Showing posts with label Shotgun Gold. Show all posts

Showing posts with label Shotgun Gold. Show all posts

Monday, August 17, 2015

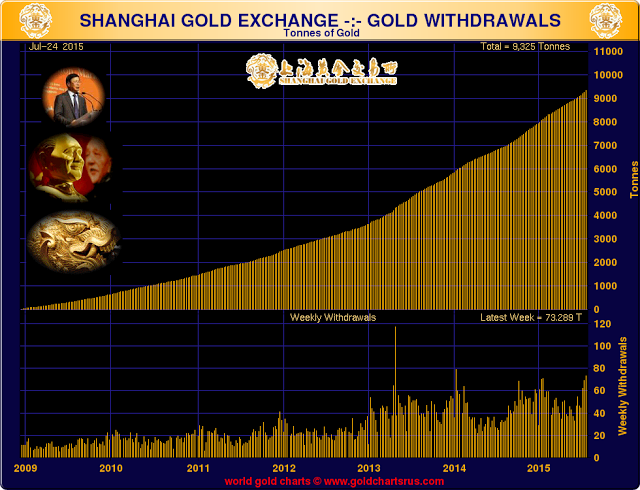

Boom: China SGE Gold Withdrawals An Enormous 1464 Tonnes So Far This Year.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

This Has Never Happen Before: Gold Hedge Funds Aggregate Net Position Has Been Short For The First Time In History.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Energy And Precious Metals Royalty Company: TNR Gold Holds 2015 Annual General Meeting.

Energy And Precious Metals Royalty Company: TNR Gold Holds 2015 Annual General Meeting.

We are very fortunate to have the strong support for TNR Gold from its shareholders. We continue to realise our business plan and building Royalty Company holding Royalty and Stakes in Precious and Energy Metals. International Lithium development with Ganfeng Lithium is at the front line of our advance now.

TNR Gold main assets include:

Sale of our assets in Los Azules copper project will provide TNR Gold with capital to advance our other projects. International Lithium is developing its J/V projects with Ganfeng Lithium - one of the top world leaders in Lithium materials production from China.

TNR Gold And Los Azules Copper: McEwen Mining - Back To The Basics.

There is very little coverage on Los Azules copper project despite of being "One of the largest undeveloped copper deposits in the world" - according to McEwen Mining. I am very pleased to find out this publication about McEwen Mining, Argentina and magnitude of Los Azules copper project.

Please read carefully my legal disclosure. All this material is provided for information only, I was not able to verify any technical information in this article, it should not be relied upon in any investment decisions.

TNR Gold holds now 0.4% NSR on the whole Los Azules copper deposit, 1% bonus on the sale of Los Azules and McEwen Mining shares. You can find all our financial information in the official reporting on SEDAR.

"Copper and Lithium become the strategic metals for the ongoing green revolution. Solar and Wind Energy and Electric Cars will drive the new demand for these metals. Solar Energy is growing very fast all over the world now. Energy Storage will be the next step to ignite this growth. This is the new focus of Elon Musk and his Gigafactory. He will introduce the home storage system based on the lithium batteries in the next few months. Copper will have its special place in this mass scale roll out of distributed energy generation systems with Wind and Solar Power. Integral part of this system - Energy Storage is getting popular now with Elon Musk Gigafactory and Warren Buffet with BYD making the headlines. These Trillion Dollar industries: Electric Cars and Energy Storage will drive the demand for Copper and Lithium in the future. Read more."

TNR Gold:

TNR GOLD HOLDS 2015 ANNUAL GENERAL MEETING

"August 7, 2015

TNR GOLD HOLDS 2015 ANNUAL GENERAL MEETING

Vancouver B.C.: TNR Gold Corp. (“TNR” or the “Company”) held its Annual General Meeting on August 6, 2015 and is pleased to announce that all resolutions proposed in the information circular were passed. In addition, all agenda items, as outlined in the circular, were approved and all directors standing for election were re-elected. The Directors for the ensuing year will consist of Mr. Gary Schellenberg, Mr. Kirill Klip, Mr. Paul Chung and Mr. Greg Johnson.

