Note: we are not sure that this particular Judge will be involved in this court hearing.

Disclaimer (loosely based on investment bankers' small print): please read our full disclaimer, nothing on this website or any links provided should be relied upon in any way and nobody will accept any responsibility in any case.

We have the very interesting development in litigation case for Los Azules: TNR Gold vs McEwen Mining and Xstrata. McEwen Mining was very modest in litigation risk assessment before, so you can imagine our surprise - and, must be, that other shareholders involved have the same feelings - by the recent statement:

The Los Azules copper project is subject to ongoing legal proceedings with the potential that we may lose all or part of our interest in the project.

Minera Andes is currently subject to ongoing litigation regarding the Los Azules Copper Project. TNR Gold Corp ("TNR Gold") and its subsidiary, Solitario Argentina S.A. ("Solitario" and together with TNR Gold, "TNR") claim that certain properties that comprise the LosAzules Copper Project were not validly transferred to Minera Andes and therefore should be returned to TNR. In the alternative, TNRclaims that even if Minera Andes validly owns the Los Azules Copper Project, TNR has a 25% back-in right to a substantial portion of theLos Azules project underlying known mineral resources that may be exercised to acquire a 25% interest in such part of the property. TNRhas also claimed damages. We estimate that the Los Azules Copper Project represents approximately 50% of the total assets acquired, not counting liabilities assumed, in the acquisition, based on our preliminary estimate of the fair value of all identifiable assets acquired and liabilities assumed.

Minera Andes has stated that it is not able to estimate the potential financial impact of this claim. If resolved adversely to Minera Andes, this litigation could materially adversely affect the value of Minera Andes by reducing or terminating its interest in a significant portion of the Los Azules Copper Project and its ability to develop the Los Azules Copper Project. Alternatively, Minera Andes could be subject to a significant damages award. Such a result would have a significant negative impact on the value of the combined company and could have a significant impact on our stock price. In addition, on a consolidated basis we will inherit the legal liabilities and costs associated with the litigation and the claims surrounding the Los Azules Copper Project, including the risk of loss of a significant portion of the Los Azules Copper Project. See Item 3. Legal Proceedings."

We knew that Northern Half of the Los Azules project is at stake in litigation now and TNR Gold claims that its former properties to be returned back to TNR Gold. This part can represent up to 2/3 of the Los Azules metal value - the high grade core appeared to be based on former TNR Gold properties. But now McEwen Mining is talking about the Risk to lose all Los Azules deposit?!

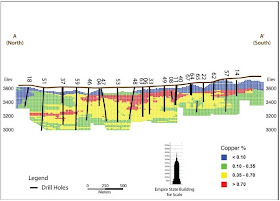

Latest TNR Gold presentation shows Los Azules maps and cross sections with the former TNR Gold properties claimed to be return to TNR Gold now.

You can find additional information on Los Azules litigation in McEwen Mining 10-K ITEM 3. Legal Proceedings.

This very fast developing story is too big to miss now and you can find a lot of information below. Please make you own DD and rely always only on official court documents and companies' filings.

Los Azules: Gold bug McEwen eyes big copper play - TNR Gold claims Northern Half of the project back

"Rob McEwen is back on the road and talking about one of the largest Copper deposits in the world at PDAC2012 in Toronto! We are exited as well and will help to fill the gaps in this story.

“It is an intriguing project to me because it is an order of magnitude bigger than anything that I have ever been involved with,’’ said McEwen.

Finally, after the Minera Andes takeover is completed by US Gold Rob McEwen is talking about the real potential of the "...world's sixth largest undeveloped copper deposit..." This year McEwen Mining will spent another 10 mln on exploration at Los Azules and we have all chances that the deposit will grow further.

This story is too big to miss now. Peter Kennedy reports from PDAC for Stockhouse and we will add some recent developments around this M&A special situation story 2012 in action - for your own Due Diligence. Litigation with TNR Gold has been highlighted again and you can find more information and links to the court documents below.

