Pages

▼

Thursday, May 25, 2006

One more reason for the big bust

I was expecting bounce in Nasdaq and rotate my June puts into Jan ones, but Google can not bounce (target 410) with the market due to Yhoo and eBay news. Now when Yhoo and eBay have joined forces Google valuation seems completely ridiculer. Once 370 will be violated again stock will melt down. Nasdaq will bounce here (target qqqq 40.5) Dow and S&P will form double top on weekly basis and long term double top in Dow will be confirmed. Emerging markets was just the beginning: USA market are due to the big sell off this year. Wise man would sell into the strength on every bounce it is not temporary blip it is bear market came back. Google's melt down will be the major issue in the coming revaluation of assets value and risk approach. A lot of people will be taken surprised how low it can go and they will be astonished how could they pay such prices for SEARCH COMMODITY INTERNET BUSINESS WITH QUESTIONABLE REVENUE, ARROGANT FOUNDERS CONTROLLING THE COMPANY AND MOUNTING COMPETITION.

The last drop on the back of tired overblown stock: Google can not sustain this valuation.

"Yahoo, eBay to Join Forces in PartnershipThursday May 25, 11:07 am ET By Michael Liedtke, AP Business Writer

Yahoo, eBay to Join Forces in Partnership to Thwart Expansions From Rivals

SAN FRANCISCO (AP) -- Internet powerhouses Yahoo and eBay are joining forces in an alliance that appears aimed at thwarting the recent expansions of online search engine leader Google and Microsoft.

Shares of both companies rose after the news.

Under the multiyear partnership announced Thursday, the Silicon Valley companies will draw upon each other's strengths in online advertising, payments and communications so they can connect with even more Web surfers than they already do.

Sunnyvale, Calif.-based Yahoo Inc. operates the world's most trafficked Web site with 402 million users and ranks second in the lucrative search advertising market behind Google.

But the deal between Yahoo Inc. and eBay Inc. seems likely to shift the competitive landscape.

Yahoo will become the exclusive provider of graphical advertising throughout eBay's Web site and will provide some search-generated ads, as well. Yahoo's brand and search engine will also be blended into an eBay toolbar that has been downloaded by 4 million users so far.

Ebay's PayPal service will become the preferred payment provider for purchases made on Yahoo's site, which provides a wide array of shopping, auctions and subscription services.

The Skype service will be used to build another marketing vehicle that will allow advertisers to connect with prospective customers on the phone instead of through their Web sites.

Yahoo and eBay said they will begin testing some of their joint services later this year, but all the benefits are unlikely to be available until next year.

San Jose, Calif.-based eBay boasts nearly 200 million users at its Internet auction site, owns the biggest online payment system in PayPal and operates a thriving voice communications system in Skype.

"We are thrilled to be working more closely with Yahoo! and we think this agreement represents a great opportunity to benefit our communities and grow our businesses," said Meg Whitman, eBay's chief executive officer.

Thursday's announcement, which had been foreshadowed by several weeks of rampant Wall Street speculation, contained no details on whether the two companies are investing in each other.

But both Yahoo and eBay are striving to bolster each other's partnership at a time when their stocks have been slumping as Google continues to expand its lead in search while offering new services that pose new threats.

Meanwhile, Microsoft Corp. has vowed to invest heavily in the Internet during the next year, focusing on building a better online advertising platform. As part of its push, Microsoft is dropping ads distributed by Yahoo's search engine.

In recent months, Google has invaded eBay's turf by offering a free classified listing service as well as a payment service. Despite those moves, Google has stressed it has no plans to trample eBay, one of the largest advertisers on its network.

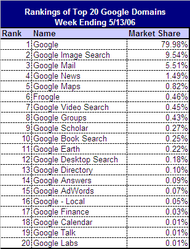

Mountain View, Calif.-based Google Inc. dominates Internet search, with a 43.1 percent U.S. market share in April compared with 28 percent for Yahoo and 12.9 percent for Microsoft's MSN, according to comScore Media Metrix.

Shares of eBay rose $2.24, or 7.4 percent, to $32.44 in early trading on the Nasdaq Stock Market, where Yahoo shares rose 91 cents, or 2.9 percent, to $32.70. Google shares fell $4.75, or 1.2 percent, to $376.50. "

Yahoo, eBay to Join Forces in Partnership to Thwart Expansions From Rivals

SAN FRANCISCO (AP) -- Internet powerhouses Yahoo and eBay are joining forces in an alliance that appears aimed at thwarting the recent expansions of online search engine leader Google and Microsoft.

Shares of both companies rose after the news.

Under the multiyear partnership announced Thursday, the Silicon Valley companies will draw upon each other's strengths in online advertising, payments and communications so they can connect with even more Web surfers than they already do.

Sunnyvale, Calif.-based Yahoo Inc. operates the world's most trafficked Web site with 402 million users and ranks second in the lucrative search advertising market behind Google.

But the deal between Yahoo Inc. and eBay Inc. seems likely to shift the competitive landscape.

Yahoo will become the exclusive provider of graphical advertising throughout eBay's Web site and will provide some search-generated ads, as well. Yahoo's brand and search engine will also be blended into an eBay toolbar that has been downloaded by 4 million users so far.

