TNR Gold Extends Mineralized Zones At Shotgun With 209 Metres Of 1.02 g/t Gold TNR.v

• Drill hole SR12-57 returns mineralized interval of 209 metres averaging 1.02 grams per tonne gold.• Included within this interval is 61.4m averaging 1.53 g/t Au.

• Combined with SR12-56 ( containing a 242m interval with 1.25 grams per tonne gold), the gold mineralization model at Shotgun Ridge is confirmed along strike and down dip

• Drill hole SR12-57 ended in mineralization at a down hole depth of 300 metres (approximately 150m below the topographic surface)."

TNR Gold Intersects 242 Metres of 1.25 g/t Gold on New Geophysical Target at Shotgun TNR.v

- Drill hole SR12-56 returns mineralized interval of 242.22 metres averaging 1.25 grams per tonne gold.

- Included within this interval is 114.22m averaging 1.84 g/t Au.

- Hole ended in mineralization at target depth of 293.22 metres.

- Mineralized zones are open at depth and coincident with geophysical anomalies found in 2011.

- Assays pending for two more holes."

TNR Gold Corp. - HALTED - At the Request of the Company Pending News TNR.v

"It is getting interesting, we have found two recent developments regarding TNR Gold:"

TNR Gold vs McEwen Mining Los Azules Litigation: Pretrial Motion - Notice of Application August 20 2012 TNR.v, MUX

"TNR Gold has published on its website the latest filing in Los Azules litigation vs Minera Andes (McEwen Mining) and MIM (Xstrata):"

TNR Gold Completes Drill Program, Confirms Mineralization Model & Expands Target Area At Alaska Shotgun Gold Project TNR.v

TNR Gold Rejects Third Party Proposal And Provides Los Azules Update TNR.v, MUX

"Kirill Klip, Chairman of TNR commented that: “Although the price being proposed for the Company was materially higher than TNR’s current trading price, in our view it fell far short of reflecting the value of the Company and, in particular, the value of the Company’s claims in the current Los Azules litigation with Minera Andes Inc.”

TNR Gold Confirms Down-Dip Mineralization At Shotgun Gold Property In Alaska

Concluding Drill Hole Returns 83 Metres of 0.82 Grams per Tonne Gold in Southwest Zone

Vancouver B.C.: TNR Gold Corp. (the “Company”) is pleased to announce assay results from the third and final hole of the 2012 drilling program on the Shotgun gold project in Alaska. Drill hole SR12-58 returned 83 metres averaging 0.82 grams per tonne gold across the full length of the southwest zone within the Shotgun Ridge porphyry system. These results include a higher-grade intercept of 2.03 grams per tonne gold over 18.35 metres at the top intrusive contact and an average grade of 1.14 grams per tonne gold over 46.55 metres within the southwest mineralized zone. Of particular significance is the consistent thickness and grade of the southwest zone encountered in all three of the 2012 drill holes. The northeast zone was not tested as the hole ended in disseminated gold mineralization at 221 metres. Elevated gold grades at the end of hole indicate proximity to the northeast zone, which is also open at depth.

• Drill hole SR12-58 returns mineralized interval of 83 metres averaging 0.82 grams per tonne gold.

• Included within this interval is 18.35m averaging 2.03 grams per tonne gold (“g/t Au”).

• Drill hole SR12-58 ended in mineralization at a down hole depth of 221 metres

• The gold mineralization at Shotgun Ridge remains open at depth

• Interpretation of new geophysical results opens up prospectivity of additional targets

2012 Drilling Results

Diamond drill hole SR12-58 was drilled from the same location as SR12-57 with a steeper dip angle. (Table 1 shows the collar locations and orientations of the 2012 drill holes). DDH SR12-58 was designed to test the down dip extent of mineralized zones intersected in previous drill holes. SR12-58 confirmed the mineralization encountered in the southwest zone in all three previous drill holes but did not reach the target depth of the anticipated northwest mineralized zone. The hole ended in mineralization at a depth of 220.98 metres.

