Showing posts with label Bubble. Show all posts

Showing posts with label Bubble. Show all posts

Friday, August 21, 2015

Sunday, August 02, 2015

Friday, June 27, 2014

Kirill Klip.: Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

Bubble Chronicles. Mystery Solved: Meet Satoshi Nakamoto - The Face Behind Bitcoin

Kirill Klip.:

Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

Even Golden Bubbles Are Made Of Bubbles. I was following Bitcoin for a while ... and other 50 crypto-currencies. Once the amount of crypto-ideas about Gold 2.0 exceeded 60 - I have lost my interest. But the last Fall moment was truly historical: when Bitcoin has briefly touched parity with Gold.

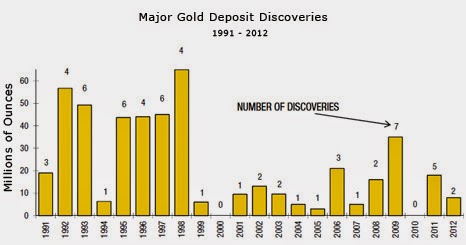

I will leave you to your own studies on this subject, but will mention only one particular angle. Bitcoin was supposed to be the competition to FIAT currencies. Why there is such a "tolerance" from authorities in U.S. - compare to the "FED's 100 years War on Gold"? Maybe I know the answer, maybe you will find another one. Gold is finite and the Only Money accepted for thousand of years as such. It cannot be printed or created in any way apart from the very hard work to discover and recover it from the ground. Gold companies are mining the dust now compared to the 90s and new discoveries are few and far between. Bitcoin, on another side, can be manufactured at Will and there is the different opinions about the Control of this Will in Bitcoin case, but NSA will always provide you with the better substitute of Bitcoin at some point: NSAcoin.

TNR Gold: Shotgun Gold Project - Why Do We Need New Gold Deposits?

Some wise, but very dangerous men once said: "We will take the best out of Them, we will intrigue them by Enigma and Secret, we will make Them think that they are running the world ... but it will be Us who is really in charge." Do you see the historical parallels?"Brothers" are still in denial and Bitcoin "revolutionaries" are fighting the FED ...

Chris Martenson: The Perfect Business Case - Exponential Money And Limited Resources Supply.

I will encourage you to read the brilliant "Gold Price Relative To Monetary Base At All-Time Low":

"The newest edition of the annual In Gold We Trust report is out. This eight edition goes again to the heart of gold’s value and analyzes the yellow metal as a monetary asset rather than an industrial commodity. The In Gold We Trust 2014 report takes a sober look at the big picture in the monetary system and offers a holistic analysis of the gold sector. It is written by Ronald Stoeferle who is the managing partner of a global fund at Incrementum AG in Liechtenstein, based on the principles of the Austrian school of Economics. GoldSilverWorlds."

If James Rickards is right with his "The Death Of Money", which I think is the case, than we are heading straight into the Currency Collapse at some point. The idea to test the substitutes to US Dollar and build up the opposition to the Only and True Money - Gold is very attractive. Problem is that the people with a lot of even FIAT money prefer Gold, only people with a lot of Debt are searching for Gold 2.0 - China buys Gold and encourages its citizens to do so. And as James Rickards has put it:

#Bitcoin fans are always promoting "Gold v Bitcoin" debates. I've never seen a#gold advocate do that.#RealMoneyEnvy

Wednesday, December 04, 2013

Can Bitcoin Be The Digital Con Scheme? - Quantitative Analysis of the Full Bitcoin Transaction Graph

We do not know whether it is the shellbomb or just another scam around Bitcoin, but decided to share it and find comments from more technically sophisticated readers. All our analysis before was based on the Bubble signs which can be attributed to Bitcoin exorbitant rise and that it is unsustainable in the long term.

From this report we can take that Bitcoin Open Source is not that open after all and we can see the attempt to game the other Bitcoin participants with artificially inflated prices - pure OTC stock style Pump and Dump run by insiders. This report analyses transactions in 2012, but its findings are particularly interesting now in light of recent parabolic rise of Bitcoin. How do we know that similar type of coordinated transactions are not taking place now artificially inflating Bitcoin prices?

Before you can make any of your conclusions we must accept that this report and its findings are real and correct and not just another scam around Bitcoin apart from its price. We welcome any comments from technically sophisticated readers.

