The art of selling: Byron securities is financing TNR Gold TNR.v second time within one month and it looks like they can not get enough. Jon Hykawy did not mention TNR Gold in his last piece on Lithium plays below, but we guess it is just because there is no need to push this one now and financing is sold already. We will monitor the closing and our Global Lithium and REE play graduating to the new level. Financing is above the recent market price and shows management confidence in company's value proposition. Some results from exploration programmes must be due early next month and Xstrata decision on Los Azules will bring more excitement to the market place. Industry insiders are taking their stakes in the promising sector.

As consideration for acting as agent, the Agent will receive a commission of 5% of the gross proceeds raised, payable in cash. In addition, the Agent will be issued agent's warrants ("Agent's Warrants") equal in number to 5% of the number of Units placed in the Offering, each such Agent's Warrant entitling the Agent to acquire one common share of the Company at an exercise price of $0.30 per common share for 12 months from closing. The offering is subject to TSX Venture Exchange approval and any regulatory approvals.

Proceeds of the private placement will be used to fund the evaluation of TNR's Lithium and Rare Metal properties, implement the proposed spin-off of International Lithium Corp. and for general corporate purposes

ABOUT TNR GOLD CORP. / INTERNATIONAL LITHIUM CORP.

TNR is a diversified metals exploration company focused on identifying and exploring existing properties in and new prospective projects globally. TNR has a total portfolio of 32 properties, of which 16 will be included in the proposed spin-off of International Lithium Corp. It is anticipated that TNR shareholders of record will receive one share and one full tradable warrant of International Lithium Corp. for every 4 shares of TNR held as of the yet determined record date. This will result in TNR shareholders owning shares in both TNR and International Lithium. For further details of the spin-off please refer to TNR's April 27, 2009 news release or visit

The recent acquisition of lithium projects in Argentina, Canada, USA and Ireland confirms the company's commitment to project generation, market diversity, and building shareholder value.

Byron Capital Markets (Division of Byron Securities Ltd) contact: Robert Orviss CFA 647.426.1668.Gary SchellenbergPresident"

The Gold Report: You've indicated strong demand ahead for lithium ion batteries, anticipating a

40% increase by 2014 and suggesting good return-on-investment opportunities in lithium companies. To what extent does the demand for batteries that underlies those expectations rely on an economic recovery?

Jon Hykawy: Due to the downturn's global hits on demand for all metals, no question; and that forecast depends on some sort of economic recovery. But the recovery we've built into our model is actually fairly—and perhaps somewhat surprisingly—slow. We don't see the economy getting back to historic levels of growth in consumer electronics or in battery demand, for that matter, for at least two years, probably not until about 2012. Yet lithium demand and lithium battery growth will increase in much the same way as they have since 1999 or 2000. Part of that demand is predicated on continued growth in sectors where the lithium battery has almost fully penetrated, such as cell phones and laptops. Part of it is continuing cost reductions that are driving lithium batteries into new areas.

TGR: What are some of those areas?

JH: Demand for nickel-metal hydride (NiMH) batteries for items such as power tools will disappear as lithium battery prices continue to fall and start to rival prices for smaller NiMH battery packs. Very few analysts have built that into their lithium demand models to date. It's going to be interesting to see the growth curve over the next two, three to five years.

TGR: Do you see any potential breakthroughs in battery technology that could affect the demand for lithium the same way lithium is affecting NiMH batteries?

JH: Certainly chemistries are under development that could be positive for lithium. Various groups are investigating the use of lithium vanadium phosphate batteries or lithium vanadium fluorophosphate batteries. Their advantages over current chemistries are greater safety and much longer operating lives, which might be very, very interesting for automotive batteries. But these are out a number of years.

On the flip side, things that could damage lithium demand—we know of a couple of companies that are doing a fair bit of research into NiMH batteries, specifically into the powders used in those batteries. They could certainly take a significant chunk out of demand for conventional NiMH powders in NiMH batteries because their chemistries are cheaper to produce and actually slightly more efficient in terms of the battery that they can create. But the companies themselves would by no means claim that they can beat lithium ion at its own game, so lithium ion demand shouldn’t be impacted.