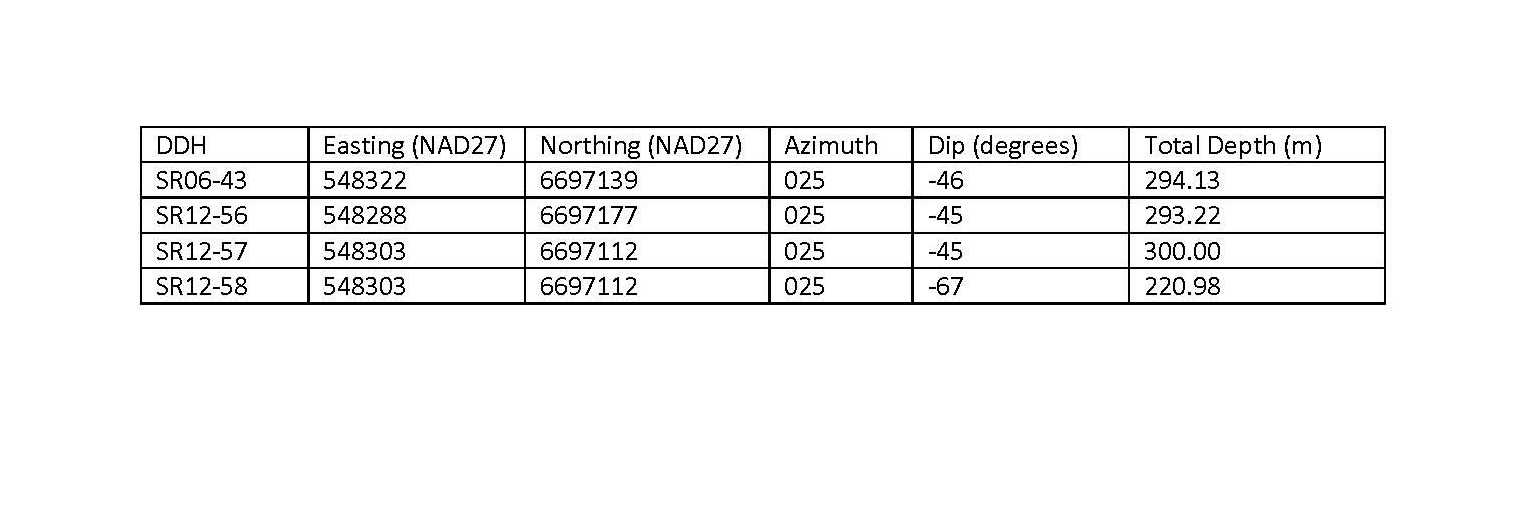

Table 1

The mineralization intersected in SR12-58 is similar to the southwest zone encountered in drill holes 06-43, 12-56 and 12-57. Each of these holes has a core-mineralized interval between 46 m and 57 m in length with average grades over one gram gold per tonne (Table 2). There is a correlation between resistivity and chargeability modelled data that suggests these mineralized zones in addition to continuing to greater depth and along strike, are also repeated in a faulting controlled pattern to the northwest and southeast of the mineralization currently defined at Shotgun Ridge.

The Company believes the style of mineralization and thicknesses encountered are significant and the deposit remains open to expansion at depth. Based on a clearly defined mineralization model, interpretation of 3D geophysics and the existence of elevated gold grades at the bottom of SR12-58, the depth extension of the northeast zone is now a high-priority drill target for future exploration programs.

A Model for Exploration and Discovery

Geophysical interpretation supports the idea that mineralization at Shotgun Ridge continues down dip and future exploration will focus on testing these targets. Ground based, 3D resistivity and IP surveys have demonstrated they are able to identify target areas, several of which have not yet been drill tested. Coupled with airborne magnetic surveys, the Company has identified a series of targets that repeat through structural displacement in much the same way as at Donlin Gold project (previously named Donlin Creek).

”The mineralization style observed at Shotgun Ridge bears a strong resemblance to the 40 million ounce deposit at the Donlin Gold project operated by Barrick and NovaGold,” stated recently appointed director Greg Johnson, “The similar age and host intrusive rocks suggest that, with continued exploration, there is significant potential to locate larger volumes of mineralization in and around Shotgun Ridge.”

“We are continuing to analyse data acquired in 2012, which in conjunction with historic data is contributing to refining an exploration strategy designed to maximize the chances for success in defining bulk-mineable gold deposits within the Shotgun project area.” comments John Harrop, VP Exploration.

Continued exploration at the Shotgun project will include regional reconnaissance efforts such as airborne magnetic and electromagnetic surveys that may help to identify other prospective areas and to provide a better understanding of targets in the Shot, King and Winchester areas where gold mineralization is already known to occur. Geochemical and geophysical surveys were highly effective during exploration phases at Donlin Gold and will be expanded at Shotgun in conjunction with additional structural mapping.

“Our first priority is to expand on the mineralization encountered at Shotgun Ridge targeting a multi-million ounce bulk mineable gold deposit. Newly defined geophysical and geochemical targets suggest the potential of identifying additional Donlin Gold style targets,” Gary Schellenberg, President and CEO.

