We always need someone to tell us: "it is time", problem here is that everybody suddenly become awaken to apparent stupidity of existing perception of value in the face of reality which always has been here just nobody pays attention to it. And the game "find another fool" is getting to its logical end...

http://internet.seekingalpha.com/article/21221

From Henry Blodget:

http://www.internetoutsider.com/2006/11/on_barrons_anal.html#comments

It was written here before about Multiple compression and Growth slowing.

Pages

▼

Monday, November 27, 2006

Friday, November 24, 2006

GOOGLE sued by French Movie Producer

In Knowledge Economy one of the most important functions is to store, organize and search all relevant and available data - GOOGLE is the best here in this Commodity business. User can always switch to another Producer of this service, competitor is just click away and switch cost is zero. But the real value will be always with content producing agents in this economy, knowledge will be important and not the transportation of it, as soon as delivery will be abundant uniqueness of any particular participant in this sector will be diminished and their valuation will be on the normal "industrial" level. Content Producers meanwhile will be starting to fight for their Copyright right, because for them it is matter of survival:

http://money.cnn.com/2006/11/23/news/international/google_france.reut/index.htm?postversion=2006112311

Wednesday, November 22, 2006

Tenke Mining Presentation and Reports

http://www.tenke.com/s/CorporatePresentation.asp

Note: TNK's 24.75% equals 8 billion pounds of cooper and 700 million pounds of cobalt.

Rock Value at 3.1$/CUlb=24.8 billion plus 15$/Colb=10.5 billion Total: 35.3 billion $. All South American Properties as Bonus. When production will start Market Cap target will be 3.5 billion $. Now it is CAD14.69*0.88*58.7mil shares=758.8 million $.

96 million $ in Cash

Less than half of the concession area explored.

Mine construction 2006 end, production 2008.

November 10th Repots on 3rd Q and MD&A:

http://www.tenke.com/i/pdf/2006q3.pdf

http://sedar.com/FindCompanyDocuments.do

Note: 6 properties will be drilled in coming explorational season in Argentina and Chile.

Congo: feasibility study to be completed in 4Qth 2006.

Note: TNK's 24.75% equals 8 billion pounds of cooper and 700 million pounds of cobalt.

Rock Value at 3.1$/CUlb=24.8 billion plus 15$/Colb=10.5 billion Total: 35.3 billion $. All South American Properties as Bonus. When production will start Market Cap target will be 3.5 billion $. Now it is CAD14.69*0.88*58.7mil shares=758.8 million $.

96 million $ in Cash

Less than half of the concession area explored.

Mine construction 2006 end, production 2008.

November 10th Repots on 3rd Q and MD&A:

http://www.tenke.com/i/pdf/2006q3.pdf

http://sedar.com/FindCompanyDocuments.do

Note: 6 properties will be drilled in coming explorational season in Argentina and Chile.

Congo: feasibility study to be completed in 4Qth 2006.

Monday, November 20, 2006

Tenke mining Update on Tenke Fungurume Project

"Final feasibility study, environmental impact assessment work and implementation of local social programs have progressed significantly over the past quarter. In addition, significant pre-construction activities have advanced on site to maintain a target of first copper cathode production at Tenke Fungurume towards the end of 2008."

"The potential acquisition of Phelps Dodge by Freeport-McMoRan Copper & Gold, Inc. ("Freeport") announced today is expected to be very positive for the project. Freeport successfully pioneered the enormous Ertsberg/Grasberg mine in a remote region in Papua, Indonesia (formerly Irian Jaya), mastering the technical, political and geographic challenges at Grasberg to make it one of the largest, most successful copper/gold mines in the world."

Stock Price of Tenke Agrees with it.

http://biz.yahoo.com/ccn/061120/200611200358881001.html?.v=1&printer=1

"The potential acquisition of Phelps Dodge by Freeport-McMoRan Copper & Gold, Inc. ("Freeport") announced today is expected to be very positive for the project. Freeport successfully pioneered the enormous Ertsberg/Grasberg mine in a remote region in Papua, Indonesia (formerly Irian Jaya), mastering the technical, political and geographic challenges at Grasberg to make it one of the largest, most successful copper/gold mines in the world."