Dorit Ron and Adi Shamir

Department of Computer Science and Applied Mathematics, The Weizmann Institute of Science, Israel {dorit.ron,adi.shamir}@weizmann.ac.il

"5 ConclusionsThe Bitcoin system is the best known and most widely used alternative payment scheme, but so far it was very difficult to get accurate information about how it is used in practice. In this paper we describe a large number of statistical properties of the Bitcoin transaction graph, which contains all the transactions which were carried out by all the users until May 13th 2012. We discovered that most of the minted bitcoins remain dormant in addresses which had never participated in any outgoing transactions. We found out that there is a huge number of tiny transactions which move only a small fraction of a single bit- coin, but there are also hundreds of transactions which move more than 50,000 bitcoins. We analyzed all these large transactions by following in detail the way these sums were accumulated and the way they were dispersed, and realized that almost all these large transactions were descendants of a single transaction which was carried out in November 2010. Finally, we noted that the subgraph which contains these large transactions along with their neighborhood has many strange looking structures which could be an attempt to conceal the existence and relationship between these transactions, but such an attempt can be foiled by following the money trail in a sufficiently persistent way."

Here is another research paper from the same authors just recently released and fiercely rebuffed by Bitcoin community:

Maybe it is too much for the even the Gold 2.0? At some point the price of Bitcoin will be just too high to justify any Network Effect and Infrastructure argument, particularly when nobody really knows what is happening with it.

US Dollar is Down Now And Gold Goes Vertical GLD, MUX, TNR.v, GDX

Something interesting is happening with Gold today. After all the positive news about the economy Gold was not sold off, but was crawling up with much higher US Dollar. Now US Dollar is Down for the day and Gold is sharply Up in vertical reversal to $1245 from day's low of $1211.

Is somebody getting Short Squeezed already? Number of mainstream banks were calling for Gold going down to $1180, $1150 or $1000. Maybe somebody doesn't like to push his luck this time? We will monitor the situation and Interest Rates now.

As we have discussed, the collapse in Bitcoin will ignite the next Gold Bull Leg Up, according to Business Insider clever people are cashing out Bitcoin into Gold and Silver already!

People Are Buying A Lot Of Silver And Gold With Their Bitcoins

As we have discussed, the collapse in Bitcoin will ignite the next Gold Bull Leg Up, according to Business Insider clever people are cashing out Bitcoin into Gold and Silver already!

People Are Buying A Lot Of Silver And Gold With Their Bitcoins

"Amagi Metals chief Stephen McAskill told BI in a separate interview that his site processed $900,000 worth of bitcoin between Thanksgiving and Sunday. The biggest selling items? Silver and gold coins and bars."

Ultimate Bitcoin Showdown: Schiff vs. Voorhees

"Peter Schiff is digging up Bitcoin phenomenon with Voorhees and its claims for being "Gold 2.0" Markets are not very happy pricing Taper now and people suddenly remember that Equity prices can go down as well. Peter is raising the very important point of "Bitcoin limited supply" - even if Bitcoin number is limited by algorithm to 22 million total there are another 100 crypto-currences to chose from even now. Voorhees is arguing that Bitcoin has already the Network Effect, which brings its value, but he warns that Bitcoin is very risky investment proposition as well. As we have mentioned before, crypto-currency backed by Gold will be the next logical step in this development.

Gold is holding up today so far after the recent sell off even with rising US Dollar today - which is interesting."

FED "Operation Twist": Bitcoin Crashed To $820 from $1120 on BitStamp

"Welcome to the adult world of the alternatives to FIAT currencies and "End The FED" fighters. Please never mix again the religion and Investment Valuation.

In a thin Sunday trade - before the Chinese market opens - Bitcoin has collapsed from $1120 to $820 at the BitStamp today. You still can buy with Bitcoin a few copies of the very important book for all Bitcoin "investors": "Extraordinary Popular Delusions and the Madness of Crowds."

We congratulate all traders, who has sold it higher than their purchase price. You are welcome to follow us with other 100 Crypto-Currencies now, but better watch Gold and Silver in the next few days."

