Rare Earths have a very wide range of applications, we have been covering mostly those ones crucial for the Electrification of our transportation - namely Neodymium and Dysprosium. LED is another driver for this sector. With looming Energy transition to post carbon society LED will be taking a crucial role in energy conservation and China leads here the way again.

With James Dines calling on the last opportunity to get on the Rare Earths bandwagon we continue our search for the fundamental drivers in this sector and the hidden value opportunities among the bitten into the dust juniors miners.

This week reversal in the markets with S&P advance of more than 5% provide some hope for the risk sipping down the food chain into the miners and junior mines particularly. Jim Puplava this week talks about the record level of short interest in Mining stocks.

With James Dines calling on the last opportunity to get on the Rare Earths bandwagon we continue our search for the fundamental drivers in this sector and the hidden value opportunities among the bitten into the dust juniors miners.

This week reversal in the markets with S&P advance of more than 5% provide some hope for the risk sipping down the food chain into the miners and junior mines particularly. Jim Puplava this week talks about the record level of short interest in Mining stocks.

"Lithium Charge: China Begins Implementation of "12th five-year" Plan for Electric Cars. China takes Electrification of its transportation system very seriously and Chinese companies are very active now in the Lithium and Rare Earths spacesecuring the supply of this strategic commodities."

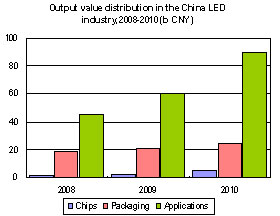

| China's LED industry under the 12th Five Year Plan | |

|

No comments:

Post a Comment