Jesse reports about another escalation in the Scam Of The Century - ongoing Game Of Music Chairs in the Fractional Gold Reserve System. It will definitely become the one of the most important events in the Gold market history, there are rumours about impending explosion of the one of the LBMA members, but we even do not need them to materialise. Just check the numbers in the record breaking deliveries of Gold to Asian countries this year.

Brutal Past 24 Months For Precious Metals Investors, Nearing A Bottom – Rob McEwen MUX, TNR.v, GLD, GDX, SLV, CU

China, India, Turkey and Thailand Buying Record Amount of Gold - What Do They Know The Others Don't? GLD, MUX, TNR.v, GDX

Adam Hamilton: Gold-Futures Buying Returns GLD, MUX, TNR.v, GDX

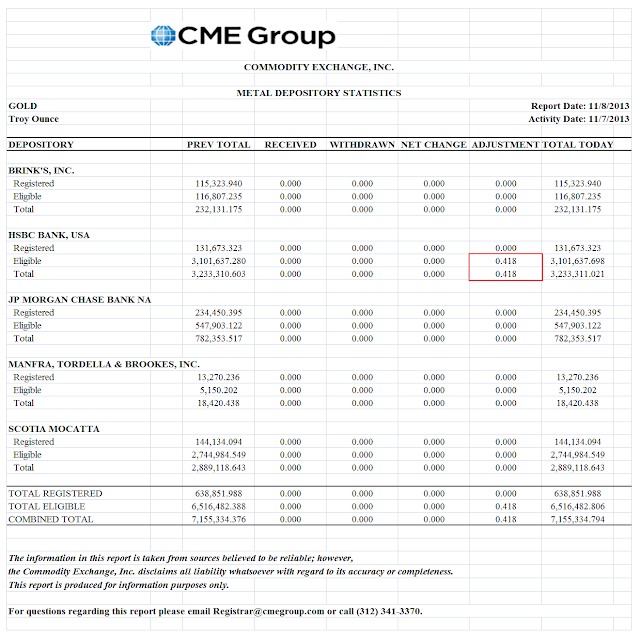

Comex Registered Gold Falls To New Low at 640,552 Ounces - Claims Per Ounce Still Around High of 59 GLD, MUX, TNR.v, GDX

Jesse Cafe American:

As you probably know the US posted a blowout headline number for the October Non-Farm Payrolls report of 204,000 jobs gains, and upwardly revised the prior month. What made this significant was the thinking that the government shutdown would have negatively impacted the jobs number.

That was not to be, not that it didn't impact jobs, but it did not impact the way in which the government counted jobs in what is the headline, 'establishment' report. The 'Household Report,' which is based on a direct survey of people, and the Labor Participation Rate which compares people who are working versus those who are available for work, were in the tank. Some other aspects like wages and hours worked were not looking very good either.

There was intraday commentary on the Non-Farm Payrolls Report here.

But hey, Wall Street was happy, with both stocks and the dollar rallying, and the SP and DJIA reaching new all time highs. Naturally in keeping with Non-Farm Payroll tradition gold and silver were hit hard, and not all that subtly. The reason for this was that the great jobs number would bring out the Fed taper talk again, but not for stocks, which were just frothing. Except of course for Twitter which had its frothy moment yesterday.

The 'claims per deliverable ounce' for gold on the Comex rose to an all time high of 60.38 contracts per ounce said to be in their warehouses and available for delivery. There was very little action in or out of the Comex gold warehouses yesterday. They are the pretty magician's assistance on the stage. The real action is taking place behind the screens.

Most of the commentary from the US financial media was funny, but in a very sad sort of way.

Let's see how the delivery process for gold plays out into year end.

Have a pleasant evening.

That was not to be, not that it didn't impact jobs, but it did not impact the way in which the government counted jobs in what is the headline, 'establishment' report. The 'Household Report,' which is based on a direct survey of people, and the Labor Participation Rate which compares people who are working versus those who are available for work, were in the tank. Some other aspects like wages and hours worked were not looking very good either.

There was intraday commentary on the Non-Farm Payrolls Report here.

But hey, Wall Street was happy, with both stocks and the dollar rallying, and the SP and DJIA reaching new all time highs. Naturally in keeping with Non-Farm Payroll tradition gold and silver were hit hard, and not all that subtly. The reason for this was that the great jobs number would bring out the Fed taper talk again, but not for stocks, which were just frothing. Except of course for Twitter which had its frothy moment yesterday.

The 'claims per deliverable ounce' for gold on the Comex rose to an all time high of 60.38 contracts per ounce said to be in their warehouses and available for delivery. There was very little action in or out of the Comex gold warehouses yesterday. They are the pretty magician's assistance on the stage. The real action is taking place behind the screens.

Most of the commentary from the US financial media was funny, but in a very sad sort of way.

Let's see how the delivery process for gold plays out into year end.

Have a pleasant evening.

No comments:

Post a Comment