Showing posts with label BRICS. Show all posts

Showing posts with label BRICS. Show all posts

Monday, August 17, 2015

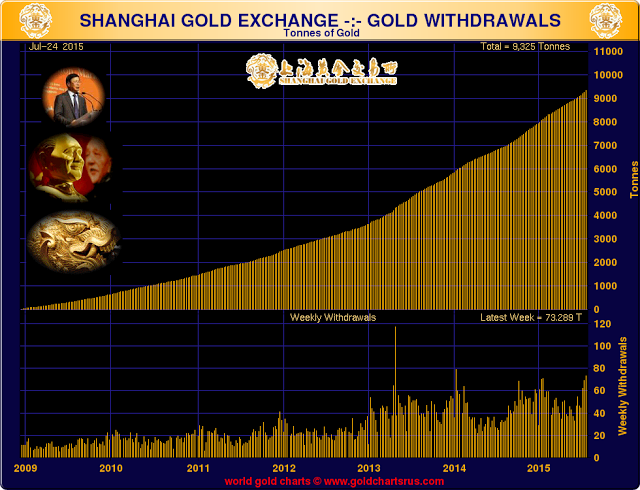

Boom: China SGE Gold Withdrawals An Enormous 1464 Tonnes So Far This Year.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

This Has Never Happen Before: Gold Hedge Funds Aggregate Net Position Has Been Short For The First Time In History.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Thursday, August 13, 2015

Number Of Owners Per Once Of Gold At The COMEX Is At Record High At 117 to 1.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Shanghai Gold Exchange Has 73.3 Tonnes of Bullion Withdrawn Its Third Largest Week.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Gold Catalyst: Don Coxe: Bull Market in Bonds Now Ending - Risks Ahead.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Monday, August 03, 2015

Is China Moving Toward a Gold Standard? Peter Schiff on the Chinese Market Crash.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Sunday, August 02, 2015

FED's Mission Impossible: "Gold Is Dead And Nobody Loves It Any More."

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Is China Moving Toward a Gold Standard? Peter Schiff on the Chinese Market Crash.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

The Asset They Love To Hate: Gold And The Grave Dancers.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Gold Catalyst: Don Coxe: Bull Market in Bonds Now Ending - Risks Ahead.

Labels:

AIIB,

Alaska,

Asia,

Barrick Gold,

BRICS,

Calista Corporation,

china,

Donlin Gold,

Gold Manipulation,

Gold mining,

Kirill Klip,

LBMA,

Mining,

NovaGold,

SGE,

Shotgun Gold,

Teck Resources,

TNR Gold

Monday, March 17, 2014

Jim Sinclair: Russia Can Collapse US Economy, Gold Update, Silver is Gold on Steroids MUX TNR.v GDX GLD

Jim Sinclair still stands by his $50,000 price for Gold. His explanation about the Gold market manipulation deserves very careful attention. According to Jim Sinclair nine entities including one in Russia and one in Singapore - where Jim involved himself - are building now Exchanges with Gold physical delivery settlement. You simply can not manipulate the Gold market in that case like it happen last year when huge amount of "Gold" was dumped in the paper market.

The situation around Ukraine and Russia is very dangerous and this new cold war can become hot very fast. In any case this ongoing confrontation between USA and Russia will have the very far reaching economic complications for both sides. The Petrodollar is the base for US Dollar now, after Nixon has taken it from Gold standard. US Dollar slide below 80.00 is very important, it shifts the entire US Dollar based system. "We are going to war for Petrodollar." Putin does not need any nuclear weapons, he has economic weapons of mass distraction. All he needs to do is to stop accept US Dollar.

We have absolutely seen the double bottom in Gold in 2013. Gold is heading towards $2,000 and at least $1,918 level this year.

We have absolutely seen the double bottom in Gold in 2013. Gold is heading towards $2,000 and at least $1,918 level this year.

Eric Sprott - Gold To See Powerful Bullish "Golden Cross" Within Days TNR.v MUX GDX GDXJ GLD ABX NG

"C.S. Eric Sprott is talking about the "Golden Cross" - the very powerful bullish signal coming for Gold within the next few days. On the chart above you can see the very strong first move of the new Bull market in Gold from the December 2013 low. We are just 2% from 20% increase when media will start talking about the new Gold Bull market being "confirmed officially." As you can see MA 50 is turning decisively Up and is ready to cross MA200 to the upside.

