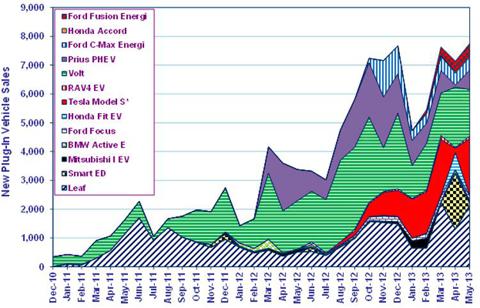

For us here the only question left is when. We are following Lithium story for years and have our own ups and downs with the sector. Tesla Model S has taken the question about the viability of electric cars out of the market equation now - they are here to stay.

Now the only time is required for general public to realise that shale oil is the dead end and find out why China and Japan are securing the Lithium supply now. Way Of The Future came out with the great article putting Lithium Big Picture together.

Lithium M&A "Art of War": Talison Lithium backs $848,000,000 Chinese Takeover Bid TLH.to, ILC.v, LMR.v, RM.v

International Lithium Corp.'s Drilling Confirms Historical Results and Identifies Unexposed Mineralization at Blackstairs Lithium Project, Ireland. ILC.v, TNR.v

Seeking Alpha:

Lithium Stocks That Could Explode

The Purpose Of This Article

In my previous article, The Birth Of The Lithium Millionaires, I discussed a future possibility that investors taking risk with lithium mining companies could become millionaires. It was more like a future prediction that, in my opinion, had a good chance of coming true. The gross consensus, however, interpreted it as a 100% fully certain "Birth of the Lithium Millionaires" article. As with the weather, it was a forecast and should only be considered as such.

After posting the article, Seeking Alpha started showing its true power. I was able to put a theory out on the wire and get an unbelievable response from such a global array of people. The counter-arguments are exactly what we need to ultimately arrive at: the truth. They've given me tons of fuel to pursue and research the issue further. There should be no reason that we together, as a body of educated people, can't use mass discussion and scientific fact to arrive at the truth. This article will further discuss the future of energy and the mechanisms behind its storage and transportation.

A Brief Summary Of The Previous Article

For those of you who didn't read the previous article, here's a short summary:

Battery electric vehicles are the future of the auto industry because the electric grid is the most efficient way to deliver the renewable sources of energy. The electric grid is compatible with all energy sources and, due to its high compatibility, leaves room for energies of the future. It also supports our current "cloud" based energy system compiled from multiple energy sources. Since lithium is the lightest metal in the world combined with a high energy density, it will play a significant role in batteries of the future.

Electric Vehicles Have Been Around For 100 Years, What Makes Now Any Different?

- The overwhelming international government joint effort on human induced climate change. (Described in detail below)

- Battery technology has just arrived at the doorstep. (Tesla Model S: 300 mile range, 8 year 125,000 mile battery warranty, negligible cold climate effect on battery.) (Tesla Range Estimator)

- Government is funding the electric charging infrastructure, just like they did the interstate before vehicles. No more "Chicken or the Egg." (EV Project 1, EV Project 2, ChargePoint, ECOtality (ECTY))

- Electric vehicle pricing is approaching the masses.

- Innovation in battery technology is a significant bi-product of the computer industry.

- Tesla (TSLA) has turned profitable, vouching for the economic feasibility of electric cars.

The Existence Of Global Warming Is Inconsequential

It makes no difference whether or not human induced climate change is true. Governments across the world have already decided to take action and they're serious about it; and yes, that includes China. Their reason behind this decision is quite simple: they are taking action "just in case" climate change is human induced. They are not willing to "roll the dice" when it comes to the survival of humankind. The ball has already started rolling; and that's very unlikely to change.

International Programs On Climate Change

- United Nations

- United Nations Framework Convention On Climate Change

- Intergovernmental Panel On Climate Change

- China Policies On Climate Change

- China National Development And Reform Commission

- Indian National Action Plan On Climate Change

- Australia Department Of Agriculture

- Australian Climate Change Adaptation Program

- WWF Russia Climate Change Program

- European Environment Agency

- Europa International Program For Climate Change

- DOE - United States Department of Energy

- NOAA - National Oceanic And Atmospheric Administration

- NASA - National Aeronautics And Space Administration

- EPA - Environmental Protection Agency

Partners On Climate Change

Natural Gas Does NOT Burn Clean

Natural gas is not a solution for carbon emissions. If you compare natural gas to gasoline you could say, relatively speaking, that natural gas burns clean. This is misleading, however, because natural gas burns dirty! When taking into account carbon dioxide emissions, natural gas emits approximately 80% the emissions of gasoline. This is not a viable long-term solution for carbon emissions. (Questar, CA.Gov, NGV)