The only other thing I've seen that's credible for automotive use, for instance—certainly not for handhelds—are some of the molten salt batteries or sodium-sulfur type chemistries, or some other similar things that have been proposed. They have a very long operating life, long enough to have the game won over lithium in that regard. Although not nearly as good as lithium, they also have reasonably good energy density and power density. The problem is that they have to run at several hundred degrees, creating both infrastructure and safety issues.

I know people are working on lightweight lead-acid versions and various other chemistries. I wish them all the luck in the world, but I don't think they'll be able to do anything to blunt the scale or the pace of lithium battery development. So, no, I don't see anything in the immediate future with the potential to really push lithium ion out of the game.

TGR: So the battle for batteries in the current marketplace is between lithium ion and nickel-metal hydride?

JH: Yes, and the decision has kind of come out in lithium ion's favor simply because it can put out so much more energy. Basically you get operating lifetime per charge out of the battery, and now it can also put out the power. The one area in which nicad (nickel-cadmium) or NiMH was once better was an abundance of power; so, in the past, the ability to turn a screw into hardwood with a power drill or accelerate an electric vehicle favored NiMH. But that's no longer true. Lithium's development has been so rapid that its specific power—the amount of power that you can draw out of the battery of a given size and weight—has now overtaken NiMH.

TGR: What about the electronics space?

JH: Portable game-playing devices would be a good example. Circa 2000, Nintendo would have shipped the Game Boy Advance without batteries. It would have come with slots where you plugged in either your own rechargeable AA batteries or regular alkaline batteries. The new Nintendo DSi comes with a rechargeable lithium ion battery. Until recently, it would have been too expensive to include it with the device, but it's dropped to a feasible price point now. And frankly, NiMH was never there in terms of its performance. It simply couldn't deliver an experience that would make Nintendo happy.

TGR: Is the electronics arena where you see future growth coming from as well?

JH: Since 2000, though we've seen about 30,000 or 40,000 tons a year of additional demand arise for lithium, most of it coming out of nowhere in terms of these consumer batteries. And that demand continues to grow, so lithium is in substantial demand. The price has gone up as a result, and we continue to see that kind of growth.

Lithium is also used in glass production, basically to drive down the melting point of glass and keep energy costs low.

We believe future growth will continue to come from a combination of theft of market share from some of the other rechargeable chemistries and encroachment into new areas where the lithium ion battery hasn't been before. It's entirely possible that we'll see lithium ion batteries become the batteries of choice for starting and lighting in the automotive industry, for instance, but price points have to drop considerably before that happens.

TGR: Will lithium-oriented batteries play a role in alternative energy technologies?

JH: Not a huge role. We don't factor that into our model for lithium growth at all. I am a big believer in the space generally, but existing small-cell battery technologies such as lead-acid have been disproven already and actually have come to be hated in the alternative energy industry. A number of large-scale lead-acid power-storage experiments were economic disasters for the companies that tried them. Lithium is likely to fall in the same camp.

TGR: What's the problem in those situations?

JH: When you move up to the scale required of large alternative energy projects such as wind farms, when you pile that many of them together, even lithium ion batteries have an unacceptable failure rate on an individual cell basis. After a period of time, you end up with a stream of technicians running in and out of the storage facility just carrying batteries. It's not a pretty picture.

TGR: And there is a global abundance of lithium on the supply side to meet the demand you foresee?

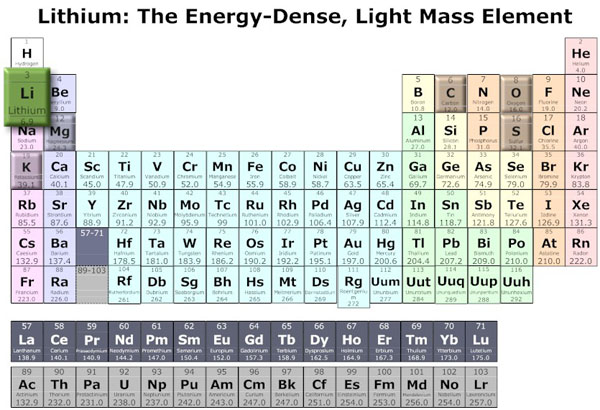

JH: There absolutely is a huge abundance of lithium. It is about as common in the earth's crust as nickel or lead.

