Showing posts with label BitCoin. Show all posts

Showing posts with label BitCoin. Show all posts

Saturday, March 31, 2018

Sunday, June 29, 2014

Peak Oil Is Back! Secret Trade Memos, TTIP And Write-down Of Two-thirds Of US Shale Oil Explodes Fracking Myth.

We will start with the punch line:

"According to a secret trade memo obtained by the Huffington Post, the Obama administration and the European Union are pushing ahead with efforts to "expand US fracking, offshore oil drilling and natural gas exploration", as well as exports to the EU, under the prospective Transatlantic Trade and Investment Partnership (TTIP) agreement. The Guardian."

Why nobody in mass media is really talking about it? You decide for yourself, we will give you just couple of thoughts and will present the brilliant article by Dr Nafeez Ahmed in full, people are lazy these days even to click through - and we are not even talking about some independent thinking here. Gold and Truth about Peak Oil are two major things exposing the Central Banks scam and Inflation tax on our societies, so expect the full blown attack on both to keep the status quo. For those who are quick to come to the conclusions on who is behind the assault on "100% Safe Fracking" we will start with:

NATO: Russian Spies Against "100% Safe Fracking", Two-thirds Of US Shale Oil "Could Be Stolen By Chinese Hackers."

Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

"Some wise, but very dangerous men once said: "We will take the best out of Them, we will intrigue them by Enigma and Secret, we will make Them think that they are running the world ... but it will be Us who is really in charge." Do you see the historical parallels?"Brothers" are still in denial and Bitcoin "revolutionaries" are fighting the FED ... "

Peak Oil Was Just Postponed - IEA Write-down Of Two-thirds Of US Shale Oil Explodes Fracking Myth.

"Jim Puplava has a very interesting discussion about Peak Oil on his Financial Sense this week. You do not hear a lot in the mass media about the report on coming write-down by IEA of two-thirds of US shale oil reserves, but it is the really groundbreaking news exposing fracking hype and myth everybody should be worried about now. Peak Oil Is Back! You can find my own findings and how we are addressing this coming Peak Oil by building our International Lithium to make Electric Cars mass market possible one day below on the links. Please, enjoy: "Jim Puplava's Big Picture: Peak Oil - Delayed But Not Resolved":

"Jim’s first topic on the Big Picture this week is “Peak Oil – Delayed but Not Resolved”. Jim lays out the issue of Peak Oil in depth, and quotes studies that believe it could still arrive by the end of this decade. Jim also looks at the Shale Revolution in the US and discusses how long the shale story may delay the onset of Peak Oil. The next topic is “OPEC’s New Competition”. Jim looks at the geological and geopolitical constraints on OPEC and sees North America as a growing and viable competitor to OPEC’s energy dominance in the future. Jim Puplava."

The Guardian:

Dr Nafeez Ahmed

Next month, the US Energy Information Administration (EIA) will publish a new estimate of US shale deposits set to deal a death-blow to industry hype about a new golden era of US energy independence by fracking unconventional oil and gas.

EIA officials told the Los Angeles Times that previous estimates of recoverable oil in the Monterey shale reserves in California of about 15.4 billion barrels were vastly overstated. The revised estimate, they said, will slash this amount by 96% to a puny 600 million barrels of oil.

The Monterey formation, previously believed to contain more than double the amount of oil estimated at the Bakken shale in North Dakota, and five times larger than the Eagle Ford shale in South Texas, was slated to add up to 2.8 million jobs by 2020 and boost government tax revenues by $24.6 billion a year.

Industry lobbyists have for long highlighted the Monterey shale reserves as the big game-changer for US oil and gas production. Nick Grealy, who runs the consultancy No Hot Air which is funded by "gas and associated companies", and includes the UK's most high-profile shale gas fracker Cuadrilla among its clients, predicted last year that:

"... the star of the North American show is barely on most people's radar screens. California shale will... reinvigorate the Golden State's economy over the next two to three years."

