Note: we are not sure that this particular Judge will be involved in this court hearing.

Disclaimer (loosely based on investment bankers' small print): please read our full disclaimer, nothing on this website or any links provided should be relied upon in any way and nobody will accept any responsibility in any case.

Update February 12th, 2012. CNNMoney:

Allen Ambrose emails:

24. "Next we should look at our alternatives to take out the Solitario (TNR Gold - S) agreement..."

TNR Gold vs Minera Andes (McEwen Mining now) and MIM (Xstrata now).

From Page 11

Part 3: Legal Basis

http://bit.ly/xhdqag

Now we have more information on Los Azules, McEwen mining and litigation with TNR Gold.

Disclaimer (loosely based on investment bankers' small print): please read our full disclaimer, nothing on this website or any links provided should be relied upon in any way and nobody will accept any responsibility in any case.

Update February 12th, 2012. CNNMoney:

$1.7M of MUX sold by Allen Ambrose

We guess, that at some stage Mr Allen Ambrose - former CEO of Minera Andes, will be questioned during the Los Azules litigation on what exactly were his intentions explained in his emails presented by TNR Gold litigation counsel in Amended Claim.

24. "Next we should look at our alternatives to take out the Solitario (TNR Gold - S) agreement..."

TNR Gold vs Minera Andes (McEwen Mining now) and MIM (Xstrata now).

From Page 11

Part 3: Legal Basis

http://bit.ly/xhdqag

Now we have more information on Los Azules, McEwen mining and litigation with TNR Gold.

Reuters:

"McEwen Mining projects include the Gold Bar project in the U.S. state of Nevada, El Gallo in Mexico, both from the U.S. Gold stable. Its San Jose silver/gold mine and Los Azules copper property in Argentina are part of the Minera Andes portfolio.

McEwen said the company will either seek a partner for or sell Los Azules, one of the largest undeveloped copper properties in the world outside the control of a major miner. The project would cost about $3 billion to develop.

"We think there's room to expand the resource and then from there to talk to players that have more money and more skills than we have in-house, to develop a project of this size," said McEwen.

"Another option would be if someone comes along with an interesting bid that would more than address all of our financial requirements for development capital on our gold properties."

We hope that McEwen Mining has a clear understanding now that Los Azules property title must be cleared from any litigation suppressing its valuation before any transaction will be viable. Will the newly formed company decide to run the risk to lose in the court up to 2/3 of Los Azules deposit now? S&P 500 dreams and ongoing litigation are not the best friends. It is very interesting to see in the new McEwen Mining presentation that Los Azules is already discribed like it supposed to be and like it was before the latest TNR Gold claims and the "merger" idea: "Los Azules - Argentina One of the World's largest Undeveloped Copper Deposits". Further drilling to be started this month and will bring more value to the deposit - last drilling season 2011 Minera Andes was very modest and can not find the spectacular drilling results were "material enough to increase the resource base at the Los Azules"

Newly created McEwen Mining website states:

"A Preliminary Economic Assessment for the Los Azules project indicates a Net Present Value of $2.8 billion at a discount rate of 8%. At the base case copper price of $3.00/lb copper, the project has an Internal Rate of Return of 21.4% and a payback of about three years. The production rate is envisioned to be 100,000 tonnes per day with a life of mine average 169,000 tonnes per year of copper contained in a conventional flotation concentrate. The pre-production capital cost is estimated at $2.9 billion. Details may be found in the Updated Preliminary Assessment technical report dated December 16, 2010, can be downloaded here."...

After BMG merged with Newmont 2000, the BMG properties were acquired by Solitario Resources, a Canadian junior exploration company (now called TNR Resources), and an individual from San Juan named Hugo Bosque. MIM optioned the Solitario property in May 2004. Xstrata succeeded MIM, and in April 2007 it exercised its option to acquire Solitario’s concessions. In 2007, Minera Andes and Xstrata entered into an option agreement that consolidated Minera Andes’ and Xstrata’s properties. In October 2009, Xstrata declined to continue to participate in the project, and as a result Xstrata assigned its properties to McEwen Mining, and the company now owns 100 percent of the project. TNR, as successor to Solitario has lodged a legal action in the Superior Court of British Columbia claiming that it has the right to back-in to up to 25 percent of the Solitario concessions; however, McEwen Mining believes that TNR’s claim is without merit and is contesting TNR’s claim."