Ebay's PayPal service will become the preferred payment provider for purchases made on Yahoo's site, which provides a wide array of shopping, auctions and subscription services.

The Skype service will be used to build another marketing vehicle that will allow advertisers to connect with prospective customers on the phone instead of through their Web sites.

Yahoo and eBay said they will begin testing some of their joint services later this year, but all the benefits are unlikely to be available until next year.

San Jose, Calif.-based eBay boasts nearly 200 million users at its Internet auction site, owns the biggest online payment system in PayPal and operates a thriving voice communications system in Skype.

"We are thrilled to be working more closely with Yahoo! and we think this agreement represents a great opportunity to benefit our communities and grow our businesses," said Meg Whitman, eBay's chief executive officer.

Thursday's announcement, which had been foreshadowed by several weeks of rampant Wall Street speculation, contained no details on whether the two companies are investing in each other.

But both Yahoo and eBay are striving to bolster each other's partnership at a time when their stocks have been slumping as Google continues to expand its lead in search while offering new services that pose new threats.

Meanwhile, Microsoft Corp. has vowed to invest heavily in the Internet during the next year, focusing on building a better online advertising platform. As part of its push, Microsoft is dropping ads distributed by Yahoo's search engine.

In recent months, Google has invaded eBay's turf by offering a free classified listing service as well as a payment service. Despite those moves, Google has stressed it has no plans to trample eBay, one of the largest advertisers on its network.

Mountain View, Calif.-based Google Inc. dominates Internet search, with a 43.1 percent U.S. market share in April compared with 28 percent for Yahoo and 12.9 percent for Microsoft's MSN, according to comScore Media Metrix.

Shares of eBay rose $2.24, or 7.4 percent, to $32.44 in early trading on the Nasdaq Stock Market, where Yahoo shares rose 91 cents, or 2.9 percent, to $32.70. Google shares fell $4.75, or 1.2 percent, to $376.50. "

Sunday, May 21, 2006

Brasil, now Korea then everywhere: Child porn

"Google accused of exposing Korean kids to porn

Search giant allegedly failing to check users' ages

Simon Burns in Taipei, vnunet.com 19 May 2006

ADVERTISEMENT

Google is allegedly exposing children to obscene online content in South Korea, according to government officials quoted in local media reports.

However, state ethics watchdogs claim that they have been unable to talk to the search firm because it does not have a local representative office, the Korea Times reported.

Leading Korean search portals confirm that users are at least 20 years old before showing search results that contain sex-related keywords. Google's Korean search engine does not, the newspaper reported.

Because the search results page includes summary text taken directly from other websites, it may contain language deemed to be obscene.

Although the age of consent in South Korea is 13, the age at which people legally become adults and are able, for example, to marry without parental approval is 20.

Google has had trouble breaking into the Korean market, which is dominated by local companies.

The search giant's share of click-throughs has been estimated at between 10 and 17 per cent by various sources this year, with rival Yahoo holding about 30 per cent.

"Google is not legally required to check whether internet users are over 19 years old before showing the search results for adult content," Han Meyong-ho, an official at the state-run Information Communication Ethics Committee told the Korea Times.

However, Han said that it would be "proper" for Google to check that users are adults in a similar manner to other popular Korean-language search sites, including Yahoo's Korean portal.

Despite Han's claim that his office had been unable to communicate with Google, the Korea Times said that it had spoken with an "unnamed Google official " in Korea.

According to the newspaper, the official claimed that Google was already filtering out adult-only sites from search results. This appears to be a reference to the company's SafeSearch technology."

http://www.infomaticsonline.co.uk/vnunet/news/2156469/google-exposing-kids-porn-sites

Search giant allegedly failing to check users' ages

Simon Burns in Taipei, vnunet.com 19 May 2006

ADVERTISEMENT

Google is allegedly exposing children to obscene online content in South Korea, according to government officials quoted in local media reports.

However, state ethics watchdogs claim that they have been unable to talk to the search firm because it does not have a local representative office, the Korea Times reported.

Leading Korean search portals confirm that users are at least 20 years old before showing search results that contain sex-related keywords. Google's Korean search engine does not, the newspaper reported.

Because the search results page includes summary text taken directly from other websites, it may contain language deemed to be obscene.

Although the age of consent in South Korea is 13, the age at which people legally become adults and are able, for example, to marry without parental approval is 20.

Google has had trouble breaking into the Korean market, which is dominated by local companies.

The search giant's share of click-throughs has been estimated at between 10 and 17 per cent by various sources this year, with rival Yahoo holding about 30 per cent.

"Google is not legally required to check whether internet users are over 19 years old before showing the search results for adult content," Han Meyong-ho, an official at the state-run Information Communication Ethics Committee told the Korea Times.

However, Han said that it would be "proper" for Google to check that users are adults in a similar manner to other popular Korean-language search sites, including Yahoo's Korean portal.

Despite Han's claim that his office had been unable to communicate with Google, the Korea Times said that it had spoken with an "unnamed Google official " in Korea.