This sort of hype triggered "a speculation boom among oil companies" according to the LA Times. The EIA's original survey for the US Department of Energy published in 2011 had been contracted out to Intek Inc. That report found that the Monterey shale constituted "64 percent of the total shale oil resources" in the US.

The EIA's revised estimate was based partly on analysis of actual output from wells where new fracking techniques had been applied. According to EIA petroleum analyst John Staub:

"From the information we've been able to gather, we've not seen evidence that oil extraction in this area is very productive using techniques like fracking... Our oil production estimates combined with a dearth of knowledge about geological differences among the oil fields led to erroneous predictions and estimates."

The Intek Inc study for the EIA had relied largely on oil industry claims, rather than proper data. Hitesh Mohan, who authored the Intek study for the EIA, reportedly conceded that "his figures were derived from technical reports and presentations from oil companies, including Occidental Petroleum, which owns the lion's share of oil leases in the Monterey Shale, at 1.6 million acres." Mohan had even lifted his original estimate for the EIA to 17 billion barrels.

Geoscientist David Hughes, who worked for the Geological Survey of Canada for 32 years, said:

"The oil had always been a statistical fantasy. Left out of all the hoopla was the fact that the EIA's estimate was little more than a back-of-the-envelope calculation."

Last year, the Post Carbon Institute (PCI) published Hughes' study,Drilling California: A Reality Check on the Monterey Shale, which conducted an empirical analysis of oil production data using a widely used industry database also relied on by the EIA. The report concluded that the original EIA estimate was "highly overstated," and unlikely to lead to a "statewide economic boom.... California should consider its economic and energy future in the absence of an oil production boom."

A spokesman for the Institute, Tod Brilliant, told me:

"Given the incredible difference between initial projections of 15 billion barrels and revisions to 600 million, does this not call into account all such global projections for tight oil?"

As I'd reported earlier in June last year, a wider PCI study by Hughes had come to similar conclusions about bullish estimates of US shale oil and gas potential, concluding that "light tight oil production in the USA will peak between 2015 and 2017, followed by a steep decline", while shale gas production would likely peak next year. In that post, I'd pointed out previous well-documented, and alarmingly common, cases of industry over-estimates of reserve sizes which later had been questioned.

Analysts like Jeremy Leggett have said, citing exaggerated oil industry estimates, that if reserve and production reality are indeed significantly lower than industry forecasts, we could be at risk of an oil shock as early as within the next five years.

The latest revelations follow a spate of bad news for industry reassurances about the fracking boom. New research published this month has found that measured methane leaks from fracking operations were three times larger than forecasted. The US Environment Protection Agency therefore "significantly underestimates" methane emissions from fracking, by as much as a 100 to a 1,000 times according to a new Proceedings of the National Academy of Sciences study published in April.

The Associated Press also reported, citing a Government Accountability Office investigation, that the US Interior Department's Bureau of Land Management had failed to adequately inspect thousands of oil and gas wells that are potentially high risk for water and environmental damage.

Despite the mounting evidence that the shale gas boom is heading for a bust, both economically and environmentally, both governments and industry are together pouring their eggs into a rather flimsy basket.

According to a secret trade memo obtained by the Huffington Post, the Obama administration and the European Union are pushing ahead with efforts to "expand US fracking, offshore oil drilling and natural gas exploration", as well as exports to the EU, under the prospective Transatlantic Trade and Investment Partnership (TTIP) agreement.

Dr. Nafeez Ahmed is an international security journalist and academic. He is the author of A User's Guide to the Crisis of Civilization: And How to Save It, and the forthcoming science fiction thriller, Zero Point. Follow him on Facebook and Twitter @nafeezahmed."