Mr. Gary Schellenberg was reappointed President and Chief Executive Officer. Mr. Kirill Klip was appointed Non Executive Chairman of the Board and will directly support and advise the Chief Executive Officer of the Company. Mr. Jerry Bella was reappointed Secretary and Chief Financial Officer, Mr. John Harrop was reappointed Vice President of Exploration and Mr. Anthony Kovacs was appointed Chief Operating Officer.

ABOUT TNR GOLD CORP.

Over the past twenty-five years TNR, through its lead generator business model, has been successful in generating high quality exploration projects around the globe. With the Company’s expertise, resources and industry network, it is well positioned to aggressively identify, source, explore, partner and continue to expand its project portfolio.

In 2014 TNR Gold converted a back-in right on a portion of the Los Azules copper deposit in Argentina, owned by McEwen Mining, into a 0.4% NSR on the entire Los Azules deposit (see news release dated 17 October 2014).

In 2013 TNR Gold reported an inferred mineral resource at the Shotgun Gold project in Alaska containing 20,734,313 tonnes at 1.06 grams per tonne (“g/t”) gold for a total of 705,960 ounces gold (“Au”) using a 0.5 g/t Au cut-off (see news release dated 22 April 2013).

In 2011 TNR listed subsidiary, International Lithium Corp. (TSX:ILC.V), which demonstrates the successful application of TNR’s business model in which TNR shareholders benefited from a unit distribution upon spin-out of TNR's lithium and rare metals projects. TNR remains a large shareholder in ILC at 25.5% of outstanding shares.

At its core, TNR provides significant exposure to gold and copper through its holdings in Alaska and Argentina; and teamed with the recent acquisitions of rare-earth elements and iron ore projects in Canada confirm TNR’s commitment to continued generation of in-demand projects, while diversifying its markets and building shareholder value

On behalf of the board,

Gary Schellenberg

President"

Thursday, August 13, 2015

Number Of Owners Per Once Of Gold At The COMEX Is At Record High At 117 to 1.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Shanghai Gold Exchange Has 73.3 Tonnes of Bullion Withdrawn Its Third Largest Week.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Gold Catalyst: Don Coxe: Bull Market in Bonds Now Ending - Risks Ahead.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Monday, August 03, 2015

Is China Moving Toward a Gold Standard? Peter Schiff on the Chinese Market Crash.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Sunday, August 02, 2015

FED's Mission Impossible: "Gold Is Dead And Nobody Loves It Any More."

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Is China Moving Toward a Gold Standard? Peter Schiff on the Chinese Market Crash.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

The Asset They Love To Hate: Gold And The Grave Dancers.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Gold Catalyst: Don Coxe: Bull Market in Bonds Now Ending - Risks Ahead.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Friday, June 27, 2014

Kirill Klip.: Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

Bubble Chronicles. Mystery Solved: Meet Satoshi Nakamoto - The Face Behind Bitcoin

Kirill Klip.:

Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

Even Golden Bubbles Are Made Of Bubbles. I was following Bitcoin for a while ... and other 50 crypto-currencies. Once the amount of crypto-ideas about Gold 2.0 exceeded 60 - I have lost my interest. But the last Fall moment was truly historical: when Bitcoin has briefly touched parity with Gold.

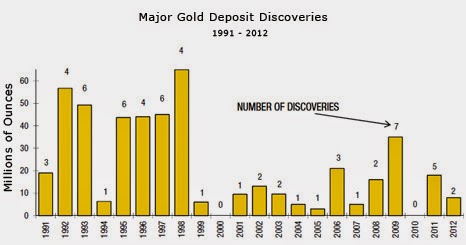

I will leave you to your own studies on this subject, but will mention only one particular angle. Bitcoin was supposed to be the competition to FIAT currencies. Why there is such a "tolerance" from authorities in U.S. - compare to the "FED's 100 years War on Gold"? Maybe I know the answer, maybe you will find another one. Gold is finite and the Only Money accepted for thousand of years as such. It cannot be printed or created in any way apart from the very hard work to discover and recover it from the ground. Gold companies are mining the dust now compared to the 90s and new discoveries are few and far between. Bitcoin, on another side, can be manufactured at Will and there is the different opinions about the Control of this Will in Bitcoin case, but NSA will always provide you with the better substitute of Bitcoin at some point: NSAcoin.

TNR Gold: Shotgun Gold Project - Why Do We Need New Gold Deposits?