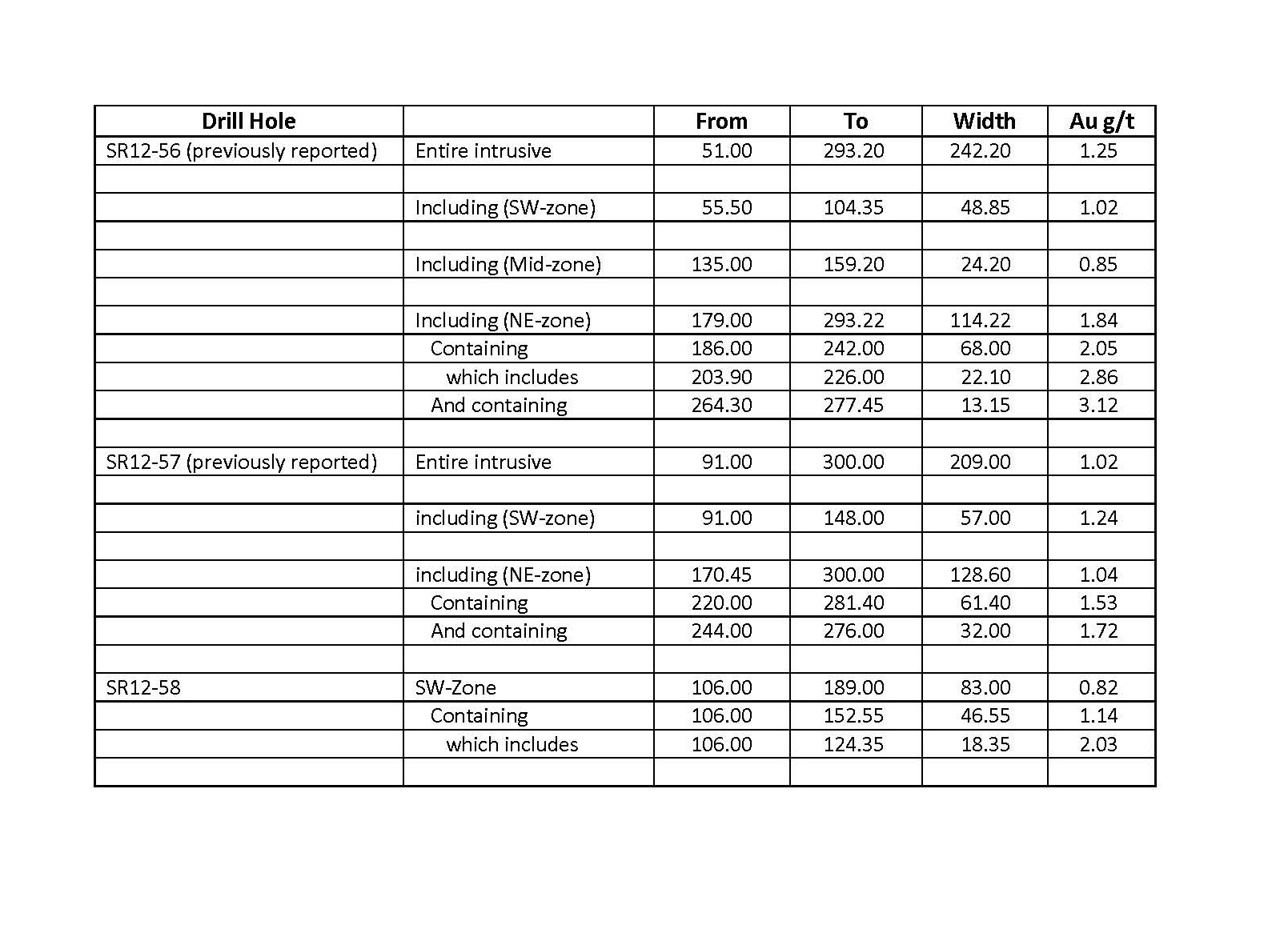

Table 2

Cross section and plan map images for the 2012 drilling are available on the Company’s website, http://www.tnrgoldcorp.com

About the Shotgun Gold Project

TNR holds a 100% interest in the Shotgun property located 175 kilometres south of The Donlin Gold deposit within the Kuskokwim Gold Belt in southwestern Alaska. This area is emerging as a world-class, multimillion ounce gold district. The Shotgun property includes a number of prospects, including Shotgun Ridge and nearby Winchester. Donlin Gold is an intrusion-associated system and represents one of the largest undeveloped gold deposits in the world. The Company believes that there are several key similarities between prospects on the Shotgun property and that of the Donlin Gold project deposit as well as other important intrusion-associated deposits.