It totally forgets to mention about the Real Value at stake in this litigation (even after litigation discounts provided by Raymond James and RBC for Los Azules in justification of Minera Andes value) and latest TNR Gold claims - we are not sure how it works with listing in US and why shareholders have to look for the proper description and risks associated with this litigation in the small print in filing again, but about it below:

"January 11, 2012

TNR Gold Provides Update on Litigation with Minera Andes Over the Los Azules Project

We hope that McEwen Mining has a clear understanding now that Los Azules property title must be cleared from any litigation suppressing its valuation before any transaction will be viable. Will the newly formed company decide to run the risk to lose in the court up to 2/3 of Los Azules deposit now? S&P 500 dreams and ongoing litigation are not the best friends. It is very interesting to see in the new McEwen Mining presentation that Los Azules is already discribed like it supposed to be and like it was before the latest TNR Gold claims and the "merger" idea: "Los Azules - Argentina One of the World's largest Undeveloped Copper Deposits". Further drilling to be started this month and will bring more value to the deposit - last drilling season 2011 Minera Andes was very modest and can not find the spectacular drilling results were "material enough to increase the resource base at the Los Azules"

Newly created McEwen Mining website states:

"A Preliminary Economic Assessment for the Los Azules project indicates a Net Present Value of $2.8 billion at a discount rate of 8%. At the base case copper price of $3.00/lb copper, the project has an Internal Rate of Return of 21.4% and a payback of about three years. The production rate is envisioned to be 100,000 tonnes per day with a life of mine average 169,000 tonnes per year of copper contained in a conventional flotation concentrate. The pre-production capital cost is estimated at $2.9 billion. Details may be found in the Updated Preliminary Assessment technical report dated December 16, 2010, can be downloaded here."...

After BMG merged with Newmont 2000, the BMG properties were acquired by Solitario Resources, a Canadian junior exploration company (now called TNR Resources), and an individual from San Juan named Hugo Bosque. MIM optioned the Solitario property in May 2004. Xstrata succeeded MIM, and in April 2007 it exercised its option to acquire Solitario’s concessions. In 2007, Minera Andes and Xstrata entered into an option agreement that consolidated Minera Andes’ and Xstrata’s properties. In October 2009, Xstrata declined to continue to participate in the project, and as a result Xstrata assigned its properties to McEwen Mining, and the company now owns 100 percent of the project. TNR, as successor to Solitario has lodged a legal action in the Superior Court of British Columbia claiming that it has the right to back-in to up to 25 percent of the Solitario concessions; however, McEwen Mining believes that TNR’s claim is without merit and is contesting TNR’s claim."

It totally forgets to mention about the Real Value at stake in this litigation (even after litigation discounts provided by Raymond James and RBC for Los Azules in justification of Minera Andes value) and latest TNR Gold claims - we are not sure how it works with listing in US and why shareholders have to look for the proper description and risks associated with this litigation in the small print in filing again, but about it below:

"January 11, 2012

TNR Gold Provides Update on Litigation with Minera Andes Over the Los Azules Project

Background to the Los Azules Litigation

The Los Azules dispute involves certain properties constituting the northern half of the project (the "Solitario Properties") which are subject to an option agreement (the "Solitario Option") between Solitario and Xstrata Copper, a predecessor in title to Minera Andes. The Company disputes that Xstrata's expenditure obligations under the option were properly met and asserts that the option was not properly exercised. On that basis, the Company and Solitario are asking the Court to convey 100% of the Solitario Properties to the Company or to award the Company damages equivalent to the value of the Solitario Properties.