The very important driving forces behind this Gold rally is the record buying from China and the ongoing Gold Manipulation investigations. Eric thinks that all major bullion banks are at risk now and their compliance departments are very busy trying to manage the damage of potential litigation and fines. "The most important here that this process removes the manipulators out of the market. The ceiling is taking off from the Gold price now, they can not continue to manipulate Gold market as they did any more"

You can listen to Eric on the link below and we will run a few charts showing what "Golden Cross" means for particular stocks."

Labels:

BRICS,

china,

Cold War,

FED,

Gold Investment,

Jim Sinclair,

Russia,

Silver,

Singapore,

Ukraine

Sunday, August 25, 2013

Don Coxe: "The Trend Has Shifted" For Commodities GDX, GDXJ, MUX, TNR.v

Tekoa Da Silva has published very important article about Don Coxe recent market observations. With all unfolding crises among the BRICS currencies funds are not going to the US dollar any more, but to the Euro. The critical differences between European Central Bank policies and FED's expanding balance sheet are in play here.

His observations about the changing trend in the commodities are extremely important - he is widely followed by the institutional investment community and they can start to reallocate their assets accordingly. The help to the commodities markets came from the places least expected: China reviving growth and Europe coming out of recession.

This move will be highly beneficial for our darlings: McEwen Mining and TNR Gold with world class Los Azules copper deposit unlocking its value.

Rick Rule On Gold & Resources: "The Stage Is Set For An Absolutely Dramatic Recovery" TNR.v, MUX

"Then, suddenly, after a few weeks of the water torture without any direction in the market, selected stocks start to move by 10 - 20 percent a day. Sellers are gone and Pros are picking up the pieces for cents on the dollar value - the new Bull market is born.

To make this dramatic and pleasant for Survivors picture come true we need just one thing - Pros with the money coming into the market, without them it will always be only the wishful thinking. We can see them coming now."

Gold Breakout: Jim Sinclair - The three entities that called the $1900 in gold are back long. GLD, SLV, GDX, MUX, TNR.v

"Now we have the full A Team calling for the New Bull Leg in Gold. Summer doll drums time out is officially over. Gold was over 1400 intraday and Silver is over 24 now. Junior miners are exploding to the upside with McEwen Mining pushing 3 dollar mark. Survived Juniors will show this Fall what is called the ten baggers again."Don Coxe: "The Trend Has Shifted" For Commodities

Don Coxe, Chairman of Coxe Advisors LLP, has issued a powerful new weekly review of the global capital markets, entitled, “This Time

When the BRICs Tumble The Euro is the Haven.”

When the BRICs Tumble The Euro is the Haven.”

In this updated conference call, Don spoke to the returning strength of commodities, the true impetus behind J.P. Morgan exiting the metals warehousing business, and what investors should be doing right now in considering commodities.

Beginning at the 13:30 mark, Don noted that:

“Commodities collectively, are a cyclical bet…the CRB bottomed out in June and is up sharply since then…gold bottomed out at that time and it’s moved up to a pretty good level…$1391 doesn’t sound as good as to compared to where it was a year ago, but once again—the trend has shifted.”

“Commodities are demonstrating that there is new strength, and then we see the tremendous change in China’s imports of commodities, a record level of import in July of iron ore. We’ve seen the leap in the price of copper, and one of the things that is helping the commodity situation…is that JP Morgan has been forced by governments, the CFTC, and by the supervisors in Washington, to get out of operating their metals warehouses. The reason they did [so] was not because of ideology, but because so many congressman were being contacted by their constituents, who said ‘We cannot get the metals from the Morgan warehouses—they own these warehouses, we can’t even get aluminum,’ which is the one that has the biggest inventories of all time, [but] they tell us nine-months delay for delivery.”

“So [what] you should be doing now…I believe that you should certainly be increasing your exposure to the good commodity stocks…if you believe in stronger economic growth, and you’re not fooled by the fact that these emerging markets right now are having trouble adjusting.”

“China is once again coming through this pretty unscathed, and that means that you’ve got a great source of stability—and of course you’ve got a new player, which is the oldest of old players, Japan, to the plus side.”