Stock Price of Tenke Agrees with it.

http://biz.yahoo.com/ccn/061120/200611200358881001.html?.v=1&printer=1

Tenke Mining and its Congo assets at Tenke Fungurume at the spotlight in the Biggest Mining Acquisition.

Freeport-McMoRan's Acquisition of Phelps Dodge Creates Largest Publicly Traded Copper Company

http://biz.yahoo.com/ap/061120/freeport_phelps_dodge.html?.v=8

"Phelps Dodge has operations throughout the world, and is working on an $850 million expansion of its Cerro Verde mine in Peru. It also is building a $550 million copper mine near Safford, Ariz., and planning a $650 million copper mine at Tenke Fungurume in the Democratic Republic of the Congo."

I hope that bidding war for the TNK.to will start after CAD50.0.

With all majors struggling and fighting for additional reserve base Tenke with CU 3% sounds very good to me. For the best value to shareholders I would expect spin off all their NON Congo properties in Tenke Exploration Co as in-kind dividend like Capstone (CS.to) did this year, management should know it is not valued at all in the price of TNK.to.

http://biz.yahoo.com/ap/061120/freeport_phelps_dodge.html?.v=8

"Phelps Dodge has operations throughout the world, and is working on an $850 million expansion of its Cerro Verde mine in Peru. It also is building a $550 million copper mine near Safford, Ariz., and planning a $650 million copper mine at Tenke Fungurume in the Democratic Republic of the Congo."

I hope that bidding war for the TNK.to will start after CAD50.0.

With all majors struggling and fighting for additional reserve base Tenke with CU 3% sounds very good to me. For the best value to shareholders I would expect spin off all their NON Congo properties in Tenke Exploration Co as in-kind dividend like Capstone (CS.to) did this year, management should know it is not valued at all in the price of TNK.to.

Sunday, November 19, 2006

Bear Case Update

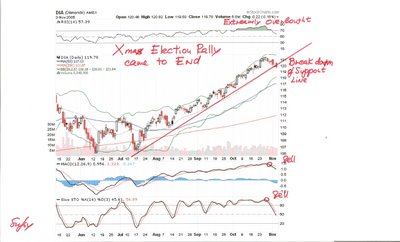

Xmas rally came and maybe already gone:

http://www.nytimes.com/2006/11/19/business/yourmoney/19mark.html?_r=2&ref=business&oref=slogin&oref=slogin

Housing pain is noway near end: Bull excesses can be overdone within 6 months of bear market. It is not reaction to the bull - it is NEW BEAR Housing Market - leading indicators turn soar:

http://www.nytimes.com/2006/11/19/business/yourmoney/19mark.html?_r=2&ref=business&oref=slogin&oref=slogin

FED is in the puzzle: to increase or not to increase: save the Dollar or kill housing/consumer/economy/market:

http://www.bloomberg.com/apps/news?pid=20601103&sid=aEv9pgKHpIos&refer=us

http://www.nytimes.com/2006/11/19/business/yourmoney/19mark.html?_r=2&ref=business&oref=slogin&oref=slogin

Housing pain is noway near end: Bull excesses can be overdone within 6 months of bear market. It is not reaction to the bull - it is NEW BEAR Housing Market - leading indicators turn soar:

http://www.nytimes.com/2006/11/19/business/yourmoney/19mark.html?_r=2&ref=business&oref=slogin&oref=slogin

