Bubble Chronicles. Mystery Solved: Meet Satoshi Nakamoto - The Face Behind Bitcoin

Kirill Klip.:

Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

Even Golden Bubbles Are Made Of Bubbles. I was following Bitcoin for a while ... and other 50 crypto-currencies. Once the amount of crypto-ideas about Gold 2.0 exceeded 60 - I have lost my interest. But the last Fall moment was truly historical: when Bitcoin has briefly touched parity with Gold.

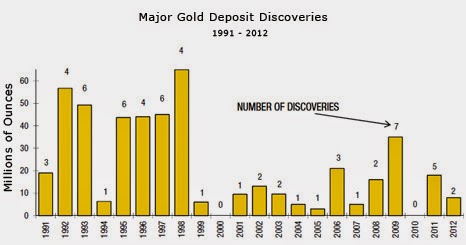

I will leave you to your own studies on this subject, but will mention only one particular angle. Bitcoin was supposed to be the competition to FIAT currencies. Why there is such a "tolerance" from authorities in U.S. - compare to the "FED's 100 years War on Gold"? Maybe I know the answer, maybe you will find another one. Gold is finite and the Only Money accepted for thousand of years as such. It cannot be printed or created in any way apart from the very hard work to discover and recover it from the ground. Gold companies are mining the dust now compared to the 90s and new discoveries are few and far between. Bitcoin, on another side, can be manufactured at Will and there is the different opinions about the Control of this Will in Bitcoin case, but NSA will always provide you with the better substitute of Bitcoin at some point: NSAcoin.

TNR Gold: Shotgun Gold Project - Why Do We Need New Gold Deposits?

Some wise, but very dangerous men once said: "We will take the best out of Them, we will intrigue them by Enigma and Secret, we will make Them think that they are running the world ... but it will be Us who is really in charge." Do you see the historical parallels?"Brothers" are still in denial and Bitcoin "revolutionaries" are fighting the FED ...

Chris Martenson: The Perfect Business Case - Exponential Money And Limited Resources Supply.

I will encourage you to read the brilliant "Gold Price Relative To Monetary Base At All-Time Low":

"The newest edition of the annual In Gold We Trust report is out. This eight edition goes again to the heart of gold’s value and analyzes the yellow metal as a monetary asset rather than an industrial commodity. The In Gold We Trust 2014 report takes a sober look at the big picture in the monetary system and offers a holistic analysis of the gold sector. It is written by Ronald Stoeferle who is the managing partner of a global fund at Incrementum AG in Liechtenstein, based on the principles of the Austrian school of Economics. GoldSilverWorlds."

If James Rickards is right with his "The Death Of Money", which I think is the case, than we are heading straight into the Currency Collapse at some point. The idea to test the substitutes to US Dollar and build up the opposition to the Only and True Money - Gold is very attractive. Problem is that the people with a lot of even FIAT money prefer Gold, only people with a lot of Debt are searching for Gold 2.0 - China buys Gold and encourages its citizens to do so. And as James Rickards has put it:

#Bitcoin fans are always promoting "Gold v Bitcoin" debates. I've never seen a#gold advocate do that.#RealMoneyEnvy

Jim Rickards

Jim Rickards