ZeroHedge presents Gold Miners Sector and Gold supply chain as we are searching for the answer: where the Gold will come from in the future? A lot of miners are at the break-even levels with this level of Gold price and are cutting back on new project development and exploration. Juniors are cut off from the capital markets and only the strongest will survive. With record amount of Gold flowing from West to the East and China now being the top consumer of Gold we have the almost perfect set up for the much higher Gold prices.

Junior miners with the best stories can represent the life time buying opportunity in these markets. Goldcorp hostile bid for Osisko is the very good indication of the major bottom in the market.

Among our "Golden Nuggets" McEwen Mining has received the last permit for its El Gallo 2 mine development in Mexico. Rob McEwen has addressed these developments recently, presenting his progress in Mexico, Argentina and Nevada. He has discussed at length the questions of resource nationalism and miss-guided "rear view mirror" mining sector policies around the world in his recent interview. Safe mining jurisdictions like Alaska in case with TNR Gold Shotgun deposit will gain the more attraction from the industry in the new cycle.

Junior miners with the best stories can represent the life time buying opportunity in these markets. Goldcorp hostile bid for Osisko is the very good indication of the major bottom in the market.

Among our "Golden Nuggets" McEwen Mining has received the last permit for its El Gallo 2 mine development in Mexico. Rob McEwen has addressed these developments recently, presenting his progress in Mexico, Argentina and Nevada. He has discussed at length the questions of resource nationalism and miss-guided "rear view mirror" mining sector policies around the world in his recent interview. Safe mining jurisdictions like Alaska in case with TNR Gold Shotgun deposit will gain the more attraction from the industry in the new cycle.

Rob McEwen On Goldcorp's Hostile Bid, M&A Opportunity And Market Bottoms MUX, TNR.v, GLD, GDX

"With general equity markets sliding into the territory which will challenge Bernanke's Happy Exit with Tapering, time is to listen to those who have seen and have done it. Rob McEwen is dissecting the recent market situation in Gold and M&A activity, which will make the best stories in the market to move very fast from the bottom. McEwen Mining has bottomed at $1.65 in December and has closed at $2.63 last Friday. Los Azules Copper project will be the one of the coming M&A stories this year, which will move valuations of McEwen Mining and TNR Gold. TNR Gold holds shares of McEwen Mining after the settlement on Los Azules. Rob McEwen has announced on Twitter about the commencement of drilling in Nevada now. With Gold crossing $1270 and closing just below it we have a very exciting time for the best stories in junior mining these days."

It is a cold one out in Nevada at the Grass Valley exploration project! View the photos here: https://www.facebook.com/media/set/?set=a.583538461730172.1073741855.144409045643118&type=1 …#MUX#Nevada#gold

TNR Gold Corp. Files Technical Report on Shotgun Gold Project, Alaska TNR.v

ZeroHedge:

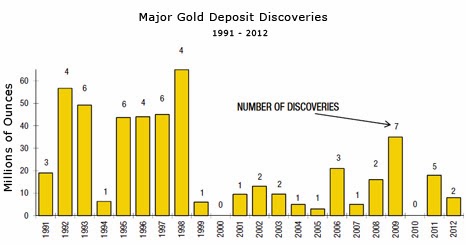

Infographic: Which Gold Miners Hold The Most Supply (And Who Must Replenish Through M&A)

The following infographic focuses on what is probably the key issue for current

state of the physical gold-strapped market: which gold miners hold the

most (physical, not paper) supply.

state of the physical gold-strapped market: which gold miners hold the

most (physical, not paper) supply.

Readers will note that a key tangent of the above infographic is the presentation of which miners need to add new reserves, or otherwise boost their asset base quickly, ostensibly through M&A - information that may be useful if and when the inevitable wave of consolidation in the miner space finally takes place. To provide a more in depth perspective on that issue, here is Jeff Desjardins from Visual Capitalist with additional insight.

Which Gold Miners Must Replenish Their Reserves Through M&A?

We often hear that large gold producers are usually not the best explorers. As such, when it comes time to replenish or grow their resource base, they must look to M&A.

With the recent offer from Goldcorp to buy Osisko for $2.6 billion, we wanted to do the math and see how much gold the majors and mid-tiers actually have in the ground. In addition, we wanted to find how much of it was in undeveloped projects vs. current producing mines.

Two months ago, using data from the 2013 Gold Deposit Rankings, we completed a rough approximation of total gold for each major. However, this time we took it a step further and conducted a much more rigorous analysis. We looked at each major and mid-tier in depth, took into account joint ventures, and calculated what percentage of their gold is in undeveloped projects. Presumably, it is the companies that have nothing in the pipeline that will want to acquire more gold assets. This is especially true, given that the target companies for potential takeover offers are trading at some of their lowest valuations in years.

Note: because the 2013 Gold Deposit Rankings only deals with gold deposits above 1 million oz and with certain cutoff specifications, we haven’t included small ones.

To start at a high level, here is the breakdown between how many mines are owned by big producers vs. junior miners.

Of the 2.02 billion oz Au that majors and mid-tiers have, it turns out 71.3% of projects in their portfolios are already in production.

This means that big producers have less than 30% of their total reserves and resources contained in undeveloped projects. On average, while each undeveloped project is slightly higher grade (1.27 g/t vs. 1.11 g/t), they contain less overall gold.

In fact, each average project in the pipeline has 38% less gold than those in production:

Projects in the pipeline are both fewer and smaller in size. However, what is really interesting is that we have not even yet looked at development hurdles such as permitting or jurisdiction risk. Take the Pebble Project – this is the biggest gold project in the world (even though it is primarily copper). It holds 107 million oz of gold, and it is currently stalled by the EPA.

Of the 76 projects in the pipeline for majors and mid-tiers, how many of them will never go into production? How many of them will run into significant development challenges like Barrick’s Pascua Lama project? The math says that majors and mid-tiers have less than 30% of their gold in undeveloped projects, but this number could be even less based on these considerations.

That all said, let’s look at what is available in the junior market – this is where majors and mid-tiers would go to fill their pipeline of projects:

There are many projects, but at a much lower grade and size. About 20% are in production and 80% are in development.

The question is now: which majors are going to be the most likely to acquire new projects? In this chart, I’ll show the resources and reserves for each company. For a more detailed chart, see the infographic done through Visual Capitalist.

Last, but not least, here are four other companies besides Goldcorp that we think may be looking to boost their asset base: Gold Fields, Newcrest, Newmont, and Kinross.

Newcrest (ASX: NCM)

- Cash: $69 million (June financials)

- Resources currently in production: 86%

- Resources in pipeline: 14%

- Avg. grade of pipeline: 0.86 g/t

Gold Fields (NYSE: GFI)

- Cash: $1.2 billion

- Resources in production: 89%

- Resources in pipeline: 11%

- Avg. grade of pipeline: 0.63 g/t

Newmont Mining (NYSE: NEM)

- Cash: $1.5 billion

- Resources in production: 78%

- Resources in pipeline: 22%

- Avg. grade of pipeline: 1.02 g/t

Kinross Gold (NYSE: KGC)

- Cash: $950 million

- Resources in production: 66%

- Resources in pipeline: 34%

- Avg. grade of pipeline: 1.12 g/t

Note: The recent writedown of the Tasiast project may make Kinross wary of M&A for the time being."

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.