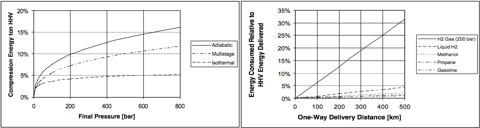

Hydrogen Is NOT The Energy Transportation Solution For The Auto Industry

Hydrogen is not feasible for use in the natural gas pipeline infrastructure:

"Several studies have discussed the issue of maximum hydrogen blend levels at which no or minor modifications would be needed for end-use systems, including appliances such as household boilers or stoves and industrial or power generation (Florisson 2010; De Vries 2009; Haeseldonckx 2007; De Vries 2007; Schumra and Klingenberg 2005; Kelly and Hagler 1980). The conditions determining a maximum hydrogen blend level that does not adversely influence appliance operation or safety vary significantly and include the composition of the natural gas, the type of appliance (or engine), and the age of the appliance. The impact of hydrogen blends on industrial facilities must be addressed on a case-by-case basis, and stationary gas engines likely will require changes to control systems (Florisson 2010). Ranges noted as being acceptable generally for end-use systems fall within 5%-20% hydrogen, and most discussions note types of changes, precautions, or costs associated with higher blends." (NREL/DOE)

A 5-20% hydrogen blend with natural gas is not a viable long-term solution. You are still at 80% natural gas, best case scenario: 50%. A complete replacement to 100% hydrogen isn't feasible either. What about the hundreds of millions, if not billions, of appliances currently running on the natural gas system? Heaters, Stoves, Hot Water Heaters, Dryers, etc... Do you think completely converting the natural gas pipelines to 100% hydrogen would be feasible? Can you imagine the enragement of the population being forced to purchase new appliances? What kind of cost do you think this would entail? What would families do in the interim? How plausible would this solution be not for our country, but for the entire world?

Quotes from the Hydrogen Properties study at Energy.Gov:

"The molecules of hydrogen gas are smaller than all other gases, and it can diffuse through many materials considered airtight or impermeable to other gases. This property makes hydrogen more difficult to contain than other gases.""Hydrogen has the added property of low electro-conductivity so that the flow or agitation of hydrogen gas or liquid may generate electrostatic charges that result in sparks.""Flammable mixtures of hydrogen and air can be easily ignited.""The burning speed of hydrogen at 8.7-10.7 ft/s (2.65-3.25 m/s) is nearly an order of magnitude higher than that of methane or gasoline (at stoichiometric conditions)."

The highway would be the next option to transport hydrogen. It seems pretty obvious to me this wouldn't be an ideal solution due to the compression, trucking, transferring, and storage of the hydrogen. The energy used in the process kills the efficiency. As you can see in the below diagrams, the compression and transportation of hydrogen by highway results in a significant waste of energy:

Hydrogen Goes BOOM, No Wait, That's An Understatement

Note: You didn't even have to read that previous section to understand why hydrogen is not the energy transportation solution for the auto industry. All you have to do is watch what happens when hydrogen mixed with oxygen explodes. When I saw the following videos on YouTube, it was absolute shock and awe. Talk about a violentexplosion!

Hydrogen IS The Solution For Storage Of Excess Energy In Non-Volume Limited Sources

While hydrogen is not the energy transportation solution for the auto industry, hydrogen has huge potential as an excess energy storage medium. In particular, energy sources not limited by volume such as renewable power plants. Solar, Wind and Hydro can store their excess energy in huge hydrogen tanks. Since you are not limited by tank size, less compression of the hydrogen is required thereby saving energy. Since this excess energy would otherwise be wasted, it's an absolute gain.

Electricity IS The Energy Transportation Solution For The Auto Industry

The arguments focused on inadequacies of the electrical grid have merit; however, they are missing the point. The electric grid is not a perfect option to deliver energy; it's our best option for lack of a better alternative. You can do all the studies you want, but taking a step back and looking at the sheer physics will give you the answer. There is no way, hands down, trucking or pumping of any physical fuel will be cheaper than piping electrons at almost the speed of light through a wire. At the speed of light you could travel around the earth approximately 7 times in 1 second! A web-based energy system couldn't be more obvious.