Analytical work was conducted by Inspectorate (A Bureau Veritas Group Company) with prep work performed in their Fairbanks Alaska facility. Fire assay with ICP-ES finishing was conducted by Acme Analytical laboratories (A Bureau Veritas Group Company) in Vancouver, Canada. Samples with greater than 10 g/t Au were automatically reanalysed using fire assay with a gravimetric finish. Both of these laboratories are ISO 9000 certified and in addition Acme has ISO 17025 certification. TNR Gold inserts certified reference materials and blanks in a quality control procedure that follow industry current best practices.

John Harrop, PGeo, FGS, a Qualified Person for TNR Gold Corp. as defined by NI 43-101 has reviewed the technical information contained in this report.

About TNR Gold Corp.

Over the past twenty-one years TNR, through its lead generator business model, has been successful in generating high quality exploration projects around the globe. With the Company's expertise, resources and industry network, it is well positioned to aggressively identify, source, explore, partner and continue to expand its project portfolio.

TNR's subsidiary, International Lithium Corp. (TSX:ILC.V), demonstrated the successful application of TNR's business model in which TNR shareholders benefited from a unit distribution upon spin-out of TNR's lithium and rare metals projects. Gangeng Lithium Co. Ltd. Is a leading China based, multi-product lithium manufacturer, and strategic partner and investor in ILC. TNR remains a large shareholder in ILC at 25.5% of outstanding shares.

At its core, TNR provides significant exposure to gold and copper through its holdings in Alaska and Argentina; and teamed with the recent acquisitions of rare-earth elements and iron ore projects in Canada confirm TNR's commitment to continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the board,

Gary Schellenberg

President

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Statements in this press release other than purely historical information, historical estimates should not be relied upon, including statements relating to the Company’s future plans and objectives or expected results, are forward-looking statements. News release contains certain "Forward-Looking Statements" within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended. Forward-looking statements are based on numerous assumptions and are subject to all of the risks and uncertainties inherent in the Company’s business, including risks inherent in resource exploration and development. As a result, actual results may vary materially from those described in the forward-looking statements.

Symbol: TNR: TSXV

CUSIP: #87260X 109

SEC 12g3-2(b): Exemption #82-4434

620 - 650 West Georgia Street

Vancouver, British Columbia

V6B 4N9, Canada

Voice: (604) 687-7551

Fax: (604) 687-4670

1-800-667-4470

E-mail: info@tnrgoldcorp.com

Website: http://www.tnrgoldcorp.com

• Drill hole SR12-58 returns mineralized interval of 83 metres averaging 0.82 grams per tonne gold.

• Included within this interval is 18.35m averaging 2.03 grams per tonne gold (“g/t Au”).

• Drill hole SR12-58 ended in mineralization at a down hole depth of 221 metres

• The gold mineralization at Shotgun Ridge remains open at depth

• Interpretation of new geophysical results opens up prospectivity of additional targets

2012 Drilling Results

Diamond drill hole SR12-58 was drilled from the same location as SR12-57 with a steeper dip angle. (Table 1 shows the collar locations and orientations of the 2012 drill holes). DDH SR12-58 was designed to test the down dip extent of mineralized zones intersected in previous drill holes. SR12-58 confirmed the mineralization encountered in the southwest zone in all three previous drill holes but did not reach the target depth of the anticipated northwest mineralized zone. The hole ended in mineralization at a depth of 220.98 metres.

Table 1

The mineralization intersected in SR12-58 is similar to the southwest zone encountered in drill holes 06-43, 12-56 and 12-57. Each of these holes has a core-mineralized interval between 46 m and 57 m in length with average grades over one gram gold per tonne (Table 2). There is a correlation between resistivity and chargeability modelled data that suggests these mineralized zones in addition to continuing to greater depth and along strike, are also repeated in a faulting controlled pattern to the northwest and southeast of the mineralization currently defined at Shotgun Ridge.

The Company believes the style of mineralization and thicknesses encountered are significant and the deposit remains open to expansion at depth. Based on a clearly defined mineralization model, interpretation of 3D geophysics and the existence of elevated gold grades at the bottom of SR12-58, the depth extension of the northeast zone is now a high-priority drill target for future exploration programs.

A Model for Exploration and Discovery

Geophysical interpretation supports the idea that mineralization at Shotgun Ridge continues down dip and future exploration will focus on testing these targets. Ground based, 3D resistivity and IP surveys have demonstrated they are able to identify target areas, several of which have not yet been drill tested. Coupled with airborne magnetic surveys, the Company has identified a series of targets that repeat through structural displacement in much the same way as at Donlin Gold project (previously named Donlin Creek).

