Smog in China.

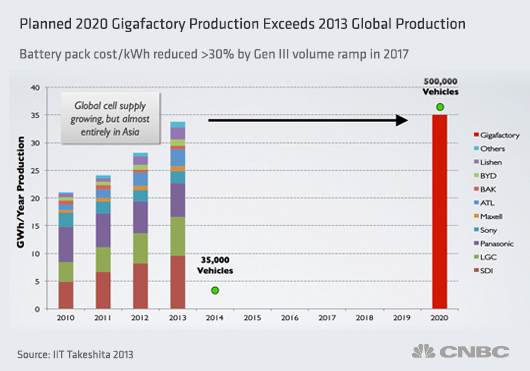

Investors are still connecting the dots and far reaching implications of the Tesla Gigafactory for the Electric Cars, Solar and Wind power industries. The real players are taking steps already to secure the supply of the strategic commodities like Lithium for the ongoing Electric Revolution. China is literally chocking up with pollution in all major cities and government has announced dramatic shift towards the cleaner economy. Electric Cars will be the very important part of it.

We will have to learn the new names like Ganfeng Lithium - China has very quietly built the Lithium Industry over the last few years and now controls the very big part of the world-wide Lithium Materials market. Now these companies have grown up and searching the globe in order to built vertically integrated conglomerates with value chain from raw materials to the Lithium Batteries. International Lithium from Canada has built the portfolio of Lithium Projects spanning the globe from Canada to Ireland and Argentina and is moving forward with development in the partnership with Ganfeng Lithium. Do your own DD and enjoy the ride, hopefully in the Electric Car!

"Kirill Klip, president of International Lithium (TSXV:ILC), views the announcement of Tesla’s Gigafactory as a “groundbreaking development.”Tesla “brought attention to what Elon Musk has accomplished,” Klip told Lithium Investing News. “He showed to everyone that electric cars are not toys anymore — they are for real.”

International Lithium In The Survey: Will Tesla’s Gigafactory Be Good For Lithium? ILC.v TNR.v LIT

"Kirill Klip is making some rounds in the industry media with International Lithium these days. Stock has been halted pending the news announcement from the company now. You can get more information on Tesla Gigafactory, Ganfeng Lithium and International Lithium from the presentations below."International Lithium's Strategic Partner, Ganfeng Lithium, Takes Large Stake in Mariana and a $10 million Option on the Blackstairs Projects ILC.v TNR.v LIT

"Mar 19, 2014 (ACCESSWIRE via COMTEX) -- Vancouver, B.C. / ACCESSWIRE / March - 2014 / International Lithium Corp. (the "Company" or "ILC") announces several major transactions with strategic partner GFL International Co., Ltd. ("Ganfeng Lithium" or "GFL")."Tesla’s bet on winning the global lithium race

By: Clay Dillow, Special to CNBC.com

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.

No comments:

Post a Comment