Think of household appliances and the power they pull. Clothes dryers pull an average of 5 kW for one hour of usage. An average daily driving range of 35 miles would require 10 kWh of daily recharging. This would be the equivalent of running your clothes dryer for two hours. Sure, the electric grid will need upgrading to support a major electric vehicle uptake, but it's our best option. More importantly, the uptake of hybrid and fully electric vehicles won't happen overnight. It will take years for them to gain a majority share in the market. As the years progress, the costs come down, and they become more popular; the upgrading of the electric grid will naturally follow. (Europa, DOT/ORNL, Tesla Calculator)

"Cloud" Based Energy Is The Present, And The Future

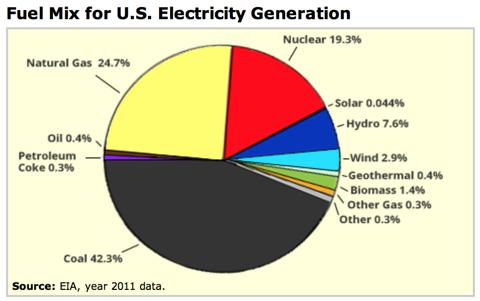

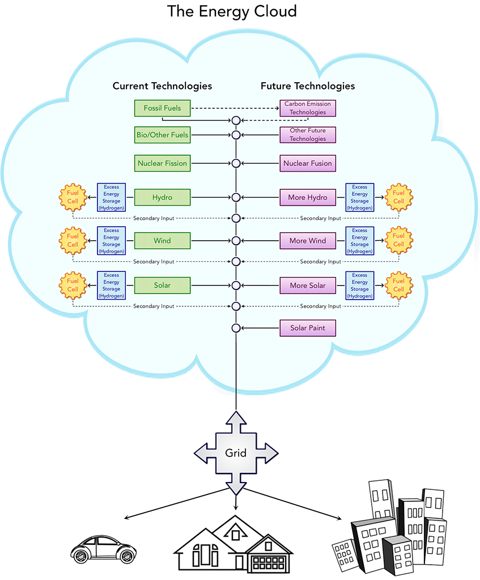

As you can see in the following diagram, we already have a cloud based energy system:

As long as the infrastructure outside the cloud is emission-less and efficient, we'll continue to devote our time to expensive new technologies that clean up the cloud. These expensive technologies may be feasible for power plants, but probably not for each and every vehicle in the country. Check out this new and unbelievable, 60% flex-efficiency gas turbine made by GE. Look at this thing! I don't see them putting this in your car any time soon!

(GE FE60)

(GE FE60)

In short, expensive new technologies will continue to reduce emissions at the power plant. An efficient grid and electric auto industry will successfully shift emissions from the vehicle to the cloud. As these technologies continue to improve, an electric vehicle infrastructure will always be compatible with it. You handle emissions at the plant, period.

Solar Paint - The Game Changer

Solar Paint will likely be the most significant game changer in the cloud. Currently, there are many hurdles to overcome with solar paint technology. Hopefully, we will have a workable solution soon. If we ever produce a feasible solar paint, it will completely change our lives as we know it. We'll be able to paint skyscrapers, parking lots, houses, cars, etc... In my opinion, this could be our renewable energy solution for the long term. Once added to the cloud, we'll start to make huge progress. Most importantly, an electric grid compatible vehicle infrastructure leaves a wide open window for game changing technologies such as solar paint.

I've created the following diagram to give a visualization of the energy cloud and its future:

Lithium: The World's Lightest Metal

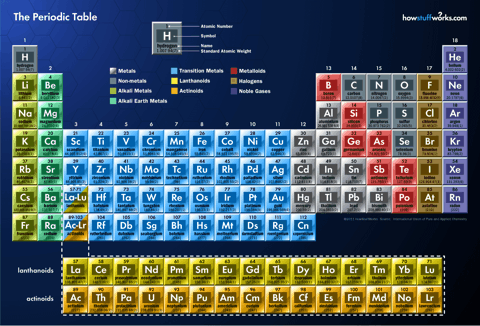

Please take a look at the periodic table of elements below. These are the building blocks that make up our world. If you're not familiar with this, here is an analogy: The letters in the alphabet are to the English language as the elements in the periodic table are to the makeup of our world. Lithium (Li) is on the top left:

Lithium is the 3rd element in the table; however, it's the 1st metal. Lithium is the lightest metal in the world. This combined with its high energy density makes it the perfect candidate for our batteries. At the current rate technology is improving, I find it hard to believe lithium won't continue to play a major role in the near future. 20 years ago we had brick cell phones: look how far we've come in such a short period of time. When the stock of Apple (AAPL) goes down because they "only" sold 15 million phones and not 20 million, it makes me think: we're going to need every energy storage medium we can find.

