Green Fellow knows better when it is time to come down, with 13 Trillion in Debt U.S. Corp better not to play with deflation any games: time is for next round of US Dollar debasing. Problem is how to make is orderly, when even Canada has to raise Rates now?

If you would like to know the future study the history, time again is to come to solid values: Gold and Silver will flourish as real store of value. Ride will be very volatile, but this Bull still has a lot of power.

This stuff above can save us from famine and there is still a chance to produce it at home and friendly countries. Lithium can power the technology switch from oil based economy to Electrification with Electric Cars leading the way. Other options are well written in this report.

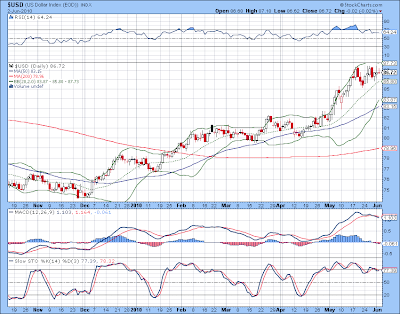

With all Euro scare it is so easy to Forget that Green Fellow is going to land hard as well in time. All FIAT currencies will depreciate against Hard Assets: Gold, Silver, Commodities like Copper and Zinc. Lithium will become the super leveraged play on Oil Squeeze: higher oil prices due to US Dollar debasement multiplied by Peak Oil situation. Have you heard about any austerity measures in U.S. lately? Total US Debt surpassed today 13 Trillion dollars and is very close to 100% of GDP. This amount is without off balance sheet obligations on social programs which are over 100 Trillion dollars now. Nobody needs and can afford the strong dollar and Green Fellow will be under pressure very soon again.

We will leave the situation on how technically stock like P&G could drop 50% in fifteen minutes to be investigated by the mass media, but will confirm here one more time: it was second Deflationary Test with sudden drop in liquidity this time driven by sovereign debt crisis. Call it Run On The Bank among Big Guys. Fifteen minutes made no mistake about the state of the market and economy in deflationary environment - we have seen the future and it is ugly. Deflation spiral means death of financial market by thousand cuts - financial system is insolvent and the only way to run it is to keep liquidity high enough that nobody is testing it to deliver. QE will provide flood of money, debt will be rolled over and by destroying the value of FIAT currencies Debt will be Inflated out in the end. This time it is different - it is not only our theory, but confirmed market action. This time the most important here is that Gold was at almost all time high at the moment of test, Gold was moving up against all currencies and this time in a sharp contrast to the events of 2008 it was sharply up and over 1200 on the day of Market Crash. This new round of QE (when Europe has not even started!) will be going already from this very high base in Gold value and rising Inflation in Commodity and Growth driven economies. We will not go into the debt issue today in details and will only point out that it is a notch under 13 Trillion and in dangerously close proximity to 100% of GDP of U.S.

After pictures from Greece we do not think that anybody will go there in U.S. Corp. Deflation will be prevented by any means, it is easy and price to pay is not so obvious. Newly printed US Dollars are "free", but price to drop them is not: you need Oil to keep you helicopters flying and here will be our first conundrum: At what point price of Oil becomes prohibitive to use Helicopters by Ben Bernanke in his open market operations?

After pictures from Greece we do not think that anybody will go there in U.S. Corp. Deflation will be prevented by any means, it is easy and price to pay is not so obvious. Newly printed US Dollars are "free", but price to drop them is not: you need Oil to keep you helicopters flying and here will be our first conundrum: At what point price of Oil becomes prohibitive to use Helicopters by Ben Bernanke in his open market operations?

No comments:

Post a Comment