Some wise, but very dangerous men once said: "We will take the best out of Them, we will intrigue them by Enigma and Secret, we will make Them think that they are running the world ... but it will be Us who is really in charge." Do you see the historical parallels?"Brothers" are still in denial and Bitcoin "revolutionaries" are fighting the FED ...

Chris Martenson: The Perfect Business Case - Exponential Money And Limited Resources Supply.

I will encourage you to read the brilliant "Gold Price Relative To Monetary Base At All-Time Low":

"The newest edition of the annual In Gold We Trust report is out. This eight edition goes again to the heart of gold’s value and analyzes the yellow metal as a monetary asset rather than an industrial commodity. The In Gold We Trust 2014 report takes a sober look at the big picture in the monetary system and offers a holistic analysis of the gold sector. It is written by Ronald Stoeferle who is the managing partner of a global fund at Incrementum AG in Liechtenstein, based on the principles of the Austrian school of Economics. GoldSilverWorlds."

If James Rickards is right with his "The Death Of Money", which I think is the case, than we are heading straight into the Currency Collapse at some point. The idea to test the substitutes to US Dollar and build up the opposition to the Only and True Money - Gold is very attractive. Problem is that the people with a lot of even FIAT money prefer Gold, only people with a lot of Debt are searching for Gold 2.0 - China buys Gold and encourages its citizens to do so. And as James Rickards has put it:

#Bitcoin fans are always promoting "Gold v Bitcoin" debates. I've never seen a#gold advocate do that.#RealMoneyEnvy

Friday, June 20, 2014

Kirill Klip.: FED Has Found ... Sorry, Created Inflation To Save Us All - Gold Celebrates ... Quietly So Far.

Kirill Klip.:

"Gold and Silver are acting today like if the Chinese virus "Missing Collateral" has finally reached the London BOE vaults!

Bullish For Metals?! Missing Collateral in China, Follow The Trail of Loans, Copper and Fraud.

In my personal opinion, we are witnessing the same game of the rehypothecation as it is happening with FED, BIS, Investment Banks and Gold. This, actually missing metal as collateral, will be the very bullish set up for the commodities markets. After initial selling due to the margin calls and unwinding of Paper Positions in the market, Mr Market will realise that all these metal accounted for the supply and demand picture is NOT there. Industrial demand will stay in place, but Supply which was supposed to be hoarded in the warehouses is missing: the collateral was used a few times for the different transactions. You can study this subject more with explanation in plane English in the very good podcast I have published yesterday: Read more."

FED has finally "succeeded" and Inflation is raising its ugly head. Everybody mortal, apart from the DC and FED System, who has visited at least few times any grocery shop this year knows that food prices are going up. And gas, and insurance, and electricity bills, and ... yes plasma TV prices are going down and iPads, but they are not very tasty for those on food stamps.

We have a positive resolution today in the Head and Shoulder Bullish Reversal pattern, which we have discussed before. Closing above $1,317 this week will be very important. Nobody can manipulate markets forever. Watch the headlines tomorrow: Inflation Is Back - Gold Surges On The FED News.

I Vote To End Gold Manipulation: FSA Fines Barclays For Manipulation Of Gold Price - Join Me.

Sufiy: Gold Market And The Stock Bull Topping.

TNR Gold: Shotgun Gold Project - Why Do We Need New Gold Deposits?

"This picture above is stronger than thousand words written by the FED's hired academics and even Austrian School of Economics - it cuts through the verbal mist to the bone of Inflation definition and what it really means. It means that your FIAT money are losing it purchasing power. It happens every day, day by the day. How much you can see from the McDonald's menu from 70s.And below is the chart representing "Strong US Dollar Policy" in action implemented by FED from the day of its inception in 1913. Some people even think that Federal Reserve is as Federal as Federal Express, but we will not go that road today.

Inflation is the dirty open secret of all Central Banks in the world. It creates the Inflation Tax by gradually stealing from the value of your savings and deflating the government's obligations on all social programs. It is the way for governments to finance wars and "Inflate away" their debts without taxing you "directly". Inflation follows currency debasement - organised by money printing or by QE in the iPad's century - and it is making its dirty work by itself.Why Gold is so important here? It is the real measure of the rate of Currency Debasement and Inflation: Gold is the Real Money, not dollars. That is why it is manipulated so heavily:

I will address you to James Rickards' books: "Currency Wars" and "The Death of Money" to get more information in depth on these subjects and Gold Manipulation is widely discussed on the web today. Read more."

