Story about REE market is getting out and race for secure supply of strategic commodities: REE and Lithium is well on track. China calls the shots and U.S. Corp is still very slow to asses the situation.

"Nothing will be left to a chance in this methodical execution of state-level plan in China: transformation of the country's transportation system into the base of 21st century clean tech industrial revolution to further power its rise. China has already surpassed Japan as a second largest economy in the world and it is the largest auto market now.

Now you can see a few details of state level planing in China: they have capital to invest with reserves over Two Trillion US Dollars, thousands of engineers with annual salaries compared to monthly ones in the West and, the most important, political will to implement the far going geopolitical plan to get rid off the Oil Hook. We are out of the politics and our idea is to define Macro trends and position ourselves early enough to capitalise on it.

The last piece in this game against Peak Oil (or fading American domination connected to the control of Oil in the world) is to have secure supply of strategic commodities for this technological advance. Here China already controls 97% of market in Rare Earth Elements and now it is time to build up position in Lithium. If in the beginning of Lithium Bull last year mostly Japanese companies were very active in junior mining space where small companies are controlling resources, now more and more reports from the juniors suggesting that Chinese companies are on the road."

Report from Congressional Research Service: Rare Earth Elements: The Global Supply Chain

InformationWeekGovernment:

A Congressional Research Service report considers whether U.S. dependency on foreign sources of rare earth elements threatens the defense and technology industries.

By Thomas Claburn

InformationWeek

August 28, 2010 08:10 AM

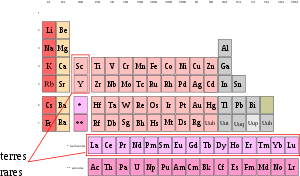

Image via Wikipedia

Image via WikipediaThere are 17 rare earth elements (REEs). They have names like lanthanum, europium and yttrium. And they're critical to a variety of high-tech products and manufacturing processes, including catalytic converters, petroleum refining, color TV and flat panel displays, permanent magnets, batteries for hybrid and electric vehicles, medical devices, and various defense systems like missiles, jet engines, and satellite components.

About 124,000 metric tons of REEs were produced in 2009, with worldwide demand during this period estimated to be 134,000 metric tons -- the difference have been made up from existing stockpiles. By 2012, worldwide demand is expected to reach 180,000 metric tons while mining operations are not expected to keep up with demand in the near term.

More Government InsightsWhitepapersTop Reasons to Choose Red Hat Enterprise Linux Top 5 differences between Red Hat Enterprise Linux 5 and Solaris 10 System Startups Videos

Techweb's Weekly Comedy Show On YouTube lawsuits, Intel anti-trust suits, Mac vs. PC spoofs and More This situation is explored in a report published by the Congressional Research Service in late July and recently posted to the Federation of American Scientists' Secrecy News Web site.

Congressional representatives have taken notice of what some, like Rep. Mike Coffman (R-CO), are calling a crisis. In May,Coffman introduced a rare earth amendment to the National Defense Authorization Act for Fiscal Year 2011.

Increased efficiency through converged infrastructure and modular blade servers.

Close the Technology Gap in the Public Sector

"The Department of Defense is facing a near-term shortage of key 'rare earth' materials necessary to support our defense weapon systems, and rare earth magnets are especially critical. ...," he said in a statement. "Today, the United States does not have a manufacturer of neodymium iron boron rare earth magnets, yet they are found in our precision guided munitions, ships, aircraft, and other critical weapons systems.”

Critical to the discussion is the fact that 97% of rare earth element production is currently controlled by China, where internal demand is rising and interest in exporting these materials is becoming more complicated as China's leaders look to take advantage of their country's market dominance.

The CRS report lists a variety of policy options: funding the U.S. Geological Survey to locate more viable REE deposits; supporting greater REE exploration in the U.S., Australia, Africa, and Canada; challenging Chinese export restrictions through the WTO; and establishing a stockpile of REE to mitigate potential supply interruptions.

This fall, the leaders of the public and private sectors will convene at Gov 2.0 Summit in Washington, D.C., to discuss government's critical challenges. Request an invitation to join this unparalleled group of influencers. It happens Sept. 7-8. Click here to find out more.

No comments:

Post a Comment