According to the newspaper, the official claimed that Google was already filtering out adult-only sites from search results. This appears to be a reference to the company's SafeSearch technology."

http://www.infomaticsonline.co.uk/vnunet/news/2156469/google-exposing-kids-porn-sites

Thursday, May 18, 2006

Wednesday, May 17, 2006

Forbes: Going After Google

Competition is mounting and opposed to what Eric have told on the press day that competition could increase the revenue, on shareholders meeting he has admit that the growth will slow. Revenue will be hit once they start to lose share to MSFT and YHOO, click fraud will put all business model under pressure and margins will be squeezed in competitive battle.

http://www.forbes.com/technology/2006/05/16/microsoft-google-yahoo_cx_ck_rr_0517yahoo.html?partner=moreover

http://www.forbes.com/technology/2006/05/16/microsoft-google-yahoo_cx_ck_rr_0517yahoo.html?partner=moreover

Botnet implicated in click fraud scam

"Botnets are being used for Google Adword click fraud, according to security watchers.

The SANS Institute has uncovered evidence that networks of compromised PCs are being used to click on banner ads, generating revenue for unscrupulous publishers.

Pay-per-click schemes such as Google Adsense have programs to detect fraudulent clicks and suspend publishers implicated in click fraud. In an effort to disguise bogus visits, these publishers have begun hiring botnets to slip under the radar of fraud detection programs.

The "bottom line is that the advertiser pays in exchange for a bot visiting him", the SANS Institute reports.

Generating traffic from a small number of machines (numbered in the hundreds) makes the traffic generated from compromised machines look innocuous. In return for helping click fraud scammers keep a low profile, botnet owners rake in a percentage from the scam.

The ruse came to light after security experts in the SANS Institute's Internet Storm Centre investigated malicious software on a hacker's website. Control panels on the site, designed to facilitate the control of compromised machines infected with malware, were left open. This allowed security experts to analyse the actions of the botnet operator behind the site.

"The botnet was 115 bots in size at the early time of the day I was looking at it and most were under 15 clicks each," a handler at SANS Institute reports in a diary entry filed last weekend.

The institute has reported the site and its findings to Google. ®"

http://uk.news.yahoo.com/15052006/368/botnet-implicated-click-fraud-scam.html

The SANS Institute has uncovered evidence that networks of compromised PCs are being used to click on banner ads, generating revenue for unscrupulous publishers.

Pay-per-click schemes such as Google Adsense have programs to detect fraudulent clicks and suspend publishers implicated in click fraud. In an effort to disguise bogus visits, these publishers have begun hiring botnets to slip under the radar of fraud detection programs.

The "bottom line is that the advertiser pays in exchange for a bot visiting him", the SANS Institute reports.

Generating traffic from a small number of machines (numbered in the hundreds) makes the traffic generated from compromised machines look innocuous. In return for helping click fraud scammers keep a low profile, botnet owners rake in a percentage from the scam.

The ruse came to light after security experts in the SANS Institute's Internet Storm Centre investigated malicious software on a hacker's website. Control panels on the site, designed to facilitate the control of compromised machines infected with malware, were left open. This allowed security experts to analyse the actions of the botnet operator behind the site.

"The botnet was 115 bots in size at the early time of the day I was looking at it and most were under 15 clicks each," a handler at SANS Institute reports in a diary entry filed last weekend.

The institute has reported the site and its findings to Google. ®"

http://uk.news.yahoo.com/15052006/368/botnet-implicated-click-fraud-scam.html

Tuesday, May 16, 2006

Here is official news release from Bloomberg

"D.E. Shaw Sells Its Entire Google Stake, Pares Tech Holdings2006-05-15 17:08 (New York)By Jason Kelly May 15 (Bloomberg) -- D.E. Shaw & Co., the world's biggesthedge-fund firm, sold its stake in Google Inc. as the stock fell6 percent during the first quarter, according to a governmentfiling. D.E. Shaw's sale of 1.46 million Google shares was itsbiggest during the period ended March 31, according to aregulatory filing today. The stake in Google, owner of theworld's most-used largest Internet search engine, was worth about$606.9 million at the end of last year, according to the filing. As the firm, run by David Shaw, sold Google, it bought 1.39million shares in Internet search rival Yahoo! Inc., worth $44.9million at the end of the quarter. Mountain View, California-based Google in January said its profit missed analysts'estimates, snapping a streak of better-than-expected results thatdated back to its initial public offering in 2004. Google is accelerating innovation to fend off competitorsincluding Microsoft Corp. and Yahoo, Google Chief ExecutiveOfficer Eric Schmidt said May 11 at the company's annualshareholder meeting. Shares of Google rose $2.07 to $376.20 at 4 p.m. today inNasdaq Stock Market composite trading. Sunnyvale, California-based Yahoo gained 22 cents to $31.03. Shaw spokesman Trey Beck didn't immediately return a phonecall seeking comment. New York-based D.E. Shaw's total holdings were worth about$38.9 billion at the end of the period, according to the filingmade with the U.S. Securities and Exchange Commission. The firm,founded by Shaw in 1988, bought 5.62 million shares of Royal Bankof Canada, that country's largest bank, during the first quarter. Cisco, Apple Shaw, a former computer science professor at ColumbiaUniversity in New York, is known for using sophisticated computerprograms to pick stocks. Of the 10 stakes that Shaw sold completely, five wererelated to computers, telecommunications or media, includingVodafone Group Plc and Comcast Corp. Shaw also pared its holdingin Cisco Systems Inc., its fourth-biggest holding, by 3.8 millionshares. Shaw's biggest holding is a 9.75-million share stake inApple Computer Inc., worth $611 million at the end of thequarter. The firm increased its holdings of Hewlett-Packard Co.,its eighth-biggest position, by 2.6 million shares.--Editor: MoodyStory illustration: To chart the share performance of Google, see{GOOG US GP }. For a rundown of funds' activitiesduring the first quarter, see {NI 13F }.To contact the reporter on this story:Jason Kelly in Atlanta at (1)(404) 507-1307 orjkelly14@bloomberg.net.To contact the editors responsible for this story:Emma Moody at (1)(212) 617-3504 or emoody@bloomberg.net."