Investment banks are starting to connect the dots even for the clients, they are themselves all-in long time ago, as I would guess, and announcing that Inflation is ... bullish for Gold.

"Upgrade comes earlier than expected…Canaccord Genuity North American Portfolio Strategist, Martin Roberge, has lifted his rating on the Gold Sector to Overweight, due to escalating inflation risk.The upgrade comes slightly earlier than expected as Roberge believes that the Fed is cornered…following stronger-than-expected U.S. CPI on Tuesday and the marked jump in Roberge’s CPI diffusion index, Martin believes there is a non-trivial risk that the Fed temporarily abandons its 2% inflation target.If the Fed is willing to take an inflation risk, investors should buy inflation-protection hedges. Already, bond vigilantes are doing so byfavouring real-return bonds (RRBs) over Treasuries. Inflationary pressures fuel inflation expectations, two positive drivers for the price of gold. Lastly, investors should note that U.S. inflation jitters are brewing while monetary reflation has gone global. World central bankers are in a race to reflate before a global bear market in bonds renders their easing policies impotent.For those who remember, this looks like 1993 all over again and Roberge further highlights that there are many seasonal factors that could lead to a rally in gold and gold equities in H2/14:· Golds tend to have a strong H2 in calendar years following a gold rout

· 2014 marks the third year of the gold bear market and the 200-week average sits at $1,500/oz

· Roberge thinks gold stocks are cheap and should protect portfolios in a correction."

The chart above provides you with idea why we need more Gold deposits now. Even if Major Gold Miners are squeezed on margins and divesting the projects now - it is these industry's fundamentals which will drive this market forward. Falling gold prices are the best cure from the low Gold prices. Gold miners are mining the "Gold Dust" by the 90s standards.Number of discoveries is going down and will go down even more with Junior Miners struggling to get access to the capital now to develop their projects. Grades and sizes of discoveries are going down as well - easy stuff is all already found or is located in not so friendly places. We have Peak Cheap Gold in place now, whatever the Gold market massaged by BIS will tell you.China's buying record amount of gold last couple of years will be the very strong confirmation of Gold monetary value and recent pick up in M&A activity provides very important signal for the bottom in this mining cycle:

"China continues its buying spree of copper assets all over the Globe: last month the huge Las Bambas copper project in Peru was bought by Minmetals Group for $5.85 B and now Guandong is bidding for PanAust. Reuters reports on the deal and you can notice how the activity in M&A by Chinese companies is picking up during the "soft market". It is the very important indication of the major bottom in the mining cycle: it is cheaper "to dig" for Copper and Gold on the Stock Exchanges now, when valuations of assets in the ground of listed companies are discounted by the depressed mining markets. "

This is another reason why I personally came into the TNR Gold - Shotgun Gold project in Alaska. Gary Schellenberg and John Harrop - our VP of Explorations, have done the great job over the years exploring this project with Nova Gold and now we have 100% of it and Nova Gold has become TNR Gold's shareholder. After our drilling results in 2012 Greg Johnson the founder of Nova Gold has joined our Board and we have published the first resource estimation on the Shotgun Gold project last May.It was the first confirmation of my personal dream to develop the important Gold deposit and even if it is still the very early stage of project development, this dream is not limited in size by the resource model at Shotgun Gold project at this time:

"The mineralization style observed at Shotgun Ridge bears a strong resemblance to the 40 million ounce deposit at the Donlin Gold project operated by Barrick and NovaGold," stated recently appointed director Greg Johnson, "The similar age and host intrusive rocks suggest that, with continued exploration, there is significant potential to locate larger volumes of mineralization in and around Shotgun Ridge."

We are working on the corporate structure now, which will allow to develop Shotgun Gold with the potential new strategic partner on J/V basis like we are doing with Ganfeng Lithium in International Lithium. You can find more information in the Shotgun Gold Project presentation below, on our website and give us a call to discuss it at any time.

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.

Subscribe to:

Posts (Atom)

Jim Rickards

Jim Rickards

.jpg)