The Company is also seeking rectification and recognition of its right under the Solitario Option to 'back in' to 25% of the equity of the Solitario Properties; together with a declaration that a disputed property adjacent to the Solitario Properties and known as Escorpio IV was not subject to the Solitario Option and that the Company has retained ownership of this property."

Update January 20th 2012:

In order to have one of the the "largest litigation cases in the history of BC Supreme Court" you need one of the largest Copper deposits in the world, very big ambitions and bunch of emails describing the way of thinking how to get it all and "take out of the game" the junior partner. Now US Gold shareholders will join the litigation lawyers' party after the merger with Minera Andes. We continue to monitor the situation and implications for the newly listed in the US McEwen Mining.

After the completed take over of Minera Andes by US Gold, McEwen Mining will become the party of litigation. Damage control at the expense of Minera Andes shareholders will give some room now to McEwen Mining - combined company can better withstand the litigation risk of potential lost of up to 2/3 of Los Azules deposit, which high grade core is located on former TNR Gold properties, according to the published by Minera Andes maps. TNR Gold's offer for the settlement is off the table now and the key to ongoing litigation will be further discoveries and called witnesses in preparation to the trial. Things will be getting very interesting now. One of the questions to discover is why Xstrata has decided not to exercise its own option for 51% of Los Azules with Minera Andes?

"We must admit, that all this time we were at lost why has Xstrata decided not to exercise its own option with Minera Andes for 51% of all Los Azules in October 2009? Why has the Copper company like Xstrata decided just to walk away from such a deposit like Los Azules, when copper market was turning up with the recovering economy? Does Rob McEwen really think that he outsmarted Xstrata for the free gift here? Now we have some indications that, maybe, TNR Gold litigation team has found the real reasons behind Xstrata's move out of the project."

We have an interesting take from Joel Chury at VantageWire.com on Los Azules litigation. The story is making its way into the mainstream media now, we have been covering it here for years and hope that this year will bring the resolution to this case, which is simply too big to miss now.

TNR Gold Offers To Settle Los Azules Litigation With Minera Andes For Us$125 Million

Mineweb:

"...But, according to court documents, TNR Gold now alleges Minera Andes and Xstrata failed to meet those expenditures as they rushed to hit the $1 million mark so they could as quickly as possible "take-out" TNR Gold's 25-percent back-in right on the property...

Moreover, TNR Gold charged, Xstrata never intended to produce a feasibility study. To that alleged end, in its application to advance its new claim TNR Gold quoted an email apparently sent between two Xstrata employees at the time. According to TNR Gold it read, "Yes, taking Solitario (TNR Gold subsidiary) out of the game is a good idea. All we have to do now is not complete a feasibility study within the next three years!.."

Mineweb has made a very good summary of the case and different views of the parties involved and it will be a good idea to read the full article.

Emails mentioned above are particularly entertaining and can be found in the document below:

Can we say that George Macintosh, QC has started his 2012 "exploration" season with this move? First, we have to congratulate him with making Best Lawyers in Canada 2012 and Lawyer of the Year 2012. We are not sure why he is in charge in this particular case and leading TNR Gold litigation team, but things are getting interesting by the day and now we have, quite surprising for many shareholders, the number on the TNR Gold's claims, which must be still discounted for the potential early settlement. Idea of the settlement was rejected after "careful consideration" within 48 hours by Minera Andes and they insist with US Gold that:

"The Board of Directors of US Gold, including the Special Committee of independent directors formed to evaluate the transaction with Minera Andes, remains of the view that the proposed business combination with Minera Andes on the terms of the arrangement agreement dated September 22, 2011 is fair to shareholders and in the best interests of US Gold and its shareholders and recommends that shareholders vote in favour of this transaction at the special meeting to be held on January 19, 2012."

Public offer of TNR Gold is valid until January 18th, 2012 but it looks like there is no interest even to discuss it with parties involved and decisions were made very quickly. We just hope, for the sake of shareholders, that legal documents in this case are getting more proper attention and time allocated.