Lithium Supply - An Abundance Of Lithium

The debate is over: our world has an adequate supply of lithium. The skeptics' primary counter-argument usually refers back to a study done in 2006 by William Tahil (Meridian). Completely ignoring the red flag thrown because Mr. Tahil's paper had virtually no academic reference, when he wrote it the USGS world estimated resource was only 14 million tons (USGS 1). As of the year 2013, the USGS has revised its estimate to approximately 40 million tons (USGS 2).

Since 2006, Mr. Tahil's paper has been steamrolled by more recent, properly academic referenced, scientific research:

"The global lithium resource is estimated to be over 38 Mt (million tonnes) while the highest demand scenario does not exceed 24 Mt. We conclude that even with a rapid and widespread adoption of electric vehicles powered by lithium-ion batteries the lithium resources are sufficient to support demand until at least 2100." (University of Michigan)"In the case of materials for lithium‐ion batteries, it appears that even an aggressive program of vehicles with electric drive can be supported for decades with known supplies." (Argonne National Laboratory)"The review of lithium availability indicates that there is sufficient lithium to ensure significant lithium battery electric vehicles in the future." (Monash University, University of Technology, Australia)"This total, 31.1 Mt of Li, is more than sufficient to meet estimated lithium demand of less than 20 Mt for the next century, as long as batteries are recycled as discussed by Gruber et al. (2011) and prices encourage development of more challenging deposits. The large number of pegmatite and brine deposits for which resource estimates are unavailable (Tables 1 and 2) provide an additional cushion against lithium shortages during the coming century." (UM, UCD, Ford)

Lithium-Sulfur: Quadruple Supply Equivalent

Please take note: the research papers above were done on the basis of lithium-ion technology. The next generation lithium-sulfur technology has an energy density 4 times greater than current lithium-ion. Since this technology would only require 1/4 the lithium, the demand scenarios in the research papers could effectively be divided by 4. The lithium-ion energy storage equivalent of lithium-sulfur would be a virtual world resource of approximately 160 million tons. Not even considering the potentials of future lithium-air technology, apply this as the world resource estimate for the research papers above and you have quite simply: an abundance of lithium.

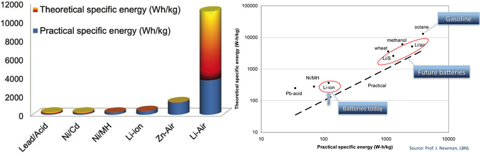

Huge Potential Ranges For Lithium-Sulfur And Lithium-Air

The current Tesla Model S boasts a huge range of 300 miles. If we take into account lithium-sulfur technology with the same size battery, we would have a theoretical range of approximately 1200 miles. Lithium-air would have a theoretical range of approximately 2400 miles. That would mean you could drive across the country on a single charge! This obviously wouldn't be the case though; instead, you would make a significantly smaller battery. Not only would this reduce the cost, but it would bring to life the ability to own multiple batteries for one vehicle. While you are driving on your current battery, your spare can charge at home.

Lithium's Competitors

Lithium-ion isn't alone in the battery space. In addition to the potential technologies of lithium-sulfur and lithium-air, there is also zinc-air. Lithium-air has a huge theoretical energy density compared to zinc-air, but zinc-air may have cost advantages. Zinc-air development is still in progress, but it may have a place in the future. Most markets have a similarity: they consist of multiple parts, each with its own advantages and disadvantages. In my opinion, lithium will be a significant part of this future market. If you thought I was trying to say lithium would be the "only" energy storage medium of the future, then this article would essentially be "too good to be true": and we all know how that ends. Basically, what I'm trying to say is: there's risk involved, but it's a risk I'm willing to take.

Lithium-Ion: Bridge To The Future

Regardless of the rate battery technology improves, lithium-ion is the industry standard for the present. Pretty much every vehicle manufacturer has either a hybrid with a battery or a fully battery operated vehicle. I think it's pretty obvious: for the first time in my life I'm starting to see these vehicles all over the place. This combined with the worldwide push on climate change will make lithium-ion the bridge to future technologies.

