Vancouver B.C.: TNR Gold Corp. (the “Company”) is pleased to announce assay results from the second hole of the 2012 drilling program on the Shotgun gold project in Alaska. Drill hole SR12-57 returned 209 metres averaging 1.02 grams per tonne gold across the full length of the targeted porphyry system. These results include several higher-grade intercepts that confirm the Company’s model of mineralization where elevated gold values occur in repeating structural features through the Shotgun Ridge area.

•

Drill hole SR12-57 returns mineralized interval of 209 metres averaging 1.02 grams per tonne gold.

• Included within this interval is 61.4m averaging 1.53 g/t Au.

• Combined with SR12-56 ( containing a 242m interval with 1.25 grams per tonne gold), the gold mineralization model at Shotgun Ridge is confirmed along strike and down dip

• Drill hole SR12-57 ended in mineralization at a down hole depth of 300 metres (approximately 150m below the topographic surface).

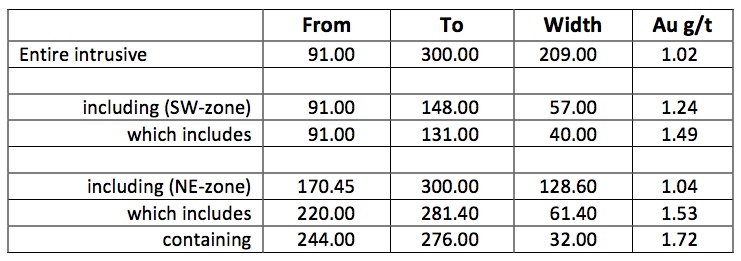

Drilling Results

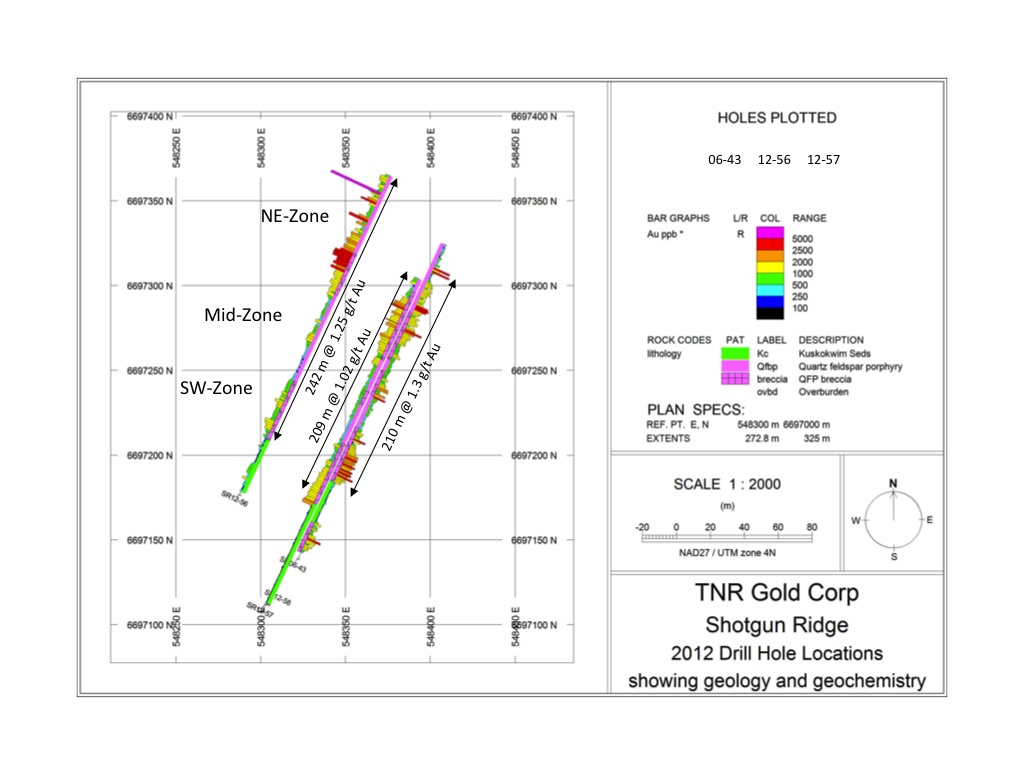

Diamond drill hole SR12-57 was drilled at the same orientation as SR06-43, approximately 35m to the southwest (SR06-43 was previously reported to contain 210 metres averaging 1.3 g/t Au). SR12-57 was one of three drill holes drilled in 2012 to test continuation of the mineralized zones encountered in 06-43 along strike and to depth. 12-57 is the first drill hole in a fence below 06-43 and together enhances the Company’s understanding of the controls on gold mineralization at Shotgun Ridge.

