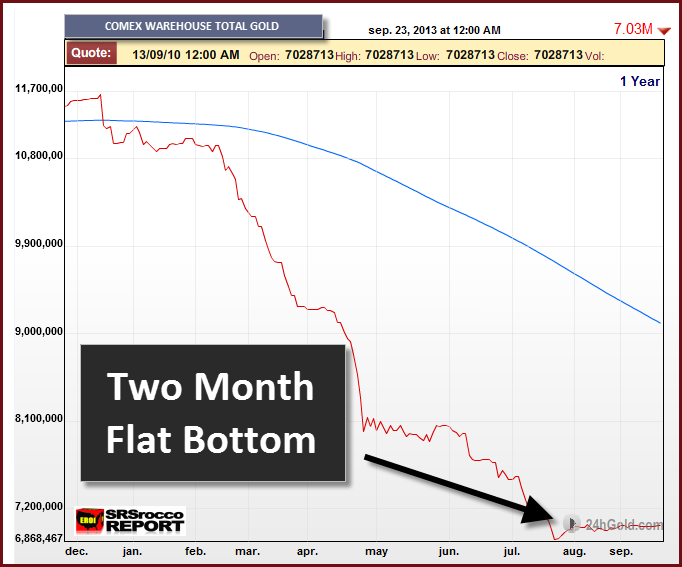

It looks like the stagnate two month bottom in the Comex Gold inventories is now over as a huge withdrawal from HSBC has taken the total warehouse stocks to a new low not seen since 2006.

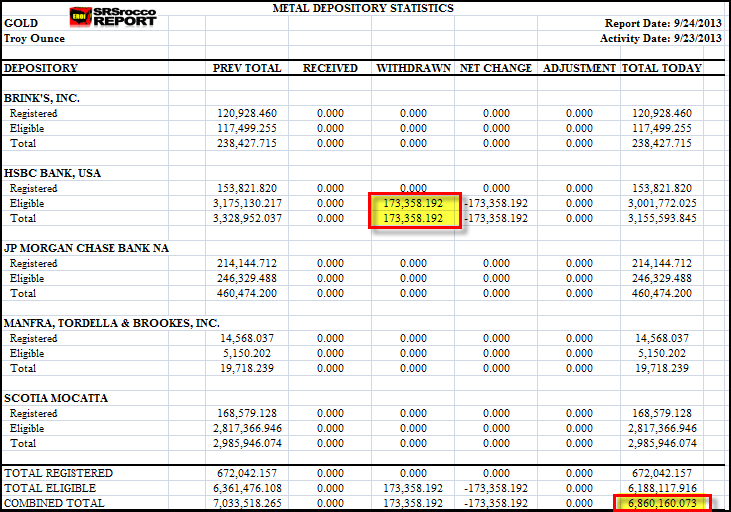

As you can see from the table, 173,358 oz of gold were withdrawn from HSBC’s Eligible category. While this withdrawal was only 5.5% of HSBC’s Eligible (Customer) inventory, it would have totally wiped out Brinks, HSBC, Scotia Mocatta, and most of JP Morgan’s Registered inventories.

This single withdrawal was more than what most of these individual banks held in their Registered Inventories. Furthermore, the 173,358 oz withdrawn from HSBC is 5.4 tonnes of gold… now more than likely gone forever from the Comex.

Not only does this large withdrawal from HSBC break the two month flat line bottom, but it also puts the Comex Gold Inventories at a NEW LOW not seen since 2006:

Here we can see in the one month chart below what a huge decline has taken place as it does not fit on the chart. This chart will not be updated until tomorrow, so I stretched the graph to include the new data point which is now at 6,860,160 oz.

Another surprising trend is taking place on the GLD inventories. Since the price of gold bottomed in the beginning of July, the level of gold at the GLD is 1,887,419 ounces less even though the price has rallied nearly 12%.

On July 1st, the gold inventory at the GLD stood at 31,131,769 oz while the price of gold bottomed at $1,180. Today, gold ended the day at $1,323, but the total gold inventory at the GLD is 29,244,351 oz. For some odd reason, the GLD is not adding gold as readily now that the price has increased compared to how it was drained as the price declined.

There seems to be an orchestrated effort by the Gold Cartel to convince investors not to purchase physical gold. As I mentioned in a previous article, the World Gold Council has announced the following:

(Kitco News) - Weak investor demand in gold markets remains a major concern as outflows continue to plague gold-backed exchange-traded funds.

However, the World Gold Council is trying to change investors’ perceptions of the yellow metal with the creation of a new program. On Thursday, the council announced the appointment of William Rhind as the managing director of its new Institutional Investment Program.

According to the WGC, Rhind will be “responsible for developing and implementing initiatives focused on expanding the use of SPDR Gold Shares (NYSE: GLD) and other physical gold-backed products.” GLD is the world’s biggest gold-backed ETF and since the start of the year has seen significant outflows as investors moved out of gold and into better performing equity markets.

Thus, the World Gold Council has appointed Rhind to be “Responsible for developing and implementing initiatives focused on expanding the use of the SPDR Gold Shares and other ETFS” to continue to bamboozle investors into buying worthless paper garbage gold products while making sure that MUMS the word for those who want to purchase physical metal.

There seems to be serious trouble ahead for the bullion banks as their registered inventories are at record lows. There is no way a withdrawal of this size today could have been met by the bullion banks registered gold inventories.

There will be new updates on the COMEX & Shanghai inventories at the

SRSrocco Report."