Showing posts with label LBMA. Show all posts

Showing posts with label LBMA. Show all posts

Monday, August 17, 2015

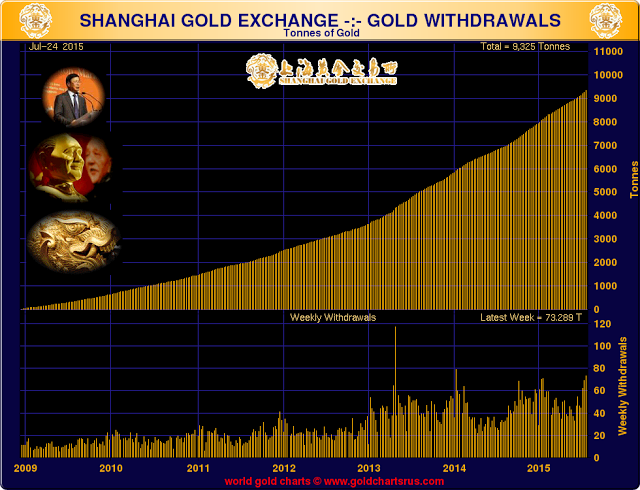

Boom: China SGE Gold Withdrawals An Enormous 1464 Tonnes So Far This Year.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

This Has Never Happen Before: Gold Hedge Funds Aggregate Net Position Has Been Short For The First Time In History.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Thursday, August 13, 2015

Number Of Owners Per Once Of Gold At The COMEX Is At Record High At 117 to 1.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Shanghai Gold Exchange Has 73.3 Tonnes of Bullion Withdrawn Its Third Largest Week.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Gold Catalyst: Don Coxe: Bull Market in Bonds Now Ending - Risks Ahead.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Monday, August 03, 2015

Is China Moving Toward a Gold Standard? Peter Schiff on the Chinese Market Crash.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Sunday, August 02, 2015

FED's Mission Impossible: "Gold Is Dead And Nobody Loves It Any More."

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Is China Moving Toward a Gold Standard? Peter Schiff on the Chinese Market Crash.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

The Asset They Love To Hate: Gold And The Grave Dancers.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Gold Catalyst: Don Coxe: Bull Market in Bonds Now Ending - Risks Ahead.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Thursday, January 16, 2014

ZeroHedge: Precious Metals Manipulation Worse Than Libor Scandal, German Regulator Says GLD, TNR.v, MUX, GDX

Update Jan 17th, 2014:

Rats are running from the sinking ship! Now JPMorgan scale down and sale of its commodity trading businesses are getting the new meaning. Are we close to the final revelations with Record High Leverage at COMEX now!

Reuters:

ZeroHedge reports on latest news from Bloomberg about Gold manipulation investigation in Europe. No surprises for us here - it is worse than Libor scandal. Will this news propel Gold above $1270 now to confirm the Double Bottom Reversal in 2013?

Rats are running from the sinking ship! Now JPMorgan scale down and sale of its commodity trading businesses are getting the new meaning. Are we close to the final revelations with Record High Leverage at COMEX now!

Reuters:

Deutsche Bank to withdraw from gold fix amid probe

"Deutsche Bank is withdrawing its participation in the gold and silver benchmark setting process following the significant scaling back of our commodities business," the bank said in a statement on Friday."We remain fully committed to our precious metals business."

ZeroHedge reports on latest news from Bloomberg about Gold manipulation investigation in Europe. No surprises for us here - it is worse than Libor scandal. Will this news propel Gold above $1270 now to confirm the Double Bottom Reversal in 2013?

Arthur Cutten: COMEX Gold Potential Claims Per Deliverable Ounce Rises to Historical High 112 to 1 GLD, TNR.v, MUX, GDX

"After issuing his Buy Signal on Gold, Arthur reports the new historical all-time-high leverage at COMEX with 112 potential owners for each one ounce of Gold!"