Three zones are identified by more intense brecciation and increased gold grades within the porphyritic intrusive and correlate well between all 2012 drill holes. These new results, combined with those previously released for SR12-56, significantly reinforce confidence in the specific orientation of the higher-grade southwest dipping mineralized zones and provide a basis for future drill targeting. The strongest mineralization encountered in hole SR12-57 is coincident with interpreted geophysical anomalies. The hole, drilled at a 45 degree angle down the side of the ridge, ended in mineralization at a down hole depth of 300m which is approximately 150m below the topographic surface.

As per

Table A

Cross section and plan map images showing SR12-57 are available on the Company’s website, http://www.tnrgoldcorp.com

Click for plan map.

Drill targeting was aided by geophysical surveys conducted in 2011. The IP/Resistivity surveys were successful in identifying the position of important, mineralization controlling structures and contacts. The geophysical surveys were expanded in 2012. The Company believes that the new drill results confirm the orientation of these key structures and the correlation with geophysical anomalies provide a clear targeting method for continued drill programs and future resource delineation.

“We are encouraged by the uniformity of gold grades across the reported intersections and that the averages are not supported by narrow, high grade intervals. The results build on the success of the 2011 geophysical surveys, and establish an exploration method that can locate buried targets at the Shotgun property. This is a key step in being able to apply geophysical results from 2012 to planning for the next season of exploration,” comments John Harrop, VP Exploration

“The positive results from this year’s drilling have significantly elevated the projects’ potential and is a major turning point in the exploration at Shotgun Ridge. A previous interpretation of the mineralization at Shotgun showed limited room for expansion. Confirmation of our new model greatly increases the size potential of Shotgun and opens up a number of new zones that will be tested next season,” Gary Schellenberg, President and Executive Chairman.

About the Shotgun Gold Project

TNR holds a 100% interest in the Shotgun property located 175 kilometres south of Donlin Creek within the Kuskokwim Gold Belt in southwestern Alaska. This area is emerging as a world-class, multimillion ounce gold district. The Shotgun property includes a number of prospects, including Shotgun Ridge and nearby Winchester. Donlin is an intrusion-associated system and represents one of the largest undeveloped gold deposits in the world. The Company believes that there are several key similarities between prospects on the Shotgun property and that of the Donlin Creek gold deposit as well as other important intrusion-associated deposits.

Analytical work was conducted by Inspectorate (A Bureau Veritas Group Company) with prep work performed in their Fairbanks Alaska facility. Fire assay with ICP-ES finishing was conducted by Acme Analytical laboratories (A Bureau Veritas Group Company) in Vancouver, Canada. Samples with greater than 10 g/t Au were automatically reanalysed using fire assay with a gravimetric finish. Both of these laboratories are ISO 9000 certified and in addition Acme has ISO 17025 certification. TNR Gold inserts certified reference materials and blanks in a quality control procedure that follow industry current best practices.

John Harrop, PGeo, FGS, a Qualified Person for TNR Gold Corp. as defined by NI 43-101 has reviewed the technical information contained in this report.

About TNR Gold Corp.

Over the past twenty-one years TNR, through its lead generator business model, has been successful in generating high quality exploration projects around the globe. With the Company's expertise, resources and industry network, it is well positioned to aggressively identify, source, explore, partner and continue to expand its project portfolio.

TNR's recently listed subsidiary, International Lithium Corp. (TSX:ILC.V), demonstrated the successful application of TNR's business model in which TNR shareholders benefited from a unit distribution upon spin-out of TNR's lithium and rare metals projects. Gangeng Lithium Co. Ltd. Is a leading China based, multi-product lithium manufacturer, and strategic partner and investor in ILC. TNR remains a large shareholder in ILC at 25.5% of outstanding shares.

At its core, TNR provides significant exposure to gold and copper through its holdings in Alaska and Argentina; and teamed with the recent acquisitions of rare-earth elements and iron ore projects in Canada confirm TNR's commitment to continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the board,

Gary Schellenberg

President

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Statements in this press release other than purely historical information, historical estimates should not be relied upon, including statements relating to the Company’s future plans and objectives or expected results, are forward-looking statements. News release contains certain "Forward-Looking Statements" within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended. Forward-looking statements are based on numerous assumptions and are subject to all of the risks and uncertainties inherent in the Company’s business, including risks inherent in resource exploration and development. As a result, actual results may vary materially from those described in the forward-looking statements.

Symbol: TNR:TSXV

CUSIP: #87260X 109

SEC 12g3-2(b): Exemption #82-4434"