Bubbles Chronicles: Bill Still Is Pumping Quark vs Bitcoin - Collapse Is Near

All world has gone mad: Bill Still is pumping Quark! Just watch this video and remember how the Bubble stage looks like and what are the arguments presented to buy something "which definitely will go up." We must be very close to the Bitcoin final parabolic rise before the Crash. If Bill Still can not withstand the plot to get fast rich scheme, what can we tell about the other people?

It is very interesting that Bill talks about another 30 crypto-currencies and there are at least 100 else are in existence. Why on Earth to buy Bitcoin at $1200 if you can buy "the better" Quark, which was pumped by Bill Still only to 4.5 cents by now (more then 2000% as Bill proudly has noted!?). Just Sell you Bitcoin now and move down the food chain - "it will be a sure thing: all crypto-currencies will go up once Chinese will be able to buy it, particularly after the Bitcoin will be Crashed."

It looks like we have found finally our own youth portion and will spread our bets evenly among all 100 crypto-currencies, with this kind of sure gains how can we lose anyway? Can you imaging if India will join this crazy feast, what about Malaysia? You can monitor some of those Crypto-Currencies here: Crypto-Currency Market Capitalisation. Junkcoin is not doing well - must be something with its name ... all others are "solid investments".

Can somebody tell Obama to put NSA to proper work finally? Just make the super duper NSAcoin with triple encryption, warranted from Spying and accepted for Tax payments and let Obama to Pump it a little bit ... 17 Trillion in Debt will be repaid very soon - at least we will have better roads and bridges. Can we get into this one as well at the start of Pumping?

And yes, who needs Gold and Silver any more, particularly, when it goes nowhere in price or even down compare to Quark as Bill is reporting? All that dirt, billions of investments - who are those silly people buying all that Gold any more?

China, India, Turkey and Thailand Buying Record Amount of Gold - What Do They Know The Others Don't? GLD, MUX, TNR.v, GDX

Gary North: Bitcoins - The Second Biggest Ponzi Scheme in History

"Gary North presents a very good explanation of the Bitcoin Bubble from the Austrian Economics point of view on the Money. We decided to present this RT video as well so that you can hear Bitcoin advocates as well. Unfortunately Bitcoin's parabolic rise is the most dangerous event for its future. It supposed to challenge the System - at least the FED power in the U.S. How serious is it for the System? It is Everything. All markets are at the mercy of the Fed now. Can we be certain that after 100 Year War Against Gold, FED will find resources to Crash Bitcoin and any idea about viable Currency Alternatives with it?

We have a feeling that this recent exorbitant rise in Bitcoin is purely manipulated. One thing if it is the Insiders - holders of largest number of Bitcoin amounts are gaming the rest of the market with OTC Pump and Dump style. They are trading "the restricted" amount of Bitcoin by driving the price up and will start the distribution to the crowd once liquidity will allow it.

Quite another thing if the System is already defending itself. With Bitcoin's "market cap" of 13 Billion even after recent parabolic rise to $1200, FED can easily accumulate enough amount of Bitcoin to drive the price up and then Crash it into the ground.

Quite another thing if the System is already defending itself. With Bitcoin's "market cap" of 13 Billion even after recent parabolic rise to $1200, FED can easily accumulate enough amount of Bitcoin to drive the price up and then Crash it into the ground.

We do hope that it is not the case and Bitcoin will be able to stabilise somehow to preserve the brilliant idea, but with every parabolic move up in the price we are getting closer to the crash now."

Bitcoin still high risk, not yet ready for mainstream - Bitcoin Foundation General Counsel

"It is very important video to watch for everybody chasing Bitcoin right now. Bitcoin Foundation general counsel warns: "Everybody who buys Bitcoin right now should expect to lose everything". It does not mean that Bitcoin goes to zero tomorrow, but he is very honest with the presentation of Bitcoin, its potential and its risks.

The more we study it - the more we like the idea behind Bitcoin. The problem is not with Bitcoin - as we have wrote before, we consider it as one of the major developments in the financial industry - the problem is with the speculators driving this Bubble. Will Bitcoin survive its astronomic rise and collapse at some point to become the real alternative Currency? What will happen when 100 top holders will start cashing out? Nobody knows how high speculators can chase the Bubble, but the higher it goes the harder it will get down. For Bitcoin future it will be very important whether it can stabilise now and grow gradually presenting the real Currency alternative, otherwise its crash will expose its weakness - that it was gamed by few as usual - and crowd will chase other 60 crypto-currencies available now.