World's biggest hedge fund D.E. Shaw has sold entire holding of google shares

Bloomberg, world's biggest hedge fund E.D. Shaw has sold its entire holding of Google shares according to last filing before 1st q they hold more then 1.5 mil shares representing at that time more then 600 mil dollars. Someone really wants this story to be hit this morning: it is on Bloomberg every 30 minutes. Smart money have left Google, only guys who are managing "other peoples'" money and retail will be holding the bags, fund managers will later sue the management of Google and will keep all their bonuses, what retail will do? Those who are trusting to all this price targets and "strong buy" will be hit most.

"The D. E. Shaw group is a specialized investment and technology development firm whose activities center on various aspects of the intersection between technology and finance. Headquartered in New York, the D. E. Shaw group encompasses a number of closely related entities with approximately US $21 billion in aggregate capital. Activities range from computer-based quantitative investment management to the development and financing of technology-oriented business ventures, but are tied together by a common focus on the economic implications of technological innovation. Since its organization in 1988, the firm has earned an international reputation for financial innovation and technological leadership, and has been described as “the most intriguing and mysterious force on Wall Street.*”

http://www.deshaw.com/

"The D. E. Shaw group is a specialized investment and technology development firm whose activities center on various aspects of the intersection between technology and finance. Headquartered in New York, the D. E. Shaw group encompasses a number of closely related entities with approximately US $21 billion in aggregate capital. Activities range from computer-based quantitative investment management to the development and financing of technology-oriented business ventures, but are tied together by a common focus on the economic implications of technological innovation. Since its organization in 1988, the firm has earned an international reputation for financial innovation and technological leadership, and has been described as “the most intriguing and mysterious force on Wall Street.*”

http://www.deshaw.com/

Now Google will be abused

Press day Q: Why are you complaining about MSFT plans if your product is superior?

A: Sergey Brin: Because we can be abused.

Nothing will prevent to incorporate IE7 into new MSFT Vista and according to some reseach 90% of people are never changing their default settings.

"

DoJ laughs Google out of court IE 7 search box is not anti-trust

By Nick Farrell: Tuesday 16 May 2006, 07:47

ord=Math.random();ord=ord*10000000000;

THE LONG time enema of Microsoft, the Department of Justice will not back Google's anti-trust complaint against the software giant.

Google has been moaning that Vole has been using its power as a monopoly to squash its operation by arranging the search engine default settings on the new Internet Exploder in alphabetical order.

It thinks that the default settings should be set up to put the most popular search engine, in other words Google, at the top.

However even though the DoJ has not been above writing stiff letters of complaint to Vole in the past over any action it might considered whiffed of anti-trust, it seems that it thinks that this time there is no case to answer.

The Justice Department, in a court document released late Friday, said it and other plaintiffs in the US government's antitrust case against Microsoft have finished their look at the IE search feature and found there was nothing wrong with it.

In fact the DoJ thought that IE 7, now in beta, made it easy for users to change the default search engine within the browser. More here. µ"

A: Sergey Brin: Because we can be abused.

Nothing will prevent to incorporate IE7 into new MSFT Vista and according to some reseach 90% of people are never changing their default settings.

"

DoJ laughs Google out of court IE 7 search box is not anti-trust

By Nick Farrell: Tuesday 16 May 2006, 07:47

ord=Math.random();ord=ord*10000000000;

THE LONG time enema of Microsoft, the Department of Justice will not back Google's anti-trust complaint against the software giant.

Google has been moaning that Vole has been using its power as a monopoly to squash its operation by arranging the search engine default settings on the new Internet Exploder in alphabetical order.

It thinks that the default settings should be set up to put the most popular search engine, in other words Google, at the top.

However even though the DoJ has not been above writing stiff letters of complaint to Vole in the past over any action it might considered whiffed of anti-trust, it seems that it thinks that this time there is no case to answer.

The Justice Department, in a court document released late Friday, said it and other plaintiffs in the US government's antitrust case against Microsoft have finished their look at the IE search feature and found there was nothing wrong with it.