But on a global basis, the question is never whether there is a ready supply or an abundance; it's whether the supply is economically viable. There are huge quantities of lithium available in the ocean too, but it's extremely dilute and its chemical similarity to the huge quantity of magnesium that's also in the water is another issue. Getting to the lithium supply economically at a price point similar to today's is even trickier. So while lithium may be plentiful, there is not a huge abundance of places on earth where you can get inexpensive lithium. That's really the question to concentrate on.

TGR: Where would an investor track the price of lithium?

JH: That is a tough one. The market really is dominated today by four very large chemical company players, to which lithium is somewhat an afterthought. They tend to sell to only a few buyers who basically phone them and set up contracts. We track the price of lithium either by calling these companies ourselves and asking about the short-term delivery cost for a ton of lithium carbonate or relying on Industrial Minerals magazine. It has fairly good coverage of the lithium space and puts out reasonable numbers gleaned from those buyers on longer-term contracts.

TGR: So, it's similar to uranium before uranium started trading on the futures exchange.

JH: It really is. It's a relatively small market controlled by very few players. You certainly can't trade contracts or anything like that in lithium, so it's tougher to watch. Since SQM (NYSE:SQM) drove a lot of the hard rock players out of the market in the 2001–2002 timeframe, the price has marched up steadily. We have seen prices go to the range of $6,500–$6,600 per metric ton of lithium carbonate equivalent. It has plateaued a bit through this downturn, but I fully expect the price to climb again.

TGR: Where can an investor look at the price trends?

JH: The U.S. Geological Survey is actually the easiest place to check. I believe the price was about $3,500 per ton in the late '90s. When it hit about $4,000, spodumene producers started to make inroads into the market because that price made them economically viable. SQM flooded the market with lithium and drove the price down to about $1,400, taking a lot of the spodumene players out of the game. The only one left standing at the end of the day was Talison Minerals Pty Ltd. in Australia because they had tantalum to tide them over. The price climbed from the 2000–2001 low point at that time to as high as $7,000, and then leveled off to about $6,500 through this downturn. It remains near historical high levels.

TGR: What's driving the price of lithium up if there's enough production to match demand?

JH: Good point. The lithium is out there and available. The problem is the big producers today are not producing it as their sole product. For instance, lithium probably drives only 7% or 8% of SQM's revenues. Their primary product is potash. Secondly, the largest producers in the world—SQM (NYSE:SQM), FMC Lithium, which is part of FMC Lithium Corporation (NYSE:FMC) and Chemetall Lithium, which is part of Rockwood Holdings Inc (NYSE:ROC) —

by and large draw from aquifers, from brines, to produce the lithium. If you pull too much water out of the aquifer too fast, you run the risk of depleting it completely or diluting it substantially and damaging not only lithium production, but also potash.

TGR: What's the investor opportunity in lithium if the majors treat it as an afterthought?

JH: We believe the best way to play the market is to buy a good basket of juniors that are exploring for lithium. It's traditionally the juniors that go out and find it and either become major players themselves or get acquired by players already in the market.

TGR: Brine extraction is today's low-cost production technology for lithium, but aren't these juniors looking at a different type of extraction?

JH: Yes and no. Brine certainly is, by and large, the lowest-cost way to go, though investors have to watch out for some things. The first cut for wheat from chaff is the magnesium-to-lithium ratios in brines. For every integer point increase in that ratio, add $180 to $200 of cost per ton. That puts the economically viable point for brine these days at a ratio of about 11:1 or 12:1. If you see anything much higher than that, run; there's no point in looking at it. Anything close to that actually gets to be economically scary because certainly we could have downturns in pricing.

A lot of the juniors are looking in places with good magnesium-to-lithium ratios, good concentrations of lithium in the brine, good evaporation rates so that production is relatively quick and good hydrogeology so they can actually pump enough water out of the ground to reach reasonable annual production levels.