We will monitor the situation further, but already now the chart below will be the chart of the year for us here and shows the potential for the real FIAT alternatives like Gold and Silver."

Thursday, October 09, 2008

Friday, September 26, 2008

FEDs should consider to relaunch the banking system based on Google's Android.

Why not? Google's market cap is still bigger then all gold mining companies in HUI Gold Bugs Index. Company has the best banking motto "Do not be Evil". And its clicks are solid as gold or maybe even better. You click me your invoice I will click you back my payments click, click, click We all clicking will not be able to keep up with the FED printing money.

Thursday, September 25, 2008

RIMM dissappoints and tanking, will Google GOOG be next to miss?

Bailout is like Prozac keeps everybody happy until you remember the reason: Economy is in a grave danger. Google particularly exposed:

1. Even before recent market blow off its growth rate was deteriorating. With Financial sector under water its revenue streams are definitely effected.

2. Multiple market cap to FCF is unsustainable in a Bear market and nobody even The President is not questioning it any more.

3. US Dollar rally takes it toll on non US revenue and it will be lower this Q.

Bear Case continued:

http://sufiy.blogspot.com/2008/07/google-goog-bear-case-contunued.html

1. Even before recent market blow off its growth rate was deteriorating. With Financial sector under water its revenue streams are definitely effected.

2. Multiple market cap to FCF is unsustainable in a Bear market and nobody even The President is not questioning it any more.

3. US Dollar rally takes it toll on non US revenue and it will be lower this Q.

Bear Case continued:

http://sufiy.blogspot.com/2008/07/google-goog-bear-case-contunued.html

Tuesday, September 09, 2008

Google GOOG is facing a legal challenge

Stock was under pressure yesterday in a rallying market, legal problems will not help its valuation which is already under constrain of falling multiple and slowing rate of growth. Another blow this quoter will come from strong USD when company will not be able to book a nice currency advantage from its international operations.

By JOHN R. WILKESeptember 9, 2008; Page B1

Washington -- The Justice Department has quietly hired one of the nation's best-known litigators, former Walt Disney Co. vice chairman Sanford Litvack, for a possible antitrust challenge to Google Inc.'s growing power in advertising.

Mr. Litvack's hiring is the strongest signal yet that the U.S. is preparing to take court action against Google and its search-advertising deal with Yahoo Inc. The two companies combined would account for more than 80% of U.S. online-search ads.

Google shares tumbled 5.5%, or $24.30, to $419.95 in 4 p.m. trading on the Nasdaq Stock Market, while Yahoo shares were up 18 cents to $18.26.

For weeks, U.S. lawyers have been deposing witnesses and issuing subpoenas for documents to support a challenge to the deal, lawyers close to the review said. Such efforts don't always mean a case will be brought, however."

Friday, July 18, 2008

Google GOOG bear case continued.

The last pillar of palace full with memories and sweet dreams about forgone Bull market is shaking: Google is firmly on track of our bearish scenario with further slowing growth, flat FCF and contracting multiple. We have wrote before http://sufiy.blogspot.com/2008/04/google-goog-has-deliveredanother.html about recent trends and now they are finally manifested in crashing stock price.

Trust is shaken and company is not immune to slowdown - sell off will continue and will surprise a lot of people with its magnitude: fear is much stronger feeling then greed. Our diagnoses is that company is at its peak in market share, biggest foreign market in UK is saturated and economy is in downswing there as well, it is still one trick pony and is feeling the hit of slowdown in economy. Financials were hit first, next is consumers, the advertising budgets are cut: first print media, TV; then web based as well.

On our bearish financial front signs of further deterioration are all over the recent report: Revenue Growth Q/Q has slowed -50% from 6% to 3%, Y/Y has slowed -33% from 58% to 39%. The same rate of decreasing rate of growth as in Q1 2008.

EPS growth was -5% Q/Q and 33% Y/Y. Yearly growth is still impressive, but nothing out of the ordinary in order to support bubble valuation in recession environment. Capex has decreased to 697,5 mil -17% Q/Q YouTube blades add broadband must be eating hard into the company's margin and it is desperate to cut it in order to save FCF. Cash Flow from operations was flat Q/Q. With a lot of spin around two closed offices are indication of drastic financial measures: boom is over.