Update February 12th, 2012. CNNMoney:

$1.7M of MUX sold by Allen Ambrose

We guess, that at some stage Mr Allen Ambrose - former CEO of Minera Andes, will be questioned during the Los Azules litigation on what exactly were his intentions explained in his emails presented by TNR Gold litigation counsel in Amended Claim.

Allen Ambrose emails:

24. "Next we should look at our alternatives to take out the Solitario (TNR Gold - S) agreement..."

TNR Gold vs Minera Andes (McEwen Mining now) and MIM (Xstrata now).

From Page 11

Part 3: Legal Basis

http://bit.ly/xhdqag

24. "Next we should look at our alternatives to take out the Solitario (TNR Gold - S) agreement..."

TNR Gold vs Minera Andes (McEwen Mining now) and MIM (Xstrata now).

From Page 11

Part 3: Legal Basis

http://bit.ly/xhdqag

Now we have more information on Los Azules, McEwen mining and litigation with TNR Gold.

Reuters:

"McEwen Mining projects include the Gold Bar project in the U.S. state of Nevada, El Gallo in Mexico, both from the U.S. Gold stable. Its San Jose silver/gold mine and Los Azules copper property in Argentina are part of the Minera Andes portfolio.

McEwen said the company will either seek a partner for or sell Los Azules, one of the largest undeveloped copper properties in the world outside the control of a major miner. The project would cost about $3 billion to develop.

"We think there's room to expand the resource and then from there to talk to players that have more money and more skills than we have in-house, to develop a project of this size," said McEwen.

"Another option would be if someone comes along with an interesting bid that would more than address all of our financial requirements for development capital on our gold properties."

We hope that McEwen Mining has a clear understanding now that Los Azules property title must be cleared from any litigation suppressing its valuation before any transaction will be viable. Will the newly formed company decide to run the risk to lose in the court up to 2/3 of Los Azules deposit now? S&P 500 dreams and ongoing litigation are not the best friends. It is very interesting to see in the new McEwen Mining presentation that Los Azules is already described like it supposed to be and like it was before the latest TNR Gold claims and the "merger" idea: "Los Azules - Argentina One of the World's largest Undeveloped Copper Deposits". Further drilling to be started this month and will bring more value to the deposit - last drilling season 2011 Minera Andes was very modest and can not find the spectacular drilling results were "material enough to increase the resource base at the Los Azules"

Newly created McEwen Mining website states:

"A Preliminary Economic Assessment for the Los Azules project indicates a Net Present Value of $2.8 billion at a discount rate of 8%. At the base case copper price of $3.00/lb copper, the project has an Internal Rate of Return of 21.4% and a payback of about three years. The production rate is envisioned to be 100,000 tonnes per day with a life of mine average 169,000 tonnes per year of copper contained in a conventional flotation concentrate. The pre-production capital cost is estimated at $2.9 billion. Details may be found in the Updated Preliminary Assessment technical report dated December 16, 2010, can be downloaded here."...

After BMG merged with Newmont 2000, the BMG properties were acquired by Solitario Resources, a Canadian junior exploration company (now called TNR Resources), and an individual from San Juan named Hugo Bosque. MIM optioned the Solitario property in May 2004. Xstrata succeeded MIM, and in April 2007 it exercised its option to acquire Solitario’s concessions. In 2007, Minera Andes and Xstrata entered into an option agreement that consolidated Minera Andes’ and Xstrata’s properties. In October 2009, Xstrata declined to continue to participate in the project, and as a result Xstrata assigned its properties to McEwen Mining, and the company now owns 100 percent of the project. TNR, as successor to Solitario has lodged a legal action in the Superior Court of British Columbia claiming that it has the right to back-in to up to 25 percent of the Solitario concessions; however, McEwen Mining believes that TNR’s claim is without merit and is contesting TNR’s claim."