“So it’s a time where you can have a greater confidence level in demand for basic materials.”

—

Editor’s Note: Don Coxe may be launching a subscription service soon. His conference calls and market comments are currently all free, and available at the website link below. So this is a fantastic opportunity to hear and learn from Don every week—which may not be here for very long. Please take advantage of it.

To learn more about Don Coxe (and to follow his regular work) visit: CoxeAdvisors.com"

Labels:

BRICS,

china,

Commodity,

Copper,

Don Coxe,

European Central Bank,

Federal Reserve System,

Gold,

J. P. Morgan,

Japan,

Silver,

United States

Wednesday, June 17, 2009

US Dollar Collapse and Inflation: China's lower holding of U.S. Treasury bonds "response to weaker dollar" RMK.v, TNR.v, GBN.v, CGH.to, SNU.v, AMM.to

Recent Dollar small hesitation on the way down could be over very soon. If the health of "reserve currency of choice" US Dollar depends on what Russian finance minister thinks - then it is finished even sooner then we thought.

Recent Dollar small hesitation on the way down could be over very soon. If the health of "reserve currency of choice" US Dollar depends on what Russian finance minister thinks - then it is finished even sooner then we thought. Who needs enemies if you have such friends? Should US Corp. send Mr Secretary to Brazil and Russia as well after China or Green Fellow will jump out of the window after it? Gold and Silver are in Tree Shaking mode and weakest will be gone at exactly the wrong moment. Cup and Handle on Gold is still in place.

Who needs enemies if you have such friends? Should US Corp. send Mr Secretary to Brazil and Russia as well after China or Green Fellow will jump out of the window after it? Gold and Silver are in Tree Shaking mode and weakest will be gone at exactly the wrong moment. Cup and Handle on Gold is still in place.

China's lower holding of U.S. Treasury bonds "response to weaker dollar"

BEIJING, June 16 (Xinhua) -- For the first time in more than one year, China reduced its holding of U.S. Treasury bonds, and experts told Xinhua Tuesday that move reflected concern over the safety of U.S.-dollar-linked assets.

Data from the U.S. Treasury showed China pared its stake in Treasury bonds by 4.4 billion U.S. dollars, to 763.5 billion U.S. dollars, as of the end of April compared with March.

Tan Yaling, an expert at the China Institute for Financial Derivatives at Peking University, told Xinhua that the move might reflect activity by China's institutional investors. "It was a rather small amount compared with the holdings of more than 700 billion U.S. dollars."

"It is unclear whether the reduction will continue because the amount is so small. But the cut signals caution of governments or institutions toward U.S. Treasury bonds," Zhang Bin, researcher with the Institute of World Economics and Politics of the Chinese Academy of Social Sciences, a government think tank, told Xinhua.

He added that the weakening U.S. dollar posed a threat to the holdings of U.S. Treasury bonds.

The U.S. government began to increase currency supply through purchases of Treasury bonds and other bonds in March, which raised concern among investors about the creditworthiness of U.S. Treasury bonds. The move also dented investor confidence in the U.S. dollar and dollar-linked assets.

China, the biggest holder of U.S. Treasury bonds, is highly exposed. In March, Premier Wen Jiabao called on the United States "to guarantee the safety of China's assets."

China is not the only nation that trimmed holdings of U.S. Treasury bonds in April: Japan, Russian and Brazil did likewise, to reduce their reliance on the U.S. dollar.

However, Tan said that U.S. Treasury bonds were still a good investment choice.

Hu Xiaolian, head of the State Administration of Foreign Exchange, said in March that U.S. Treasury bonds played a very important role in China's investment of its foreign exchange reserves. China would continue to buy the bonds while keeping an eye on fluctuations.

Zhang said it would take months to see if China would lower its stake. Even so, any reduction would not be large, or international financial markets would be shaken, he said.

Wang Yuanlong, researcher with the Bank of China, said the root of the problem was the years of trade surpluses, which created the huge amount of foreign exchange reserves in China. It left China's assets tethered to the U.S. dollar, he said.

He said making the Renminbi a global currency would cut China's demand for the U.S. dollar and reduce its proportion in the trade surplus."

Subscribe to:

Posts (Atom)