EPS growth was -5% Q/Q and 33% Y/Y. Yearly growth is still impressive, but nothing out of the ordinary in order to support bubble valuation in recession environment. Capex has decreased to 697,5 mil -17% Q/Q YouTube blades add broadband must be eating hard into the company's margin and it is desperate to cut it in order to save FCF. Cash Flow from operations was flat Q/Q. With a lot of spin around two closed offices are indication of drastic financial measures: boom is over.

Free Cash Flow in Q2 is 1068.6 plus 14% (in the Q1 FCF was 842 mil - here was a typo FCF was 937.8 mil). Company can play with TAC figures and reduce CAPEX further in order to deliver at least 4 bil FCF in 2008. But what will it tell us with further slowing growth rate in revenue? It means that company has hit a wall in its YouTube monetisation efforts and will start reduce even existing bleak expectation about break through on that front. Double Click purchase is dilutive to the rate of growth as well: display advertising will be cut first before click based.

With our prerecession multiple at 30 we will arrive to 120 billion market cap for Google which translates into USD377 target price.

Problem is that market is punishing the yesterday winner very brutally after missing its always overoptimistic expectations. I will put a crazy and heretic for a lot of bubble vision guests assumption that we will see in this bear market FCF multiple of 20 and Google's market cap at 80 bil (please put it in economic context guys: it is still Internet Advertisement Company, not water, bread or oil).

This valuation will translate into USD250 share price.

Wednesday, July 09, 2008

Google GOOG YouTube will continue to be a money drain.

News are old, but with a new meaning in the recession times: Google can not monetise its 1.65 billion investment, revenues are not material (200mil for 2008 is estimated) and it is officially a money drain from other profitable business. When you consider running costs for all those blades and bandwidth eaten by huge video traffic the picture will become even more bleak.

"Of course, one other obvious solution to YouTube's sales woes would be to simply start advertising on YouTube pages, period. Nearly any page you see on the site today is ad-free. But Google is showing a billion clips a day. Why not simply start loading some of those pages with AdSense units?

Because of the other big admission in the WSJ story -- Google is afraid to sell ads on 96% of its inventory:

Fearful of fueling allegations that it is profiting from copyright infringement, Google will only sell ads against YouTube clips that have been posted or approved by media companies and other partners -- roughly 4% of the total, says one person familiar with the matter.

The story ascribes Google's fears to the billion-dollar Viacom suit, but we think that's not fair: Even if Philippe Dauman ends up settling with Google, it's not going to resolve the copyright cloud hovering over YouTube. So either Google's going to need a legal ruling that gives it the go-ahead to make money on its copyright-violating inventory -- or it's going to have live with diminished expectations for its $1.65 billion business."

Because of the other big admission in the WSJ story -- Google is afraid to sell ads on 96% of its inventory:

Fearful of fueling allegations that it is profiting from copyright infringement, Google will only sell ads against YouTube clips that have been posted or approved by media companies and other partners -- roughly 4% of the total, says one person familiar with the matter.

The story ascribes Google's fears to the billion-dollar Viacom suit, but we think that's not fair: Even if Philippe Dauman ends up settling with Google, it's not going to resolve the copyright cloud hovering over YouTube. So either Google's going to need a legal ruling that gives it the go-ahead to make money on its copyright-violating inventory -- or it's going to have live with diminished expectations for its $1.65 billion business."

Friday, April 18, 2008

Google GOOG has Delivered...another shorting opportunity

Few thoughts on earnings which were "missed" by main stream media:

Google has "blown up" earnings at 4.84 and meet revenue estimates at 5.2 bil. If somebody thinks that stock will go back to October Highs - think twice: company has beat only reduced estimates, just 90 days ago EPS was expected at 4.87.

On our bearish front signs of further deterioration are all over the recent financial report:

Revenue Growth Q/Q has slowed -50% from 14% to 7%, Y/Y has slowed -33% from 63% to 42%.

Google has "blown up" earnings at 4.84 and meet revenue estimates at 5.2 bil. If somebody thinks that stock will go back to October Highs - think twice: company has beat only reduced estimates, just 90 days ago EPS was expected at 4.87.