FED is in the puzzle: to increase or not to increase: save the Dollar or kill housing/consumer/economy/market:

http://www.bloomberg.com/apps/news?pid=20601103&sid=aEv9pgKHpIos&refer=us

Monday, November 13, 2006

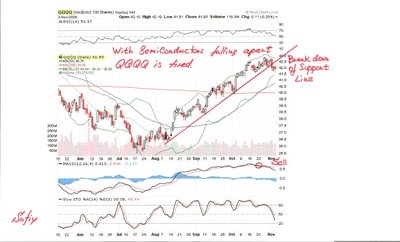

Sandisk downgraded

We can see this story developing as it was discussed here before: consumers are hurt by housing, mass market production is feeling the hit and cutting on inventories, SNDK is early bird in the cycle to cut down its amusement. Semis are indicator for health of the consumer economy: Election rally is coming to End reality is little bit different then media would like you to believe:

"LONDON (MarketWatch) -- UBS downgraded memory chip manufacturer SanDisk Corp. SNDK45.75, -0.38, -0.8%) to neutral from buy, citing a likely oversupply in flash memory chips in 2006 and 2007. The firm said capacity growth at SanDisk and its peers means oversupply could reach 10% to 15% in 2006 and 5% to 10% in 2007."

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7bA9F9A1B2-0A8F-4C25-BDDF-CF2A1C8E7CCF%7d&siteid=yhoo&dist=yhoo

"LONDON (MarketWatch) -- UBS downgraded memory chip manufacturer SanDisk Corp. SNDK45.75, -0.38, -0.8%) to neutral from buy, citing a likely oversupply in flash memory chips in 2006 and 2007. The firm said capacity growth at SanDisk and its peers means oversupply could reach 10% to 15% in 2006 and 5% to 10% in 2007."

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7bA9F9A1B2-0A8F-4C25-BDDF-CF2A1C8E7CCF%7d&siteid=yhoo&dist=yhoo

Sunday, November 12, 2006

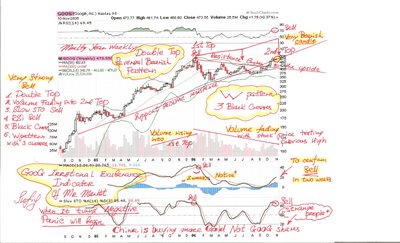

Google: unrealistic expectations of growth are build into the price

All new areas of growth: diffusing into Old Media World with New Technology will mean that growth will not be as explosive as with "clicks" due to:

1. Competition of Old Media.

2. Failure to really innovate outside of search.

3. Copyright nightmare.

4. Becoming Media Company...with much lower multiples.

5. And last but not the least - big Budgets in Old Media World are won not with "clicks" but rather with "ticks".

http://blogs.zdnet.com/micro-markets/?p=654

1. Competition of Old Media.

2. Failure to really innovate outside of search.

3. Copyright nightmare.

4. Becoming Media Company...with much lower multiples.

5. And last but not the least - big Budgets in Old Media World are won not with "clicks" but rather with "ticks".

http://blogs.zdnet.com/micro-markets/?p=654

Recession: to Paint Rosy Picture becomes more and more difficult

From Barron's:

"Recession: The preconditions are in place: (1) Housing drop of 10-20% (which usually signals a recession of unusual length). (2) Weak auto sales. (3) Inverted yield curve. "Where we had been looking for a slowdown, we now think there's a 40% to 50% probability of a recession. Next year could be a very difficult time in the U.S. economy."

Retail: Wal-Mart is his "favorite economist" due to its size, its market (low-middle income), and its monthly numbers. There has been a dramatic reduction in low-income spending. "I would suspect the retail-sales environment will be the next sector of the economy that we will start to hear less exciting news from."

Election: Lower capital-gains and dividend taxes have fuelled the current bull market. Although the current tax treatment, passed in 2003, is in place until 2010, even mentions of change are negative. The planned Democrat minimum-wage increase will raise unit labor costs and impact profit margins.

Inflation: Not a worry -- it will peak by year-end or early '07.

Oil/commodities: U.S. is the world's major consumer. If economic growth slows, so will consumption. "We think the price of oil could drop to a range of $45 to $50 by this time next year."

Interest rates: The Fed is finished raising short-term rates. He sees a 200-basis-point drop from early '07 to early '08. "I have never seen a slowdown or a recession where bond yields go up."