In fact the DoJ thought that IE 7, now in beta, made it easy for users to change the default search engine within the browser. More here. µ"

Monday, May 15, 2006

Selling in commodities has its own story as usual

Banks face vast losses in copper mayhemBy Ambrose Evans-Pritchard (Filed: 13/05/2006)

The spike in copper prices over recent weeks has left a group of banks and operators on the London Metal Exchange (LME) nursing vast losses, raising concerns about the stability of the commodities market.

Simon Heale unexpectedly said that he would be stepping down by the end of the year

The banks have been caught out by a sudden widening in the gap between the price of three-month futures and that of long-term futures, for December 2010 or April 2011.

"The dramatic differential we have seen over the past six weeks has cost them a huge amount of money," said a market source. "The bigger players can absorb the losses but smaller operators have nowhere to hide."

Copper surged this week to an all-time high of $8,875 a tonne, rising almost 10pc on Thursday. Yet futures prices for April 2011 are just $3,778 a tonne.

Barclays Capital denied reports that it faced losses of £500m on copper trades, saying that it would have issued a statement if such claims were true.

Banks help to finance the LME's $3,000bn trades each year, often taking on long-term hedges from metal producers, which they cover by selling short-term futures. If the two suddenly diverge, it plays havoc with their books.

Adding to the intrigue, the LME's chief executive, Simon Heale, unexpectedly said on Thursday that he would be stepping down by the end of the year. His spokesman denied that there was any link to the metals mayhem this week, insisting that

Mr Heale wished to spend more time with his family.

Copper has doubled in price this year even though industrial demand is flat.

"This is fairyland," said Richard Elman, head of the Noble Group. "We have

never seen such a disconnect between reality and pricing

of raw materials. The long-term story is sound but the short-term froth is patently frightening."

William Adams, an analyst at BaseMetals.com, said demand for copper tubes was collapsing as producers switched to PVC plastics. The market in Germany has halved from 90,000 to 45,000 tonnes. "There's a very rapid switch from copper. When it turns, copper could easily drop $1,000 a tonne in one day," he said.

David Threlkeld, a veteran copper trader, said the market had been "out of control" for months, allowing speculators to run roughshod over industrial producers and users. "The LME has been seduced by hedge funds, [which have] pushed prices to levels unsupported by fundamentals. There's a vacuum below and the crash could set off a chain of margin calls running through the whole commodities sector. We've got a crisis on our hands and it is a lot bigger than copper," he said.

http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2006/05/13/cncopp13.xml&menuId=242&sSheet=/money/2006/05/13/ixcitytop

The spike in copper prices over recent weeks has left a group of banks and operators on the London Metal Exchange (LME) nursing vast losses, raising concerns about the stability of the commodities market.

Simon Heale unexpectedly said that he would be stepping down by the end of the year

The banks have been caught out by a sudden widening in the gap between the price of three-month futures and that of long-term futures, for December 2010 or April 2011.

"The dramatic differential we have seen over the past six weeks has cost them a huge amount of money," said a market source. "The bigger players can absorb the losses but smaller operators have nowhere to hide."

Copper surged this week to an all-time high of $8,875 a tonne, rising almost 10pc on Thursday. Yet futures prices for April 2011 are just $3,778 a tonne.

Barclays Capital denied reports that it faced losses of £500m on copper trades, saying that it would have issued a statement if such claims were true.

Banks help to finance the LME's $3,000bn trades each year, often taking on long-term hedges from metal producers, which they cover by selling short-term futures. If the two suddenly diverge, it plays havoc with their books.

Adding to the intrigue, the LME's chief executive, Simon Heale, unexpectedly said on Thursday that he would be stepping down by the end of the year. His spokesman denied that there was any link to the metals mayhem this week, insisting that

Mr Heale wished to spend more time with his family.

Copper has doubled in price this year even though industrial demand is flat.

"This is fairyland," said Richard Elman, head of the Noble Group. "We have

never seen such a disconnect between reality and pricing

of raw materials. The long-term story is sound but the short-term froth is patently frightening."

William Adams, an analyst at BaseMetals.com, said demand for copper tubes was collapsing as producers switched to PVC plastics. The market in Germany has halved from 90,000 to 45,000 tonnes. "There's a very rapid switch from copper. When it turns, copper could easily drop $1,000 a tonne in one day," he said.

David Threlkeld, a veteran copper trader, said the market had been "out of control" for months, allowing speculators to run roughshod over industrial producers and users. "The LME has been seduced by hedge funds, [which have] pushed prices to levels unsupported by fundamentals. There's a vacuum below and the crash could set off a chain of margin calls running through the whole commodities sector. We've got a crisis on our hands and it is a lot bigger than copper," he said.

http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2006/05/13/cncopp13.xml&menuId=242&sSheet=/money/2006/05/13/ixcitytop

Commodities will correct sharply and will rise again Google's pain will persisit for months.

