and OZ Minerals talks with potential partners. Now the projects like Los Azules copper will get more industry attention. We are following McEwen Mining and TNR Gold involved in this project, please read carefully all our disclaimers and do your own DD, as usual.

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.

Labels:

Alaska,

Barrick Gold,

Glencore,

Gold,

M&A,

McEwen Mining,

Newmont Mining Corporation,

OZ Minerals,

Shotgun Gold,

TNR Gold

Subscribe to:

Posts (Atom)

Jim Rickards

Jim Rickards