It totally forgets to mention about the Real Value at stake in this litigation (even after litigation discounts provided by Raymond James and RBC for Los Azules in justification of Minera Andes value) and latest TNR Gold claims - we are not sure how it works with listing in US and why shareholders have to look for the proper description and risks associated with this litigation in the small print in filing again, but about it below:

"January 11, 2012

TNR Gold Provides Update on Litigation with Minera Andes Over the Los Azules Project

We hope that McEwen Mining has a clear understanding now that Los Azules property title must be cleared from any litigation suppressing its valuation before any transaction will be viable. Will the newly formed company decide to run the risk to lose in the court up to 2/3 of Los Azules deposit now? S&P 500 dreams and ongoing litigation are not the best friends. It is very interesting to see in the new McEwen Mining presentation that Los Azules is already described like it supposed to be and like it was before the latest TNR Gold claims and the "merger" idea: "Los Azules - Argentina One of the World's largest Undeveloped Copper Deposits". Further drilling to be started this month and will bring more value to the deposit - last drilling season 2011 Minera Andes was very modest and can not find the spectacular drilling results were "material enough to increase the resource base at the Los Azules"

Newly created McEwen Mining website states:

"A Preliminary Economic Assessment for the Los Azules project indicates a Net Present Value of $2.8 billion at a discount rate of 8%. At the base case copper price of $3.00/lb copper, the project has an Internal Rate of Return of 21.4% and a payback of about three years. The production rate is envisioned to be 100,000 tonnes per day with a life of mine average 169,000 tonnes per year of copper contained in a conventional flotation concentrate. The pre-production capital cost is estimated at $2.9 billion. Details may be found in the Updated Preliminary Assessment technical report dated December 16, 2010, can be downloaded here."...

After BMG merged with Newmont 2000, the BMG properties were acquired by Solitario Resources, a Canadian junior exploration company (now called TNR Resources), and an individual from San Juan named Hugo Bosque. MIM optioned the Solitario property in May 2004. Xstrata succeeded MIM, and in April 2007 it exercised its option to acquire Solitario’s concessions. In 2007, Minera Andes and Xstrata entered into an option agreement that consolidated Minera Andes’ and Xstrata’s properties. In October 2009, Xstrata declined to continue to participate in the project, and as a result Xstrata assigned its properties to McEwen Mining, and the company now owns 100 percent of the project. TNR, as successor to Solitario has lodged a legal action in the Superior Court of British Columbia claiming that it has the right to back-in to up to 25 percent of the Solitario concessions; however, McEwen Mining believes that TNR’s claim is without merit and is contesting TNR’s claim."

It totally forgets to mention about the Real Value at stake in this litigation (even after litigation discounts provided by Raymond James and RBC for Los Azules in justification of Minera Andes value) and latest TNR Gold claims - we are not sure how it works with listing in US and why shareholders have to look for the proper description and risks associated with this litigation in the small print in filing again, but about it below:

"January 11, 2012

TNR Gold Provides Update on Litigation with Minera Andes Over the Los Azules Project

Background to the Los Azules Litigation

The Los Azules dispute involves certain properties constituting the northern half of the project (the "Solitario Properties") which are subject to an option agreement (the "Solitario Option") between Solitario and Xstrata Copper, a predecessor in title to Minera Andes. The Company disputes that Xstrata's expenditure obligations under the option were properly met and asserts that the option was not properly exercised. On that basis, the Company and Solitario are asking the Court to convey 100% of the Solitario Properties to the Company or to award the Company damages equivalent to the value of the Solitario Properties.

The Company is also seeking rectification and recognition of its right under the Solitario Option to 'back in' to 25% of the equity of the Solitario Properties; together with a declaration that a disputed property adjacent to the Solitario Properties and known as Escorpio IV was not subject to the Solitario Option and that the Company has retained ownership of this property."

Update January 20th 2012:

In order to have one of the the "largest litigation cases in the history of BC Supreme Court" you need one of the largest Copper deposits in the world, very big ambitions and bunch of emails describing the way of thinking how to get it all and "take out of the game" the junior partner. Now US Gold shareholders will join the litigation lawyers' party after the merger with Minera Andes. We continue to monitor the situation and implications for the newly listed in the US McEwen Mining.