Sell off started on Thursday when GAZPROM fell heavily in Russia, then chart were broken on Nasdaq in Thursday and Friday action. Today all emerging markets took the hit as commodities and commodities related markets were driven down by profit taking and general risk averse situation. But the main picture is that USD is falling apart and all dollar related assets will be under pressure. All commodities after brief correction will continue their rise because they are driven by fundamentals: demand from BRICS (Brazil, Russia, India and China) and fundamental weakness in USD. As more and more dollars will be dumped into the market more and more commodities will rise. Latest TIC report is showing that foreign banks are NET SELLERS of US treasuries, so today's blip in the dollar is very temporary thing and in the days ahead with dramatic increase in volatility this situation will be considered as one of the last buying opportunity in the powerfully move ahead. Who will be hostage's of the risen volatility and risk averse approach: usual suspects high beta stocks with almost all analyst at buy and fundamental problems to the underlying business, crash will be brutal because valuation is supported by only belief in the myth about profitability and growth, as soon as the smoke will settle and retail will realize that there is no way to justify even half of the GOOGLE market cap disaster will be on the front pages.

Sunday, May 14, 2006

Friday, May 12, 2006

Economist on Google: "Is Google the new Microsoft?"

Finally Economist came with coverage on Google. I have been awaiting it for the long time because this paper is one of the prime sources for unbiased (if it is possible) information and renown for its sober economic stance. I am strongly advice to invest in your education and buy this issue in paper to smell the ink. They are not questioning particular valuation, but rather came with few important observation comparing dominant positions of Microsoft and Google in their markets:

In the first piece “Is Google the new Microsoft” Economist wrote: “More important, however are the differences that suggest that Google will not be able to establish an IBM-Microsoft-style lock on the industry…in the new era of internet services, open standards predominate, rivals are always just click away (!!!) … Try to avoid using Microsoft software for a day, particularly if you work in office and you will have difficulty; but surviving the day without Google is relatively easy… Large firms such as Yahoo!, which previously farmed searches out to Google, have switched to other technologies (as did Amazon in favour of MSN) Google market share in search has fallen from 80% to around 50% today. Perhaps the clearest evidence that Google’s continued dominance is not inevitable is the fate of AltaVista, the former top dog in internet search. Who remembers is today.” The second piece “Special report Google” dated May, 13th 2006 (no luck for Google now) with halo above second “g” in logo. After math geeks history of the company and its high flying arrogant ambitions (halo staff) Paper stated: “But many who deal with Google in their daily lives are getting fed up with such grandiose notions. Google’s shares after nearly quintupling since they began trading have fallen in recent months. Pip Coburn, an investment strategist, says that “Google was a simple story at one point…But now it is pretty much a mess…Mr Sullivan of Search Engine Watch says Google become distracted…one strength (search) and string of mediocre “metoo” products: Google video is overtaken by YouTube with four times as much traffic, Google News perennially lags behind Yahoo! News, Google instant-messaging software is tiny compared with AOL’s, Yahoo!’s and MSN’s. …(everybody) are getting annoyed by Google’s seemingly endless “betas” Very important is concern about data protection: “As more and more data builds up in the company’s disc farms,” says Edward Felten, an expert on computer privacy at Princeton University, “the temptation to be evil only increases” Here I must add that this privacy issue will be third most important legal issue which will hurt Google in the coming months after exposure of Click Fraud and Child Porn lawsuit. Nobody from Press Day paid any attention to one very important phrase of Vice President on Innovation lady pronounced: “..with our toolbar we know a lot about you and can offer you our help with ads for your needs(!!!)” Google literally scanning every file on your computer and will be spamming your with ads on “relevant” issues like in Gmail! But most importantly is that speaking in the words of bellowed by boys Warren Buffet Google’s business franchise is almost ZERO. Switching cost of the customer end user is literally zero: “competitor is just click away”. Who is really thinking that you can lock-in user by such break through innovation like “Gnotes”. So before buying the deeps try to use some other guys for search, there are plenty: “Search.com searches Google, Ask.com, LookSmart and dozens of other leading search engines to bring you the best results. Search.com metasearch search engine - The only search you need.” Plus Yahoo!, MSN, Accoona you name the others.