We can understand Mr McEwen - he is the largest shareholder of both companies and knows them very well. He knows where the value is and how to buy it in a best way for all parties involved...from both sides. We even join him in his worries on BNN another daythat nobody really reads all those 500 pages of Merger Info Circulars these days. Everything should be fine - people managing other people's money do not have time as well to read everything.

What will happen if somebody is still reading and even has invested in a calculator? These ideas will be a pure speculation from our side and we urge you to base all your decisions only on official documents (even better if they are from BC Supreme Court) and after consulting your certified and trusted financial adviser."

Update 01/18/2012:

Minera Andes Announces Fourth Quarter and Full Year 2011 San Jose Mine Production |

-- Drilling at the Los Azules Copper Project is expected to resume by the end of January. A total of 8,000 meters has been planned in order totest the potential to increase the size of the resource."

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advise on this blog and there is no solicitation to buy or sell any particular company here. Always consult with your qualified financial adviser before making any investment decisions.

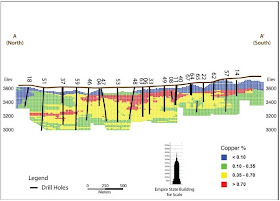

According to published by Minera Andes maps, high grade core of Los Azules deposit is located on former TNR Gold properties.

The Battle of Los Azules: TNR Gold vs Minera Andes in Copper Showdown

January 16, 2012 at 11:25:30 EST by G. Joel Chury

Last week witnessed a tit-for-tat press release exchange between $11M market cap TNR Gold [TNR – TSX.V] and $549M market cap Minera Andes [MAI – TSX] over a hotly contested Argentinian copper property known as the Los Azules. Projected to produce upwards of 375 million pounds of copper annually, it’s no wonder that each party is fighting tooth and nail to retain as much interest in the project as possible for their shareholders.

If not settled before the clash lands each party in the Supreme Court of British Columbia come November, a multitude of scenarios could unfold. If Minera Andes and its leader Rob McEwen (CEO of both Minera Andes and US Gold) get their way, the court would dismiss TNR’s claims and the project would move on unfettered. But, through the claims levied by TNR, the court could also dish out one of two outcomes that would be in TNR’s favour.

The initial claim would potentially award TNR its claimed right to “back in” a 25% interest of the proposed mine site, which in total holds indicated resources of some 2.2 billion pounds of copper. But even more gasp-worthy would be the scenario for which could flip 100% ownership back to the company on a critical technicality.

Some background explanation at this point is important, and the details from both sides remain dicey at best. To start, the property began in TNR’s hand, as an option agreement was arranged with Xstrata Copper in 2007. Under the terms of the deal, Xstrata could acquire 100% interest in the property by meeting a $1 million exploration expenditure requirement.

In early September, 2007, TNR Gold originally signed off on the option agreement, stating in a press release, “All cash payments due by May 15, 2008 have now been received. All exploration expenditures have also been incurred."

However, according to court documents, TNR Gold alleges Xstrata and subsequently Minera Andes (which later acquired the rights from Xstrata) failed to actually meet the expenditure requirements, through an alleged rush to hit the $1 million mark in order to “take-out” TNR Gold's 25-percent back-in right on the property as quickly as possible.

TNR’s claim is that it was essentially duped into signing off on a back-in right with an expiry. In the final draft of the option agreement stipulated TNR Gold could acquire a 25% stake over a 120-day period if Xstrata (or later Minera Andes) completed a feasibility study within 36 months of exercising the TNR Gold-Los Azules option.

The dispute heats up around the time-limit clause, which TNR Gold states publicly never was discussed with Xstrata, and that initial drafts of the option didn’t include. The allegation is that the time limit was added after initial discussions on the option agreement were concluded, and that were unnoticed for years after they were added.

It is of TNR’s opinion that Xstrata never intended to produce a feasibility study to begin with. Brought forward in the claims is a quote from an email between two Xstrata employees at the time which TNR Gold claims read, "Yes, taking Solitario (TNR Gold subsidiary) out of the game is a good idea. All we have to do now is not complete a feasibility study within the next three years!"