TGR: Are there any particular juniors you're watching in that space?

JH: We've generally been counseling investors to look at primarily two things first. We believe the big drivers in this market are going to be cost and time to market. You keep the cost as low as possible because that gives you the best opportunity in any market. The companies that can get into production and be in the marketplace quickly are likely the ones to benefit the most in the lithium space. That tends to point to good companies that are exploring and looking at brines.

There are several good examples of companies doing what I described. You've probably seen stories recently about Lithium One Inc. (TSX.V:LI) acquiring good properties on Salar de Hombre Muerto in Argentina. The area has historically good chemistries in terms of that magnesium-lithium ratio. Grab sampling on these sites indicates good lithium concentrations. That's the kind of property that is available if you look for it.

Amerpro Resources Inc. (TSX.V:AMP.A) and Rodinia Minerals Ltd. (TSX.V:RM) would be two other examples. They're looking in Nevada near the old Foote Minerals operation, which Chemetall now owns and has been operating for a number of years. Those brines have historically had extremely good chemistries; they've produced in the range of 5,000–10,000 tons per year for decades. Interestingly, the brines in Nevada are more suited to producing lithium and not really economically viable potash.

You obviously never know until you drill, but you'd expect them to be of similar quality for lithium for Amerpro and Rodinia. And of course Nevada is politically stable; it's a good part of the world with a good record with mining and no land claim issues outstanding. You know what you're getting into.

Similarly, we like stories such as Orocobre Limited (ASX:ORE) and Lithium Americas Corp. that operate in Argentina. Lithium One's new property on Salar de Hombre Muerto, just down the road from FMC's great lithium-producing area, isn't the size of some of the others that are in the media more extensively (such as Salar de Uyun in Bolivia or Salar de Atacama in Chile), but it is regarded as one of the prime properties on earth because of its chemistry, its history and its hydrogeology.

TGR: And Orocobre?

JH: Orocobre has properties on the Salar de Cauchari and Salar de Olaroz in Argentina, and politically Argentina's stands head and shoulders above some other jurisdictions Again, a good project, a very good area, very accessible. And from what I've seen, hands down, Orocobre may have the most knowledgeable management team I've run across.

Of the juniors in Argentina that are at the exploration stage, they're ahead of everyone else. They are test-pulling brine out of their deposit and have evaporation ponds up and running. I've seen them in action. They aren't full-scale yet, but everyone else is just starting to do their drills and their characterization if they're lucky. Orocobre has done all of that. If everything works out in terms of the chemistry, they could be one of the early players into production.

It's relatively north of some of the other salars. Good access, probably only an hour or so from major highways, so transport issues are relatively minimal. That's a huge benefit, because some of the other salars are very remote.

Lithium Americas also is on Cauchari, Olaroz and several other salars. Again, a very good group. All of these companies seem to have very tight, very good management teams, which is also critical because you want to get these projects into production.

TGR: Any others?

JH: A couple of other names I should highlight are New World Resources (TSX.V:NW) and Western Lithium Corp. (TSX.V:WLC). New World has properties in Bolivia. Everybody is excited about Bolivia because it is the Saudi Arabia of lithium with Salar de Uyun. There are issues with de Uyun, chemical as well as political. It has very high levels of magnesium. As I explained, if the magnesium-lithium ratio is sort of 10:1 or better, you still might have something that's economic—but barely. In large portions of de Uyun, the ratio is 30:1—very difficult to be economical. New World also has property that I believe is south of de Uyun, on Salar de Pastos Grandes. The area they're in has extremely good magnesium-to-lithium ratios. Again, others have explored the area; the hydrogeology looks right. We won't know until drill holes and wells are in, but things look good, and the land claim they're on is private. The government has never stepped on private land claims in Bolivia. The management team there already has a good relationship with COMIBOL, the state-owned mining authority. John Lando, New World's president, and Joan McCorquodale, its Exploration VP, have worked in Bolivia for extended periods. They know the land, the people and what they need to do to get into production. So that's another story we like.

TGR: How about Western Lithium?