In the first piece “Is Google the new Microsoft” Economist wrote: “More important, however are the differences that suggest that Google will not be able to establish an IBM-Microsoft-style lock on the industry…in the new era of internet services, open standards predominate, rivals are always just click away (!!!) … Try to avoid using Microsoft software for a day, particularly if you work in office and you will have difficulty; but surviving the day without Google is relatively easy… Large firms such as Yahoo!, which previously farmed searches out to Google, have switched to other technologies (as did Amazon in favour of MSN) Google market share in search has fallen from 80% to around 50% today. Perhaps the clearest evidence that Google’s continued dominance is not inevitable is the fate of AltaVista, the former top dog in internet search. Who remembers is today.” The second piece “Special report Google” dated May, 13th 2006 (no luck for Google now) with halo above second “g” in logo. After math geeks history of the company and its high flying arrogant ambitions (halo staff) Paper stated: “But many who deal with Google in their daily lives are getting fed up with such grandiose notions. Google’s shares after nearly quintupling since they began trading have fallen in recent months. Pip Coburn, an investment strategist, says that “Google was a simple story at one point…But now it is pretty much a mess…Mr Sullivan of Search Engine Watch says Google become distracted…one strength (search) and string of mediocre “metoo” products: Google video is overtaken by YouTube with four times as much traffic, Google News perennially lags behind Yahoo! News, Google instant-messaging software is tiny compared with AOL’s, Yahoo!’s and MSN’s. …(everybody) are getting annoyed by Google’s seemingly endless “betas” Very important is concern about data protection: “As more and more data builds up in the company’s disc farms,” says Edward Felten, an expert on computer privacy at Princeton University, “the temptation to be evil only increases” Here I must add that this privacy issue will be third most important legal issue which will hurt Google in the coming months after exposure of Click Fraud and Child Porn lawsuit. Nobody from Press Day paid any attention to one very important phrase of Vice President on Innovation lady pronounced: “..with our toolbar we know a lot about you and can offer you our help with ads for your needs(!!!)” Google literally scanning every file on your computer and will be spamming your with ads on “relevant” issues like in Gmail! But most importantly is that speaking in the words of bellowed by boys Warren Buffet Google’s business franchise is almost ZERO. Switching cost of the customer end user is literally zero: “competitor is just click away”. Who is really thinking that you can lock-in user by such break through innovation like “Gnotes”. So before buying the deeps try to use some other guys for search, there are plenty: “Search.com searches Google, Ask.com, LookSmart and dozens of other leading search engines to bring you the best results. Search.com metasearch search engine - The only search you need.” Plus Yahoo!, MSN, Accoona you name the others.

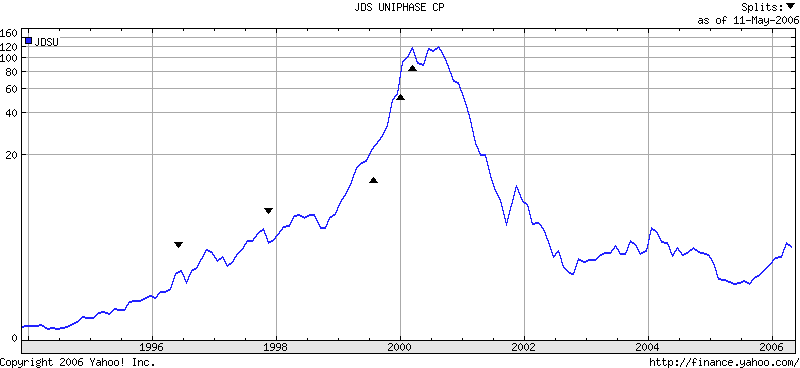

It is all different this time...Again!

You can say that YHOO 2000 and GOOG 2006 have nothing in common, the truth is: if you will subtract 1.5 billion Click Fraud (faked revenue) estimated by click forensics.com GOOG HAVE NO PROFIT. Six years have passed and new were born, who knows everything, who still believes into STRONG BUY and "limitless growth". Just read old papers and remember those days. What is different today?

1. End of FED's tightening.

2. Eyeballs vs Clicks.

3. "Limitless growth"

ENRON, WORLDCOM and TYCO were all strong buy just before the crash.

Investing in GOOG at these levels is nothing more then playing old Wall Street game: "find another fool" It is important that you will not be the last before the music stops. As this stock will be out of fashion and will get first Downgrade crash 2000 will look like slow motion movie. This blockbuster will be directed by John Woo.

1. End of FED's tightening.

2. Eyeballs vs Clicks.

3. "Limitless growth"

ENRON, WORLDCOM and TYCO were all strong buy just before the crash.

Investing in GOOG at these levels is nothing more then playing old Wall Street game: "find another fool" It is important that you will not be the last before the music stops. As this stock will be out of fashion and will get first Downgrade crash 2000 will look like slow motion movie. This blockbuster will be directed by John Woo.

Thursday, May 11, 2006

"We will keep them honest"

Press day Q: "Will you allow for independent agents to monitor your click fraud (ME: will you allow for independent agent - auditors - to monitor your financial reporting system and to verify your presentation of material facts) A: Google No, we have our own system in place" (ME: No, we have our OWN ACCOUNTANTS IN PLACE)

"We will keep them honest" - Bill Gates

http://www.clickforensics.com/

"We will keep them honest" - Bill Gates

http://www.clickforensics.com/

War is declared, no prisoners will be taken 30.04.06

Can you imaging what will happen to Google stock price with first wave of downgrades?

The main story is always behind the curtain. Is Bill Gates stupid enough not to understand what will happen to the stock price and his own wealth, almost totally connected to it?

No, he is not stupid, the is the real friend of Warren Buffet, he is the guy who bought Silver years ago to hedge his Tech “exposure”. The main story is: “He is ready to act and sacrifies his temporarily wealth decreasing (remember those who not sold will not lose long term) in order to make GOOG to the front pages with the word CRASH in front of it. One of the main reasons for downgrades of MSFT is “ridiculously high R&D CAPEX”. What it means for MSFT - I am not sure for the long term, but story is about GOOGLE - every stone will be turned over, it is THE WAR, it was declared by GOOGLE (stupidly enough) and now they have got it. What will be the result: nobody will win, just look at INTEL and AMD. But the truth about google will be exposed, wait for articles and other PR, lawsuits form “advertises” and “investors” and full weaponry of wall street will be deployed the big price will be paid and today Bill signed a first check for it.