Arthur Cutten: JPM Holds the Whip Hand on the Comex - Gold Buy Signal GLD, MUX, TNR.v, GDX

"Arthur Cutten has issued his Buy Signal on Gold. He has a very conservative approach and his article speaks for itself."GATA: China Gold Chief Confirms Gold Price Suppression by U.S. MUX, TNR.v, GLD, GDX, SLV

ZeroHedge:

Precious Metals Manipulation Worse Than Libor Scandal, German Regulator Says

Remember when banks were exposed manipulating virtually everything except precious metals, because obviously nobody ever manipulates the price of gold and silver? After all, the biggest "conspiracy theory" of all is that crazy gold bugs blame every move against them on some vile manipulator. It may be time to shift yet another conspiracy "theory" into the "fact" bin, thanks to Elke Koenig, the president of Germany's top financial regulator, Bafin, which apparently is not as corrupt, complicit and clueless as its US equivalent, and who said that in addition to currency rates,manipulation of precious metals "is worse than the Libor-rigging scandal." Hear that Bart Chilton and friends from the CFTC?

More on what Eike said from Bloomberg:

The allegations about the currency and precious metals markets are “particularly serious, because such reference values are based -- unlike Libor and Euribor -- typically on transactions in liquid markets and not on estimates of the banks,” Elke Koenig, the president of Bafin, said in a speech in Frankfurt today.

Actually, what makes the most serious, is that precisely because they are on liquid markets means they implicitly have the blessing of the biggest New Normal market maker of call - the central banks, and their own "regulator" - the Bank of International Settlements (hello Mikael Charoze).

“That the issue is causing such a public reaction is understandable,” Koenig said, according to a copy of the speech. “The financial sector is dependent on the common trust that it is efficient and at the same time, honest. The central benchmark rates seemed to be beyond any doubt, and now there is the allegation they may have been manipulated.”Bafin has also interviewed employees of Deutsche Bank AG as part of a probe of potential manipulation of gold and silver prices, a person with knowledge of the matter has said.

We wonder how long until this particular investigation is stopped based on an "executive order" from above, because Bafin is now stepping into some very treacherous waters with its ongoing inquiry of gold manipulation: what it reveals will certainly not be to the liking of the financial "powers that be."

Arthur Cutten: COMEX Gold Potential Claims Per Deliverable Ounce Rises to Historical High 112 to 1 GLD, TNR.v, MUX, GDX

After issuing his Buy Signal on Gold, Arthur reports the new historical all-time-high leverage at COMEX with 112 potential owners for each one ounce of Gold!

Arthur Cutten: JPM Holds the Whip Hand on the Comex - Gold Buy Signal GLD, MUX, TNR.v, GDX

"Arthur Cutten has issued his Buy Signal on Gold. He has a very conservative approach and his article speaks for itself."Glenn Beck: Where Is German Gold? GLD, TNR.v, MUX, GDX

"Glenn Beck is digging up the mystery of German Gold repatriation. With the reports that even small amount of the delivered Gold so far was melted beforehand we can be sure that there is no more original German Gold left. As we have discussed before, the Gold smashing down has started with Venezuela's request for Gold to be returned back and last year Gold's bloodbath was assured with Germany seeking for its Gold to be returned as well."

Jesse's Cafe Americain:

Comex Warehouse Potential Claims Per Deliverable Ounce Rises to Historical High 112 to 1

"The false man is more false to himself than to any one else. He may despoil others, but himself is the chief loser. The world's scorn he might sometimes forget, but the knowledge of his own perfidy is undying."

Horace Mann

An almost shocking decline in deliverable (registered) gold has taken the ratio of open interest to deliverable gold to 112 to 1.

This is not a default scenario since the supply of eligible gold in the warehouses remains adequate and at historically manageable levels as shown in the last chart below.

Rather, it suggests that higher prices will be required to persuade more bullion owners to place their inventory up for delivery.

That higher price, of course depends on who those owners are, and how motivated they might be by profits from their metals trades. For some interested parties it is enough to be the very close friends of the Central Banks, with benefits that make them incredibly rich, self-satisfied, and occasionally audacious to the point of over-reaching.

But of course, it is well to remember that the Comex has become the tail wagging the dog, as the gold bullion markets have shifted to the East.

February may be an interesting month, in an interesting year.

Weighed, and found wanting.

Stand and deliver.

Labels:

Central bank,

china,

COMEX,

FED,

Germany,

Glenn Beck,

Gold,

LBMA,

US Dollar,

Venezuela

Arthur Cutten: JPM Holds the Whip Hand on the Comex - Gold Buy Signal GLD, MUX, TNR.v, GDX

Arthur Cutten has issued his Buy Signal on Gold. He has a very conservative approach and his article speaks for itself.