Everyone complains lithium-ion batteries decay over time. We've made major strides when it comes to lithium-ion technology. The "memory" effect is nowhere near what it used to be. Also, the "cold weather" effect is now negligible. All you have to do is spend some time on the forums and it's pretty obvious. Also, you can dial in a cold temperature on the Tesla website and it will show you the effect on the battery, which is negligible (Tesla Range Estimator). These downsides to lithium-ion used to be real, but are now a thing of the past. Granted, the battery isn't going to give the same charge 10 years from now, but that's beside the point. Here's the point: the car is electric and can run on batteries of the future. Tesla offers an 8 year 125,000 mile warranty on their battery. In 8 years, I find it hard to believe we won't make major strides with batteries. Electric vehicles run on electricity; it's the compatibility that's key.

Economical Recycling Of Batteries

I can't tell you how many times I've heard batteries are toxic and we're just shifting our current problem into another. Lithium-ion batteries arenot toxic. Also, they are recyclable.

"At the end its usable life, the cells and pack could, by law, be disposed in a landfill. The pack contains neither heavy metals nor toxic materials. While the components could be thrown away, Tesla has implemented a recycling strategy which reuses or recycles over 60% of the battery. Once pack production volumes increase, further recycling steps become profitable and the recycling percentage increases to 90%. The components recovered in the recycling process are valuable which creates a financial incentive for recycling." (Tesla-1, Tesla-2)

Lithium Investments

Here are my following three recommendations in order of risk/reward. The Global X Lithium ETF is a safer bet due to diversification. Unfortunately, the only way the title of my article could hold true is if you take the risk. You probably won't become a millionaire from a small investment in huge mega-cap lithium companies. As with most investments, the only way to hit it big is to invest in a promising company when they're still a baby. The 2nd/3rd stock recommendations are for two lithium mining companies that are still babies. If you're looking for super safe investments on the other hand, then I would recommend: Sociedad Qumica y Minera de Chile S.A. (SQM), FMC Corporation (FMC) and Rockwood Holdings, Inc. (ROC). If you are like me and want to invest in companies before they get big, then you'll have to go with the riskier stuff. It's sheer stock market nature: risk and reward usually ride together. And like Warren Buffett said: "Someone's sitting in the shade today because someone planted a tree a long time ago." If this is my chance to plant a tree I'm not going to miss it, even if the tree may never grow.

Global X Lithium (LIT) - ETF

- Professionally managed ETF.

- Provides diversification across many lithium related companies.

- Includes several already established large cap companies, which may minimize risk.

- Fully listed ETF on the NYSE, providing a large pool of potential investors.

- Mitsubishi Corporation holds an equity interest.

- Fully listed company on the Toronto Stock Exchange, meaning they have satisfied the appropriate listing requirements, rules and regulations of the exchange.

- Huge land ownership amounting to approximately 400,000 acres of land in the Lithium Triangle.

- Flagship Cauchari-Olaroz project boasts a huge figure of 11.7 million tons lithium carbonate, which is believed to be the 3rd largest brine resource in the world. This one mine is estimated to have a minimum life of 40 years.

- JEMSE has an equity interest significantly decreasing governmental risk.

- Completed feasibility study and on track for production.

- Investor Presentation

- Technical Report

- ShanShan Corporation, one of China's largest battery suppliers, holds an equity interest and their CEO sits on the board of directors at Rodinia. Their massive customer base provides long-term growth potential. ShanShan supplies battery components to companies including Apple, Sony, Sanyo, Samsung, Lishen, Benz and BMW. (ShanShan)

- Fully listed company on the Toronto Venture Exchange, meaning they have satisfied the appropriate listing requirements, rules and regulations of the exchange.

- Clayton Valley Project controls over 70,000 acres of land in Nevada, one of the only brine deposits in the USA.

- Flagship Salar de Diablillos project has a huge estimated IRR at 36% due to geographic location in the Lithium Triangle.

- Holds exploration rights in several lakes in the Lithium Triangle.

- Investor Presentation

- Technical Report

Previous Article -> The Birth Of The Lithium Millionaires

Additional disclosure: LAC and RM both trade on the Toronto Exchange and are subject to their listing requirements, rules and regulations. They can be traded in US markets through the tickers LHMAF.PK and RDNAF.PK."

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.

No comments:

Post a Comment