Eric Sprott not only does the talk, but is doing the work as well - the target size of the fund is 500 mil and it shows that China is not only interested in Gold, but in the Gold and Silver mining companies as well. This is the sign where the money will be coming from in the resource sector. China knows when to sell and when it is time to buy.

Zijin Mining Group is the largest Gold and the second largest Copper producer in China and this move shows that smart money are already shopping for the projects to feed their pipeline.

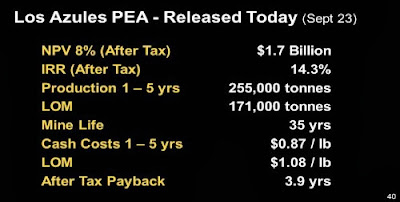

We hope that Rob McEwen is keeping his phone line open and has translated Los Azules Copper presentation in Chinese as well...

McEwen Mining & TNR Gold: CIBC Reiterates “Outperform” Rating for Lumina Copper MUX, TNR.v, LCC.v

Gold, Silver, Copper, Lithium and Market Emotions Cycle GDX, MUX, TNR.v, LIT, ILC.v

Find yourself in the picture. It is all about emotions and our ability to control it. We listen to those who has been there and did it already: stay discipline, stay focused."

Eric Sprott: "China Bought 60% of Gold Production Last Month, I Am Buying Gold And Silver Stocks Now." MUX, TNR.v

"Price of Gold and Silver will be the main driving forces for all survived companies. Eric has very bold prediction for Gold going to $2400 by next year: "The most important thing in the precious metals business - the price of precious metals. They all go up if the price of Gold will go up. The question is which one will go up 200% or 500%. If the Gold will go up to $2400, I can bet that the Gold miners index goes up 200%. What we are trying to do: where is the one which will go up 1000%."

Sprott:

Sprott Launches New Offshore Fund with Zijin Mining Group

TORONTO, Sept. 27, 2013 /CNW/ - Sprott Inc. (TSX: SII) ("Sprott" or the "Company") today announced that it has launched a new offshore global mining fund (the "Fund") with Zijin Mining Group Company Limited ("Zijin"). All relevant regulatory approvals have been received in Canada and the People's Republic of China and the Fund has been initially seeded with US$100 million from Zijin and US$10 million from Sprott.

"We are very pleased to launch this new fund which will allow us to open a new market for our investment products," said Peter Grosskopf, CEO of Sprott. "Zijin is the largest gold producer and the second largest mined copper producer in China and is listed on both theHong Kong and Shanghai stock exchanges. We believe the combination of Zijin's technical strengths and Sprott's resource investment expertise will prove to be an attractive option for investors looking to invest in the mining sector with a focus on gold."

The Fund management company is a joint venture between Sprott and Zijin and will invest primarily in the publically-listed equity and debt instruments of gold, other precious metals and copper mining companies. The Fund will be co-managed by affiliates of Sprott and Zijin. Under the joint venture agreement, Americas Now Resources Investment Management Corp. has agreed to provide technical and marketing services to the Fund.

The target size of the Fund is US$500 million and the Company anticipates receiving additional commitments from onshore Chinese investors beginning in the fourth quarter of 2013.

Forward-Looking Statements

This release contains "forward-looking statements" which reflect the current expectations of the Company. These statements reflect management's current beliefs with respect to future events and are based on information currently available to management. Forward-looking statements involve significant known and unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements including, without limitation, those listed under the heading "Risk Factors" in the Company's annual information form dated March 26, 2013. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements could vary materially from those expressed or implied by the forward-looking statements contained in this release. Although the forward-looking statements contained in this release are based upon what the Company believes to be reasonable assumptions, the Company cannot assure investors that actual results, performance or achievements will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this release and the Company does not assume any obligation to update or revise them to reflect new events or circumstances.

About Sprott Inc.

Sprott Inc. is a leading alternative asset manager dedicated to achieving superior returns for its clients over the long term. The Company currently operates through four business units: Sprott Asset Management LP, Sprott Private Wealth LP, Sprott Consulting LP, and Sprott U.S. Holdings Inc. Sprott Asset Management is the investment manager of the Sprott family of mutual funds and hedge funds and discretionary managed accounts; Sprott Private Wealth provides wealth management services to high net worth individuals; and Sprott Consulting provides management, administrative and consulting services to other companies. Sprott U.S. Holdings Inc. includes Sprott Global Resource Investments Ltd, Sprott Asset Management USA Inc., and Resource Capital Investments Corporation. Sprott Inc. is headquartered in Toronto, Canada, and is listed on the Toronto Stock Exchange under the symbol "SII". For more information on Sprott Inc., please visit www.sprottinc.com.

SOURCE Sprott Inc."