Bloomberg: China May Become The Third-largest Holder Of Gold GDX, TNR.v, MUX, GDX

"Here it comes and a lot of people will be taken totally by surprise. Record buying of Gold by China last year will be translated in the much higher Gold holdings by PBOC. Bloomberg reports that these holdings could surpass now those of Italy and France - Jim Rickards talks about the announcement by Chinese Central Bank of 5,000 t of Gold holdings in the nearest future. It will be the game changer and puts Gold solidly into the investment game as well. Yesterday shock with Jobs numbers can be the sign of the real state of US Economy and it means that FED does not have any real exit strategy from QE permanent state. In another news Royal Mint in UK has run out of gold coins due to the exceptionally high demand."

Jesse's Cafe Americain:

Gold Daily and Silver Weekly Charts - JPM Holds the Whip Hand on the Comex - Buy Signal

About 89,757 ounces of gold bullion left the deliverable category at Brinks, and a similar amount showed up in the eligible inventory at JPM yesterday.

This brings the overall number of deliverable gold ounces down to 370,137 which is a shockingly low number considering that we are coming into the normally heavy delivery month of February in a few weeks.

Along with a few other indicators this triggers a 'buy signal' for gold in the intermediate term. This is the first buy signal that I have issued since gold broke out of its cup and handle and ran to its all time high. This is a 'structural' buy signal that must be confirmed by price and the chart formation. The price signal will remain active unless gold sets a lower low on price.

I will post something about potential claims per ounce later tonight.

There is sufficient gold in the eligible categories at the bullion banks, and while we do not know who actually 'owns it,' there is a high probability that it will take higher prices to pry that gold into the delivery process in February, at least from profit motivated holders.

Take a look at the distribution of all categories of gold on the Comex. Brinks and Manfreda have been 'cleaned out,' and the three bullion banks, JPM, HSBC and Scotia Mocatta are the big holders. This market is now made up of big holders and bag holders.

There is some strong overhead resistance at 1260 which any number of analysts have noted, and there does seem to be an effort to hold the line on price here.

I have marked the most important resistance level, at least from my charting perspective, on the chart in red, just under 1,350 dollars per ounce. A breakout through 1350 will confirm the buy signal.

February is shaping up to be an interesting month. The various indicators have come together to signal a buy here but one might wish to wait for confirmation if you wish. After all, it is a manipulated market. There might be a rocky road before the precious metals finally break out.

I am now holding a full allocation of trading account gold and am considering adding more on pullbacks. There are likely to be some vicious pullbacks since the Banks will not wish to have small spec company during the initial leg of this bull market move. They are just like that.

If the specs jump on the metals here with leverage they are going to get their teeth knocked out. I was of two minds in writing this, because I do not wish to see amateur traders throwing themselves to the sharks. But on the other hand sentiment is so bad that perhaps now they will stand aside and take a more measured approach to investing rather than speculating.

It's been a long time coming. But change is going to come.

Have a pleasant evening.

Labels:

Brinks,

COMEX,

FED,

Gold,

HSBC,

LBMA,

Precious metal,

Scotia Mocatta,

US Dollar

Friday, January 10, 2014

Gold Breakout: COMEX Gold Warehouse Registered Gold Inventory at 93 to 1 GLD, MUX, TNR.v, GDX

Jesse reports the new all-time-high leverage at the COMEX with 93 owners for every ounce of Gold. Everything is primed for the fireworks in Gold now. After today's huge miss in Jobs numbers Gold is breaking out to the upside. Move above $1250 will make shorts to cover and we need to go over $1270 to confirm the double bottom formed at $1180 levels in 2013 now.

Glenn Beck: Where Is German Gold? GLD, TNR.v, MUX, GDX

"Glenn Beck is digging up the mystery of German Gold repatriation. With the reports that even small amount of the delivered Gold so far was melted beforehand we can be sure that there is no more original German Gold left. As we have discussed before, theGold smashing down has started with Venezuela's request for Gold to be returned back and last year Gold's bloodbath was assured with Germany seeking for its Gold to be returned as well."

Jesse's Cafe Americain:

Comex Warehouse Registered Gold Inventory at 93 to 1

Getting a bit thin.

As a reminder, this is open interest as a ratio to registered (deliverable) gold.

January is not an 'active month.'

Higher prices would likely move gold into that deliverable category, and there is quite a bit in delivery ready form in the eligible category.

February is shaping up to be an interesting month.