On our bearish front signs of further deterioration are all over the recent financial report:

Revenue Growth Q/Q has slowed -50% from 14% to 7%, Y/Y has slowed -33% from 63% to 42%.

EPS growth was 8.7% Q/Q and 30% Y/Y. Yearly growth is still impressive, but nothing out of the ordinary in order to support bubble valuation. Lets have a look how this level of EPS growth has been achieved. Here is the surprise - welcome to the new reality: gravity still matters even in cyberspace. Capex has increased to 841.6 mil +24% Q/Q YouTube blades add broadband must be eating hard into the company's margin. Cash Flow from operations has increased only 5% Q/Q.

Our famous metrics of Free Cash Flow multiple is not leaving a lot of place for unwarranted happiness: in the Q1 FCF was 842 mil.

Now market will decide what is Google: a new technological frontier changing universe and "this time is different" or it is still an advertising company with technology edge in its model? Its customers and consumers must be living in virtual world and not facing stagflation: rising prices due to intentionally loose monetary policy and recession in real inflation adjusted output. The most encouraging for this point is Eric's "...Eric reiterated the company has not seen any macro-economic impact." It is still to come...he needs some help to see his dramatically slowing growth and FCF.

If company will be able to deliver FCF with 5% Q/Q growth for this year and CAPEX will stay at Q1 level FCF will be 4.2 bil. At 30 FCF multiple (our next stop in bearish slide compression) stock should reach Market Cap of 126 bil which will translate into USD397. Any change of heart of devoted shareholders or unfolding another bear leg in general markets and USD350will be seen as blue sky.

The higher stock goes into this bear market rally the safer will be PUT position. Apply all CS rules as usual.

Do not be stubborn (for myself) investor's enthusiasm (stupidity in some languages) should not be underestimated: wait for Technical signal Sell.

Do not be stubborn (for myself) investor's enthusiasm (stupidity in some languages) should not be underestimated: wait for Technical signal Sell.

All these thoughts are for educational purposes and my own amusement only as usual.

Monday, March 10, 2008

Google GOOG company is "addressing click fraud concern" - market is "addressing related valuation"

Google's customers are all linked to consumers, who are losing their purchasing power by the hour in recent recession. ROI on advertising is falling, Google's customers are cutting ADs spending, debt financed prosperity has lifted all boats and Google's ad campaigns looked like justified before, but now results are not so apparent: customers do not have money or maybe Google was never so effective to attract them after all?

"...speaking at the Bear Stearns Media Conference in Florida, Tim Armstrong, Google's president of North America advertising and commerce, said that the recent slowing in paid clicks "was intentional on our part" and will result in "a long-term benefit for our business."

That's because recent quality initiatives at the company have resulted in fewer unintentional clicks and a higher number of "conversions," or revenue generated by intentional clicks, according to Armstrong.

"Conversions actually go up for advertisers, which is positive, but there are less clicks overall," he said."

"...speaking at the Bear Stearns Media Conference in Florida, Tim Armstrong, Google's president of North America advertising and commerce, said that the recent slowing in paid clicks "was intentional on our part" and will result in "a long-term benefit for our business."

That's because recent quality initiatives at the company have resulted in fewer unintentional clicks and a higher number of "conversions," or revenue generated by intentional clicks, according to Armstrong.

"Conversions actually go up for advertisers, which is positive, but there are less clicks overall," he said."

Saturday, March 08, 2008

Google GOOG first stop pit is reached at USD435

Multiples compression has brought stock price of Google to the first stop pit at USD435. Now recession fears will make its way in compressing it further to USD326:

"Finally great company has missed even greater expectations, more analyses will come later, but for now it is apparent that all financials have deteriorated further: growth rate sliped at fastest pase ever. FCF in last year was 3.4 bil USD. Multiple at closing at USD564 FCF/MC (176.5 bil) was 51.9, compared to yahoo around 20. Recession will eat hard into Google revenue growth, CAPEX will hurt FCF further in 2008. Multiple of 50 Free Cash Flow to Market Cap is not sustainable any more, expect first stop at 40. It is 40*3.4=136 bil market cap, stock price USD435. With further recession fears multiple of 30 will come into play (50% over Yahoo!). It will reflect in stock price of USD326. On the Technical side stock has broken crucial uptred line on weekly bases. Technical signal SELL which has been reported here 2 weeks ago now confirmed by fundamentals."