That said, 36 months passed without a feasibility study, and in early 2010 TNR Gold passed along to Minera Andes that it wanted to exercise its back-in right by waiving the feasibility requirement. This marks the beginning of the disagreements between the parties, as Minera Andes disagreed with TNR Gold's claim.

Minera Andes’ claim was that TNR’s back in right was dependent upon the production of a feasibility study, which was never produced, and publicly declared so on April 1, 2010. The company added, "Further, Minera Andes disputes the legal ability to waive this condition."

This is the position that Minera Andes is taking, asking the court to see its side that any back-in notice from TNR prior to or on April 23, 2010 be null, void and of no force and effect. The point from Minera Andes’ side is that a feasibility study must’ve been completed on the project prior to TNR being entitled to exercise its back-in right.

Enter TNR’s second mode of attack. According to TNR, they claim that Xstrata and Minera Andes inflated their exploration expenditures by including 250 metres of 1,574.15 metres of drilling outside of the claims in question into the $1 million expenditure requirement. If true, TNR’s point is that Xstrata didn’t actually meet the conditions necessary for exercising the option, and thus were in breach of their agreement. Thus the latest court claim that TNR has requested asks in return the northern (most valuable) Los Azules properties or equivalent damage; A bold move on behalf of TNR, which undoubtedly upset Minera Andes.

In turn, Minera Andes and its leader McEwen outwardly rejected the insufficient expenditures claim, labeling TNR’s arguments as “creative” and “strange.” To be fair to Minera Andes, an official TNR press release did indeed claim to have signed off on the expenditures.

For its part Minera Andes categorically rejected the new claim it had made insufficient exploration expenditures at Los Azules in a press release responding to the new allegation. And on Friday Minera Andes' McEwen called all of TNR Gold's court arguments "creative" and referred to the most recent concerning exploration spending as strange.

Which brings us up to last week’s exchanges between the parties. On Wednesday, TNR put out a press release pointing out that the impending merger of Minera Andes with US Gold will not effect TNR’s resolve with the litigation. A Notary Public has been engaged, accompanied by Argentinean mining police, to conduct a physical site verification of the Escorpio IV mining property as to whether or not Minera Andes trespassed on the claims.

Meanwhile, while the party was marching towards the property for investigation, TNR reiterated an offer made on January 10, 2012 for a settlement amount of US$125 million to drop the lawsuit. The conditions of the settlement were amended to extend an acceptance period for the offer to this Wednesday, January 18, 2012.

Kirill Klip, Chairman of TNR stated: "We strongly believe that our settlement offer is in the best interests of the shareholders of TNR, Minera Andes and US Gold. The Los Azules project is considered to represent one of the largest undeveloped copper projects in the world but the current legal uncertainty over its legal ownership is detracting from the value of the project for shareholders of all three companies."

The response from Minera Andes did not indicate that the settlement would be accepted. After consideration, Minera Andes responded on Friday, stating:

“After due consideration and having received the input of the Special Committee, the Board of Directors of Minera Andes resolved unanimously to reject the offer from TNR Gold as unreasonable. Minera Andes continues to reject TNR Gold's claims and intends to continue to vigorously defend against those claims and looks forward to resolving this matter in the courts of British Columbia.”

So, as the clock ticks down towards the Wednesday deadline, it appears that this ongoing legal battle will see its day in court. Set for November, the details on the claims are getting more interesting in the lead up, with much to gain and/or lose by both parties. Should Minera Andes win its side of the argument, the Los Azules will move on into the highly valuable production it is set to provide.

In turn, should TNR receive a favourable outcome of either of its claims (25% or 100%), the project would most likely instantly vault the value of TNR in the eyes of the market. And with the third outcome, Minera Andes agreeing to the settlement, TNR would receive US$125 million, which equates to more than ten times TNR’s market cap. From an outsider’s viewpoint, the moves by TNR are a Hail Mary pass, that could vault the company forward, and it’s obvious why this saga continues, as there’s just too much to lose from both parties.