Labels:

ADP report,

FED,

Gold,

Jesse,

Jobs,

LBMA,

NFP. COMEX,

US Dollar

Saturday, November 23, 2013

Jim Sinclair Named Executive Chairman of Singapore Precious Metals Exchange (SGPMX) GLD, MUX, TNR.v, GDX

After groundbreaking news from China, which will affect US Dollar Reserve Status of Choice from now on, we have another very important milestone. .Jim Sinclair is building the new institution for the physical Gold Exchange. Flow of Gold from the West to the East is breaking records this year and now this new player can push leveraged COMEX to the final stage of its Game of Musical Chairs in the Fractional Gold Reserve System run by LBMA.

US Dollar And Gold - PBOC Says No Longer in China’s Interest to Increase Reserves GLD, MUX, TNR.v, GDX

"We are following the groundbreaking changers coming out of China after The 3rd Plenum and PBOC drops another shell-bomb on the US Dollar today. We are witnessing the end of US Dollar as the Reserve Currency of Choice now. Who will be buying all these US Treasuries after that? How can FED Taper now? We can be assured about much higher interest rates with very far reaching implications for the economy and the U.S. fiscal budget.

Timing of this release is very interesting - just yesterday Gold was killed after the release of FOMC minutes. We are entering the new dramatic stage of the Currency Wars, when China picks the old Austrian economics truth - strong currency means strong country. How long Gold Smashing can keep it down with COMEX running on fumes and record high leverage?"

Michael Snyder: Next Great Wave of Economic Crisis - Gold And Silver GLD, MUX, TNR.v, GDX

"Greg Hunter is hosting Michael Snyder this time, who provides a lot of very well researched facts for your own consideration about the state of the economy. With latest reports about tampering the all important employment numbers at Census Bureau our quest for Gold and Silver manipulations acknowledgement and confirmation can be assured in the not so distant future."

Silver Doctors:

Legendary gold trader and leading PM industry advocate Jim Sinclair has just been named Executive Chairman of the new Singapore Precious Metals Exchange (SGPMX).

Sinclair will also chair the Independent Advisory Board established to oversee the transparency and management of the exchange.

If the SGPMX selection of an Executive Chairman is any indication, the new exchange should prove to be much more successful than the short lived HXMEx, which had once been thought likely to take significant market share away from the COMEX and LBMA, but was dissolved only a year after formation.

Full press release from the SGPMX as well as Sinclair’s public letter on his “Mission” at the SGPMX are below:

Sinclair will also chair the Independent Advisory Board established to oversee the transparency and management of the exchange.

If the SGPMX selection of an Executive Chairman is any indication, the new exchange should prove to be much more successful than the short lived HXMEx, which had once been thought likely to take significant market share away from the COMEX and LBMA, but was dissolved only a year after formation.

Full press release from the SGPMX as well as Sinclair’s public letter on his “Mission” at the SGPMX are below:

Sinclair’s public letter from JSMineset:

My presence in Singapore is a mission for us. Having reported to you the six locations where cash and physical only exchanges for silver and gold were to be established, I did not leave it at that. My staff and I have contacted each proposed exchange in order to determine which of the six held the best promise for the gold market transition phase for price discovery away from paper gold and to physical gold material.My original interest was to join that exchange on behalf of TRX. That desire transmuted itself into putting my shoulder behind that exchange which offers the global window to the real price of gold. That exchange in my opinion is the Singapore Physical Precious Metals Exchange, headed by CEO Victor Foo.Too long has gold suffered from trading in its paper form which was originally conceived of and has continued to live as the means of manipulating the paper price of gold for the benefit of the few.The time is at hand for Free Gold. The mechanism of freeing physical gold from price slavery to paper gold is the present time deletion of future exchange warehouse supply as the real cash price of physical gold exceeds the spot futures paper contract by the cost of shipping, the cost of insurance, and the cost of recasting of Western form 100 ounce gold bars into Asian product demand form.The reported shipment of one billion in gold recently from the USA to the Rand Refinery in the Republic of South Africa was not junk jewelry form as reported. It was rather in the form of 100 ounce Comex bars being shipped to the Rand Refinery for recasting into Asian product, and was sold mainly in China as gold rose in price.I was there as a member of the Comex exchange in March of 1980, the last time the Comex board of directors panicked over the threat of the Hunt Brothers asking for delivery of both gold, silver and copper in excess of, or equal to, the then Comex warehouse qualified for delivery supply.Asian demand for physical gold is now in excess of supply and the declining Comex warehouse supply qualified for delivery. This is the mechanism for the emancipation of Physical Gold from the 41 years of price slavery to paper gold due to the cheap paper mechanism to manipulate the world gold price.With the present time and predictable need to change the delivery mechanism on the COMEX to cash in order to avoid default on delivery, the reign of paper gold is ending. With this end we have the arrival of physical gold as the new discovery mechanism for the price of gold.For the transition to take place it is necessary that we have functional global platforms for the trading of physical metals between peers of merit and a transparent price for global physical gold that exists nowhere for even professional public consumption.There has been a clarion call from the long suffering holders of gold shares and investment gold for the Chief Executive Officers of gold companies to identify and take definitive action to end the slavery of the gold price to the mechanism of manipulation, the paper gold market. The advent of global platforms for and the true revelation to the gold public of the real gold price, the physical cash price on a 24 hour basis in the answer.The cost of trying to manipulate this public physical price wherein delivery must be immediately made or payment presented immediately in full makes it too expensive to manipulate the gold price on a consistent basis. The paper gold market cannot move far away from the real physical price when the real physical price is globally known. Therefore to manipulate price the tricksters will have to participate on the physical exchanges thereby increasing their cost of their operation by orders of magnitude. That huge increase in the cost of moving price at will is the beginning of the end of paper gold ruling the physical gold price. That substantial increase in the cost of operation is the beginning of the physical gold market taking the position as the true discovery mechanism for the global price of gold. It is the beginning of the end of the reign of paper gold.We CEOs of gold companies owe our stockholders economic production and all of our efforts to defeat the plans of the tricksters and their paper machinations that cost near to nothing and results in gold moving such as $1900 to $1200 when the true demand for physical over ground gold was on the rise and not on the fall. Where demand exceeded supply as paper gold was forced by bullies down from $1900 to $1200. This dichotomy in price is only viable via paper gold manipulation and must end here and now. To that object of “Free Gold” and the economic production of gold, I dedicate all my strength, all my contacts of 53 years in the business, all my knowledge of how to, and my capital.Respectfully yours,

Jim Sinclair

Official news release via Business wire:

SINGAPORE–(BUSINESS WIRE)–Singapore Precious Metals Exchange (SGPMX), the world’s first physical precious metals exchange with peer-to-peer bullion trading capabilities, today announced the appointment of precious metals specialist, Jim Sinclair, as Executive Chairman of SGPMX. It also announced the establishment of an Independent Advisory Board chaired by Jim Sinclair to oversee the transparency and management of the Exchange, as well as to develop education and advocacy programmes around physical bullion and wealth storage.Independent Advisory Board members of Singapore Precious Metals Exchange’s Independent Advisory Board include former CEO of Kuala Lumpur Stock Exchange (Bursa Malaysia Berhad), Dato Yusli Yusoff, President of McMillan Woods Global, Dato Raymond Liew, prominent lawyer Ranjit Singh, and experienced commodities trader, Peter Mickelberg.Jim Sinclair said, “I believe the U.S. economy is headed for hyperinflation and the alternative to currencies is precious metals. But it’s physical gold and not future gold that we should be looking at. And personally, I predict that emancipated physical gold price from future gold price will go up from US$3,200 to US$3,500 an ounce by 2016.”“I’m a firm believer of the Singapore Precious Metals Exchange’s business model and am confident that the platform addresses bullion trading challenges faced by traders, financial institutions and personal wealth investors like myself. By unifying buy, store, trade and transport elements under one platform, SGPMX will easily position itself as a catalyst for Singapore to achieve its goal as a trading hub for precious metals in Asia Pacific,” Sinclair adds.Victor Foo, CEO and founder of SGPMX said, “As part of the company’s long term growth strategy, we have invited industry specialists and experts from various fields to form the Advisory Board. With each member’s expertise, we are confident that they will not only value add to the management of the Exchange, but also drive the bullion industry forward with the initiatives in the pipeline.”Bios of Members of the SGPMX Advisory BoardJim Sinclair, Executive Chairman of SGPMXSinclair is a precious metals specialist, commodities and foreign currency trader. He was the Chief Executive Officer of Northwestern Basemetals Company Limited since 2012. He has authored three books on precious metals, trading strategies and geopolitical events, and their relationship to world economics and the markets.Dato’ Yusli Yusoff, MemberDato’ Yusli Yusoff was the CEO of Kuala Lumpur Stock Exchange (Bursa Malaysia Berhad) from 2004 till 2011. Currently, he sits as an Independent Non-Executive Director on the Board of Directors of a few public listed companies, including YTL Power International Berhad, Mulpha International Berhad, Mudajaya Group Berhad, Air Asia X Berhad and Westports Holdings Berhad.Dato’ Raymond Liew, MemberDato’ Raymond Liew is the President of McMillan Woods Global, an independent member firm of McMillan Woods Global network. He is also a Trustee of the Malaysian Accountancy Research & Education Foundation and is a Council member of the Chartered Taxation Institute of Malaysia (CTIM).Ranjit Singh, MemberRanjit is a general litigator with vast experience and appears regularly in the High Court and Federal Court of Malaysia. Besides representing and advising public listed companies and professionals, Ranjit also acts as counsel to the Malaysian Bar’s compulsory insurance scheme.Peter Mickelberg, MemberPeter Mickelberg is a financial analyst and trader who has specialized in precious metals and mining equities. He is currently a communications consultant to Mr Sinclair and his company, Tanzanian Royalty Exploration Corporation.About Singapore Precious Metals Exchange (SGPMX)Established in August 2011, SGPMX is the world’s first physical bullion exchange established for investors, traders and institutions to trade physical precious metals like gold and silver with physically backed bullion storage facilities. It provides consolidated offerings for customers to buy, sell, store and exchange precious metals under one platform, and is privately held and independently funded.