Labels:

BitCoin,

Central Banks,

FED,

Fracking,

Gold,

Inflation,

Jim Puplava,

Nafeez Mosaddeq Ahmed,

Obama administration,

OPEC,

Peak oil,

Shale oil,

TTIP,

US EU

Friday, June 27, 2014

Kirill Klip.: Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

Bubble Chronicles. Mystery Solved: Meet Satoshi Nakamoto - The Face Behind Bitcoin

Kirill Klip.:

Even Golden Bubbles Are Made Of Bubbles: Bitcoin Vs. Gold - Some Thoughts And Infographic.

Even Golden Bubbles Are Made Of Bubbles. I was following Bitcoin for a while ... and other 50 crypto-currencies. Once the amount of crypto-ideas about Gold 2.0 exceeded 60 - I have lost my interest. But the last Fall moment was truly historical: when Bitcoin has briefly touched parity with Gold.

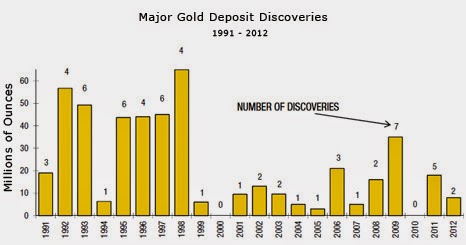

I will leave you to your own studies on this subject, but will mention only one particular angle. Bitcoin was supposed to be the competition to FIAT currencies. Why there is such a "tolerance" from authorities in U.S. - compare to the "FED's 100 years War on Gold"? Maybe I know the answer, maybe you will find another one. Gold is finite and the Only Money accepted for thousand of years as such. It cannot be printed or created in any way apart from the very hard work to discover and recover it from the ground. Gold companies are mining the dust now compared to the 90s and new discoveries are few and far between. Bitcoin, on another side, can be manufactured at Will and there is the different opinions about the Control of this Will in Bitcoin case, but NSA will always provide you with the better substitute of Bitcoin at some point: NSAcoin.

TNR Gold: Shotgun Gold Project - Why Do We Need New Gold Deposits?

Some wise, but very dangerous men once said: "We will take the best out of Them, we will intrigue them by Enigma and Secret, we will make Them think that they are running the world ... but it will be Us who is really in charge." Do you see the historical parallels?"Brothers" are still in denial and Bitcoin "revolutionaries" are fighting the FED ...

Chris Martenson: The Perfect Business Case - Exponential Money And Limited Resources Supply.

I will encourage you to read the brilliant "Gold Price Relative To Monetary Base At All-Time Low":

"The newest edition of the annual In Gold We Trust report is out. This eight edition goes again to the heart of gold’s value and analyzes the yellow metal as a monetary asset rather than an industrial commodity. The In Gold We Trust 2014 report takes a sober look at the big picture in the monetary system and offers a holistic analysis of the gold sector. It is written by Ronald Stoeferle who is the managing partner of a global fund at Incrementum AG in Liechtenstein, based on the principles of the Austrian school of Economics. GoldSilverWorlds."

If James Rickards is right with his "The Death Of Money", which I think is the case, than we are heading straight into the Currency Collapse at some point. The idea to test the substitutes to US Dollar and build up the opposition to the Only and True Money - Gold is very attractive. Problem is that the people with a lot of even FIAT money prefer Gold, only people with a lot of Debt are searching for Gold 2.0 - China buys Gold and encourages its citizens to do so. And as James Rickards has put it:

#Bitcoin fans are always promoting "Gold v Bitcoin" debates. I've never seen a#gold advocate do that.#RealMoneyEnvy

Thursday, March 06, 2014

Bubble Chronicles. Mystery Solved: Meet Satoshi Nakamoto - The Face Behind Bitcoin

One mystery is

solved: Satoshi Nakamoto is found and another one: when this

bubble will be finally over will be found soon. Warren Buffet has discussed it

recently and dismissed Bitcoin as a currency, as a store of value it

is not working very well for the latest buyers from the last Fall. It will be more and more

difficult "to find another fool" to buy it at a higher price after all recent

news about Mt. Gox bankruptcy, millions of lost Bitcoins and

crucial technical fault in Bitcoin architecture allowing it to happen. Constant

attacks from the Central Banks around the world will only add to the

pressure on FIAT alternative. There is no "Gold 2.0" - there is only

one real Gold and not so much of it left now.