G. Joel Chury

Editor in Chief

VantageWire.com

--

Disclaimer: No information in this article should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. VantageWire makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the VantageWire only and are subject to change without notice. VantageWire assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this article and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. The author of this article does not currently own shares of any of the companies mentioned in this article. Furthermore, VantageWire assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this article.

G. Joel Chury"

Joel Chury has continued discussion at Bullion Bulls Canada:

Re: TNR Gold vs Minera Andes/US Gold

JC:

As many of you already have been following, there is a proposed merger on the table between Minera Andes [MAI] and US Gold [UXG]. But what may have slipped through the cracks is this story involving Minera Andes and TNR Gold [TNR], with regarding a lawsuit over the Los Azules copper project in Argentina.

TNR claims that it has the right to "back in" for 25% of the project based on a previous option deal with Xstrata Copper that would've let Xstrata obtain 100% of the property that was previously held outright by TNR. Minera Andes, who acquired the rigths from Xstrata, doesn't believe that TNR has the right to do so, but the dispute goes further...

TNR also claims that Xstrata didn't meet the $1m expenditure requirement that would've earned the property from TNR. To be fair, Minera Andes has pointed out that TNR did previously release a statement confirming that Xstrata had in fact met the requirements. But now, in retrospect, it looks as though TNR's claim has changed to state that Xstrata had included drilling operations outside of the disputed lands in their $1m calculation.

Anyways, the lawsuit is set up for a legal battle that will take place in the BC Supreme Court in November of 2012. Both sides are lobbing press release bombs at each other, and the outcome is still very much up for grabs.

I gave a much better account of the story on VantageWire today. I'm very interested in your takes on the case, and how it could all play out. My intention is to follow the story all the way through to its conclusion."

JN:

"Fascinating stuff Joel, and congrats on your new gig!

Now HERE is something that I can sink my own teeth into: a tricky LEGAL battle between two mining companies.

Obviously (as an outsider) it is totally impossible for me to realistically "handicap" the dispute and predict a likely winner. However, while the normal assumption in contested legal battles is that the party with "deeper pockets" will win, there are a few reasons not to write-off "the little guy" here.

First of all, based on Joel's presentation of the facts (and my own interpretation) it appears that Minera Andes "position" (and their interpretation) of this business deal at least suggests that Minera Andes (and Xstrata before it) were attempting to take advantage of TNR. Courts do NOT like it when either a plaintiff or defendant attempts to argue an "interpretation" of a business deal which results in ONE SIDE obviously ending up with "the short-end of the stick".

So IF TNR's interpretation of this agreement is fair/reasonable given the ENTIRE CONTEXT of these business dealings, there is a reasonable chance of it emerging with at least a partial victory here - which financially would represent a MAJOR victory for the company.

Let me add that even with my legal background I tend to shy away from "betting" on companies involved in legal disputes. The combination of LESS than "perfect information", the unpredictability of most litigation, and the fact that the dispute could be DRAWN-OUT over an extended period of time usually causes me to wait for the dust to settle first.

In that respect, I draw a clear distinction between true "legal battles" like this (where there are OBVIOUS issues to be tried in court) versus the "nuisance law-suits" we see filed against these companies with quite a bit of regularity. I tend to NOT place much credence in these minor legal disputes - as history shows the vast majority (i.e. almost all of them) never amount to anything significant."

JC:

"It's a tough call to say who will come out on top. Both sides have very compelling arguments, and I believe there is a lot more to come in the days between now and the court date.

Minera Andes appears to have a great case, that includes TNR's press release stating that the obligations were met. From their standpoint, they haven't done anything wrong... and that they obtained their rights from Xstrata fair and square. Now the piece that's important is whether Xstrata had the rights to give in the first place.

On the other side, TNR could show that Xstrata never quite spent the $1M required to obtain 100%. If so, this is a whole new ball game. If TNR does prove this side of the case, then the $125M settlement offer that Minera Andes could've taken along the way looks cheap in comparison. Or else, should TNR prove that it still has the right to back in for that 25%, it's still a big deal for the $11M mkt cap TNR. It's pretty obvious as to why they would fight so hard, and why this has stretched on for as long as it has.