http://sufiy.blogspot.com/2008/02/google-goog-web20-bubble-is-bursting.htmlHenry Blodget is on the same page with that analysis here:

http://www.alleyinsider.com/2008/3/_google_to__350_

Tuesday, February 26, 2008

Google Disaster GOOG : Comscore Reports Awful January

Henry Blodget February 26, 2008 7:16 AM

Comscore reported shockingly bad US paid click performance for Google in January: flat growth year-over-year versus a 25% increase in Q4. Even if Comscore is only half right, this is a disaster.

Flash note from analyst Bob Peck at Bear Stearns:

comScore reported 532mn domestic paid clicks in Jan. 08, flat YoY, but down 12% sequentially (Jan. 08 vs. Oct. Oct. 07). The click through rate was the lowest since comScore stated reporting this data and was down 200bp from levels in 4Q and down 400bps from levels in 1Q of last year. While this is one data point for domestic google.com only and from one source, which may or may not be accurate, it is a concerning data point and somewhat reflects what we have heard from SEMs - that they were not seeing a high volume of clicks from consumers possibly due to the economic slowdown.Note that Google reported a 30% YoY growth rate in overall (global) paid leads in 4Q07 and comScore reported growth of 25% YoY for domestic google.com paid leads for 4Q. While not an apples-to-apples comparison, we will continue to monitor the comScore numbers for Feb and Mar before definitive conclusions can be drawn.

This report is so shocking it bears repeating: ComScore said Google's US revenue units (paid clicks) grew 25% last quarter--a quarter that disappointed Wall Street. In January, the same source, ComScore, says the same revenue units were flat.

What could be the explanation for this? Strapped shoppers not clicking on as many links. This is exactly why one insider argued last week that Google is very exposed to economic weakness--and why we have been concerned for six months that Google was not "immune" to a recession.

Yes, Comscore could be wrong, and, yes, it's only one data point. But hard to imagine how the bulls are going to spin this one.

Sunday, February 24, 2008

Google GOOG vs Commodities, Virtual vs Real

Shift to the real assets will continue further, once growth rate will slow even further compression of multiples will bring GOOG price further down to sustainable valuation:

http://sufiy.blogspot.com/2008/02/google-goog-web20-bubble-is-bursting.html

I could not agree more with this analyses:

http://www.alleyinsider.com/2008/2/google_very_exposed_to_us_recession__expert

http://sufiy.blogspot.com/2008/02/google-goog-web20-bubble-is-bursting.html

I could not agree more with this analyses:

http://www.alleyinsider.com/2008/2/google_very_exposed_to_us_recession__expert

Friday, February 01, 2008

Google GOOG WEB2.0 Bubble is Bursting

Finally great company has missed even greater expectations, more analyses will come later, but for now it is apparent that all financials deteriorated further: growth rate sliped at fastest pase ever. FCF in last year was 3.4 bil USD. Multiple at closing at USD564 FCF/MC (176.5 bil) was 51.9, compared to yahoo around 20. Recession will eat hard into Google revenue growth, CAPEX will hurt FCF further in 2008. Multiple of 50 Free Cash Flow to Market Cap is not sustainable any more, expect first stop at 40. It is 40*3.4=136 bil market cap, stock price USD435. With further recession fears multiple of 30 will come into play (50% over Yahoo!). It will reflect in stock price of USD326. On the Technical side stock has broken crucial uptred line on weekle bases. Technacal signal SELL which has been reported here 2 weeks ago now confirmed buy fundamentals.

Tuesday, January 29, 2008

Yahoo! YHOO is toasted from here. WEB 2.0 Bubble is bursting right now.

Free cash flow in 2007 was 1337 mil USD, they are projecting now only 925 (mid 850-1000) for 2008, it is 31% drop! Now Yahoo is valued at 20.7 multiple to FCF in 2007. Going into recession ( I think as you remember that USA is in recession last three Qs) with this multiple and crashing FCF will make stock valuation even at 14.35USD as very rich.

Friday, January 11, 2008

Subscribe to:

Posts (Atom)

Jim Rickards

Jim Rickards