JH: For scale and political stability, we like the clays and we like Western Lithium. If their process proves out, they should be able to produce a fair amount of potash along with the lithium, which will keep their relative costs down. If they're lucky and hit an absolute home run, they may even be able to produce hydrofluoric acid, which would be a cash cow for them. That's a bit "iffier" but they have a huge resource. They can scale up without damaging that reserve because it's basically open-pit mining. And they're in the United States (Kings Valley in northern Nevada). Everybody recognizes the value in producing in a politically stable jurisdiction, even if it does cost a little bit more. So, we like WLC; it's a good story.

TGR: Any other suggestions?

JH: In general, you need to look at the viability of the project, the viability of the management team and diversification. Don't put all your eggs in one basket, because there's always a chance that even if it's on a great property in an area that's historically been wonderful, a company could be an unlucky one that finds itself drilling into an isolated aquifer with bad chemistry, or that hits a rotten area that isn't as porous as everywhere else and they can pull only 1,000 tons a year production out of a site. You just don't know until the holes are in the ground and production begins.

The economics favor even a small company that can produce 10,000 tons of lithium carbonate equivalent a year, because you're looking at $65 million in revenue. The cash-flow margin for a company with good brine in place is probably at least $4,000 a ton—probably more like $5,000 on a variable cost basis. You're looking at a complete payback in a year and a half or two years.

TGR: And minimal capex.

JH: The entire operation—to set up the facility, dig and line the ponds, do all the processing, everything—you might be talking about $60 million or $80 million. So for brine, very definitely; for hard rock, not necessarily. A few companies have found pegmatite (the spodumene-type deposits that are near surface) and maybe can establish a shovel-and-blast type operation from surface, but by and large, they have all the costs of setting up a hard rock mine.

When you're doing this with brine, on the other hand, you dig a few pits; line them with polyethylene; basically start pumping water, and then sit back to let nature do its thing. You're really moving a fairly concentrated material out with no additional processing required, other than the wind and sun. This is neither the mining nor the capex that most people know.

TGR: Is clay an attractive alternative to brine?

JH: The advantage with the clays, such as the hectorite deposits in Nevada, is a substantially higher lithium concentration than in most of the brines you'll ever find. They're open-pit operations and the deposits are close to the surface, so their cost is relatively low. They've been proven out to some extent in terms of cost and the flow processes to get the lithium out. Engineering work completed by

Chevron Corporation (NYSE:CVX), and later by the U.S. Bureau of Mines in the 1980s, is now being advanced by Western Lithium, the only company I know that's really actively working in this area today. They have a process that is likely to be more expensive in producing lithium than a good brine deposit, but it also may be substantially cleaner as an end product. With fewer contaminants than you'd derive from a brine, this would potentially mean much lower cost to a manufacturer who would be able to avoid all the secondary refining needed to produce battery-grade lithium extracted from brine. Bulk-grade lithium carbonate equivalent sells for about $6,500 per ton, but battery-grade lithium carbonate equivalent sells for about $45,000–$50,000 a ton. It's simply more valuable and it has undergone a number of other processes to basically create something that can be used in batteries.

TGR: But won't prices like that drive the price point up high enough to hamper the growth in lithium demand we've been talking about?

JH: Not really. Raw lithium accounts for only about 1% of final battery cost, so even refined lithium doesn't add a substantial amount to cost. So I stand by what I said. Lithium demand will continue to grow.

DISCLOSURE: Jon HykawyI personally and/or my family own the following companies mentioned in this interview: noneI personally and/or my family am paid by the following companies mentioned in this interview: none

Toronto-based Jon Hykawy, who earned his PhD in physics (University of Manitoba, 1991) and an MBA (Queen's University, 1997), spent four years in capital markets as a clean technologies/alternative energy analyst before being named lithium analyst at Byron Capital Markets in August. Jon began his career in the investment industry in 2000, originally working as a technology analyst concentrating on the lithium space. Jon has become a valuable resource on everything about the light, silver-white metal—from supply and demand to exploration and production. He has extensive experience in the solar, wind and battery industries, conducting significant research in the areas of rechargeable batteries, from alkalines to lithium-ion to flow batteries."