Dollar: "The dollar is about to resume a fairly extended decline." This makes foreign investments and precious metals attractive.

Stock market: It is highly correlated to GDP growth. He foresees flatlining or decline over the next 18 months. "

http://seekingalpha.com/article/20400

"Recession: The preconditions are in place: (1) Housing drop of 10-20% (which usually signals a recession of unusual length). (2) Weak auto sales. (3) Inverted yield curve. "Where we had been looking for a slowdown, we now think there's a 40% to 50% probability of a recession. Next year could be a very difficult time in the U.S. economy."

Retail: Wal-Mart is his "favorite economist" due to its size, its market (low-middle income), and its monthly numbers. There has been a dramatic reduction in low-income spending. "I would suspect the retail-sales environment will be the next sector of the economy that we will start to hear less exciting news from."

Election: Lower capital-gains and dividend taxes have fuelled the current bull market. Although the current tax treatment, passed in 2003, is in place until 2010, even mentions of change are negative. The planned Democrat minimum-wage increase will raise unit labor costs and impact profit margins.

Inflation: Not a worry -- it will peak by year-end or early '07.

Oil/commodities: U.S. is the world's major consumer. If economic growth slows, so will consumption. "We think the price of oil could drop to a range of $45 to $50 by this time next year."

Interest rates: The Fed is finished raising short-term rates. He sees a 200-basis-point drop from early '07 to early '08. "I have never seen a slowdown or a recession where bond yields go up."

Dollar: "The dollar is about to resume a fairly extended decline." This makes foreign investments and precious metals attractive.

Stock market: It is highly correlated to GDP growth. He foresees flatlining or decline over the next 18 months. "

http://seekingalpha.com/article/20400

Google CheckOut has usual destiny of "Another Killer Product" Copycat

Google is still a company with outrages valuation, but all its strength is only in Seach Based Advertisement, all efforts to diversify from One Revenue Stream Business failed so far. After purchasing YouTube all investors has right to grill CEO about what all those PHD are doing, talking out minikitchens?

From Henry Blodget blog:

http://www.internetoutsider.com/google/index.html

From Henry Blodget blog:

http://www.internetoutsider.com/google/index.html

Saturday, November 11, 2006

USD: another Leg Down

With Gold, Silver and mining stocks HUI at BUY, USD - stock of Corporation USA is ready to go down again: no more support from FED (Housing decline is killing Consumer) and the only way to deal with mounting Debts is to inflate them away:

http://www2.pimco.com/pdf/PER040_103006_Dollar%20Downdraft_Clarida_Final.pdf

http://www2.pimco.com/pdf/PER040_103006_Dollar%20Downdraft_Clarida_Final.pdf

Thursday, November 09, 2006

Google Inc.'s online video service has been sued for copyright infringement

YouTube was so interesting because it was free, spontaneous and nobody cared about copyright issues. You was able always find materials with copyright infringement, now its popularity will be coming down with approach to try to organize it and bring its content in order with legistlation. Google has became big fat sitting duck for all those guys who has been losing money all these years due to piracy. Will they just sit on their hands and watch Google's fortune using their IP growing? I do not think so:

http://biz.yahoo.com/ap/061108/google_video.html?.v=3

http://biz.yahoo.com/ap/061108/google_video.html?.v=3

Monday, November 06, 2006

Bear Case: Recession Has Already Started

I am not alone in my observations:

http://www.rgemonitor.com/blog/roubini/155736

http://chip.seekingalpha.com/article/19939

http://www.rgemonitor.com/blog/roubini/155736

http://chip.seekingalpha.com/article/19939

Sunday, November 05, 2006

TNR Gold: Junior Exploration company introduction.

Note: I own this stock at the moment of posting.

This is very risky, but pay off could be handsome: nobody likes it, nobody follows it. Do your DD, it is very small market cap, it is beaten to 0.2cad but has partners like TNK.to, NG.to, MAI.v.

Pure option on Gold with no time value. This one could go to zero or be above 1.0CAD only money which could be lost allowed for such high risk.