After the completed take over of Minera Andes by US Gold, McEwen Mining will become the party of litigation. Damage control at the expense of Minera Andes shareholders will give some room now to McEwen Mining - combined company can better withstand the litigation risk of potential lost of up to 2/3 of Los Azules deposit, which high grade core is located on former TNR Gold properties, according to the published by Minera Andes maps. TNR Gold's offer for the settlement is off the table now and the key to ongoing litigation will be further discoveries and called witnesses in preparation to the trial. Things will be getting very interesting now. One of the questions to discover is why Xstrata has decided not to exercise its own option for 51% of Los Azules with Minera Andes?

"We must admit, that all this time we were at lost why has Xstrata decided not to exercise its own option with Minera Andes for 51% of all Los Azules in October 2009? Why has the Copper company like Xstrata decided just to walk away from such a deposit like Los Azules, when copper market was turning up with the recovering economy? Does Rob McEwen really think that he outsmarted Xstrata for the free gift here? Now we have some indications that, maybe, TNR Gold litigation team has found the real reasons behind Xstrata's move out of the project."

We have an interesting take from Joel Chury at VantageWire.com on Los Azules litigation. The story is making its way into the mainstream media now, we have been covering it here for years and hope that this year will bring the resolution to this case, which is simply too big to miss now.

TNR Gold Offers To Settle Los Azules Litigation With Minera Andes For Us$125 Million

Mineweb:

"...But, according to court documents, TNR Gold now alleges Minera Andes and Xstrata failed to meet those expenditures as they rushed to hit the $1 million mark so they could as quickly as possible "take-out" TNR Gold's 25-percent back-in right on the property...

Moreover, TNR Gold charged, Xstrata never intended to produce a feasibility study. To that alleged end, in its application to advance its new claim TNR Gold quoted an email apparently sent between two Xstrata employees at the time. According to TNR Gold it read, "Yes, taking Solitario (TNR Gold subsidiary) out of the game is a good idea. All we have to do now is not complete a feasibility study within the next three years!.."

Mineweb has made a very good summary of the case and different views of the parties involved and it will be a good idea to read the full article.

Emails mentioned above are particularly entertaining and can be found in the document below:

Can we say that George Macintosh, QC has started his 2012 "exploration" season with this move? First, we have to congratulate him with making Best Lawyers in Canada 2012 and Lawyer of the Year 2012. We are not sure why he is in charge in this particular case and leading TNR Gold litigation team, but things are getting interesting by the day and now we have, quite surprising for many shareholders, the number on the TNR Gold's claims, which must be still discounted for the potential early settlement. Idea of the settlement was rejected after "careful consideration" within 48 hours by Minera Andes and they insist with US Gold that:

"The Board of Directors of US Gold, including the Special Committee of independent directors formed to evaluate the transaction with Minera Andes, remains of the view that the proposed business combination with Minera Andes on the terms of the arrangement agreement dated September 22, 2011 is fair to shareholders and in the best interests of US Gold and its shareholders and recommends that shareholders vote in favour of this transaction at the special meeting to be held on January 19, 2012."

Public offer of TNR Gold is valid until January 18th, 2012 but it looks like there is no interest even to discuss it with parties involved and decisions were made very quickly. We just hope, for the sake of shareholders, that legal documents in this case are getting more proper attention and time allocated.

We can understand Mr McEwen - he is the largest shareholder of both companies and knows them very well. He knows where the value is and how to buy it in a best way for all parties involved...from both sides. We even join him in his worries on BNN another daythat nobody really reads all those 500 pages of Merger Info Circulars these days. Everything should be fine - people managing other people's money do not have time as well to read everything.

What will happen if somebody is still reading and even has invested in a calculator? These ideas will be a pure speculation from our side and we urge you to base all your decisions only on official documents (even better if they are from BC Supreme Court) and after consulting your certified and trusted financial adviser."