The main story is always behind the curtain. Is Bill Gates stupid enough not to understand what will happen to the stock price and his own wealth, almost totally connected to it?

No, he is not stupid, the is the real friend of Warren Buffet, he is the guy who bought Silver years ago to hedge his Tech “exposure”. The main story is: “He is ready to act and sacrifies his temporarily wealth decreasing (remember those who not sold will not lose long term) in order to make GOOG to the front pages with the word CRASH in front of it. One of the main reasons for downgrades of MSFT is “ridiculously high R&D CAPEX”. What it means for MSFT - I am not sure for the long term, but story is about GOOGLE - every stone will be turned over, it is THE WAR, it was declared by GOOGLE (stupidly enough) and now they have got it. What will be the result: nobody will win, just look at INTEL and AMD. But the truth about google will be exposed, wait for articles and other PR, lawsuits form “advertises” and “investors” and full weaponry of wall street will be deployed the big price will be paid and today Bill signed a first check for it.

Google creative accounting

“Creative accounting” invented by Woldcom and Enron help GOOGLE to save the day for insider selling until next quarter results. They have hided horrible truth that income from operations actually fell from 4q 2005 by 35%! From 659.6 mil to 487.7 mil.

In 4q 2005 “Income from operations” was 569.6 mil, they have expensed ALL related to the 4q 58.2 mil of stock-based compensation. They just mentioned that: “…SB compensation was 58 mil related to 46 mil in 3rd q…” “…SB comp will significantly higher in 2006…” Their accounting policy was in line with GAAP! All related expenses were accounted in the RELEVANT q. One of the most important GAAP principles is that “…approved accounting polices must be in line with GAAP rules and consistent within reported periods in order to give reliable and clear picture of the underlining business conditions for its creditors and shareholders…” If we will add NON business expense of 90 mil given to GOOG foundation “Income from business operations” was in 3rd q 2005 actually at 659.6 mil!

In 1st q 2006 “Income from operations” was 742.7 mil, but in contradiction to their own accounting policy they have accounted only 115 mil of stock-based compensation and transferred 255 mil reaming charges RELEVANT and Accrued in 1st q into the future periods in violations of GAAP principles. By this action they are giving misguiding information and concealing the fact that actual “Income from operations” GAAP is only 742.7 mil minus 255 mil at 487.7 mil which is representing decline in q/q “Income from business operations” of 26%!

Actual GAAP EPS in 1st q 2006 was only 1.11 compare to 1.52 (after we add non business foundation) in 4th q 2005 an astounding decline of 27%!

Now we can understand what CFO was talking about, it was apparent to him that they can never make proper GAAP numbers without crashing the stock. How could they put even their reputation on line for this scam? Money maybe, they are still selling like there is no tomorrow. Even their own numbers after proper repositioning are showing decline in margin, income from operations and actual earnings, I think they were caught by surprise how easily they can deceive retail guys with Media hyping “incredible results” they are really incredible check all figures in filings.

They have mentioned Buffet few times; I think that if we can imaging that he could be involved in such business management of this company would go to jail.

In 4q 2005 “Income from operations” was 569.6 mil, they have expensed ALL related to the 4q 58.2 mil of stock-based compensation. They just mentioned that: “…SB compensation was 58 mil related to 46 mil in 3rd q…” “…SB comp will significantly higher in 2006…” Their accounting policy was in line with GAAP! All related expenses were accounted in the RELEVANT q. One of the most important GAAP principles is that “…approved accounting polices must be in line with GAAP rules and consistent within reported periods in order to give reliable and clear picture of the underlining business conditions for its creditors and shareholders…” If we will add NON business expense of 90 mil given to GOOG foundation “Income from business operations” was in 3rd q 2005 actually at 659.6 mil!

In 1st q 2006 “Income from operations” was 742.7 mil, but in contradiction to their own accounting policy they have accounted only 115 mil of stock-based compensation and transferred 255 mil reaming charges RELEVANT and Accrued in 1st q into the future periods in violations of GAAP principles. By this action they are giving misguiding information and concealing the fact that actual “Income from operations” GAAP is only 742.7 mil minus 255 mil at 487.7 mil which is representing decline in q/q “Income from business operations” of 26%!

Actual GAAP EPS in 1st q 2006 was only 1.11 compare to 1.52 (after we add non business foundation) in 4th q 2005 an astounding decline of 27%!

Now we can understand what CFO was talking about, it was apparent to him that they can never make proper GAAP numbers without crashing the stock. How could they put even their reputation on line for this scam? Money maybe, they are still selling like there is no tomorrow. Even their own numbers after proper repositioning are showing decline in margin, income from operations and actual earnings, I think they were caught by surprise how easily they can deceive retail guys with Media hyping “incredible results” they are really incredible check all figures in filings.

They have mentioned Buffet few times; I think that if we can imaging that he could be involved in such business management of this company would go to jail.