One mystery is

solved: Satoshi Nakamoto is found and another one: when this

bubble will be finally over will be found soon. Warren Buffet has discussed it

recently and dismissed Bitcoin as a currency, as a store of value it

is not working very well for the latest buyers from the last Fall. It will be more and more

difficult "to find another fool" to buy it at a higher price after all recent

news about Mt. Gox bankruptcy, millions of lost Bitcoins and

crucial technical fault in Bitcoin architecture allowing it to happen. Constant

attacks from the Central Banks around the world will only add to the

pressure on FIAT alternative. There is no "Gold 2.0" - there is only

one real Gold and not so much of it left now.

After these revelations about Satoshi Nakamoto pedigree and his long history of working on highly classified projects you can think for yourself from what point in time NSA has been really involved in this project and what will be the implications on Bitcoin crowd of "freedom fighters" with further investigation reports coming out. The destiny of Bitcoin speculators we can learn from the history."I am no longer involved in that and I cannot discuss it," he says, dismissing all further queries with a swat of his left hand. "It's been turned over to other people. They are in charge of it now. I no longer have any connection."

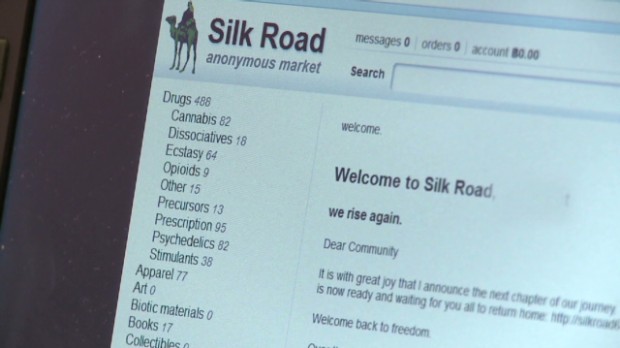

Bubble Chronicles: Drug Site Silk Road Wiped Out By Bitcoin Glitch

Bitcoin plunges 50% on Mt. Gox to hit USD230 as troubles continue

So much for the store of value and "Gold 2.0": Bitcoin continues its troubles now related not only to the herd mentality chasing the bubbles, but to the fatal flaw in the core of it praised crypto-currency architecture. Meanwhile the real and one only Gold is breaking out with topping $1,322 intraday. Realisation that there is no substitutes for Gold will be another factor to ignite this new Gold Bull leg. China was first here again and bought record amount of 247 tons of Gold in January.

So much for the store of value and "Gold 2.0": Bitcoin continues its troubles now related not only to the herd mentality chasing the bubbles, but to the fatal flaw in the core of it praised crypto-currency architecture. Meanwhile the real and one only Gold is breaking out with topping $1,322 intraday. Realisation that there is no substitutes for Gold will be another factor to ignite this new Gold Bull leg. China was first here again and bought record amount of 247 tons of Gold in January.

Bubble Chronicles: Bitcoin Crashed Down Fast to $500 at Mt. Gox and $102 at BTC-e today.

"After all the news about the Mt. Gox and Russia making any transactions with Bitcoin illegal, Bitcoin is crashing fast now with Mt. Gox quoting below any other exchanges at $530 and Litecoin is down to $15.

Bitcoin has printed low $500 on Mt Gox and fell as low as $102 at BTC-e today! So much for the crypto-currency reliability as exchange, the "value" of vapour currency can literally evaporate at any moment. Time is for Gold to shine again, it does not need any substitutes and is breaking out to the upside today clearing $1270 level."

Newsweek:

The Face Behind Bitcoin

Satoshi Nakamoto stands at the end of his sunbaked driveway looking timorous. And annoyed.

He's wearing a rumpled T-shirt, old blue jeans and white gym socks, without shoes, like he has left the house in a hurry. His hair is unkempt, and he has the thousand-mile stare of someone who has gone weeks without sleep.

He stands not with defiance, but with the slackness of a person who has waged battle for a long time and now faces a grave loss.

Two police officers from the Temple City, Calif., sheriff's department flank him, looking puzzled. "So, what is it you want to ask this man about?" one of them asks me. "He thinks if he talks to you he's going to get into trouble."

"I don't think he's in any trouble," I say. "I would like to ask him about Bitcoin. This man is Satoshi Nakamoto."

"What?" The police officer balks. "This is the guy who created Bitcoin? It looks like he's living a pretty humble life."

I'd come here to try to find out more about Nakamoto and his humble life. It seemed ludicrous that the man credited with inventing Bitcoin - the world's most wildly successful digital currency, with transactions of nearly $500 million a day at its peak - would retreat to Los Angeles's San Bernardino foothills, hole up in the family home and leave his estimated $400 million of Bitcoin riches untouched. It seemed similarly implausible that Nakamoto's first response to my knocking at his door would be to call the cops. Now face to face, with two police officers as witnesses, Nakamoto's responses to my questions about Bitcoin were careful but revealing. More"