Upside potential:

1. TNK.to Operator on Argentinean properties, Lukas Lundin's Tenke Mining President Paul K. Conibear on the Board.

2. Optioned property from Nova Gold Shotgun: with Winchester prospects - latest drilling results in press release below. Vice President of NG.to in the board. They left Rock Creek property in order to work on Shotgun. NG.to is putting Rock Creek into production in 2007. (This could be allocated to stupid decision as well of that management).

3. Los Azules Property optioned to Xtrata and from Xtrata to Minera Andes MAI.v extensive drilling and Cu finding there. Former GG chairman bought 30% of MAI.v just because of that property MAI.v adjued to TNR's one. Biggest Cu grade is on TNR's property there.

4. Very small cap, unbelievable valuation with such properties and partners, illiquid, nobody knows: with real development will sky rocket over 1.0CAD.

5. Shares are very tightly held: main shareholders: TNK.to, RAB, NG.to, management.

Risks:

1. Nothing of the above has moved the stock so far.

2. Management was sleeping completely, but has waken up recently.

3. Information flow and PR management could be way better.

4. Very slow moving environment.

Things to watch: drilling results from all properties, TNK.to warrants excises at CAD0.25.

This one you have to really dig out, I will post some more info.

http://www.tnrgoldcorp.com/news/tnrnr110106.pdf

http://www.tnrgoldcorp.com/

This is very risky, but pay off could be handsome: nobody likes it, nobody follows it. Do your DD, it is very small market cap, it is beaten to 0.2cad but has partners like TNK.to, NG.to, MAI.v.

Pure option on Gold with no time value. This one could go to zero or be above 1.0CAD only money which could be lost allowed for such high risk.

Upside potential:

1. TNK.to Operator on Argentinean properties, Lukas Lundin's Tenke Mining President Paul K. Conibear on the Board.

2. Optioned property from Nova Gold Shotgun: with Winchester prospects - latest drilling results in press release below. Vice President of NG.to in the board. They left Rock Creek property in order to work on Shotgun. NG.to is putting Rock Creek into production in 2007. (This could be allocated to stupid decision as well of that management).

3. Los Azules Property optioned to Xtrata and from Xtrata to Minera Andes MAI.v extensive drilling and Cu finding there. Former GG chairman bought 30% of MAI.v just because of that property MAI.v adjued to TNR's one. Biggest Cu grade is on TNR's property there.

4. Very small cap, unbelievable valuation with such properties and partners, illiquid, nobody knows: with real development will sky rocket over 1.0CAD.

5. Shares are very tightly held: main shareholders: TNK.to, RAB, NG.to, management.

Risks:

1. Nothing of the above has moved the stock so far.

2. Management was sleeping completely, but has waken up recently.

3. Information flow and PR management could be way better.

4. Very slow moving environment.

Things to watch: drilling results from all properties, TNK.to warrants excises at CAD0.25.

This one you have to really dig out, I will post some more info.

http://www.tnrgoldcorp.com/news/tnrnr110106.pdf

http://www.tnrgoldcorp.com/

Saturday, November 04, 2006

YouTube is not easy task to settle, a lot of money could pass down those Tubes.

I think the more Google guys will get into the copyright issue, the more price for buying YouTube will look unwise at least. It is not News settlement: it is bread and butter for powerful industry which is struggling with piracy and losing tons of money just because of "New Media" with Google and YouTube at the Edge.

http://www.hondoazul.com/YouTube_TarBaby.pdf

http://www.hondoazul.com/YouTube_TarBaby.pdf

Wednesday, November 01, 2006

Google hired its general counsel from a company that made well - timed option grants.

Could it be the case with cockroach? Usually they are not living alone, if you have found one be alerted all place may be infested.

http://www.bloomberg.com/apps/news?pid=20601109&sid=aTX__CcCLflk&refer=home

http://www.bloomberg.com/apps/news?pid=20601109&sid=aTX__CcCLflk&refer=home