We'll see what happens... but I'll be sure to keep following it to the conclusion. Be sure to check out my updates."

Joel Chury has continued discussion at Bullion Bulls Canada:

Re: TNR Gold vs Minera Andes/US Gold

JC:

As many of you already have been following, there is a proposed merger on the table between Minera Andes [MAI] and US Gold [UXG]. But what may have slipped through the cracks is this story involving Minera Andes and TNR Gold [TNR], with regarding a lawsuit over the Los Azules copper project in Argentina.

TNR claims that it has the right to "back in" for 25% of the project based on a previous option deal with Xstrata Copper that would've let Xstrata obtain 100% of the property that was previously held outright by TNR. Minera Andes, who acquired the rigths from Xstrata, doesn't believe that TNR has the right to do so, but the dispute goes further...

TNR also claims that Xstrata didn't meet the $1m expenditure requirement that would've earned the property from TNR. To be fair, Minera Andes has pointed out that TNR did previously release a statement confirming that Xstrata had in fact met the requirements. But now, in retrospect, it looks as though TNR's claim has changed to state that Xstrata had included drilling operations outside of the disputed lands in their $1m calculation.

Anyways, the lawsuit is set up for a legal battle that will take place in the BC Supreme Court in November of 2012. Both sides are lobbing press release bombs at each other, and the outcome is still very much up for grabs.

I gave a much better account of the story on VantageWire today. I'm very interested in your takes on the case, and how it could all play out. My intention is to follow the story all the way through to its conclusion."

JN:

"Fascinating stuff Joel, and congrats on your new gig!

Now HERE is something that I can sink my own teeth into: a tricky LEGAL battle between two mining companies.

Obviously (as an outsider) it is totally impossible for me to realistically "handicap" the dispute and predict a likely winner. However, while the normal assumption in contested legal battles is that the party with "deeper pockets" will win, there are a few reasons not to write-off "the little guy" here.

First of all, based on Joel's presentation of the facts (and my own interpretation) it appears that Minera Andes "position" (and their interpretation) of this business deal at least suggests that Minera Andes (and Xstrata before it) were attempting to take advantage of TNR. Courts do NOT like it when either a plaintiff or defendant attempts to argue an "interpretation" of a business deal which results in ONE SIDE obviously ending up with "the short-end of the stick".

So IF TNR's interpretation of this agreement is fair/reasonable given the ENTIRE CONTEXT of these business dealings, there is a reasonable chance of it emerging with at least a partial victory here - which financially would represent a MAJOR victory for the company.

Let me add that even with my legal background I tend to shy away from "betting" on companies involved in legal disputes. The combination of LESS than "perfect information", the unpredictability of most litigation, and the fact that the dispute could be DRAWN-OUT over an extended period of time usually causes me to wait for the dust to settle first.

In that respect, I draw a clear distinction between true "legal battles" like this (where there are OBVIOUS issues to be tried in court) versus the "nuisance law-suits" we see filed against these companies with quite a bit of regularity. I tend to NOT place much credence in these minor legal disputes - as history shows the vast majority (i.e. almost all of them) never amount to anything significant."

JC:

"It's a tough call to say who will come out on top. Both sides have very compelling arguments, and I believe there is a lot more to come in the days between now and the court date.

Minera Andes appears to have a great case, that includes TNR's press release stating that the obligations were met. From their standpoint, they haven't done anything wrong... and that they obtained their rights from Xstrata fair and square. Now the piece that's important is whether Xstrata had the rights to give in the first place.

On the other side, TNR could show that Xstrata never quite spent the $1M required to obtain 100%. If so, this is a whole new ball game. If TNR does prove this side of the case, then the $125M settlement offer that Minera Andes could've taken along the way looks cheap in comparison. Or else, should TNR prove that it still has the right to back in for that 25%, it's still a big deal for the $11M mkt cap TNR. It's pretty obvious as to why they would fight so hard, and why this has stretched on for as long as it has.