Contact:

for Singapore Precious Metals Exchange (SGPMX):

The Hoffman Agency

Jacintha Ng, +65 6361-0250

SGPMX@hoffman.com

Labels:

Chairman,

china,

COMEX,

FED,

Gold,

Greg Hunter,

Jim Sinclair,

LBMA,

London bullion market,

QE,

Silver,

Singapore,

United States

Saturday, November 16, 2013

Jesse: COMEX Claims Per Ounce Of Gold At 69 To 1 GLD, MUX, TNR.v, GDX

Jesse has updated the latest information from COMEX and it has even higher leverage now: Fractional Gold Reserved System is run at the all-time-high leverage with 69 Owners per 1 ounce of Gold.

Jesse: COMEX Registered Gold Falls To 587,235 Ounces - Claims At 63 To 1 GLD, MUX, TNR.v, GDX

"It looks like that any guessing about The Taper, QE and FED's further actions can not print more Gold for COMEX. Jesse reports that registered Gold falls to 587,235 ounces and leverage in Fractional Gold Reserve System has reached another record high of 63."

Bitcoin Heist And Jim Rickards On Taper, Janet Yellen and Gold GLD, MUX, TNR.v, GDX

"In this very interesting episode RT is reporting about the hunger for the FIAT Currencies alternatives and how it is driving the Bitcoin Bubble, but it is not The New Gold or even close to it - as we have written before. New security concerns are reported with the cryptocurremcy and Jim Rickards dissects the Currency War situation in the ECB, BOJ and FED race to the bottom. You will find out why Janet Yellen can not Taper and what is behind the Gold and why Gold Standard is still valuable option even today.

After our yesterday US dollar chart observations it has fallen out of bed so far today - maybe somebody already has received Janet Yellen's testimony for tomorrow's nomination hearing."

Jesse's Cafe Americain:

There was little movement of gold bullion in or out of the Comex warehouses.

I had Nick Laird of Sharelynx check his coding and inputs and it turns out that the 'claims per ounce' from yesterday were a bit light at 63. That did seem very little for a 51,000 ounce withdrawal.

A corrected chart is shown below.

We are at an all time record of 69 potential claims for each ounce of deliverable gold.

Have a nice weekend.

Labels:

COMEX,

FED,

Gold,

Gold as an investment,

Jesse,

LBMA,

Ounce,

Precious metal,

QE

Friday, November 15, 2013

Jesse: COMEX Registered Gold Falls To 587,235 Ounces - Claims At 63 To 1 GLD, MUX, TNR.v, GDX

It looks like that any guessing about The Taper, QE and FED's further actions can not print more Gold for COMEX. Jesse reports that registered Gold falls to 587,235 ounces and leverage in Fractional Gold Reserve System has reached another record high of 63.