Update 01/18/2012:

Minera Andes Announces Fourth Quarter and Full Year 2011 San Jose Mine Production |

-- Drilling at the Los Azules Copper Project is expected to resume by the end of January. A total of 8,000 meters has been planned in order totest the potential to increase the size of the resource."

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advise on this blog and there is no solicitation to buy or sell any particular company here. Always consult with your qualified financial adviser before making any investment decisions.

According to published by Minera Andes maps, high grade core of Los Azules deposit is located on former TNR Gold properties.

The Battle of Los Azules: TNR Gold vs Minera Andes in Copper Showdown

StockHouse:

Stockhouse Movers & Shakers: Gold bug McEwen eyes big copper play

Peter Kennedy

One of Canada’s best known gold bugs is looking at ways to develop a project in Argentina that is thought to host the world’s sixth largest undeveloped copper resource.

Predicting that the price of silver could go to US$200 an ounce, Robert McEwen’s new company McEwen Mining Inc. (TSX: T.MUX, Stock Forum) (NYSE: MUX, Stock Forum) is developing a portfolio of precious metals projects in the United States, Mexico and Argentina.

But the Toronto-based gold bug says revenue from all of those projects could eventually be dwarfed by copper output from the potentially large Los Azules project in northern Argentina.

"It’s the wild card, I’ll call it,’’ McEwen said during a speech to the Prospectors and Developers Association of Canada convention in Vancouver Tuesday.

He said Los Azules could cost as much as $2.6 billion to put into production and has the potential to produce at a rate of 100,000 tonnes per day, churning out half a billion pounds of copper in the first five years of a projected 25-year mine life.

“It is an intriguing project to me because it is an order of magnitude bigger than anything that I have ever been involved with,’’ said McEwen.

Bringing Los Azules on stream would be a departure for the Goldcorp Inc. (TSX: T.G, Stock Forum) (NYSE: GG, Stock Forum) founder, who is so certain about the price of gold that he holds over $100 million worth of bullion in his personal account.

He predicted yesterday that silver would soon hit $200 an ounce.

However, McEwen said initial production at Los Azules is still at least six years away. He also indicated that there is a lot of work to be done before the company decides to proceed with such a large scale mine.

“At the moment we are looking at various alternatives, including what financing is available, who might be the best joint venture partner, and who we might sell to,’’ he said. Any development may also be subject to the resolution of litigation, launched by TNR Gold Corp. (TSX: V.TNR, Stock Forum), which is seeking the return of part of the property.

Current development plans envisage producing copper in concentrates and transporting that material via a pipeline to the coast through Chile. McEwen said the company is looking at various cost-saving alternatives, including copper cathode instead of in concentrates.

Meanwhile, as it trades at $4.80 this week, McEwen Mining currently has a market cap of $658 million, based on 137 million shares outstanding. The 52-week range for the stock is $9.44 and $3.05.

The product of the recent merger of U.S. Gold Corp., and Minera Andes Inc.,it will be a precious metals play for the forseeable future, one that is aiming for a listing on the S&P 500, McEwen said.

McEwen Mining’s asset portfolio includes the 49%-owned San Jose silver mine in Argentina, which is expected to produce 5.9 million ounces silver and 81,000 ounces of gold this year. This year, McEwen said $40 million will be spent on exploration, with $12 million earmarked for San Jose, $10 million for Los Azules, and $8 million for the El Gallo project in Mexico. The balance is designated for projects in Nevada and Alaska.

Within the next three years, the company hopes to raise its silver production to 7.8 million ounces, from 2.8 million ounces. Within the same time frame, it also plans to raise its gold production to 130,000 ounces from 50,000 ounces this year.

McEwen currently owns 25% of the outstanding shares of McEwen Mining and takes no salary. “I am going to make money the same way as my shareholders, through a higher share price,’’ he said.

No comments:

Post a Comment