After these revelations about Satoshi Nakamoto pedigree and his long history of working on highly classified projects you can think for yourself from what point in time NSA has been really involved in this project and what will be the implications on Bitcoin crowd of "freedom fighters" with further investigation reports coming out. The destiny of Bitcoin speculators we can learn from the history."I am no longer involved in that and I cannot discuss it," he says, dismissing all further queries with a swat of his left hand. "It's been turned over to other people. They are in charge of it now. I no longer have any connection."

Bubble Chronicles: Drug Site Silk Road Wiped Out By Bitcoin Glitch

Bitcoin plunges 50% on Mt. Gox to hit USD230 as troubles continue

So much for the store of value and "Gold 2.0": Bitcoin continues its troubles now related not only to the herd mentality chasing the bubbles, but to the fatal flaw in the core of it praised crypto-currency architecture. Meanwhile the real and one only Gold is breaking out with topping $1,322 intraday. Realisation that there is no substitutes for Gold will be another factor to ignite this new Gold Bull leg. China was first here again and bought record amount of 247 tons of Gold in January.

So much for the store of value and "Gold 2.0": Bitcoin continues its troubles now related not only to the herd mentality chasing the bubbles, but to the fatal flaw in the core of it praised crypto-currency architecture. Meanwhile the real and one only Gold is breaking out with topping $1,322 intraday. Realisation that there is no substitutes for Gold will be another factor to ignite this new Gold Bull leg. China was first here again and bought record amount of 247 tons of Gold in January.

Bubble Chronicles: Bitcoin Crashed Down Fast to $500 at Mt. Gox and $102 at BTC-e today.

"After all the news about the Mt. Gox and Russia making any transactions with Bitcoin illegal, Bitcoin is crashing fast now with Mt. Gox quoting below any other exchanges at $530 and Litecoin is down to $15.

Bitcoin has printed low $500 on Mt Gox and fell as low as $102 at BTC-e today! So much for the crypto-currency reliability as exchange, the "value" of vapour currency can literally evaporate at any moment. Time is for Gold to shine again, it does not need any substitutes and is breaking out to the upside today clearing $1270 level."

Newsweek:

The Face Behind Bitcoin

Satoshi Nakamoto stands at the end of his sunbaked driveway looking timorous. And annoyed.

He's wearing a rumpled T-shirt, old blue jeans and white gym socks, without shoes, like he has left the house in a hurry. His hair is unkempt, and he has the thousand-mile stare of someone who has gone weeks without sleep.

He stands not with defiance, but with the slackness of a person who has waged battle for a long time and now faces a grave loss.

Two police officers from the Temple City, Calif., sheriff's department flank him, looking puzzled. "So, what is it you want to ask this man about?" one of them asks me. "He thinks if he talks to you he's going to get into trouble."

"I don't think he's in any trouble," I say. "I would like to ask him about Bitcoin. This man is Satoshi Nakamoto."

"What?" The police officer balks. "This is the guy who created Bitcoin? It looks like he's living a pretty humble life."

I'd come here to try to find out more about Nakamoto and his humble life. It seemed ludicrous that the man credited with inventing Bitcoin - the world's most wildly successful digital currency, with transactions of nearly $500 million a day at its peak - would retreat to Los Angeles's San Bernardino foothills, hole up in the family home and leave his estimated $400 million of Bitcoin riches untouched. It seemed similarly implausible that Nakamoto's first response to my knocking at his door would be to call the cops. Now face to face, with two police officers as witnesses, Nakamoto's responses to my questions about Bitcoin were careful but revealing. More"

Labels:

BitCoin,

BTC,

china,

Electronic money,

Gold,

Mt.Gox,

Russia,

Satoshi Nakamoto,

Silk Road

Subscribe to:

Posts (Atom)

Jim Rickards

Jim Rickards