Bitcoin Heist And Jim Rickards On Taper, Janet Yellen and Gold GLD, MUX, TNR.v, GDX

"In this very interesting episode RT is reporting about the hunger for the FIAT Currencies alternatives and how it is driving the Bitcoin Bubble, but it is not The New Gold or even close to it - as we have written before. New security concerns are reported with the cryptocurremcy and Jim Rickards dissects the Currency War situation in the ECB, BOJ and FED race to the bottom. You will find out why Janet Yellen can not Taper and what is behind the Gold and why Gold Standard is still valuable option even today.

After our yesterday US dollar chart observations it has fallen out of bed so far today - maybe somebody already has received Janet Yellen's testimony for tomorrow's nomination hearing."

Jesse: COMEX Claims Per Deliverable Ounce Up Again To 62 GLD, MUX, TNR.v, GDX

"Jesse reports that in Fractional Gold Reserve System the leverage has reached the all-time-high of 62 owners per ounce of Gold. With Janet Yellen set for hearing tomorrow we can expect another hit and run Gold accident in the DC area, but so far US Dollar has fallen out of bed today and Gold is holding up at its four weeks low. Where LBMA is going to get the physical Gold for delivery at this level of prices? We doubt that China will accept Bitcoin instead of Gold for its currency reserves any time soon."

Jesse's Cafe Americain:

There was a rather large adjustment into eligible gold storage at the HSBC warehouse as 51,617 ounces left the deliverable 'registered' category.

This is not such a big short term issue since November is a' non-active delivery month' for the Comex precious metals futures markets.

But in fact there is so little actual physical delivery activity taking place there anymore, even in an 'active month,' that one might argue that the New York metals market is approaching practical insignificance, long before it can reach the storiedpermanent backwardation.

However, one must keep up appearances, since the Comex still effectively sets the metals price for much of the free world, if only aspirationally these days for Asia.

More charts will be added as they are updated later this evening.

Earlier today in a piece about price premiums in India I included a link to the online section of Charles Mackay's Extraordinary Popular Delusions and the Madness of Crowds.

You might want to have a quick glance over the chapter regarding John Law's highly innovative dalliance into the théorie monétaire moderne that was adopted by the nation of France, almost to the point of its demise. It is a useful reminder that truly, there is nothing new under the sun.

As theoretical as all these pricing antics and market manipulations might seem, exercises in price setting for personal greed or policy considerations have real world consequences, especially when they are applied over long periods of time, and with some resort to coercion.

The longer that valuations are maintained against the market, the stronger the coercion to sutain them must become, to the demise of freedom, and the point of exhaustion and collapse. The Soviet ruble is a possible case study for what happens when the unsustainable meets the inevitable, even with a hairy knuckled police state backing it up.

We might start thinking about 2014 as the year of financial consequences.

Weighed, and found wanting.

Stand and deliver.

This is not such a big short term issue since November is a' non-active delivery month' for the Comex precious metals futures markets.

But in fact there is so little actual physical delivery activity taking place there anymore, even in an 'active month,' that one might argue that the New York metals market is approaching practical insignificance, long before it can reach the storiedpermanent backwardation.

However, one must keep up appearances, since the Comex still effectively sets the metals price for much of the free world, if only aspirationally these days for Asia.

More charts will be added as they are updated later this evening.

Earlier today in a piece about price premiums in India I included a link to the online section of Charles Mackay's Extraordinary Popular Delusions and the Madness of Crowds.

You might want to have a quick glance over the chapter regarding John Law's highly innovative dalliance into the théorie monétaire moderne that was adopted by the nation of France, almost to the point of its demise. It is a useful reminder that truly, there is nothing new under the sun.

As theoretical as all these pricing antics and market manipulations might seem, exercises in price setting for personal greed or policy considerations have real world consequences, especially when they are applied over long periods of time, and with some resort to coercion.

The longer that valuations are maintained against the market, the stronger the coercion to sutain them must become, to the demise of freedom, and the point of exhaustion and collapse. The Soviet ruble is a possible case study for what happens when the unsustainable meets the inevitable, even with a hairy knuckled police state backing it up.

We might start thinking about 2014 as the year of financial consequences.

Weighed, and found wanting.

Stand and deliver.

Labels:

COMEX,

FED,

Federal Reserve System,

HSBC,

Janet Yellen,

Jesse,

LBMA,

QE,

Taper

Subscribe to:

Posts (Atom)