”The mineralization style observed at Shotgun Ridge bears a strong resemblance to the 40 million ounce deposit at the Donlin Gold project operated by Barrick and NovaGold,” stated recently appointed director Greg Johnson, “The similar age and host intrusive rocks suggest that, with continued exploration, there is significant potential to locate larger volumes of mineralization in and around Shotgun Ridge.”

“We are continuing to analyse data acquired in 2012, which in conjunction with historic data is contributing to refining an exploration strategy designed to maximize the chances for success in defining bulk-mineable gold deposits within the Shotgun project area.” comments John Harrop, VP Exploration.

Continued exploration at the Shotgun project will include regional reconnaissance efforts such as airborne magnetic and electromagnetic surveys that may help to identify other prospective areas and to provide a better understanding of targets in the Shot, King and Winchester areas where gold mineralization is already known to occur. Geochemical and geophysical surveys were highly effective during exploration phases at Donlin Gold and will be expanded at Shotgun in conjunction with additional structural mapping.

“Our first priority is to expand on the mineralization encountered at Shotgun Ridge targeting a multi-million ounce bulk mineable gold deposit. Newly defined geophysical and geochemical targets suggest the potential of identifying additional Donlin Gold style targets,” Gary Schellenberg, President and CEO.

Table 2

Cross section and plan map images for the 2012 drilling are available on the Company’s website, http://www.tnrgoldcorp.com

About the Shotgun Gold Project

TNR holds a 100% interest in the Shotgun property located 175 kilometres south of The Donlin Gold deposit within the Kuskokwim Gold Belt in southwestern Alaska. This area is emerging as a world-class, multimillion ounce gold district. The Shotgun property includes a number of prospects, including Shotgun Ridge and nearby Winchester. Donlin Gold is an intrusion-associated system and represents one of the largest undeveloped gold deposits in the world. The Company believes that there are several key similarities between prospects on the Shotgun property and that of the Donlin Gold project deposit as well as other important intrusion-associated deposits.

Analytical work was conducted by Inspectorate (A Bureau Veritas Group Company) with prep work performed in their Fairbanks Alaska facility. Fire assay with ICP-ES finishing was conducted by Acme Analytical laboratories (A Bureau Veritas Group Company) in Vancouver, Canada. Samples with greater than 10 g/t Au were automatically reanalysed using fire assay with a gravimetric finish. Both of these laboratories are ISO 9000 certified and in addition Acme has ISO 17025 certification. TNR Gold inserts certified reference materials and blanks in a quality control procedure that follow industry current best practices.

John Harrop, PGeo, FGS, a Qualified Person for TNR Gold Corp. as defined by NI 43-101 has reviewed the technical information contained in this report.

About TNR Gold Corp.

Over the past twenty-one years TNR, through its lead generator business model, has been successful in generating high quality exploration projects around the globe. With the Company's expertise, resources and industry network, it is well positioned to aggressively identify, source, explore, partner and continue to expand its project portfolio.

TNR's subsidiary, International Lithium Corp. (TSX:ILC.V), demonstrated the successful application of TNR's business model in which TNR shareholders benefited from a unit distribution upon spin-out of TNR's lithium and rare metals projects. Gangeng Lithium Co. Ltd. Is a leading China based, multi-product lithium manufacturer, and strategic partner and investor in ILC. TNR remains a large shareholder in ILC at 25.5% of outstanding shares.

At its core, TNR provides significant exposure to gold and copper through its holdings in Alaska and Argentina; and teamed with the recent acquisitions of rare-earth elements and iron ore projects in Canada confirm TNR's commitment to continued generation of in-demand projects, while diversifying its markets and building shareholder value.

On behalf of the board,

Gary Schellenberg

President

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Statements in this press release other than purely historical information, historical estimates should not be relied upon, including statements relating to the Company’s future plans and objectives or expected results, are forward-looking statements. News release contains certain "Forward-Looking Statements" within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended. Forward-looking statements are based on numerous assumptions and are subject to all of the risks and uncertainties inherent in the Company’s business, including risks inherent in resource exploration and development. As a result, actual results may vary materially from those described in the forward-looking statements.

Symbol: TNR: TSXV

CUSIP: #87260X 109

SEC 12g3-2(b): Exemption #82-4434

620 - 650 West Georgia Street

Vancouver, British Columbia

V6B 4N9, Canada

Voice: (604) 687-7551

Fax: (604) 687-4670

1-800-667-4470

E-mail: info@tnrgoldcorp.com

Website: http://www.tnrgoldcorp.com

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advise on this blog and there is no solicitation to buy or sell any particular company

No comments:

Post a Comment