We'll see what happens... but I'll be sure to keep following it to the conclusion. Be sure to check out my updates."

James Goodwin has wrote an article McEwen Mining Silver Mining, he has background in law and is considering to write about the Los Azules litigation.

ReplyDeleteWe would like to share this new information.

James,

It will be great!

We have covered this story for years, but nobody in our team is with the law background.

You can find deposit maps, Los Azules presentations from Minera Andes and links to TNR Gold website where they have provided all latest BC court documents here:

http://bit.ly/yusMeu

McEwen mining is very modest with any information on litigation, but you can try your luck there!

Another interesting information has transpired lately.

Alan Ambrose former CEO of Minera Andes has sold recently 300,000 shares of McEwen Mining. Before he was selling almost all his stake in Minera Andes.

He was the key person in all period covering litigation of relationship with TNR Gold and some of his emails with Xstrata are exposed by TNR Gold in latest Claim filing, when Judge has allowed the new claim for Northern Half of the Los Azules deposit to be returned back to TNR.

It could be nothing it could be everything.

In any case he is taking his chips off the table, when TNR Gold insiders are buying millions of shares from last fall.

Rob's problem, as we see it is that it was Alan who was running Minera Andes and get into all that mess with Los Azules and TNR Gold, Rob came only in 2007 into the picture.

IR at TNR Gold told us that the company is now in discovery stage in preparation to the trial, when more documents and witnesses will be presented.

We guess Alan Ambrose will be one of them.

Question is quite simple now: whether Rob can afford to ride blindfolded into the risk of losing up to 2/3 of Los Azules, when his key man in charge at that time sold off his stake and he is supposed to be the line in litigation defense as we imagine?

Your take on all this will be appreciated.

Regards,

Found more on Los Azules litigation and Allen Ambrose CEO of Minera Andes at that time, it is quite a read, like a movie script:

ReplyDeleteAllen Ambrose emails:

24. "Next we should look at our alternatives to take out the Solitario (TNR Gold - S) agreement..."

TNR Gold vs Minera Andes (McEwen Mining now) and MIM (Xstrata now).

From Page 11

Part 3: Legal Basis

http://bit.ly/xhdqag

Very interesting:

Oral Reasons for Judgment - just check out the estimation of claim value by Judge:

http://bit.ly/szDi35

Regards,

CNN Money

ReplyDelete$1.7M of MUX sold by Allen Ambrose

TORONTO, ONTARIO, CANADA — Allen Ambrose sold 300,000 shares of Mcewen Mining Inc stock, or $1,697,271 worth, as noted in an SEC Filing today. As reported in the filing, the transactions occurred between February 6, 2012 - February 7, 2012.

After the transaction, Allen Ambrose's stake was reported as 334,500 shares of Mcewen Mining Inc stock (a 47% decrease from before the transaction took place). Allen Ambrose's title was listed as "Director" at Mcewen Mining Inc within the filing.

As noted on February 8, 2012, Allen Ambrose's sale was done directly over 8 transactions from February 6, 2012 to February 7, 2012. The share price ranged from $5.65 to $5.69 according to the regulatory filing detailing the transactions.

If we look over the past 12 months, Allen Ambrose has sold a total of 300,000 shares of Mcewen Mining Inc, proceeds from the sale totaled $1,697,271. Over the same time period, Allen Ambrose has purchased no shares of Mcewen Mining Inc stock. Allen Ambrose has also performed other transactions including exercise of options .

Let's take a quick, high-level look at insider trading at Mcewen Mining Inc over the past 12 months. A total of 374,000 shares of Mcewen Mining Inc stock was sold by insiders, totaling $2,189,051. Over the same time 12 month time period, 9,201,000 shares of Mcewen Mining Inc, for a total value of $59,806,500 were purchased by company insiders.

To view the complete SEC Filing: Mcewen Mining Inc 4 (Insider Trading) SEC Filing

http://money.cnn.com/news/newsfeeds/articles/marketbrief/mux_4_insider_trading_2012_2_8_9225363_s_cnn.htm#